如果您经营一家企业,找到最适合您公司需求的商家服务非常重要。不幸的是,从市场上的众多选项中选择商家服务提供商并不总是那么直观。以下是您需要了解的有关选择商家服务的所有信息。

目录

- 什么是商家?

- 什么是商家服务?

- 商家服务和商家账户有什么区别?

- 商家服务包括哪些内容?

- 商家服务的费用是多少?

- 谁提供商家服务?

- 如何为您的企业选择商家服务提供商

什么是商家?

在商家服务领域,商家是指接受客户对商品或服务付款的任何个人或企业;商家通常在第三方商家服务提供商的支持下接受付款。

什么是商家服务?

“商家服务”是各种与支付相关的业务支持服务和设备的总称。从支付处理到销售点 (POS) 系统,这些服务对于从事零售、电商或任何其他涉及支付交易的商业活动形式的企业非常重要。提供商的产品/服务各不相同,通常根据每个商家的需求量身定制。

无论包含哪些服务和支持机制,商家服务提供商都会帮助商家尽可能轻松高效地接受客户的付款。

商家服务和商家账户有什么区别?

虽然商家服务和商家账户都涉及处理企业的付款,但它们并不是一回事。以下是二者的含义。

商家账户

商家账户是专为企业设计的银行账户,通常通过信用卡、借记卡或其他电子方式接受和发放付款。它不是您的企业银行账户,而是一个单独的账户,在将交易资金发送到您的常规企业银行账户之前,该账户用于保管这些资金。商家服务

商家服务涉及将资金转入和转出商家账户,但也包括其他服务,例如电商支持和忠诚度计划。

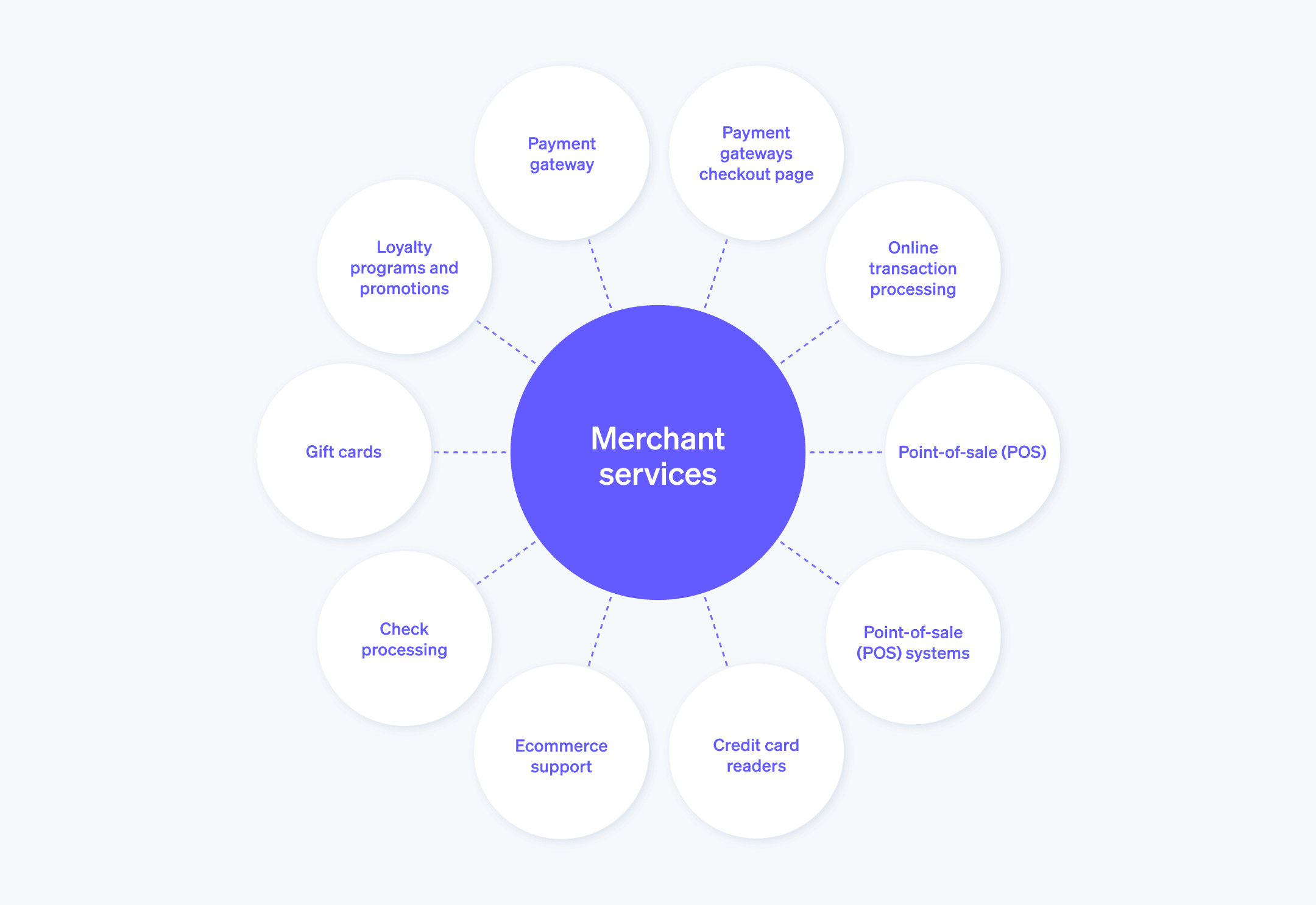

商家服务包括哪些内容?

商家服务不断完善,以适应商家不断扩大的需求以及他们开展业务的动态方式。以下是商家服务产品中最常包含的一些服务:

支付网关

支付网关是一个接口,允许客户线上提交支付信息(包括信用卡和借记卡号码),然后将其路由到商家的支付处理商。在线下,同样的机制通过销售点终端和读卡器实现。支付网关是您的企业接受线上付款的一种安全方式。商家服务提供商提供支付网关,它通常直接与您的网站或电商店铺集成。在线交易处理

商家服务通常包括在线支付处理,这涉及客户在支付网关中输入支付信息后进行的一切交易活动。您的银行和客户的银行相互通信,商家服务提供商将资金转移到需要的地方。销售点 (POS) 系统

POS 系统由硬件和软件组成,允许商家线下接受付款并完成交易。POS 系统还为更新库存和跟踪销售等任务提供相关功能。信用卡读卡器

商家服务提供商还使用信用卡终端来处理线下交易。一旦客户刷卡、触碰或插入他们的信用卡或借记卡,读卡设备就会将支付信息传输到商家的支付处理商。并非所有读卡器都一个模样,硬件可能因使用方式而异。读卡器可以是独立设备、POS 终端中的组件,也可以是商家移动设备(如手机或平板电脑)的附件。电商支持

商家服务提供商最近开始考虑商家业务需求的大局,并以更全面的方式为他们提供支持。例如,它们可能为电商企业提供为其产品、营销工具或销售分析构建和定制网站或交易市场的功能。支票处理

除了信用卡和借记卡支付处理外,商家服务提供商通常还提供支票处理支持。礼品卡

商家可将礼品卡作为一种高度灵活的方式,来获得额外的业务收入。此类产品通常包含在商家服务提供商的服务范围内。忠诚度计划和促销

忠诚度计划、销售和季节性促销可帮助商家提高客户参与度、留存率和终身价值 (LTV)。在企业的支付方面部署和执行这些计划可能很复杂。但是,许多商家服务提供商通过积极支持这些类型的计划和促销活动来简化此流程。合作伙伴网络

商家服务提供商不仅要使其产品/服务多样化;他们正在建立第三方提供商网络,这些提供商提供与自己的产品和服务套件集成的附加服务。

无论他们提供哪种服务,商家服务提供商最重要的工作是确保顺畅安全地接受和处理每笔付款。

商家服务的费用是多少?

费用因您选择的提供商和所需要的服务而异。商家服务提供商以多种方式安排其费用,包括:

- 统一月费

- 每笔交易费用

- 分层定价结构,以不同的价位包含不同的功能和服务

硬件和初始设置通常还需要付费。

谁提供商家服务?

有很多商家服务提供商可以提供商家服务。它们大致分为以下几类:

- 支付处理商:提供支付处理服务的公司(如 Stripe)也提供商家服务。

- POS 系统提供商:POS 系统和 POS 硬件提供商可以提供商家服务。

- 电商平台:一些电商平台通过将支付处理集成到平台中来提供商家服务。

如何为您的企业选择商家服务提供商

不同提供商提供的服务和功能范围各不相同。以下这些问题可帮助您缩小选择范围并找到适合您的提供商:

您最需要商家服务提供商提供什么?

考虑您的具体业务,并评估您的“必备”清单。此清单因人而异,但在您开始搜索商家服务提供商时,这里有一些示例问题需要回答:- 您的销售是在线下和线上之间分配,还是只在其中一个领域开展?

- 您目前的交易量是多少?

- 您的预计增长情况如何?

- 您是否已经有一个处理付款的网站,或者您是否在寻找可以帮您建一个网站的提供商?

- 您的销售是在线下和线上之间分配,还是只在其中一个领域开展?

您不需要什么?

盘点您满意的支付解决方案也很有帮助。您是否已经有一支负责处理优化、增长、营销和分析的团队,而您只想找一个能胜任支付处理任务的人?您最终仍可选择提供多种服务的提供商,但了解您绝对不需要的服务将有助于确定您所购买服务的范围。涉及哪些费用?

商家服务的费用结构有多种方式。确保您了解所考虑的每个提供商的成本。鉴于此功能对您的业务至关重要,您不想去讨价还价,但确实需要清楚地了解每个选项的财务影响。他们的解决方案会随您的业务规模而扩缩吗?

更换提供商可能是一个令人头疼的问题。理想情况下,选择一家能够在您的业务发展和变化时提供相应支持的提供商。他们提供什么样的客户服务?

当处理客户交易出现问题时,良好的客户服务是关键。即使一切正常,您仍然会向商家服务提供商提出问题。怎么才能接触到他们?它们的可用性如何?您可以通过电话致电支持人员,还是他们专门通过电子邮件提供客户支持?在承诺之前查看这些问题,以确保客户服务关系符合您的需求。它们是否与您已在使用的工具集成?

在确定新的商家服务提供商的软件或硬件是否与您已经在使用的工具兼容之前,不要与他们合作。大多数提供商都对便于集成引以为豪,但您应该遍历您的团队使用的所有工具,确保没有隐藏的兼容性问题。他们是否愿意公开现有的客户,您能和几个客户谈谈吗?

大多数商家服务提供商都会毫不吝啬地宣传其客户名单上的品牌。如果您正在认真考察一家提供商,可能值得与他们的一些客户联系,看看他们对自己的体验有何看法。至少,花一些时间阅读评论。

商家服务提供商是负责处理付款任务的重要合作伙伴。您会对他们寄予极大的信任,所以请花点时间,在承诺之前做好功课。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。