If your business sells to customers through online channels, it's likely that you're familiar with the perpetual process of trying to minimise friction in the shopping experience and pulling every possible lever to increase conversion. No matter what you're selling, where you sell it or the audiences you cater to, payment links offer an agile tool for your business. If you don't have a website – or don't have one that supports e-commerce – but you're interested in selling your goods, services or subscriptions to customers online, creating online payment links might be a good fit for you. Far from being a one-size-fits-all e-commerce tool, direct payment links are more like a "one-tool, any-size" solution that takes on some of the most nagging challenges of selling to customers online.

According to a Baymard Institute study, more than 69% of online shopping baskets are abandoned before a purchase is made. Various reasons have been cited for why this happens, ranging from delivery costs that are too high to a potential customer baulking at the prospect of registering for an account to complete a purchase. However, according to the study, 17% of online shoppers in the US have abandoned an order due to a checkout process being "too long/complicated". This is exactly the kind of conversion funnel drop-off that payment links are well positioned to minimise – but that's just one of the benefits of setting up a payment link.

Here's everything that businesses need to know about what payment links are and how to use them for different situations.

What's in this article?

- What are payment links?

- Who uses payment links and why?

- Stripe Payment Links

- How to create Stripe Payment Links

- How to send Stripe Payment Links to customers

- Tracking payment links

- How to create Stripe Payment Links

- Benefits of payment links

- Payment link fees

- Payment link alternatives

What are payment links?

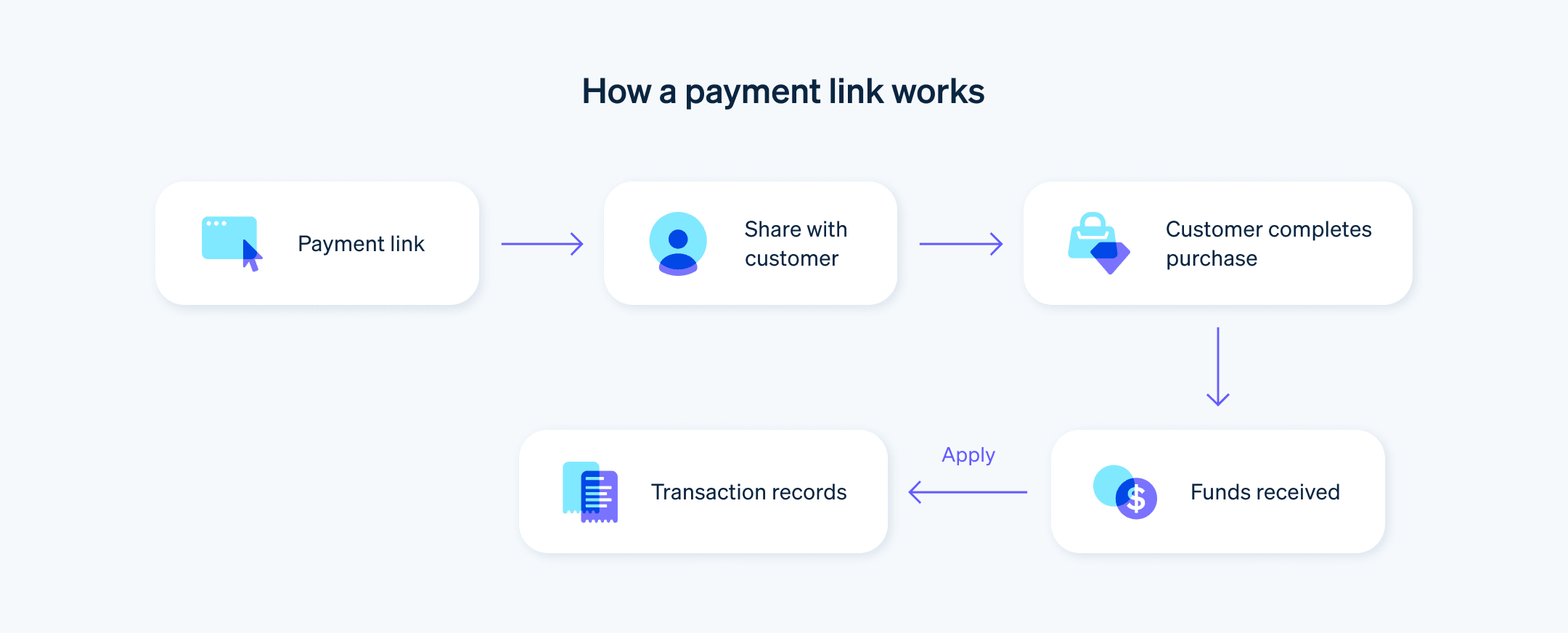

A payment link is a URL, button or QR code that takes customers directly to a unique checkout page to complete a purchase. Payment links can be created quickly and easily, and can be accessed from a web browser, text message, email or social media post. Payment links allow businesses to create a payment page and share the link directly with customers. Stripe Payment Links requires no coding and can be shared as many times as needed on any channel, including via email, social media and text messaging.

Who uses payment links and why?

Payment links can be used by any business that wants to facilitate easy, direct customer purchases online. If that sounds like a remarkably broad definition, that's because it is. Payment links are used across a wide range of industries to encourage purchasing with practically any segment of digital consumers. The superpower of payment links is their versatility – you can use them for almost any type of online purchase.

Here are a few common situations where using payment links could facilitate customer transactions:

You don't have a website.

Or at least you don't have a website that supports e-commerce. Maybe you're still building your e-commerce site or maybe you rarely need to process payments online, so you don't plan to build one at all. Either way, a link for payment offers a simple, reliable solution for businesses which need to process a payment online but don't have a website that supports payments.You do a lot of SMS marketing.

Direct payment links are an ideal tool for text message outreach to customers. If you have a robust SMS marketing list which is also a meaningful sales channel for your business, setting up payment links is a no-brainer.You have multiple customer segments.

If you have distinct audience segments for your business and you tend to use targeted messaging for each of them, direct payment links will allow you to create tailored payment pages which are optimised for each type of customer.You're fundraising or collecting donations.

When selling consumers goods and services, it's important to have a smooth, efficient checkout process, but when you're trying to collect charitable donations, this becomes even more important. If you want people to donate, the mechanism must be as effortless as possible, or there is a risk that would-be supporters end up not taking any action. If you create a payment link, this would offer a fast and direct way for people to contribute to fundraising campaigns or to donate to a charitable cause with minimal friction and time investment.You need to accept payments in person but don't have the hardware.

Let's say that you're a business that sells artisan peanut butter at farmers' markets in your region. It's the end of the day and one customer, who doesn't have any cash, shows up wanting to make a purchase – but your business partner has already packed up your card reader and left a few minutes ago. Instead of having to turn away the potential customer, you can pull out your phone, quickly create a payment link for the product and text it to them. There are any number of reasons why businesses might need to accept a payment without a card reader, and direct payment links are a versatile tool that can facilitate a payment in many of these situations.Your sales move fast.

You have timely product drops, anticipated restocks and your sales move fast – a favourable scenario by anyone's standards. So, how do you make the most of this excitement for your products? One strategy is to encourage customers to sign up for text updates and then send them direct payment links when it's "go time". Setting up a payment link thus allows you to capitalise on the urgency and scarcity of these in-demand products by offering customers a way to take action quickly.

Stripe Payment Links

Stripe Payment Links can work as a flexible component in a bigger payment setup for businesses that accept payments through multiple channels, whether online, in person or both. However, Payment Links can also work for new businesses that don't have a website yet, as a way to get started with selling their products quickly and simply. Stripe Payment Links supports more than 20 payment methods, including credit and debit cards and digital wallets such as Apple Pay and Google Pay. Payment pages are available in over 30 languages and are translated automatically into a customer's preferred language, as set in their browser.

Stripe Payment Links allows users to add custom colours and other branding elements to their payment pages. They can also add store policies and contact information, create QR codes for payment links and enable promotional codes, cross-sells and upsells.

How to create Stripe Payment Links

Stripe Payment Links is only available with a Stripe account, so if you don't have one, you'll need to register first. Once you've registered with Stripe and have logged in, go to your Dashboard. From there, click on Payment Links and follow these steps for how to create an online payment link:

- Select +Add a new product.

- Fill in the product details.

- Click Add product.

- Click Next.

- Click Create link.

Once you've completed these steps for how to create an online payment link, you'll see the details page automatically. And that's it – the link is set up and ready to be shared.

For businesses that want to set up payment links at scale, Stripe allows users to generate them using an API.

How to send Stripe Payment Links to customers

Sending Stripe Payment Links to customers is just like sending any other link: copy and paste it anywhere you want to share it. The same link can be reused as many times as you want.

Tracking payment links

Once you've sent payment links out into the world, you can track their performance from your Dashboard.

Benefits of payment links

The simple and pared-back nature of payment links makes them exceptionally appealing to businesses. If you tell a business that they can have access to stand-alone product pages that facilitate completed purchases without any additional clicks to other pages, the chances are that they'll see the potential immediately.

Besides the elegant simplicity of payment links, here are a few other notable benefits:

Easier payment experience for customers:

Payment links can be sent via email and text message, or shared on social media. Customers can complete a transaction with one click. It really doesn't get much simpler than that.Better conversion:

Whatever your abandoned basket rate is, imagine it considerably lower – this is an area where setting up payment links can move the needle significantly for your business. The flexibility of being able to create payment links can help you to reach new audiences and better target your existing audience segments. Across the board, setting up payment links can produce better conversion rates than other checkout methods.Highly customisable:

Whereas your e-commerce website allows you to have just one payment experience that needs to be relevant for every audience segment, direct payment links give you an endlessly dynamic mechanism for creating custom payment pages. Whether it's creating payment links associated with specific campaigns or a bespoke experience for a specific group of customers, payment links offer a low-commitment way to create as many customised payment moments as you need.

Payment link fees

Payment links are already integrated into Stripe's pricing model, meaning that businesses don't have to pay any additional fees to set up payment links and use them to accept payments. If you use payment links in conjunction with other Stripe solutions, such as Billing for recurring payments or Stripe Tax, then you'll still pay any applicable fees associated with those services, just as you would for transactions completed using other methods. However, beyond that, using payment links doesn't cost Stripe users anything extra.

Payment link alternatives

For online transactions, the main alternative to using links for payments is simply having a website that's set up to support e-commerce. Once you have a website that allows customers to complete purchases online and you've acquired payment-processing support, you can use direct links to product pages, sharing them in much the same way you would a payment link. Of course, these links will lack the functionality of payment links, but they'll steer direct traffic to your website and, hopefully, into a checkout flow.

However, the truth is that any alternatives to payment links ultimately end up emphasising the unique benefits of payment links themselves – nothing else allows customers to directly and easily take action and complete a purchase online, without having to navigate through a more extensive checkout process.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.