Our top product updates from Sessions 2025

This morning at our annual conference, Stripe Sessions, we shared the biggest changes we’ve ever made to Stripe with thousands of business leaders and builders. Our keynote covered our progress in four core product areas: Payments, Connect, Revenue, and Money Management. We highlighted how we’re helping you grow by applying frontier technologies like AI and stablecoins to your commerce stacks, by leveraging the vast scale of the Stripe network, which now comprises millions of businesses collectively moving more than 50,000 transactions every minute, and by making Stripe even more extensible and programmable to meet your specific needs.

This post recaps the top announcements and product releases. For a more detailed list of what’s new since Sessions last year, see our changelog.

Payments

Stripe now processes more than $1.4 trillion in payments a year, with 73% of global enterprises new to Stripe choosing to build their checkouts with our Optimized Checkout Suite. Among many other things, today we shared how we’re using AI across the full payments lifecycle to boost conversion and reduce costs, how we’re making Stripe more extensible by allowing you to manage multiple payment providers with Stripe Orchestration, and how we’re making it easier to launch and enter new markets with Stripe Managed Payments. Here’s the full list of what’s new:

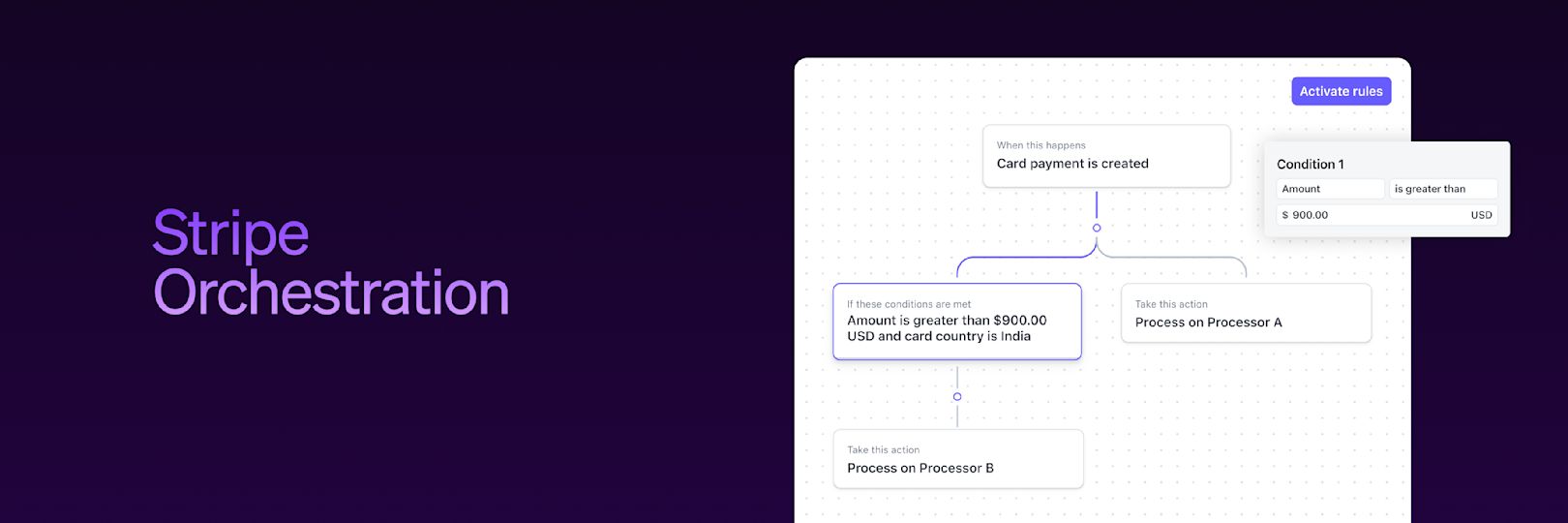

Stripe Orchestration

- We previewed Stripe Orchestration, which allows you to easily manage multiple payment processors with full control and visibility, from right within Stripe.

Optimized Checkout Suite

- We announced that one-click Klarna will soon be available on Link, allowing your customers to add their Klarna account and pay in one click.

- We announced that this summer we’ll launch Managed Payments, our merchant of record offering. Stripe will manage global tax compliance, fraud and disputes, and the checkout experience, in addition to handling customer support for transactions through Link.

- The AI models built into our Optimized Checkout Suite now use more than 100 signals to personalize checkout in real time, including which payment methods are shown and which payment fields are displayed.

- You can now access more than 125 global payment methods on Stripe, including stablecoins and real-time payments, such as Pix and UPI.

- You can now use Adaptive Pricing to localize prices in more than 150 markets with no additional fees on more prebuilt payment surfaces, including Elements and the Hosted Invoice Page.

- You can now display any payment method—with any payment processor—in the Payment Element.

- You can now accept payments on your mobile app using a customizable drop-in component with the Embedded Mobile Payment Element.

- You can now go live on the Payment Element faster than ever before with the Checkout Sessions API, our new integration path that allows you to enable products like Billing, Tax, or Adaptive Pricing with a single line of code.

Payments Intelligence Suite

- We previewed Authorization Boost, which uses AI to automatically update cards and tokens, route transactions across networks, and determine if and how to retry failed payments.

- We previewed Smart Disputes, which automatically responds to eligible disputes on your behalf, with evidence tailored to each dispute to help you recover more chargebacks.

- You can now incorporate Radar risk scores, via API, into your own in-house fraud prevention system or multiprocessor setup.

- You can now use Radar’s fraud protection for ACH and SEPA payments.

- We added new capabilities to Payments analytics, including more visibility into dispute rates with disputes analytics and quantifiable recommendations for how to increase your revenue.

- If you have a premium or enterprise support plan, you can now use our new AI-powered anomaly alerts, which catch unexpected degradations in authorization rates with over 90% precision.

- We expanded Radar’s dispute prevention, now powered by Ethoca (from Mastercard) and Verifi (from Visa), to help you proactively prevent disputes by reminding customers about order details and automatically resolving disputed transactions before they become chargebacks.

Terminal

- We previewed the ability to use Terminal on third-party hardware, beginning with Verifone.

- Through our partnership with FreedomPay, you can combine Stripe’s in-person payments with more than 1,000 POS and hardware providers.

Currency presentment

- You can now use the FX Quotes API to display prices in local currencies, lock in exchange rates, and check real-time rates and fees.

Organizations

- We previewed the ability to easily share customers and their payment methods across accounts, removing the need to re-collect information at checkout.

- You can now centrally view and manage disputes across accounts in your organization.

Revenue

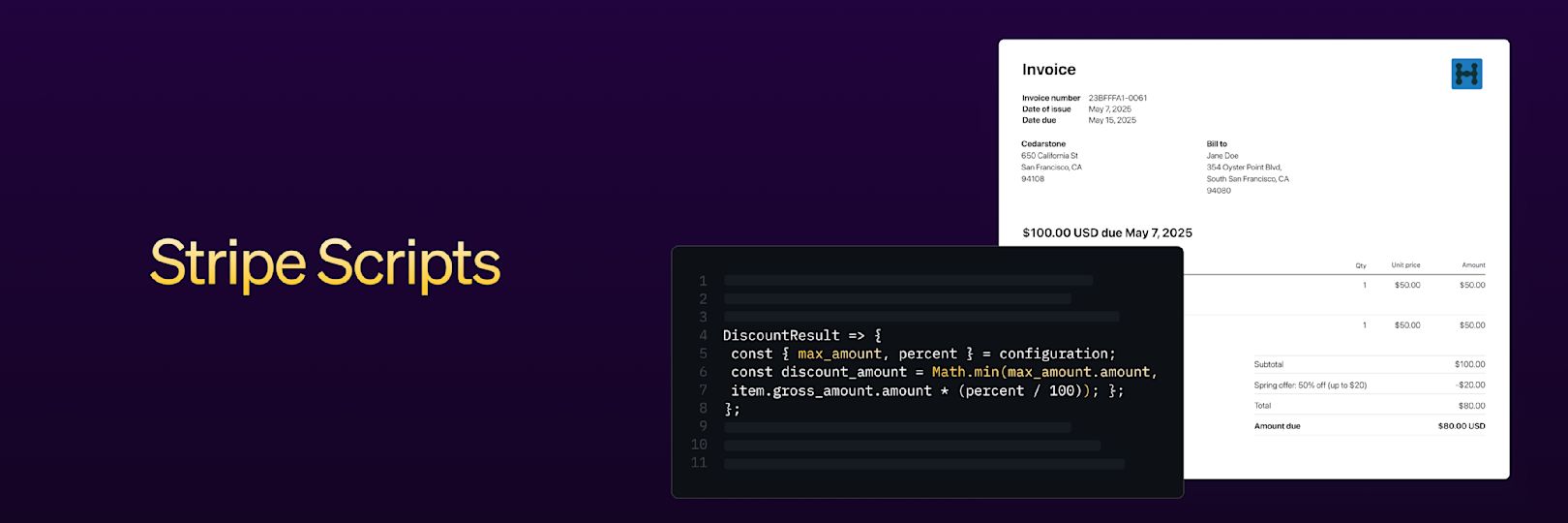

More than 300,000 businesses use Stripe Billing—the heart of our Revenue suite—including the world’s leading AI companies such as OpenAI, Anthropic, Cursor, Midjourney, and now, NVIDIA. We unveiled the biggest updates to our Revenue suite yet, including two new extensibility primitives—Scripts and Workflows—that turn Stripe into a programmable revenue engine, upgrades to usage-based billing to help you better monetize your AI offerings, and the evolution of Stripe Tax into an all-in-one global tax solution, now with automated registration and filing. Here’s more of the latest:

Billing

- We previewed Stripe Scripts, a new way to extend and customize the logic in Stripe Billing.

- You can now build, test, and execute multistep flows that orchestrate across Stripe products—using your data, Stripe’s APIs, and conditional logic—with Workflows.

- Our new AI-powered benchmarking tool lets you compare your performance against similar businesses on Stripe.

- You can now set up mixed interval subscriptions, consolidate subscriptions on an invoice, unallocate payments, and set up partial payments.

- You can now access financial reports and streamline connections to your data warehouses across all your Stripe accounts with Stripe Organizations’ expanded support for Billing.

Tax

- Tax now supports global registration and filing, allowing you to streamline every aspect of tax compliance in one solution.

- We now support tax collection in 102 countries—up from 57 last year.

- Tax now supports country- and state-specific tax rules for calculating shipping fees.

- We released new apps from Anrok, Avalara, and Sphere, which integrate with Stripe Billing and Checkout and allow you to automatically calculate tax on Stripe transactions, subscriptions, and invoices with your third-party tax solution.

- We announced that Tax will soon support additional verticals such as events and ticketing.

Revenue Recognition

- New transaction data is now available within three to four hours, allowing you to close your books within the same day.

- We previewed Revenue Recognition support for all Billing users, including those with usage-based billing models, to automate accrual accounting.

Sigma and Data Pipeline

- You can now access Stripe data sooner: query data in Sigma within three hours, and access Stripe data in your storage destination via Data Pipeline within six hours.

- You can now use Sigma and Data Pipeline with Stripe Organizations, allowing you to access and export your Stripe data at an organization level.

- We previewed the Sigma API, which allows you to access your Sigma data and templates via an API to create custom integrations and automate reporting in your own environment.

Connect and Embedded Finance

Stripe Connect now helps more than 15,000 SaaS platforms—supporting more than 10 million businesses—embed payments and financial services directly into their platform. Today, we shared powerful new tools to help you manage the complexities of running your business, including a major refresh of the Stripe Dashboard for platform users, instant onboarding that leverages the scale of the Stripe network, and support for turnkey consumer issuing programs. Updates in this area include:

Connect

- We announced a new version of Radar built just for platforms. You can use Radar’s AI-based fraud prevention features to detect potentially fraudulent accounts, set custom account-level rules, and access advanced analytics to optimize your risk strategy.

- Users who already have a Stripe account can now onboard onto your platform in just three clicks with networked onboarding.

- We previewed the new dashboard for platforms, with new summaries of financial performance and connected account growth, personalized recommendations, and snapshots of restrictions and tasks.

- You can now view support cases across all your connected accounts and get insights into the top support issues your users encounter.

- Your customers can now pay their subscription fees directly from their Stripe balance.

- With the new Accounts v2 API, you can now model your customers with a single Stripe account across Stripe Billing and Stripe Connect.

- You can now access new resources, tools, and support available through our SaaS platform partner ecosystem.

Capital

- We previewed the ability to use Capital to extend financing to more of your users—even businesses that don’t use Stripe to process their payments—by integrating your own third-party data into Stripe’s underwriting.

- You can now offer end-to-end financing for your users by integrating our ready-to-use, customizable embedded components directly into your platform in a few minutes with just a few lines of code.

Issuing

- We previewed the ability to build a turnkey consumer credit card program with Stripe Issuing.

- You now have more flexibility in how you build your Issuing program, with the option to maintain full control over your banking relationships, or use your own license while partnering with Stripe to process transactions.

- You can now easily write complex authorization rules through a no-code dashboard with our Issuing rules engine.

- Our new set of API signals and tools helps you make better fraud decisions by highlighting the fraud risk of your issuing authorizations and card activity.

- Platforms in the US can now issue US cards to subsidiaries of multinational customers in more than 40 countries.

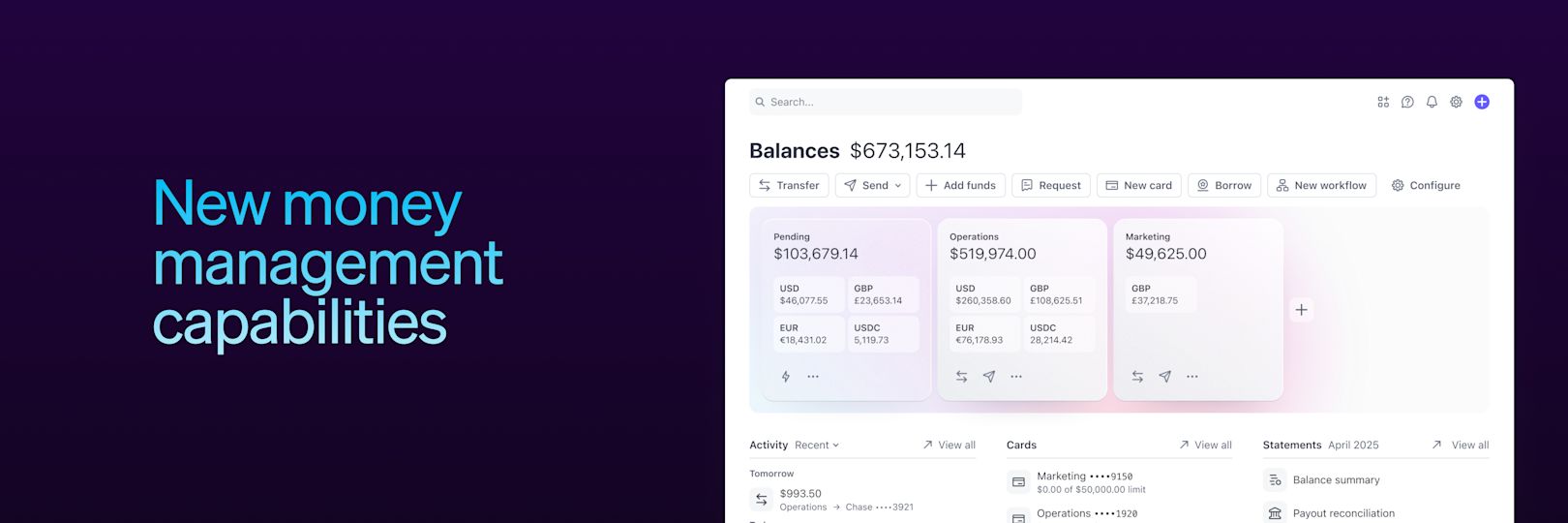

Money Management

We announced that, starting today, we’re rolling out our biggest-ever upgrade to Stripe to make money management internet-native and programmable. We previewed new capabilities to help you store, send, and receive money—including in stablecoins—all on local rails and in multiple currencies. Over the next year, we’ll make these capabilities available by default to all users on Stripe. Here’s everything we shared:

- We previewed new money management features that are built into the Stripe Dashboard, allowing businesses in the US and UK to store and manage money in multiple currencies and convert between them, send and receive money via local rails, and create virtual and physical cards.

- We announced that users from more than 100 countries will soon be able to store, receive, and send funds via crypto and fiat rails from a dollar-denominated stablecoin balance with Stablecoin Financial Accounts.

- Businesses in the US and UK can now send global payouts to customers, affiliates, contractors, or other third parties in 58 countries with just an email address with Global Payouts.

- We previewed the ability for you to get a USDC-denominated corporate card on the Visa network, powered by Stripe Issuing and Bridge.

And much more

In addition to sharing updates from our four core product areas, we also announced several other features, products, and programs that help you grow. We announced a new API that lets you embed agentic commerce directly into your applications, unveiled Stripe Verified, a new credential for an accredited Stripe business, and previewed a new networking capability that lets you easily transact with other businesses on Stripe. Here’s what’s new:

- You can now add Stripe to your agentic workflows, giving agents access to financial services so they can earn, store, and spend funds.

- We announced the Order Intents API, which allows you to create a commerce agent in seconds.

- We previewed Stripe Profiles, your public identity on the Stripe network, coming this summer. Stripe Profiles will let you streamline invoicing and payments with other businesses on Stripe. If you’re a Stripe user, you can reserve your profile today.

- We announced Stripe Verified, a new service that will help you navigate global requirements for payment processing and financial solutions with personalized monitoring, enhanced protections, and expert assistance.

- You can now use sandboxes to test functionality and experiment with new features in an isolated environment that replicates your business, without impacting your live integration.

- We launched the Stripe Startups program, which supports venture-backed, early-stage startups with financial benefits, a focused community, and expert content.

- You can now use Instant Payouts to withdraw funds from Stripe to debit cards in 32 countries.

- You can now use natural language to complete tasks in the Dashboard—e.g., creating products, processing refunds, and generating payment links—with our AI-powered Dashboard assistant.

We’d love your feedback on everything we announced at Sessions this year. Share your thoughts, questions, and requests here.

You can also read our changelog to learn more about the updates we’ve made to Stripe in the last year.