French independent workers who offer their services to businesses must manage their own accounting. Their independent—or freelance—work requires adapted invoicing. This article explains the important points for any independent worker who wants to understand how freelance invoicing works.

What’s in this article?

- Who is required to issue a freelance invoice?

- Is it necessary to invoice clients as a freelancer?

- What information must be included on a freelance invoice?

- When should a freelance invoice be sent?

- How to send a freelance invoice

Who is required to issue a freelance invoice?

Any professional carrying out an independent activity in the form of a sole proprietorship (EI) is required to invoice their clients. The “auto-entrepreneur”—someone who benefits from a simplified tax and social security regime—is a form of EI that also issues freelance invoices.

A sole proprietorship can be formed using any of the following legal statuses that can engage in freelance invoicing:

- The EI under the microbusiness (i.e., auto-enterprise) regime offers a simple and low-cost solution to start a business.

- The single-owner limited liability company (EURL) or the single-shareholder simplified joint-stock company (SASU) are more complex structures, offering better protection of personal assets.

- Salary portage is an intermediate arrangement in which the employee provides services on behalf of a company, which handles administrative and payroll management.

Is it necessary to invoice clients as a freelancer?

Any independent worker, whether they are a micro-entrepreneur or operate under another legal form (SASU, EURL, etc.), is required by law to create an invoice for each service provided to a client.

This obligation is important, regardless of the nature of the service or the amount of compensation.

Why is the invoice needed?

Required by law, the freelancer’s invoice is also useful for businesses:

- The invoice constitutes formal proof of the completion of the service and the amount owed by the client.

- It is used to calculate the freelancer’s taxes and social security contributions.

- In the event of a dispute with the client, the freelance invoice is an important element to assert one’s rights.

Invoice vs. quote

The quote is a document established before the service is performed and details the work to be done, rates, and deadlines. The invoice, on the other hand, is established after the service is performed and indicates the total amount to be paid.

Freelance contract

Although the invoice is mandatory, it is strongly recommended to sign a freelance work contract with the client. This contract specifies the conditions for carrying out the service (e.g., deadline, payment terms, etc.) and thus protects both parties in the event of a disagreement.

Retention of invoices

Invoices must be kept for a period of 10 years from the end of the accounting year. This legal obligation makes it possible to justify the declared income in the event of a tax audit

What information must be included on a freelance invoice?

The freelance invoice must include a certain number of mandatory items:

- Invoice number and date

- Contact details preceded by “EI” and the Business Directory Identification System (SIREN) or Establishment Directory Identification System (SIRET) number

- Client details

- Unit price of the service, excluding and including tax

- Total price, excluding and including tax

Auto-entrepreneurs who do not exceed the turnover thresholds must include this statement on the invoice: “VAT not applicable—Article 293 B of the General Tax Code (CGI).”

For good accounting management, it is recommended to number invoices sequentially. The format “year-month-number” (e.g., 2025-01-001) ensures precise tracking and meets legal requirements.

How have requirements changed since 2024?

As of July 1, 2024, invoices will be required to include four additional pieces of information (according to Decree No. 2022-1299 of October 7, 2022). The changes to be made to the documents include:

- The SIREN/SIRET number of the company

- The exact nature of the service (sale, service, etc.)

- Delivery and billing addresses (if different)

- The “tax on debits” option for those subject to value-added tax (VAT)

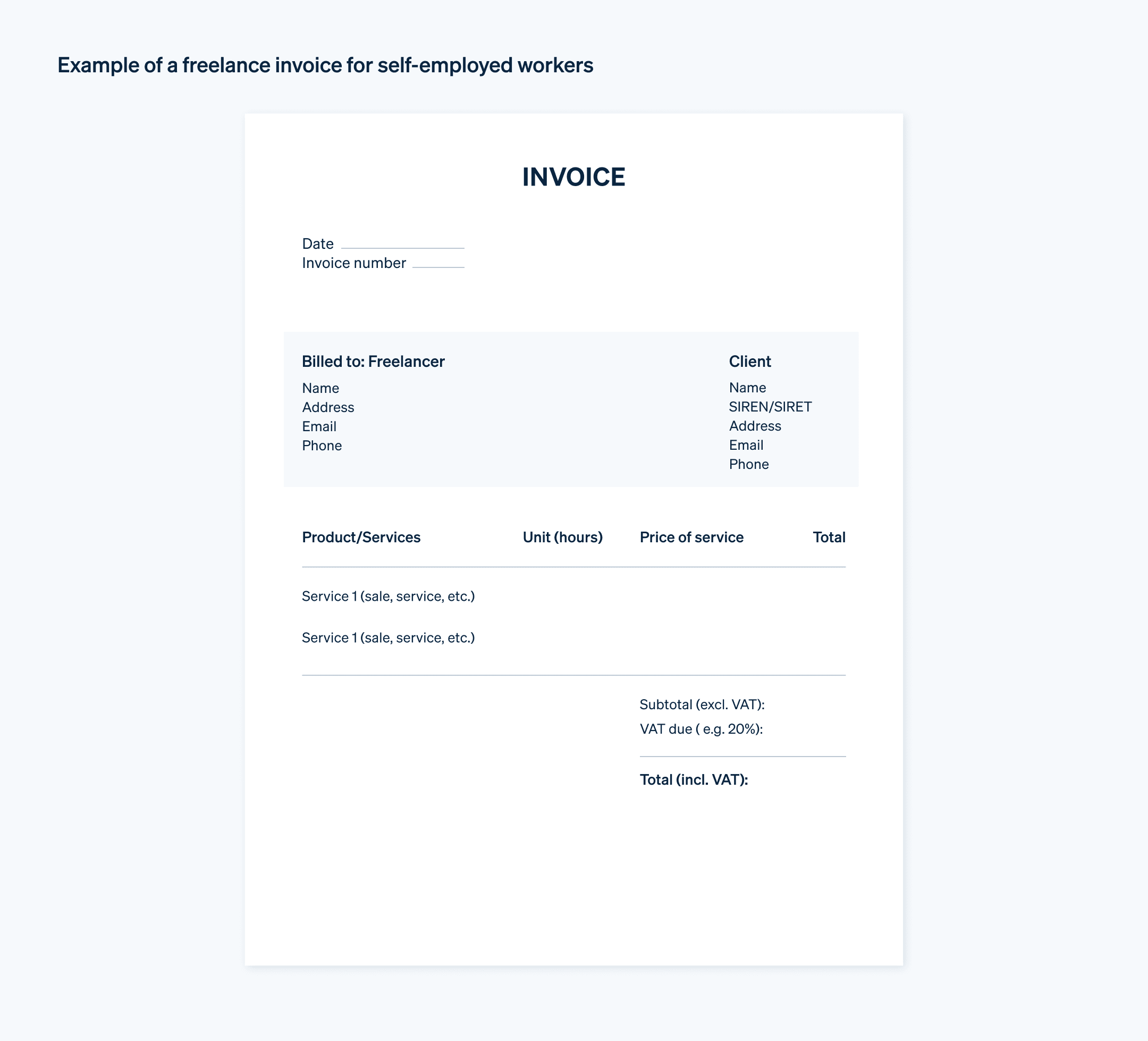

Example of a freelance invoice

The image below shows an example of a freelance invoice. Any independent worker or entrepreneur who creates this type of invoice can find precise information on the Urssaf website.

Each independent worker can adapt this template to their needs, but they should include the required elements.

When should a freelance invoice be sent?

As a freelancer, sending your invoices quickly demonstrates professionalism and is an effective way to optimize your cash flow.

Ideally, a freelance invoice should be sent as soon as the project is completed or, at the latest, on the date agreed upon contractually. In addition to speeding up payments, this action demonstrates a certain professionalism.

To help you manage your invoices more easily, Stripe Invoicing provides you with a variety of tools adapted to the specific needs of your business. Bill clients in just a few clicks by sending a PDF invoice or a Stripe payment link to receive payments online.

How to send a freelance invoice

Simply send a freelance invoice by postal mail or by email as an attachment. The seller or service provider and the client must each keep a copy of the invoice. Paper versions will soon give way to electronic invoicing.

What will change about freelance invoicing in 2026?

Starting in 2026, French companies will have to comply with the widespread use of electronic invoicing in France, also known as “e-invoicing.”

For auto-entrepreneurs, the mandatory receipt of electronic invoices begins on September 1, 2026. For all microentrepreneurs, the mandatory issuance of freelance invoices begins on September 1, 2027.

This reform aims to modernize business exchanges and simplify administrative procedures.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.