À compter du 1er janvier 2024, l’administration fiscale exigera la facturation électronique pour la plupart des titulaires de numéros de taxe sur la valeur ajoutée (TVA) en Italie. De nombreuses entreprises ont dû s’adapter à cette exigence en mettant en place des systèmes de gestion des factures électroniques et en assurant la conformité avec les nouvelles règles.

Dans l’article ci-dessous, nous expliquons comment fonctionne la facturation électronique pour les entreprises, les défis et les solutions pour les petites entreprises et les professionnels, ainsi que les développements futurs potentiels.

Sommaire

- Facturation électronique obligatoire en Italie

- Comment la facturation électronique fonctionne pour les entreprises

- Code de destinataire dans la facturation électronique pour les entreprises

- Facturation électronique pour les petites entreprises : Défis et solutions

- Tendances et développements futurs de la facturation électronique

Facturation électronique obligatoire en Italie

La loi n° 205 du 27 décembre 2017 a instauré la facturation électronique obligatoire en Italie le 1er janvier 2019. Toutefois, jusqu’en 2023, certaines catégories de contribuables étaient exonérées, comme celles relevant du régime forfaitaire ou du régime du taux minimum.

Le décret-loi n° 36/2022 a supprimé ces exonérations et a étendu la facturation électronique obligatoire à tous les titulaires de numéros de TVA, à compter du 1er janvier 2024, quels que soient leur régime fiscal ou les revenus générés.

En 2024, les groupes suivants resteront exemptés de l’obligation de facturation électronique en Italie :

- Les groupes qui émettent des factures à des entités ou des personnes étrangères qui ne sont ni résidentes ni établies au niveau fiscal en Italie.

- Les prestataires de soins de santé qui envoient des données au système de carte d’assurance-maladie (Sistema Tessera Sanitaria).

- Les personnes qui ne sont pas tenues d’envoyer des données au système de carte d’assurance-maladie, mais qui fournissent des services de santé aux personnes.

Le décret Milleproroghe 2025, approuvé par le Conseil des ministres le 9 décembre 2024, a prolongé l’exemption de facturation électronique pour la dernière catégorie de professionnels de la santé jusqu’au 31 mars 2025. Ce dernier leur interdit d’émettre des factures afin de protéger les données personnelles. Dans le cas des factures électroniques, les données d’une personne sont transmises au moyen du système d’échange de l’Agence du revenu, ce qui ne garantit pas le respect de la législation sur la protection de la confidentialité. De plus amples informations sur le décret sont à venir.

Comment la facturation électronique fonctionne pour les entreprises

L’Italie a été le premier pays européen à mettre en œuvre la facturation électronique. Une facture électronique fait référence à un document au format XML créé à l’aide d’un logiciel ou d’un service Web. Ensuite, il est envoyé par le système d’échange (Sistema di Interscambio ou SDI) de l’Agence italienne des impôts (Agenzia delle Entrate).

Le SDI vérifie que la facture contient les informations fiscales requises, puis s’assure de sa livraison au client, en fournissant un accusé de réception au fournisseur.

N’oubliez pas que votre facture électronique n’est émise qu’une fois que vous l’avez transmise au SDI. Par conséquent, la date d’émission n’est pas la date indiquée dans le champ Date de la facture.

Code de destinataire dans la facturation électronique pour les entreprises

Les informations requises pour une facture électronique pour les entreprises sont identiques à celles d’une facture papier, à l’exception du code de destinataire, également appelé « code de destinataire SDI » ou « code SDI ». Ce code permet d’assurer l’envoi correct d’une facture électronique à une entreprise ou à un professionnel. Le code de destinataire est lié au logiciel ou au service Web utilisé par le destinataire, ce qui lui permet de recevoir des factures directement dans son système de gestion des factures électroniques.

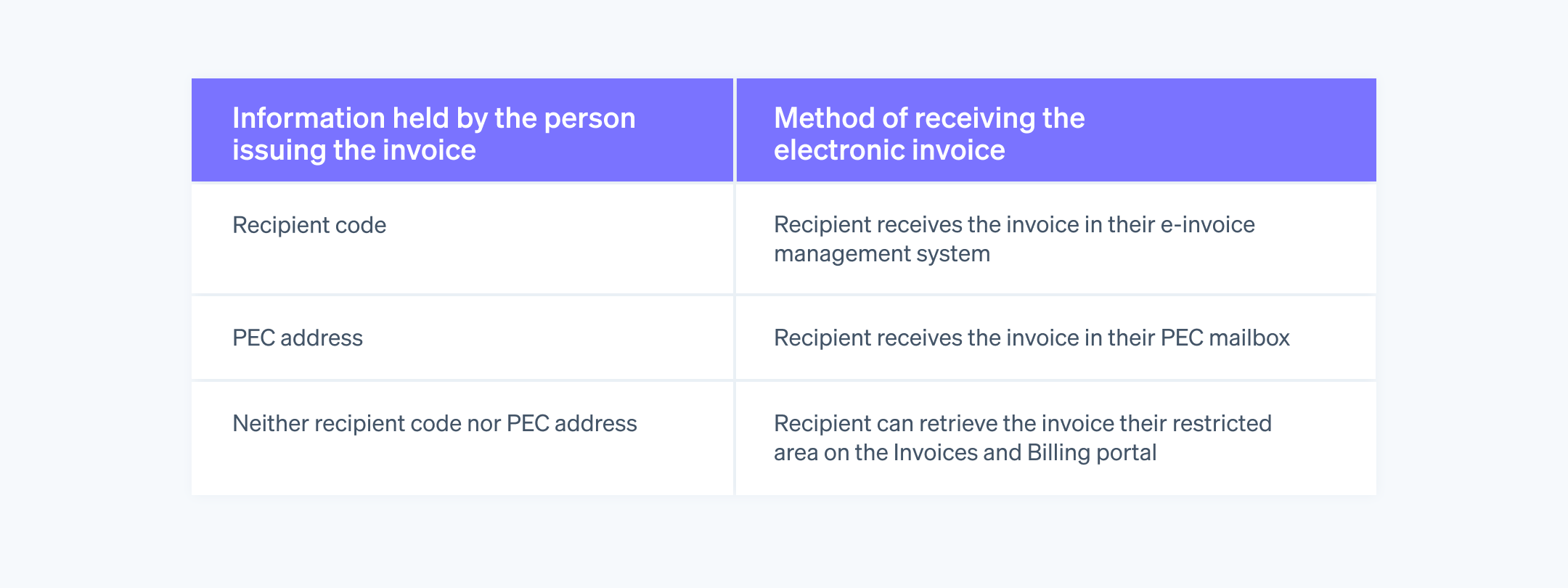

Que se passe-t-il si le code de destinataire du client n’est pas disponible? Il est possible d’émettre une facture électronique à une entreprise même sans le code de destinataire. Dans ce cas, le destinataire de la facture peut la recevoir par les méthodes suivantes :

- Adresse courriel certifiée (PEC) : Indiquez l’adresse PEC du destinataire (si elle est connue) dans le champ Destinataire PEC et entrez « 00000000 » dans le champ Code de destinataire de la facture.

- Portail des destinataires : Entrez zéro sept fois (c.-à-d. 00000000) dans le champ Code de destinataire. Dans ce cas, le SDI continuera de traiter la facture dont l’état est « Défaut de livraison » et la facture sera disponible dans la zone Consultation du portail Factures et reçus de l’Agence italienne des impôts. Nous vous recommandons d’informer le client que la facture est disponible dans son espace réservé.

Facturation électronique pour les petites entreprises : Défis et solutions

Lorsque l’Italie a introduit la facturation électronique pour les entreprises, les petites entreprises et les professionnels dont le chiffre d’affaires était inférieur à un certain seuil en étaient exemptés. Cependant, à partir de 2024, presque toutes les entreprises devront se conformer à l’obligation de facturation électronique. Par conséquent, les petites entreprises et les professionnels pourraient avoir à faire face à certains défis dans la gestion de la facturation.

Les principaux défis consistent à s’adapter à la technologie nécessaire pour gérer les factures électroniques tout en garantissant une conformité complète avec les nouvelles réglementations. Toutes les entreprises doivent utiliser un logiciel de gestion des factures électroniques ou un service infonuagique.

À cette fin, des outils gratuits de l’Agence italienne des impôts et des services payants sont disponibles. Les outils fournis par l’administration fiscale italienne sont les suivants :

- Un processus en ligne : Il est utilisé pour l’établissement et l’envoi de factures électroniques et est accessible au moyen du portail Factures et reçus (Fatture e Corrispettivi).

- Logiciel pour ordinateur personnel : Disponible sur le site de l’administration fiscale italienne, le logiciel permet uniquement de créer et d’enregistrer des factures électroniques.

- FatturAE : Une application disponible dans les magasins iOS ou Android que vous pouvez utiliser pour envoyer des factures électroniques.

Les fournisseurs commerciaux offrent divers outils de gestion de la facturation électronique aux entreprises, et plusieurs d’entre eux proposent des offres tarifaires à différents niveaux pour répondre aux besoins et aux budgets des petites entreprises et des professionnels. Pour simplifier la transition de la facturation papier à la facturation électronique, pensez à choisir un outil ou un service qui répond aux critères ci-dessous :

- Est basé sur l’infonuagique et accessible de n’importe où

- Offre une gestion facile de la facturation électronique par rapport aux logiciels téléchargeables (qui sont souvent plus complexes et entraînent des coûts de maintenance et de mises à jour plus élevés)

- Dispose d’un tableau de bord simple et intuitif

- Offre une assistance technique dédiée

- Peut s’intégrer à n’importe quel autre logiciel de gestion d’entreprise

Au fur et à mesure que votre entreprise se développe, la gestion du processus de facturation peut devenir de plus en plus complexe. Certains outils peuvent vous aider à automatiser ce processus, comme Stripe Invoicing, une plateforme de facturation complète et évolutive qui vous permet de créer et d’envoyer des factures pour des paiements ponctuels ainsi que pour des paiements récurrents sans avoir à écrire de code. Avec Stripe Invoicing, vous gagnez du temps et recevez des paiements plus rapidement, puisque les consommateurs paient 87 % des factures Stripe dans un délai de 24 heures. Grâce à la collaboration avec des partenaires tiers, vous pouvez également utiliser Stripe Invoicing pour la facturation électronique obligatoire.

Tendances et développements futurs de la facturation électronique

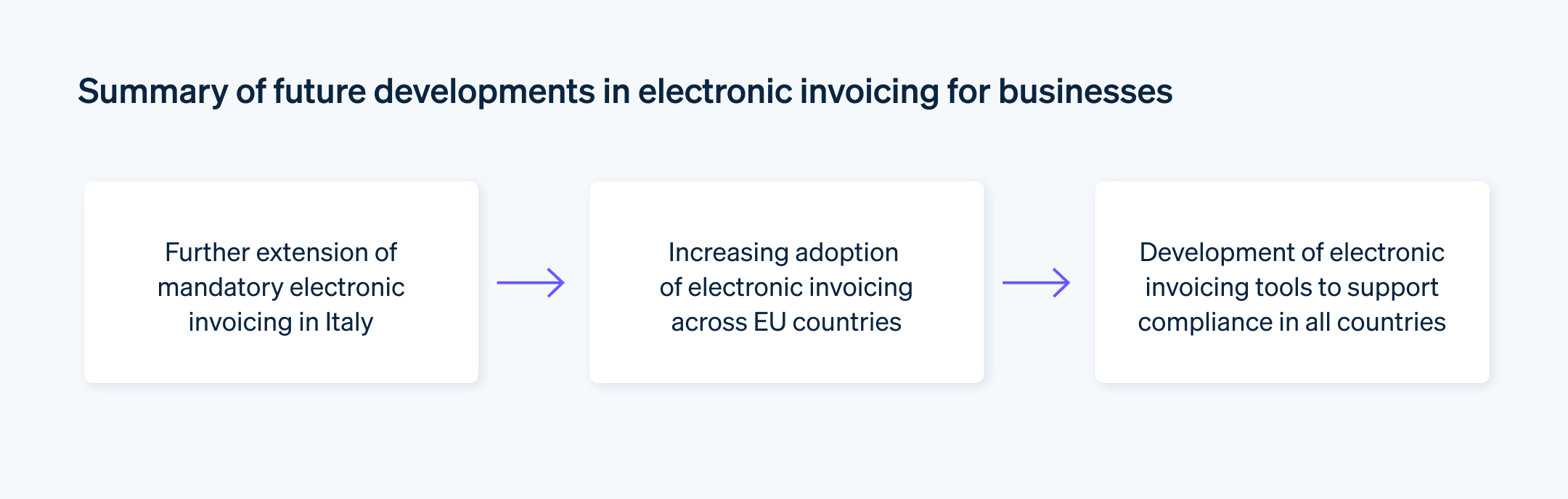

La portée de la facturation électronique en Italie pourrait encore s’étendre dans les années à venir, notamment en ce qui concerne les services de santé pour les particuliers. Toutefois, on ne sait pas encore si la facturation électronique deviendra facultative ou obligatoire dans ce secteur. De plus, vous pouvez vous attendre à ce que d’autres pays de l’UE mettent également en œuvre la facturation électronique. Par exemple, la Roumanie est devenue le deuxième pays après l’Italie à adopter ce système, rendant la facturation électronique obligatoire pour toutes les entreprises roumaines à partir du 1er janvier 2024.

La Belgique exigera l’émission et la réception de factures électroniques interentreprises à compter de janvier 2026. En France, à partir du 1er septembre 2026, toutes les entreprises devront recevoir des factures électroniques, mais leur émission ne concernera que les moyennes et grandes entreprises. L’exigence d’émission des factures s’étendra aux petites et moyennes entreprises un an plus tard, le 1er septembre 2027. Des pays comme la Croatie, l’Allemagne, la Finlande, le Danemark et l’Espagne exigeront probablement la facturation électronique pour les entreprises dans les années à venir.

Bien que de nombreux pays prennent des mesures en vue de la mise en place d’un système européen de facturation électronique, vous pouvez vous attendre à ce que le processus prenne beaucoup de temps. À l’heure actuelle, la législation reste sous le contrôle de chaque pays membre, ce qui rend complexe la gestion de la facturation électronique pour les entreprises, en particulier pour celles qui exercent des activités à l’international.

Les résultats directs comprennent la mise en place de logiciels robustes et de solutions infonuagiques conçues pour garantir la conformité avec les réglementations des différents pays européens, l’interopérabilité avec d’autres outils de gestion d’entreprise et le maintien de la convivialité pour simplifier la gestion de la facturation électronique pour les entreprises.

Le contenu de cet article est fourni uniquement à des fins informatives et pédagogiques. Il ne saurait constituer un conseil juridique ou fiscal. Stripe ne garantit pas l'exactitude, l'exhaustivité, la pertinence, ni l'actualité des informations contenues dans cet article. Nous vous conseillons de consulter un avocat compétent ou un comptable agréé dans le ou les territoires concernés pour obtenir des conseils adaptés à votre situation particulière.