Product

Stripe Atlas startups in 2025: Year in review

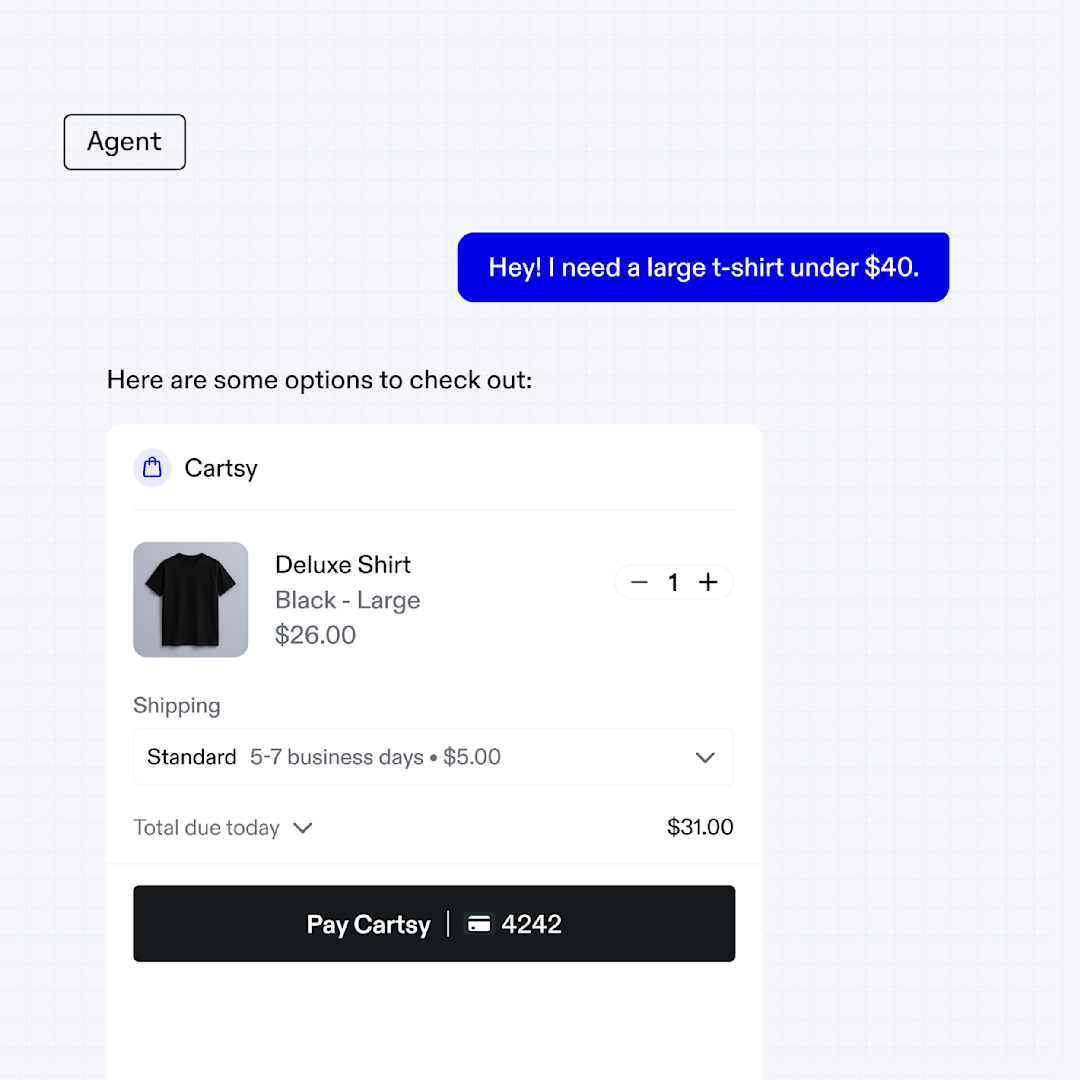

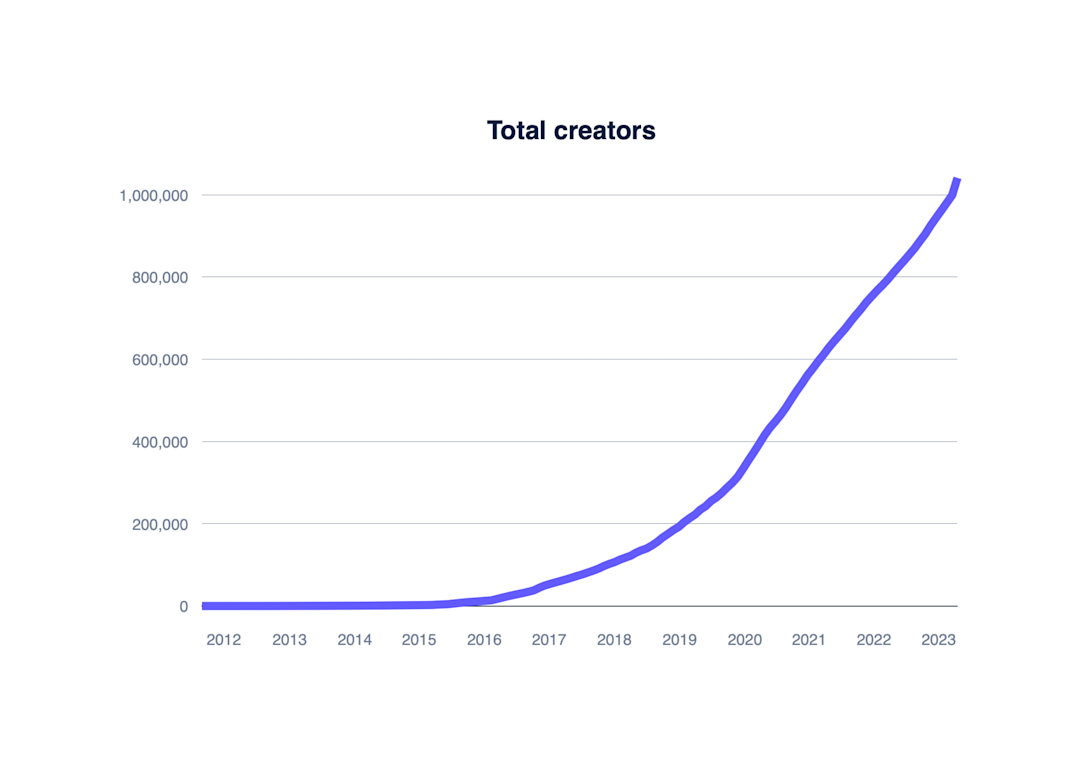

2025 was a breakout year for early-stage startups, as founders generated revenue faster than ever. Three shifts stand out: customer bases are becoming more global, time-to-revenue has compressed, and founders are turning their focus to AI agents.