Product

Metronome + Stripe: Building the future of billing

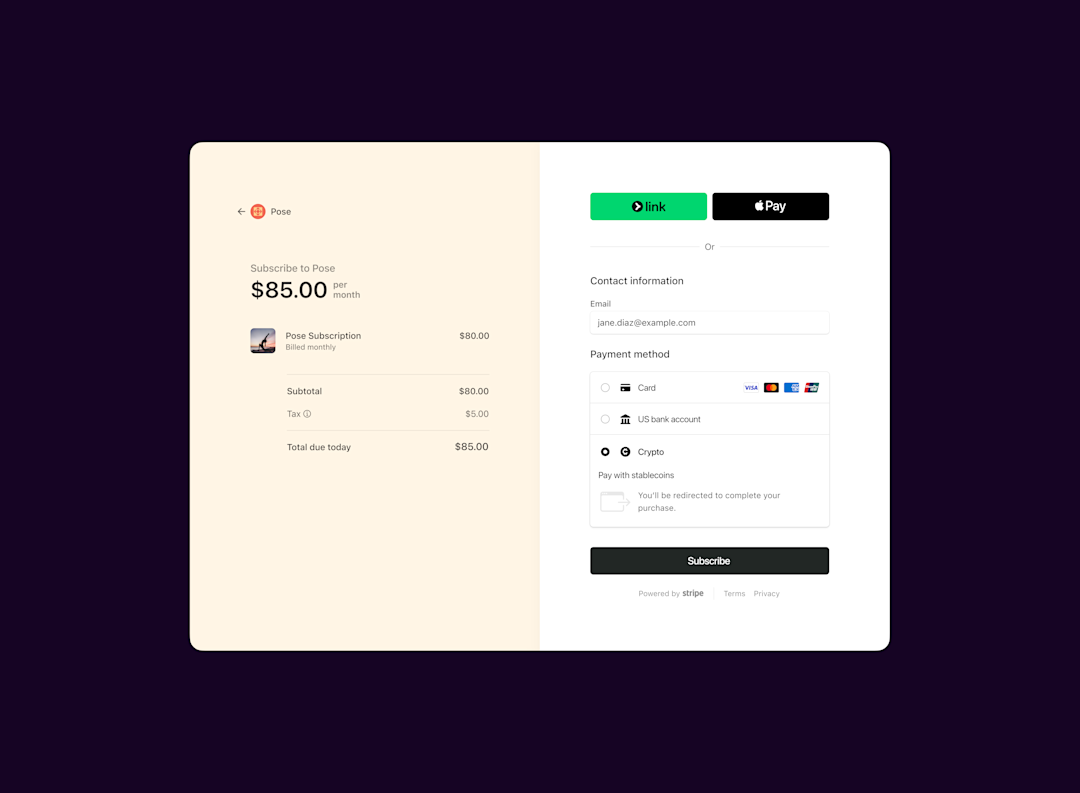

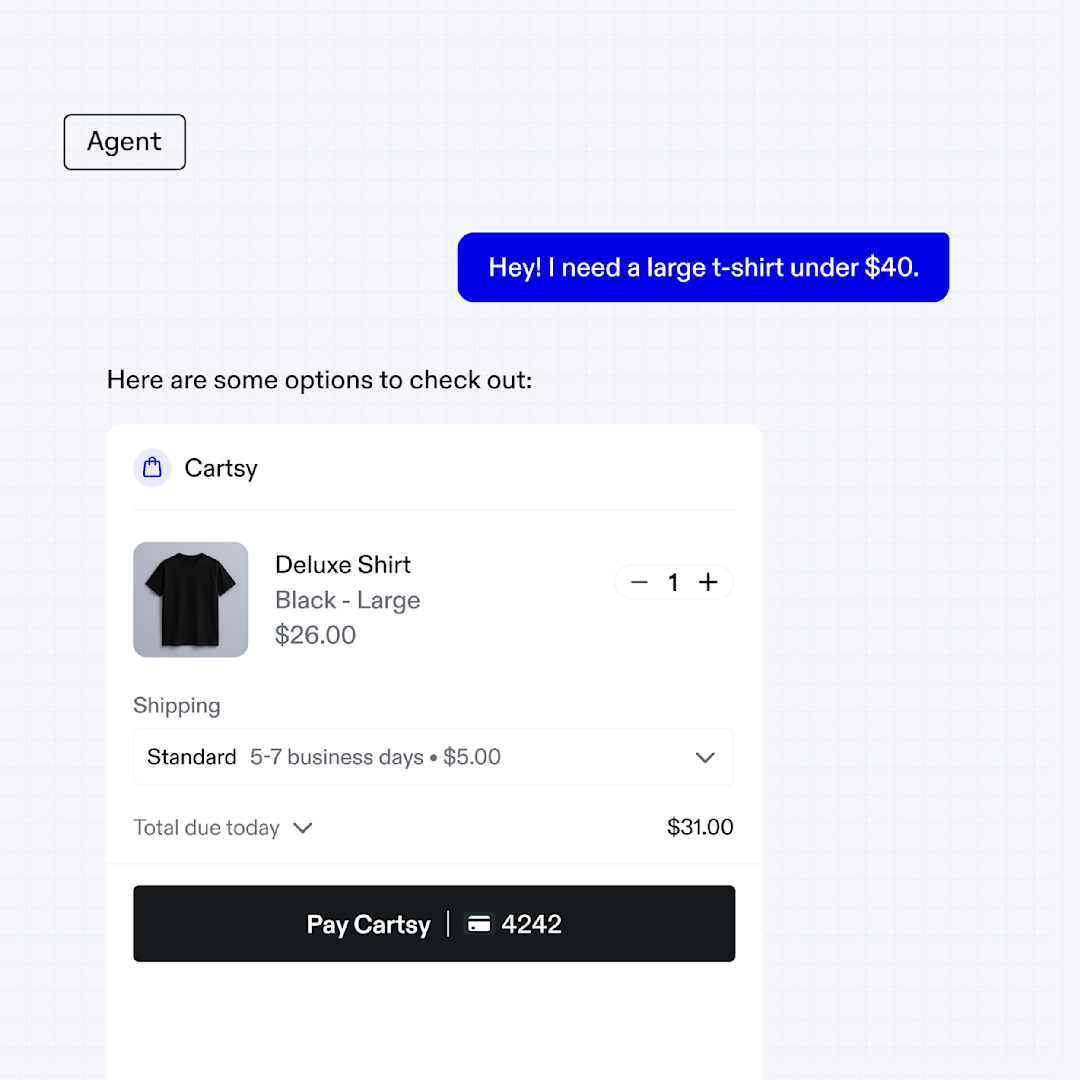

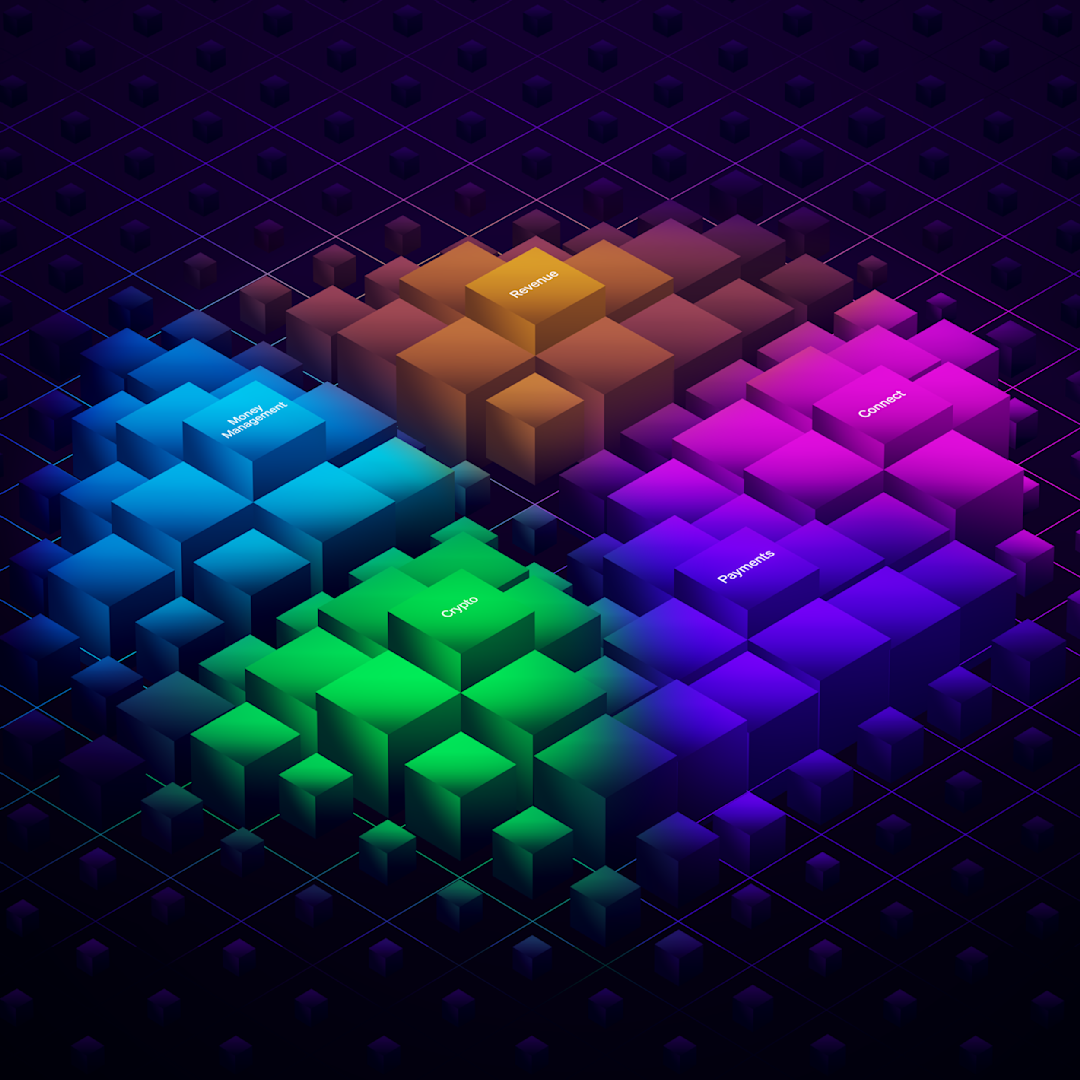

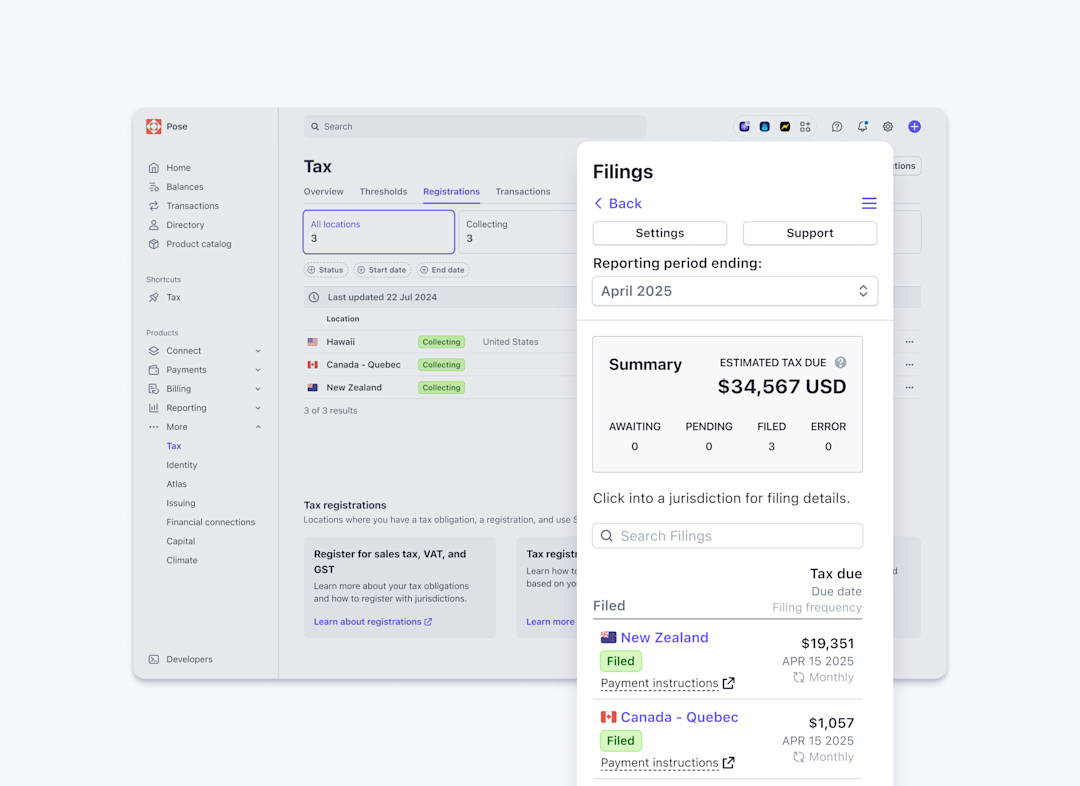

Together, Metronome and Stripe are building the most flexible and complete billing solution on the market—one that works for everyone, from engineers in a garage figuring out their business model to public companies monetizing at global scale.