Ab dem 1. Januar 2024 verlangt die Steuerbehörde für die meisten Inhaber/innen einer Umsatzsteuer-Identifikationsnummer in Italien eine elektronische Rechnungsstellung. Viele Unternehmen mussten sich an diese Anforderung anpassen, indem sie Systeme zur Verwaltung elektronischer Rechnungen implementierten und die Einhaltung der neuen Vorschriften sicherstellten.

Im Folgenden erläutern wir, wie die elektronische Rechnungsstellung für Unternehmen funktioniert, welche Herausforderungen und Lösungen es für kleine Unternehmen und Freiberufler/innen gibt und wie die möglichen zukünftigen Entwicklungen aussehen.

Worum geht es in diesem Artikel?

- Die Pflicht zur elektronischen Rechnungsstellung in Italien

- So funktioniert die elektronische Rechnungsstellung für Unternehmen

- Empfängercode bei der elektronischen Rechnungsstellung für Unternehmen

- Elektronische Rechnungsstellung für Kleinunternehmen: Herausforderungen und Lösungen

- Trends und zukünftige Entwicklungen bei der elektronischen Rechnungsstellung

Die Pflicht zur elektronischen Rechnungsstellung in Italien

Mit dem Gesetz Nr. 205 vom 27. Dezember 2017 wurde die Pflicht zur elektronischen Rechnungsstellung in Italien ab 1. Januar 2019 eingeführt. Bis 2023 waren jedoch einige Kategorien von Steuerpflichtigen von der Steuer befreit, z. B. im Rahmen der Pauschalregelung oder der Mindestsatzregelung.

Mit dem Gesetzesdekret Nr. 36/2022 wurden diese Ausnahmen aufgehoben und die obligatorische elektronische Rechnungsstellung ab dem 1. Januar 2024 auf alle Inhaber/innen von Umsatzsteuer-Identifikationsnummern ausgeweitet, unabhängig von ihrem Steuersystem oder ihren erzielten Einnahmen.

Folgende Gruppen sind in Italien auch im Jahr 2024 von der Pflicht zur elektronischen Rechnungsstellung noch ausgenommen:

- Diejenigen, die Rechnungen an ausländische Unternehmen oder Personen ausstellen, die weder in Italien ansässig sind noch steuerlich geführt werden

- Gesundheitsdienstleister/innen, die Daten an das Gesundheitskartensystem (Sistema Tessera Sanitaria) senden

- Personen, die nicht verpflichtet sind, Daten an das Gesundheitskartensystem zu senden, die jedoch Gesundheitsdienstleistungen für Einzelpersonen erbringen

Mit dem Dekret Milleproroghe 2025, das am 9. Dezember 2024 vom Ministerrat verabschiedet wurde, wurde die Ausnahme von der elektronischen Rechnungsstellung für die letzte Kategorie von Angehörigen der Gesundheitsberufe bis zum 31. März 2025 verlängert. Es untersagt ihnen die Ausstellung von Rechnungen, um personenbezogene Daten zu schützen. Bei elektronischen Rechnungen werden die Daten einer Person über das Austauschsystem der Steuerbehörde übertragen, wodurch die Einhaltung der Datenschutzgesetze nicht garantiert wird. Weitere Informationen zu dem Dekret folgen in Kürze.

So funktioniert die elektronische Rechnungsstellung für Unternehmen

Italien war das erste europäische Land, das die elektronische Rechnungsstellung eingeführt hat. Bei einer elektronischen Rechnung handelt es sich um ein Dokument im XML-Format (Extensible Markup Language), das mithilfe einer Software oder eines Webdienstes erstellt wurde. Es wird dann über das Austauschsystem (Sistema di Interscambio, SDI) der italienischen Steuerbehörde (Agenzia delle Entrate) übermittelt.

Das SDI prüft, ob die Rechnung die erforderlichen Steuerinformationen enthält, und stellt dann die Lieferung an den Kunden/die Kundin sicher, indem es dem Lieferanten einen Beleg über die Zustellung ausstellt.

Denken Sie daran, dass Ihre elektronische Rechnung erst ausgestellt wird, wenn Sie sie an das SDI übermittelt haben. Daher ist das Ausstellungsdatum nicht das Datum, das im Feld Datum der Rechnung angegeben ist.

Empfängercode bei der elektronischen Rechnungsstellung für Unternehmen

Die benötigten Informationen für eine elektronische Rechnung für Unternehmen sind identisch mit denen einer Papierrechnung, mit Ausnahme des Empfängercodes, der auch als „SDI-Empfängercode“ oder „SDI-Code“ bezeichnet wird. Dieser Code gewährleistet die korrekte Zustellung einer elektronischen Rechnung an ein Unternehmen oder eine/n Gewerbetreibende/n. Der Empfängercode ist mit der Software oder dem Webservice verknüpft, die bzw. den die Empfänger/innen verwenden, sodass sie Rechnungen direkt in ihrem elektronischen Rechnungsverwaltungssystem empfangen können.

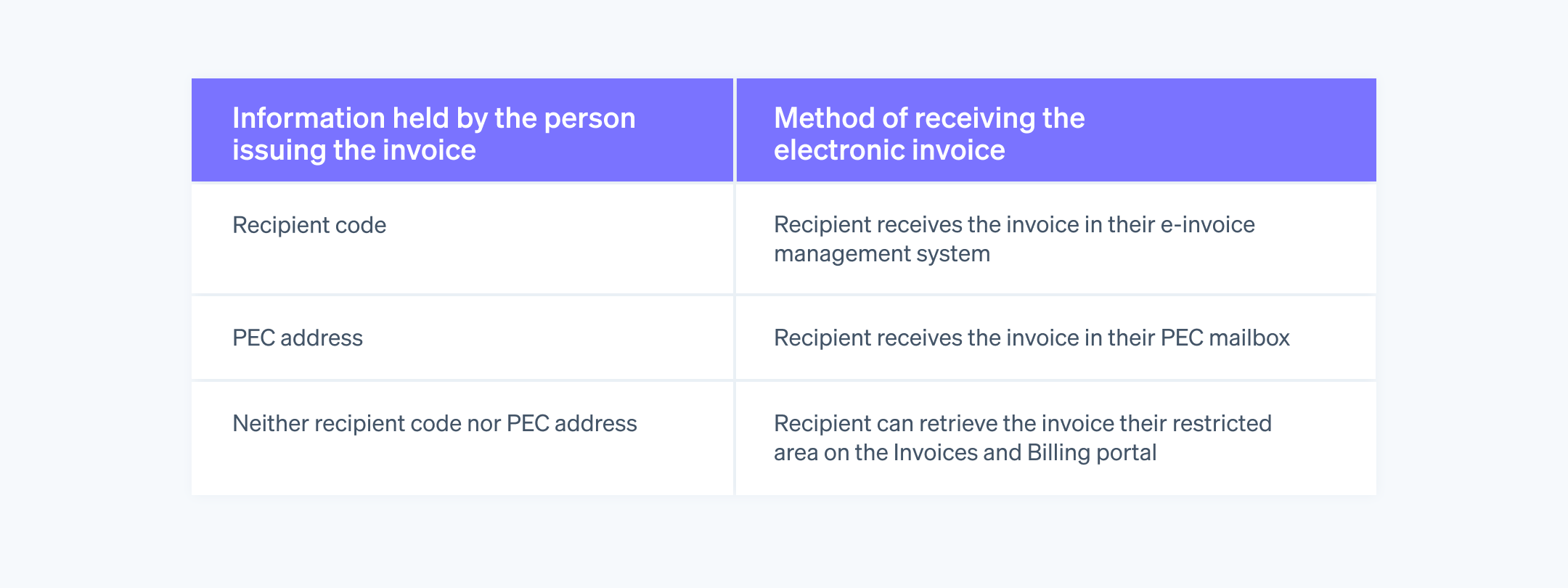

Was passiert, wenn der Empfängercode des Kunden/der Kundin nicht verfügbar ist? Es ist möglich, einem Unternehmen auch ohne den Empfängercode eine elektronische Rechnung auszustellen. In diesem Fall kann der/die Rechnungsempfänger/in diese auf folgende Weise erhalten:

- Zertifizierte E-Mail-Adresse (PEC): Geben Sie die PEC-Adresse des Empfängers/der Empfängerin (falls bekannt) in das Feld „PEC-Empfänger“ ein und geben Sie „0000000“ in das Feld „Empfängercode“ auf der Rechnung ein.

- Empfängerportal: Geben Sie siebenmal null (d. h. 0000000) in das Feld „Empfängercode“ ein. In diesem Szenario verarbeitet das SDI die Rechnung weiterhin mit dem Status „Nichtlieferung“ und ist im Beratungsbereich des Portals für Rechnungen und Belege der italienischen Steuerbehörde verfügbar. Wir empfehlen Ihnen, den Kunden/die Kundin darüber zu informieren, dass die Rechnung in seinem/ihrem reservierten Bereich verfügbar ist.

Elektronische Rechnungsstellung für Kleinunternehmen: Herausforderungen und Lösungen

Als Italien erstmals die elektronische Rechnungsstellung für Unternehmen einführte, waren kleine Unternehmen und Freiberufler/innen unterhalb einer bestimmten Umsatzschwelle davon ausgenommen. Ab 2024 müssen jedoch fast alle Unternehmen die Vorgaben zur elektronischen Rechnungsstellung erfüllen. Daher könnten kleine Unternehmen und Freiberufler/innen bei der Rechnungsstellung vor einigen Herausforderungen stehen.

Die größten Herausforderungen bestehen darin, sich auf die für die Verwaltung elektronischer Rechnungen erforderliche Technologie einzustellen und gleichzeitig die vollständige Einhaltung der neuen Vorschriften zu gewährleisten. Alle Unternehmen müssen eine Software zur Verwaltung elektronischer Rechnungen oder einen Cloud-basierten Dienst verwenden.

Zu diesem Zweck stehen sowohl kostenlose Tools der italienischen Steuerbehörde als auch kostenpflichtige Dienste zur Verfügung. Die italienische Steuerbehörde stellen folgende Tools zur Verfügung:

- Einen webbasierten Prozess: Dieser dient der Zusammenstellung und dem Versand elektronischer Rechnungen und ist über das Portal Rechnungen und Belege (Fatture e Corrispettivi) zugänglich.

- PC-Software: Die Software, die auf der Website der italienischen Steuerbehörde verfügbar ist, ermöglicht nur die Erstellung und Speicherung elektronischer Rechnungen.

- FatturAE: Eine im iOS- oder Android-Store verfügbare App, mit der Sie elektronische Rechnungen versenden können.

Kommerzielle Anbieter bieten verschiedene E-Invoicing-Management-Tools für Unternehmen an, wobei viele Pläne zu unterschiedlichen Preisen anbieten, um den Bedürfnissen und Budgets von kleinen Unternehmen und Freiberuflern gerecht zu werden. Um den Übergang von der papierbasierten zur elektronischen Rechnungsstellung zu vereinfachen, sollten Sie ein Tool oder eine Dienstleistung in Betracht ziehen, für die Folgendes gilt:

- Ist Cloud-basiert und von überall zugänglich

- Ermöglicht eine unkomplizierte Verwaltung elektronischer Rechnungen im Vergleich zu herunterladbarer Software (die oft komplexer ist und höhere Kosten für Wartung und Updates verursacht)

- Verfügt über ein einfaches, intuitives Dashboard

- Bietet engagierten technischen Support

- Kann in jede andere Business-Management-Software integriert werden

Mit der Expansion Ihres Unternehmens wird die Verwaltung des Fakturierungsprozesses immer komplexer. Einige Tools können Sie bei der Automatisierung dieses Prozesses unterstützen, beispielsweise Stripe Invoicing, eine umfassende und skalierbare Rechnungsplattform, mit der Sie Rechnungen für einmalige und wiederkehrende Zahlungen erstellen und versenden können, ohne Code schreiben zu müssen. Mit Stripe Invoicing sparen Sie Zeit und erhalten Zahlungen schneller, da Verbraucher/innen 87 % der Stripe-Rechnungen innerhalb von 24 Stunden bezahlen. Dank der Zusammenarbeit mit Drittpartnern können Sie Stripe Invoicing auch für die verpflichtende elektronische Rechnungsstellung nutzen.

Trends und zukünftige Entwicklungen bei der elektronischen Rechnungsstellung

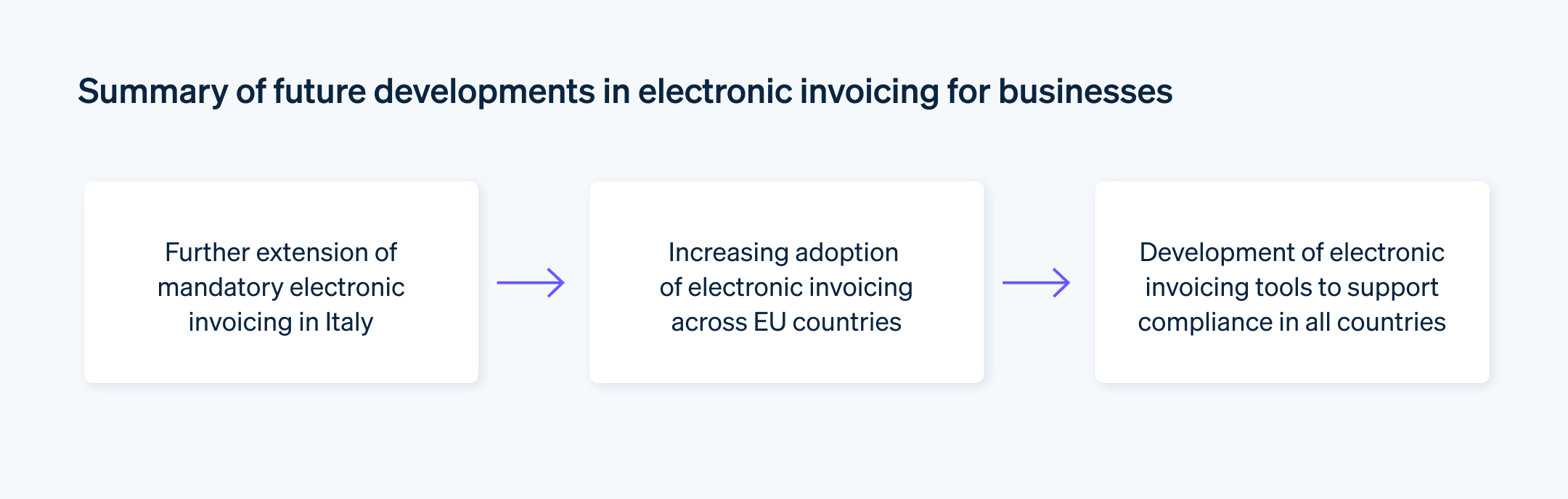

Der Umfang der elektronischen Rechnungsstellung in Italien könnte in den kommenden Jahren weiter zunehmen, insbesondere in Bezug auf Gesundheitsdienstleistungen für Privatpersonen. Unklar ist allerdings, ob die elektronische Rechnungsstellung in diesem Bereich fakultativ oder verpflichtend wird. Darüber hinaus können Sie davon ausgehen, dass auch andere EU-Länder die elektronische Rechnungsstellung einführen werden. So ist Rumänien nach Italien das zweite Land, das dieses System eingeführt hat, wodurch die elektronische Rechnungsstellung für alle rumänischen Unternehmen ab dem 1. Januar 2024 obligatorisch ist.

In Belgien müssen ab Januar 2026 elektronische Business-to-Business (B2B)-Rechnungen ausgestellt und empfangen werden. In Frankreich müssen ab dem 1. September 2026 alle Unternehmen elektronische Rechnungen empfangen können. Dies gilt allerdings nur für mittlere und große Unternehmen. Ein Jahr später, am 1. September 2027, wird die Verpflichtung zur Ausstellung von elektronischen Rechnungen auch auf kleine und mittlere Unternehmen ausgeweitet. Länder wie Kroatien, Deutschland, Finnland, Dänemark und Spanien werden in den kommenden Jahren voraussichtlich ebenfalls die elektronische Rechnungsstellung für Unternehmen vorschreiben.

Obwohl viele Länder Schritte zur Etablierung eines europäischen Systems für die elektronische Rechnungsstellung unternehmen, ist damit zu rechnen, dass dieser Prozess viel Zeit in Anspruch nehmen wird. Derzeit unterliegt die Gesetzgebung weiterhin der Kontrolle der einzelnen Mitgliedsländer, was die Verwaltung der elektronischen Rechnungsstellung für Unternehmen, insbesondere für international tätige Unternehmen, komplex macht.

Zu den direkten Ergebnissen gehören die Weiterentwicklung robuster Software- und Cloud-Lösungen, die die Einhaltung von Vorschriften in einzelnen europäischen Ländern sicherstellen sollen, die Interoperabilität mit anderen Business-Management-Tools und die Aufrechterhaltung der Nutzerfreundlichkeit, um das E-Invoicing-Management für Unternehmen zu vereinfachen.

Der Inhalt dieses Artikels dient nur zu allgemeinen Informations- und Bildungszwecken und sollte nicht als Rechts- oder Steuerberatung interpretiert werden. Stripe übernimmt keine Gewähr oder Garantie für die Richtigkeit, Vollständigkeit, Angemessenheit oder Aktualität der Informationen in diesem Artikel. Sie sollten den Rat eines in Ihrem steuerlichen Zuständigkeitsbereich zugelassenen kompetenten Rechtsbeistands oder von einer Steuerberatungsstelle einholen und sich hinsichtlich Ihrer speziellen Situation beraten lassen.