Radar now protects ACH and SEPA payments

Over the last year we’ve seen a 40% increase in noncard payment volume on Stripe. It’s a major change that has implications for many aspects of the payments landscape, including how we fight fraud. That’s because while many noncard payment methods have lower fraud rates than cards, they also introduce new fraud challenges. Consider bank debits, which have a longer settlement period compared to cards (up to four days). This means a business takes on the risk of failed bank payments—and the potential for lost revenue—if you deliver goods and services to your customers before the transaction has settled.

To help you adapt your fraud prevention strategy to the changing set of payment method preferences, we’re extending Radar’s fraud protection to cover ACH and SEPA payments. We’ve applied the same AI architecture that Radar uses for cards to new AI models that automatically screen and help block risky ACH and SEPA transactions. This allows you to confidently adopt the payment methods your customers are asking for, knowing that your fraud protection tools are tuned to the unique fraud profiles these payment methods carry. Companies including Xero, Jobber, and FreshBooks are already using Radar’s new models to combat ACH and SEPA fraud. On average, Radar users see a 42% reduction in SEPA fraud and a 20% reduction in ACH fraud.

Block ACH and SEPA fraud while maintaining a low false positive rate

Because bank debits have an extended settlement time, signals like the immediate confirmation that a payment has succeeded—which helps us predict card fraud—aren’t available right away. Instead, we engineered hundreds of new features that are unique to the asynchronous nature of ACH and SEPA transactions.

We now look at signals like average order value (which is typically larger for direct debit transactions compared to card transactions) and a bank’s historical rate of payment success and failure. This new information allows our models to predict the likelihood that an ACH or SEPA transaction will not succeed and automatically block it.

Customize your ACH and SEPA fraud protection

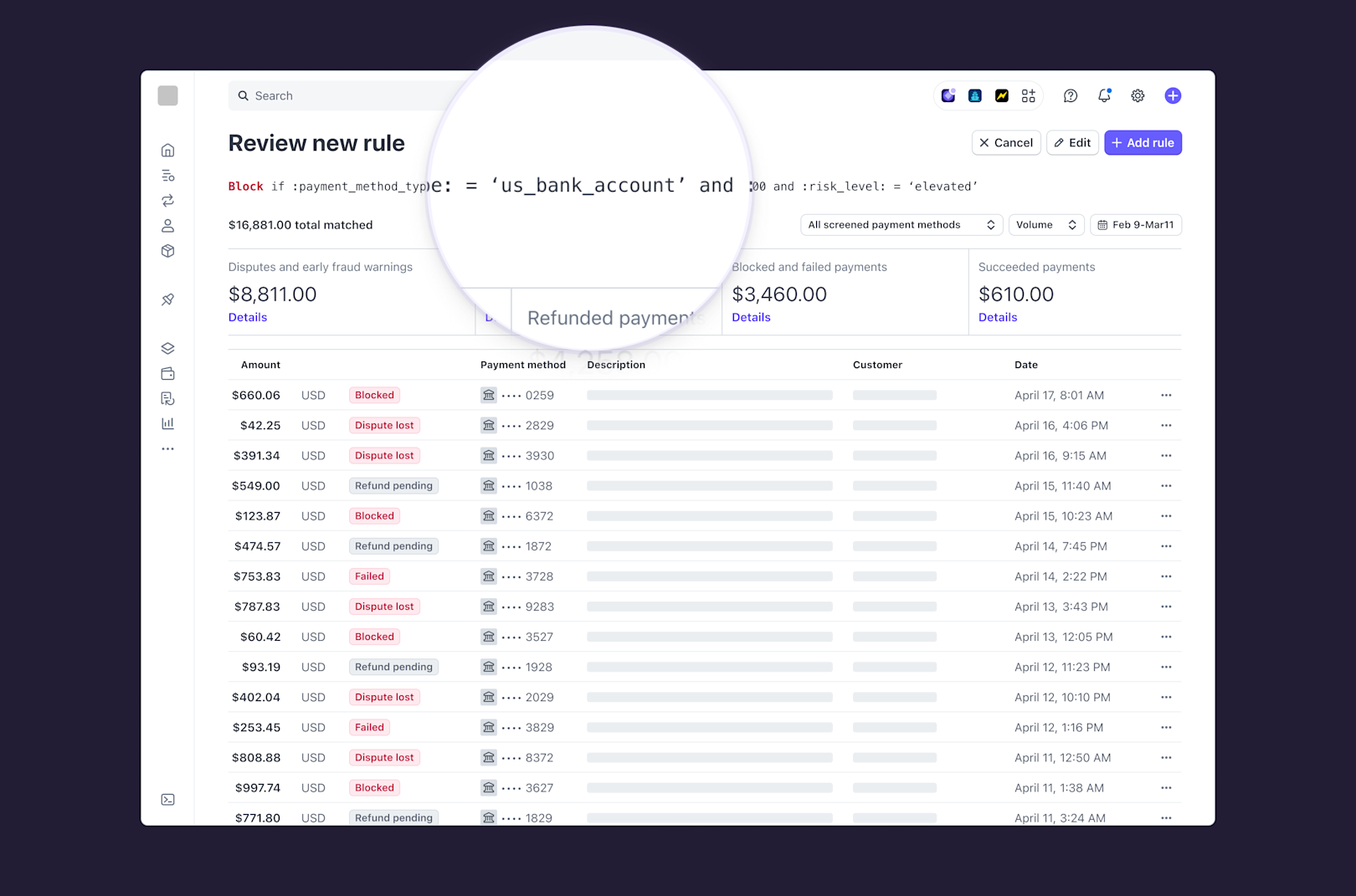

With Radar for Fraud Teams, you can create custom rules based on payment method type with new attributes that are tailored to ACH and SEPA. For example, you can write a rule to block a bank account routing number that’s produced fraudulent activity before. In addition, you can use payment method attributes to customize your default “block” and “allow” lists, and tailor your risk threshold for cards, ACH, or SEPA.

Helping you adapt to fraud

Existing Radar users automatically benefit from ACH and SEPA fraud protection—no extra work required. And because Radar is seamlessly integrated with other Stripe products such as Checkout and Connect, you get expanded fraud protection across all your payment surfaces and configurations.

Over the next year, we plan to add Radar support for fast-growing payment methods with high fraud rates and build new, customized tools that are designed to address these specific fraud vectors. Let us know which payment methods you’d like us to support next.

Learn more about how Radar can help protect your business, or get started with Radar today.