Product

Supporting additional payment methods for agentic commerce

Stripe is now the first and only provider that supports both agentic network tokens and buy now, pay later tokens in agentic commerce through a single primitive.

It takes a unified, interoperable suite of products to build economic infrastructure for the internet. As we work toward that goal, we spotlight what we’ve learned and updated across our payments, financial services, and business operations products.

Stripe is now the first and only provider that supports both agentic network tokens and buy now, pay later tokens in agentic commerce through a single primitive.

Together, Metronome and Stripe are building the most flexible and complete billing solution on the market—one that works for everyone, from engineers in a garage figuring out their business model to public companies monetizing at global scale.

2025 was a breakout year for early-stage startups, as founders launched more companies and generated revenue faster than ever. Three shifts stand out: customer bases are more international than ever, time-to-revenue has compressed, and founders are turning their attention to AI agents over AI infrastructure or copilots.

In a new study, we found a strong causal relationship between accepting financing and growing revenue on Stripe. Learn which businesses are most likely to benefit, and how greater access to financing could drive significant GDP growth.

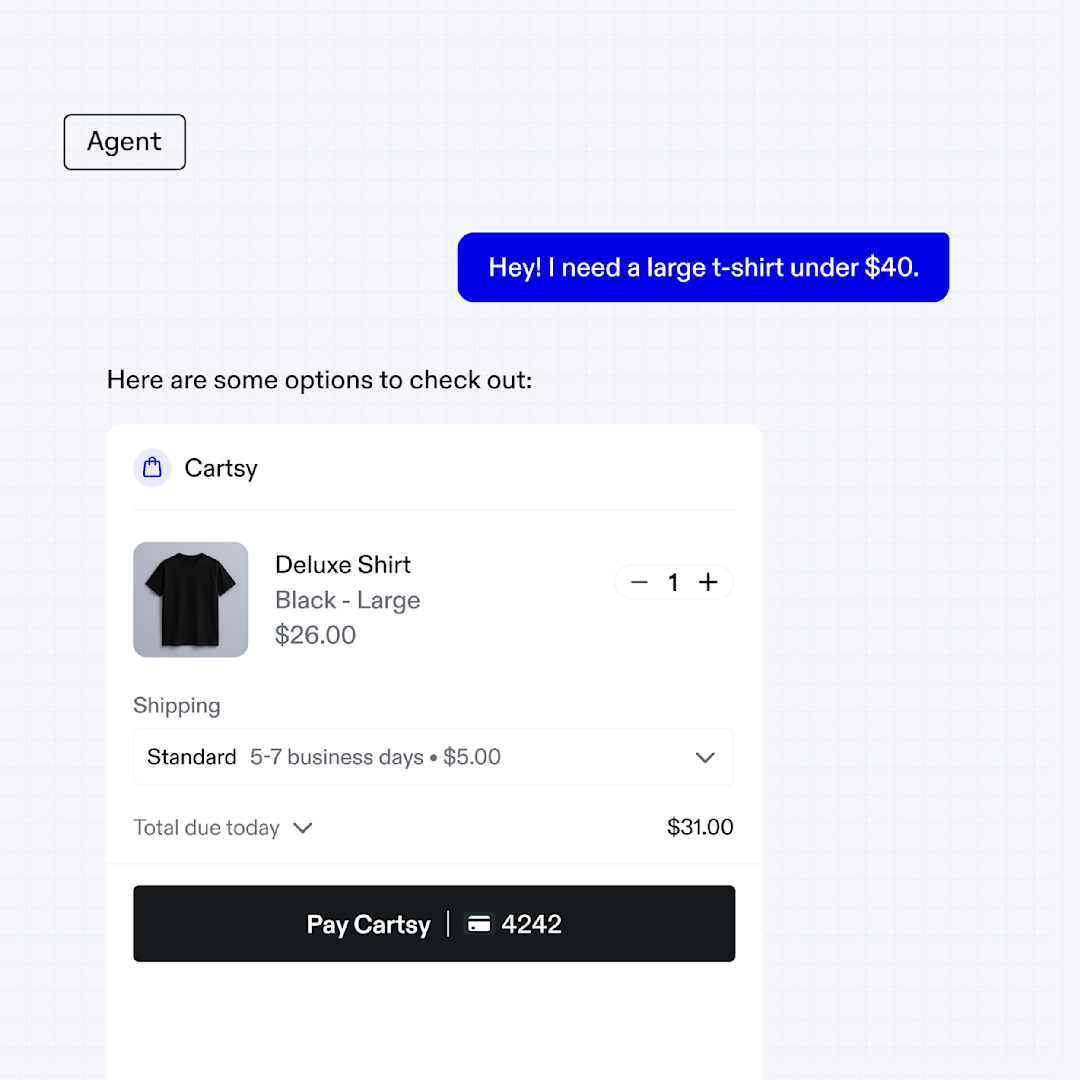

Today, we’re introducing the Agentic Commerce Suite: a new solution that gets your business agent-ready. It enables you to sell on AI agents more easily by making your products discoverable, simplifying your checkout, and allowing you to accept agentic payments via a single integration.

Leading SaaS platforms across industries—from Squarespace to Jobber—are using embedded components to ship payments and finance features with minimal code. We analyzed the data to see which types of platforms are getting the most value.

We recently launched three new features that give you more control to fine-tune your risk and compliance strategy, allowing you to use more of Stripe’s data to inform your approach. Here’s what’s new.

We recently released a series of improvements to expand multiprocessor support, give you more control over your billing and invoicing models, and better tailor your pricing for AI products. Here’s everything that’s new.

Last week, Google announced that Android apps selling digital goods to US customers can now process in-app payments using third-party payment providers. Many customers have turned to Stripe to handle in-app purchases by using multiple products: Stripe Managed Payments, Optimized Checkout Suite, and Stripe Billing. Here’s a closer look at our solutions for app developers.

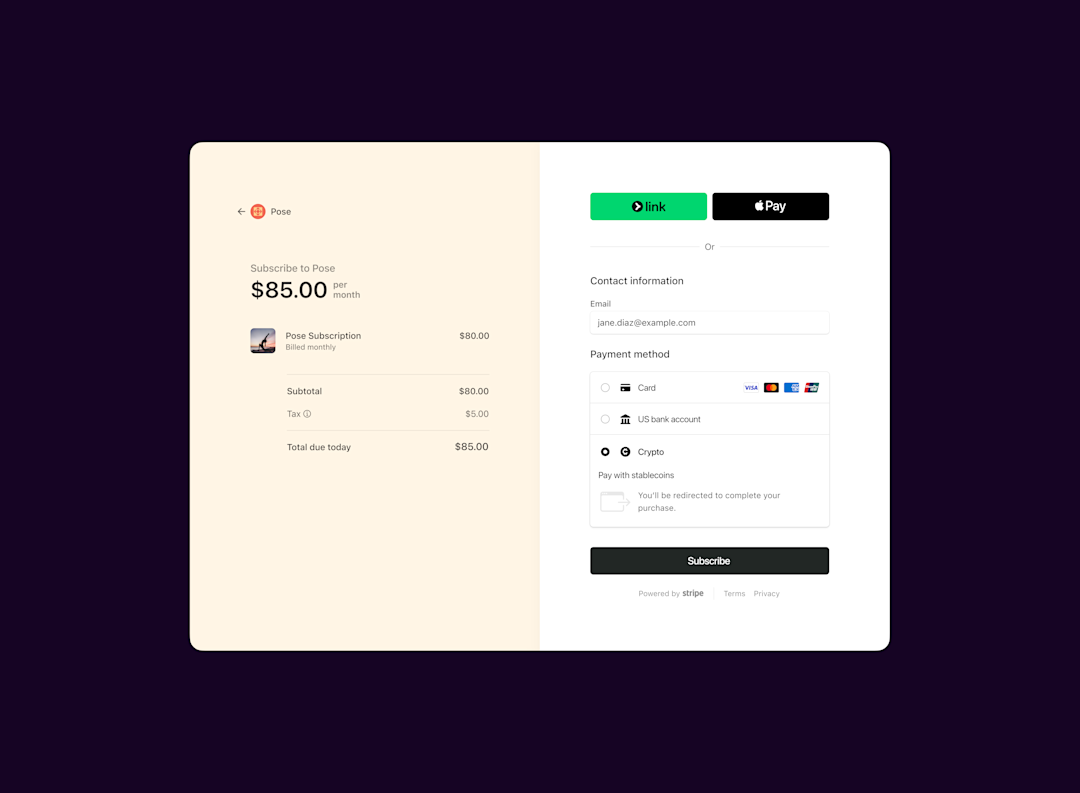

As businesses expand globally, stablecoins can help them reach a broader international audience more cost-effectively. Now we’re extending these benefits to subscription-based businesses by launching recurring payments with stablecoins.

Last week, we shared how we worked with OpenAI to develop the Agentic Commerce Protocol (ACP), a new specification to help AI platforms embed commerce into their applications and businesses sell through agentic channels without giving up trust or control. ACP is just the beginning. Here are some of the additional steps Stripe is taking to build agentic commerce solutions for AI platforms and businesses.

Open Issuance, from Bridge, is a new platform that allows any business to launch and manage its own stablecoin. With its own stablecoin, a business can control its product experience, mint and burn without limits or unnecessary fees, and earn rewards from reserves.

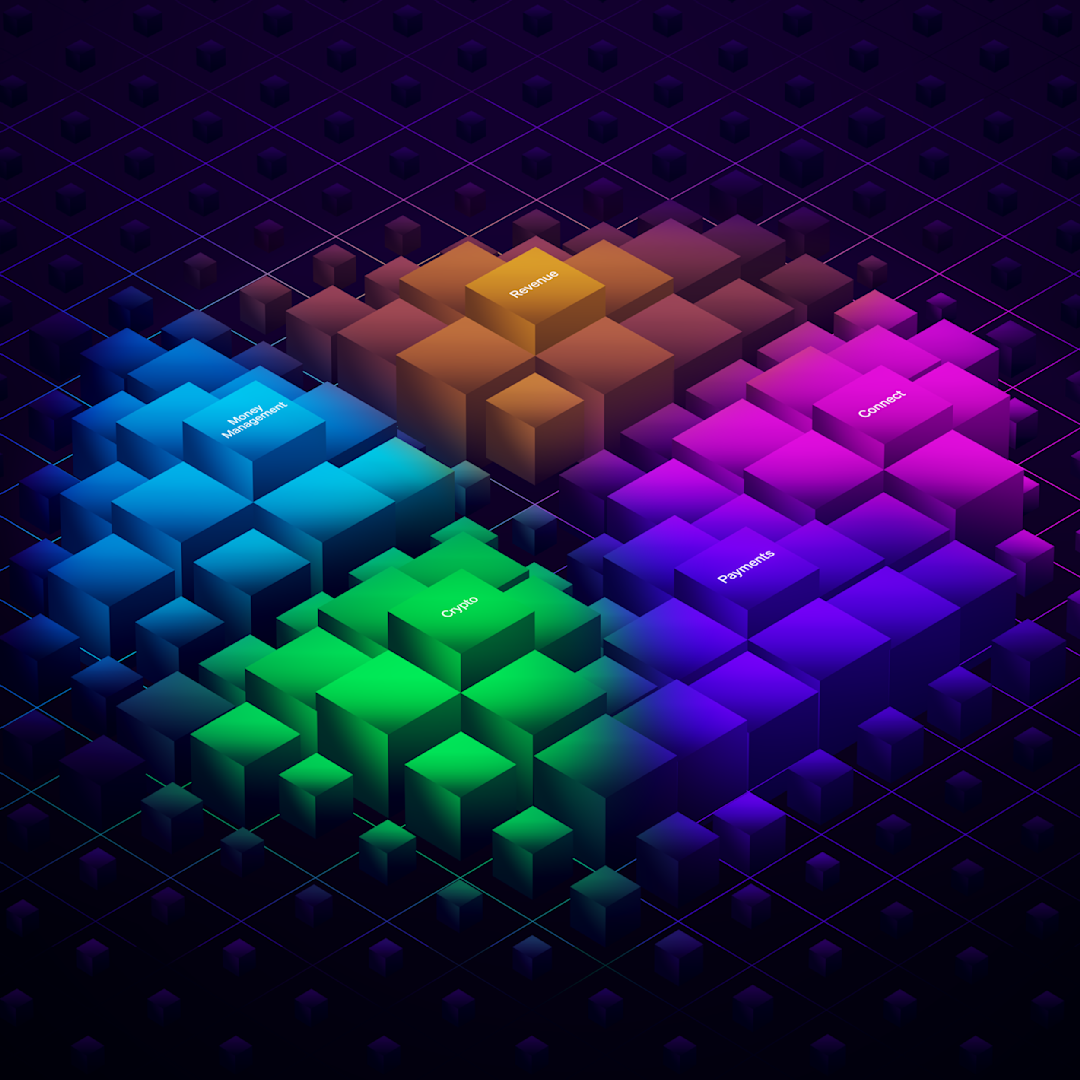

We announced new agentic commerce capabilities, modular infrastructure for all parts of the crypto stack, including the ability for you to collect subscription payments using stablecoins, and a lot more.

Today, we announced that Stripe is powering OpenAI’s newly launched commerce experience: Instant Checkout in ChatGPT. It is powered by the Agentic Commerce Protocol, a new open standard developed by Stripe and OpenAI that enables programmatic commerce flows between AI agents and businesses.

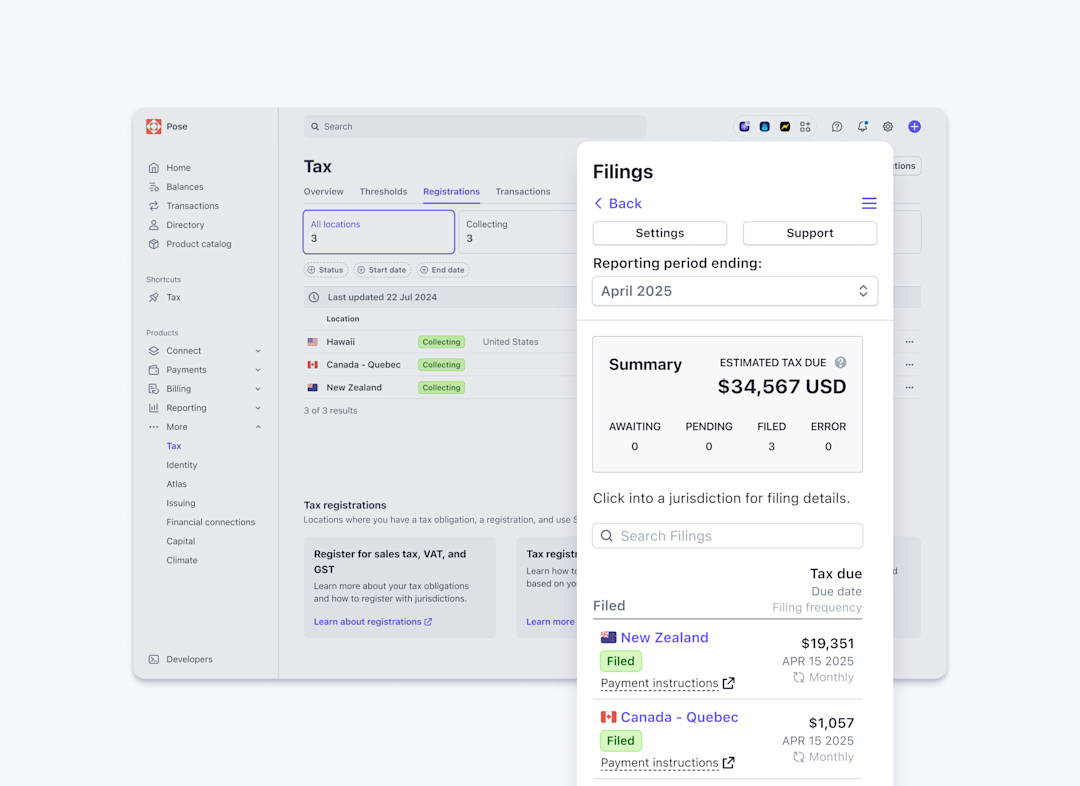

Stripe Tax is now an all-in-one global tax compliance solution, after adding international registration and filing to round out its tax calculation and collection features.

Last month at Stripe Sessions, we announced Global Payouts, which allows you to easily and securely send money to third parties around the world. Global Payouts is part of our biggest-ever upgrade to Stripe to make it less expensive, complex, and time-consuming for you to fund, store, and pay out in multiple currencies.

Earlier this month at Stripe Sessions, we announced Stablecoin Financial Accounts—our largest effort to date in expanding money management capabilities to businesses across the globe. Entrepreneurs and businesses in 101 countries can now easily access a dollar-denominated stablecoin balance to store and move money on crypto or established financial rails right from their Stripe Dashboard.

Stripe has been using AI in our payments products for over a decade, and we’re continuing to expand how we put AI to use on your behalf. Last week at Stripe Sessions, we introduced our Payments Intelligence Suite, which uses AI to make hundreds of automated, real-time decisions to maximize your profits—with no effort required.

We announced the ability to manage multiple payment providers from within Stripe, two new extensibility primitives, support for turnkey consumer issuing programs, new money management capabilities, and a lot more.

Over the last year we’ve seen a 40% increase in the share of noncard payment volume on Stripe. To help you adapt your fraud prevention strategy to this changing set of payment method preferences, we’re extending Radar’s fraud protection to cover ACH and SEPA payments.