Om ditt företag säljer till kunder via onlinekanaler är du förmodligen bekant med att ständigt göra allt för att försöka minimera friktionen i shoppingupplevelsen och gör allt du kan för att öka konverteringen. Oavsett vad du säljer, exakt var du säljer det eller vilka målgrupper du vänder dig till är betalningslänkar ett flexibelt verktyg för ditt företag. Om du inte har en webbplats – eller inte har någon som stöder e-handel – men är intresserad av att sälja dina varor, tjänster eller abonnemang till kunder online, kan betalningslänkar passa bra. Detta är långt ifrån ett e-handelsverktyg som passar alla, betalningslänkar är mer en anpassad lösning som tar sig an några av de mest tjatiga utmaningarna med att sälja till kunder online.

Enligt en studie från Baymard Institute överges mer än 69 % av kundvagnarna på nätet innan ett köp görs. Det finns olika anledningar till varför detta händer, allt från för höga fraktkostnader till att en potentiell kund tvekar inför möjligheten att registrera sig för ett konto för att slutföra ett köp. Men enligt studien har hela 17 % av nätshopparna i USA övergett en beställning på grund av en kassaprocess som var "för lång/komplicerad". Det här är precis den typ av bortfall i konverteringstratten som betalningslänkar är väl positionerade för att minimera – men det är bara en av deras fördelar.

Nedan följer allt företag behöver veta om vad betalningslänkar är och hur man använder dem i olika situationer.

Vad innehåller den här artikeln?

- Vad är betalningslänkar?

- Vem använder betalningslänkar och varför?

- Stripe Payment Links

- Så gör man för att skapa Stripe Payment Links

- Så gör man för att skicka Stripe Payment Links

- Spåra betalningslänkar

- Så gör man för att skapa Stripe Payment Links

- Fördelar med betalningslänkar

- Avgifter för betalningslänkar

- Alternativ till betalningslänkar

Vad är betalningslänkar?

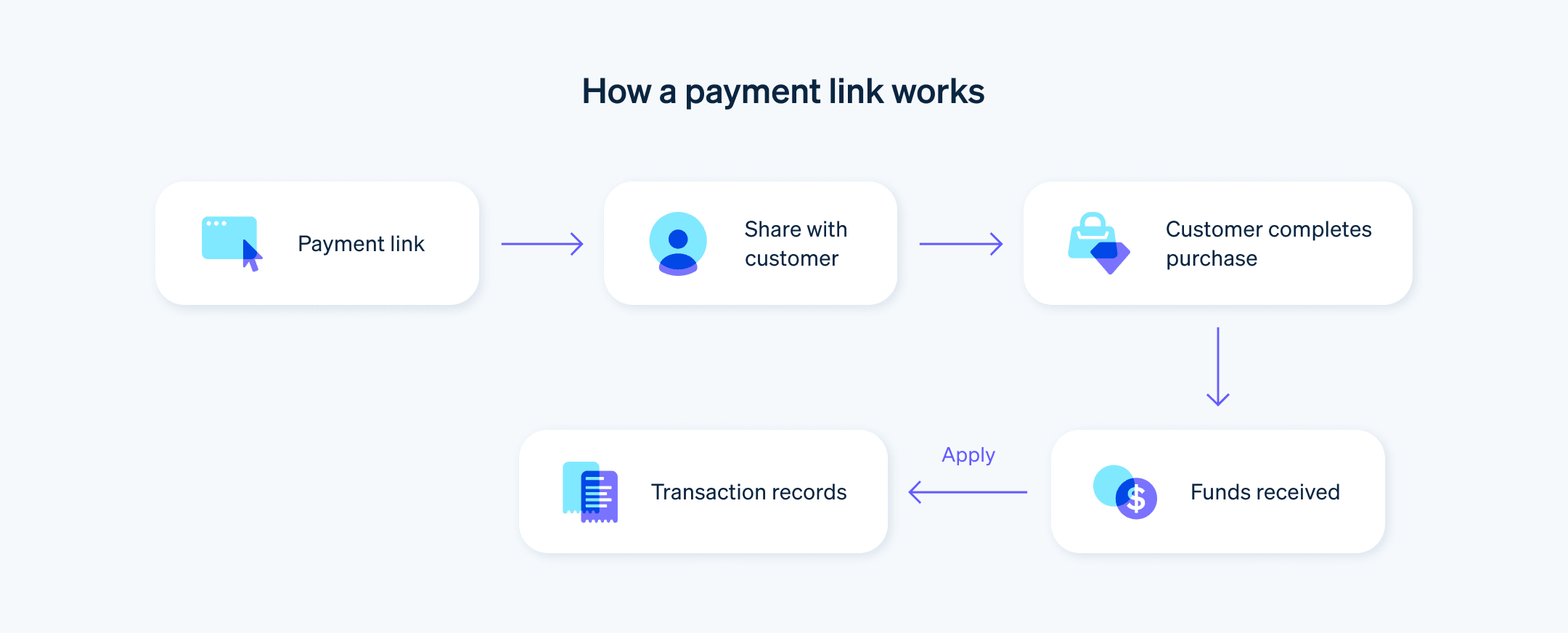

En betalningslänk är en URL, knapp eller QR-kod som tar kunder direkt till en unik kassasida för att slutföra ett köp. Betalningslänkar kan skapas snabbt och enkelt och kan nås från en webbläsare, sms, e-post eller inlägg på sociala medier. Betalningslänkar gör det möjligt för företag att skapa en betalningssida och dela länken direkt med kunder. Stripe Payment Links kräver ingen kodning och kan delas så många gånger du vill i alla kanaler, inklusive e-post, sociala medier och sms.

Vem använder betalningslänkar och varför?

Betalningslänkar kan användas av alla företag som vill erbjuda enkla, direkta kundköp online. Om det låter som en anmärkningsvärt bred definition beror det på att betalningslänkar används inom ett brett spektrum av branscher för att uppmuntra köp med praktiskt taget alla segment av digitala konsumenter. Betalningslänkarnas superkraft är deras mångsidighet – du kan använda dem för nästan alla typer av onlineköp.

Här följer några vanliga situationer där betalningslänkar kan underlätta kundtransaktioner:

Du har ingen webbplats.

Eller åtminstone har du inte en webbplats som stöder e-handel. Kanske håller du fortfarande på att bygga din e-handelswebbplats, eller så behöver du sällan behandla betalningar online, så du planerar inte att bygga en alls. Hur som helst är betalningslänkar en enkel och pålitlig lösning för företag som behöver behandla en betalning online men inte har en webbplats som stöder betalningar.Du gör mycket SMS-marknadsföring.

Betalningslänkar är ett idealiskt verktyg för att nå ut till kunderna via sms. Om du har en robust SMS-marknadsföringslista, och det är en meningsfull försäljningskanal för ditt företag, är betalningslänkar en självklarhet.Du har flera kundsegment.

Om ditt företag har olika målgruppssegment och du tenderar att använda riktade meddelanden för var och en av dem, kan du med betalningslänkar skapa skräddarsydda betalningssidor som är optimerade för varje kundgrupp.Du samlar in pengar eller donationer.

När du säljer varor och tjänster till konsumenter är det viktigt att ha en smidig och effektiv kassaprocess, men när du försöker samla in donationer till välgörenhet blir detta ännu viktigare. Om du vill att människor ska donera måste mekanismen vara så enkel som möjligt, annars riskerar du att potentiella välgörare inte kommer till skott. Betalningslänkar är ett snabbt och direkt sätt att låta personer bidra till insamlingskampanjer eller donera till välgörande ändamål med minsta möjliga friktion och tidsinvestering.Du måste ta emot betalningar personligen men har inte maskinvaran.

Låt oss säga att du har ett företag som säljer småskaligt och hantverksmässigt producerat jordnötssmör på lokala marknader. Det är i slutet av dagen och en kund, som inte har några kontanter, dyker upp och vill göra ett köp, men din affärspartner har redan packat ihop er kortläsare och gått för några minuter sedan. Istället för att behöva avvisa den potentiella kunden kan du ta fram din telefon, snabbt generera en betalningslänk för produkten och sms:a den till dem. Det finns många olika anledningar till varför företag kan behöva ta emot en betalning utan kortterminal, och betalningslänkar är ett mångsidigt verktyg som kan underlätta en betalning i många av dessa situationer.Din försäljning går snabbt.

Du släpper dina produkter vid specifika tidpunkter, du aviserar när du har fyllt på ditt lager och din försäljning går snabbt – ett gynnsamt scenario med allas mått mätt. Så hur får du ut det mesta av denna entusiasm för dina produkter? En strategi är att få kunderna att registrera sig för sms-uppdateringar och sedan skicka betalningslänkar till dem när det är dags. Detta gör att du kan dra nytta av ivern för och bristen på dessa efterfrågade produkter genom att erbjuda kunderna ett sätt att snabbt köpa dem.

Stripe Payment Links

Stripe Payment Links kan fungera som en flexibel komponent i en större betalningskonfiguration för företag som tar emot betalningar i flera kanaler online, i fysisk miljö eller både och, men Payment Links kan också fungera för nya företag som ännu inte har en webbplats, som ett sätt att snabbt och enkelt komma igång med att sälja sina produkter. Stripe Payment Links stödjer mer än 20 betalningsmetoder, inklusive kredit- och betalkort och e-plånböcker som Apple Pay och Google Pay. Betalningssidorna finns tillgängliga på över 30 språk och översätts automatiskt till kundens föredragna språk enligt inställningarna i deras webbläsare.

Med Stripe Payment Links kan användare anpassa färgerna och lägga till andra varumärkeselement på sina betalningssidor. De kan till exempel lägga till butikspolicyer och kontaktinformation; skapa QR-koder för betalningslänkar; och aktivera kampanjkoder, korsförsäljning och uppförsäljning.

Så gör man för att skapa Stripe Payment Links

Stripe Payment Links är endast tillgängligt med ett Stripe-konto, så om du inte har ett måste du först registrera dig. När du har registrerat dig på Stripe och loggat in går du till din Dashboard. Därifrån klickar du på Payment Links och följer de här stegen:

- Välj +Lägg till en ny produkt.

- Fyll i produktinformationen.

- Klicka på Lägg till produkt.

- Klicka på Nästa.

- Klicka på Skapa länk.

När du har skapat den nya betalningslänken visas sidan med uppgifterna automatiskt. Och så var det klart – länken är redo att delas.

För företag som vill skapa betalningslänkar i stor skala tillåter Stripe användare att generera dem med hjälp av en API.

Så gör man för att skicka Stripe Payment Links

Att skicka Stripe Payment Links är precis som att skicka andra länkar: Kopiera och klistra in den på den plats du vill dela den. Samma länk kan återanvändas så många gånger du vill.

Spåra betalningslänkar

När du har skickat betalningslänkar ut i världen kan du spåra deras resultat från din Dashboard.

Fördelar med betalningslänkar

Betalningslänkarnas enkla och avskalade karaktär gör dem exceptionellt tilltalande för företag. Om du berättar för ett företag att de kan få tillgång till fristående produktsidor som gör det lättare att genomföra köp utan ytterligare klick till andra sidor, är chansen stor att de ser potentialen direkt.

Förutom den eleganta enkelheten hos betalningslänkar, presenteras här några andra viktiga fördelar:

Enklare betalningsupplevelse för kunderna:

Betalningslänkar kan skickas via e-post och sms eller delas på sociala medier. Kunder kan slutföra en transaktion med ett klick. Det blir verkligen inte mycket enklare än så.Bättre konvertering:

Oavsett hur stor andel övergivna kundvagnar du har, föreställ dig att den sänks avsevärt. Här kan betalningslänkar verkligen göra skillnad för ditt företag. Flexibiliteten hos betalningslänkar kan hjälpa dig att nå nya målgrupper och vända dig till dina befintliga målgruppssegment på ett bättre sätt. Betalningslänkar kan generellt sett ge bättre konverteringsgrad än andra betalningsmetoder.Mycket anpassningsbara:

Medan din e-handelswebbplats bara låter dig ha en betalningsupplevelse som måste vara relevant för alla målgruppssegment, ger betalningslänkar dig en oändligt dynamisk mekanism för att skapa anpassade betalningssidor. Oavsett om det handlar om att skapa betalningslänkar kopplade till specifika kampanjer eller att skapa en skräddarsydd upplevelse för en specifik kundgrupp är betalningslänkar ett sätt att skapa så många anpassade betalningstillfällen som du vill.

Avgifter för betalningslänkar

Betalningslänkar är redan integrerade i Stripes prismodell, vilket innebär att företag inte behöver betala några extra avgifter för att skapa betalningslänkar och använda dem för att ta emot betalningar. Om du använder betalningslänkar tillsammans med andra Stripe-lösningar, som Billing för återkommande betalningar eller Stripe Tax, betalar du fortfarande eventuella avgifter som är kopplade till dessa tjänster, precis som du skulle göra för transaktioner som genomförs på annat sätt. Men utöver det kostar det inte Stripe-användare något extra att använda betalningslänkar.

Alternativ till betalningslänkar

För onlinetransaktioner är det viktigaste alternativet till betalningslänkar helt enkelt att ha en webbplats som tillåter e-handel. När du har en webbplats som gör det möjligt för kunder att slutföra köp online, och du hittat en betalleverantör, kan du använda direktlänkar till produktsidor och dela dem på ungefär samma sätt som du skulle göra med en betalningslänk. Naturligtvis kommer dessa länkar att sakna funktionaliteten hos betalningslänkar, men de kommer fortfarande att leda trafik till din webbplats och, förhoppningsvis, till ett kassaflöde.

Men sanningen är den att alla alternativ till betalningslänkar i slutändan betonar de unika fördelarna med just dessa länkar. Inget annat sätt gör det möjligt för kunderna att direkt och enkelt vidta åtgärder för att slutföra ett köp online utan att behöva navigera genom en mer omfattande kassaprocess.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.