If you run a business, it's important to find the best merchant services for your company's needs. Unfortunately, choosing a merchant service provider from the many options on the market isn’t always intuitive. Here’s everything that you need to know about selecting merchant services.

What's in this article?

- What is a merchant?

- What are merchant services?

- What’s the difference between merchant services and a merchant account?

- What’s included in merchant services?

- How much do merchant services cost?

- Who offers merchant services?

- How to pick a merchant service provider for your business

What is a merchant?

In the merchant services space, a merchant is any person or business that accepts payments from customers for goods or services; merchants typically accept payments with support from third-party merchant service providers.

What are merchant services?

"Merchant services" is the umbrella term for various payment-related business support services and equipment. From payment processing to point-of-sale (POS) systems, these services are important for businesses that engage in retail, e-commerce or any other form of commercial activity where payment transactions are involved. Provider offerings vary and are usually tailored to each merchant, depending on its needs.

No matter which services and support mechanisms are included, merchant service providers help merchants to accept payments from customers as effortlessly and efficiently as possible.

What's the difference between merchant services and a merchant account?

While merchant services and merchant accounts are both involved in processing payments for businesses, they aren't the same. Here's what each one entails.

Merchant account

A merchant account is a bank account that is designed specifically for businesses to accept and issue payments, usually by credit card, debit card or other electronic method. It's not your business bank account; it's a separate account that holds transacted funds before they are sent to your regular business bank account.Merchant services

Merchant services involve moving money in and out of merchant accounts, but they also include other services such as e-commerce support and loyalty programmes.

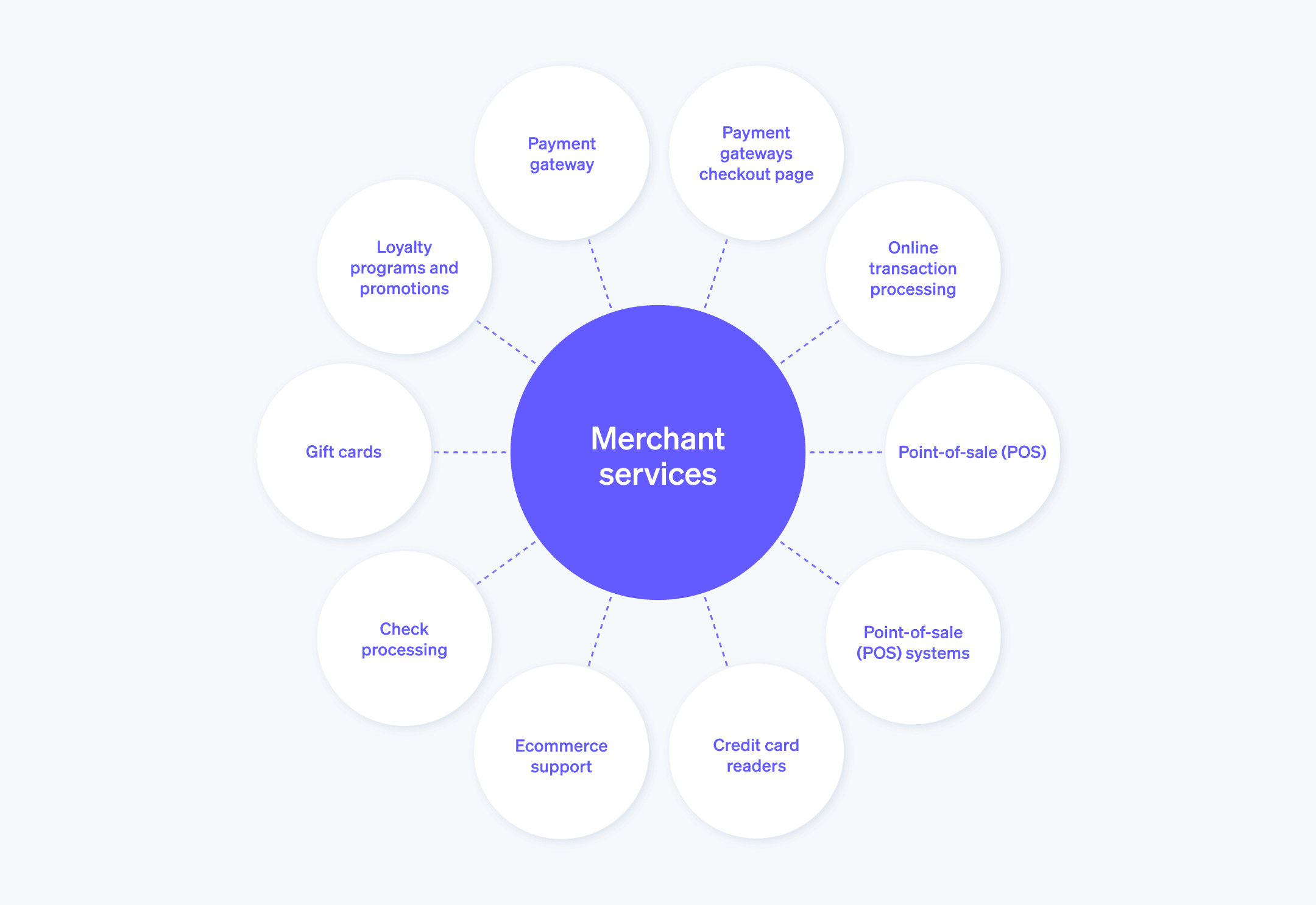

What’s included in merchant services?

Merchant services are constantly evolving to match the ever-expanding needs of merchants and the dynamic ways in which they do business. Below are a few of the services most commonly included in a merchant service offering:

Payment gateways

A payment gateway is an interface that allows customers to submit payment information online, including credit and debit card numbers, that is then routed to the merchant’s payment processor. In person, this same mechanism happens through point-of-sale terminals and card readers. A payment gateway is a secure way for your business to accept online payments. Merchant service providers offer payment gateways, usually integrated directly with your website or an e-commerce store.Online transaction processing

Merchant services typically include online payment processing, which involves everything that happens with a transaction after the customer enters payment information into the payment gateway. Your bank and the customer’s bank communicate with each other, and the merchant service provider moves the money where it needs to go.Point-of-sale (POS) systems

POS systems consist of both hardware and software that allow merchants to accept payments and complete transactions in person. POS systems additionally provide functionality for tasks such as updating inventory and tracking sales.Credit card readers

Merchant service providers also use credit card terminals to process in-person transactions. Once the customer swipes, taps or inserts their credit or debit card, the card-reading device transmits the payment information to the merchant’s payment processor. Not all card readers look the same – the hardware can vary based on how it’s meant to be used. Card readers can be standalone devices, components within a POS terminal or an attachment to a merchant’s mobile device like a phone or tablet.E-commerce support

Merchant service providers have recently started considering the big picture of merchants’ business needs and supporting them in more holistic ways. For example, they might offer e-commerce businesses the ability to build and customise a website or marketplace for their products, marketing tools or sales analytics.Cheque processing

Merchant service providers typically offer cheque-processing support in addition to credit and debit card payment processing.Gift cards

Merchants can use gift cards as a highly flexible way to secure additional revenue for their business. This type of product is often included in merchant service providers’ scope of services.Loyalty programmes and promotions

Loyalty programmes, sales and seasonal promotions help merchants generate better customer engagement, retention and Lifetime Value (LTV). These initiatives can be complicated to deploy and execute on the payments side of a business. However, many merchant service providers are making the process easier by actively supporting these types of programmes and promotions.Partner networks

Merchant service providers aren’t just diversifying their offerings; they are building networks of third-party providers who offer additional services that integrate with their own suite of products and services.

No matter which services they are offering, a merchant service provider’s most important job is ensuring that every payment is accepted and processed smoothly and securely.

How much do merchant services cost?

Costs vary depending on the provider that you select and which services you need. Merchant service providers structure their fees in multiple ways, including:

- Flat monthly rates

- Per transaction fees

- Tiered pricing structures, with different features and services included at different price points

There are also often fees for hardware and initial setup.

Who offers merchant services?

There are a lot of merchant service providers out there. They broadly fall into the following categories:

- Payment processors: Companies that provide payment processing services, such as Stripe, also offer merchant services.

- POS system providers: Providers of POS systems and POS hardware offer merchant services.

- E-commerce platforms: Some e-commerce platforms provide merchant services by integrating payment processing into the platform.

How to pick a merchant service provider for your business

The range of services and features offered by different providers varies. Here are a few questions to help you narrow down your options and find a provider that suits you:

What do you need most from a merchant service provider?

Consider your specific business and assess what your "must have" list looks like. This will look different for everyone, but here are some sample questions to answer as you launch your search for a merchant service provider:- Are your sales split between in-person and online or do you work exclusively in one of these spaces?

- What is your current volume of transactions?

- What does your projected growth look like?

- Do you already have a website for processing payments or are you looking for a provider who can help set one up?

- Are your sales split between in-person and online or do you work exclusively in one of these spaces?

What don't you need?

It's also helpful to take stock of payment solutions that you're happy with. Do you already have a team handling optimisation, growth, marketing and analytics and you just want someone who can handle payment processing? You could still end up with a provider that offers a wide range of services, but knowing what you absolutely don't need will inform the scope of services that you purchase.What costs are involved?

Fee structures for merchant services can work a number of ways. Make sure that you understand the costs for each provider that you’re considering. Given how critical this function is for your business, you don't want to go bargain shopping, but you do need to have a clear understanding of the financial implications of each option.Will their solutions scale with your business?

Switching providers can be a headache. Ideally, choose a provider that will be able to support your business as it grows and changes.What kind of customer service do they offer?

Good customer service is key when problems arise processing customer transactions. And even when everything is working as it should, you’ll still have questions for your merchant service provider. How can you reach them? How available are they? Can you call support on the phone or do they exclusively offer customer support via email? Look into these questions before committing so that you can make sure that the customer service relationship fits your needs.Do they integrate with tools you're already using?

Don't onboard with a new merchant service provider before determining whether their software or hardware is compatible with the tools that you're already using. Most providers pride themselves on being integration friendly, but you should walk through everything that your team uses and make sure that there are no hidden compatibility issues.Do they publicise their current customers – and can you speak with a few?

Most merchant service providers aren't shy about touting the brands on their customer roster. If you’re seriously considering a provider, it might be worth contacting a few of their clients to see what they think about their experience. At the very least, spend some time reading reviews.

Merchant service providers are important partners in the task of processing payments. You're going to place a huge amount of trust in them, so take your time and do your homework before committing.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.