在国内,发送支付款项既快捷又简单,但国际支付则可能涉及更多的复杂性、更长的处理时间以及更高的费用。尽管存在这些障碍,国际支付——尤其是电汇——变得越来越重要,因为预计跨境支付将从 2023 年的 190 万亿美元增长至 2030 年的 290 万亿美元。

本指南将涵盖关于国际转账的相关信息:其运作方式、平均处理时间以及可能导致延迟的常见因素。

目录

- 国际电汇的运作方式

- 国际电汇的平均时间

- 为什么国际电汇可能会延迟

- 如何发送国际电汇

How international wire transfers work

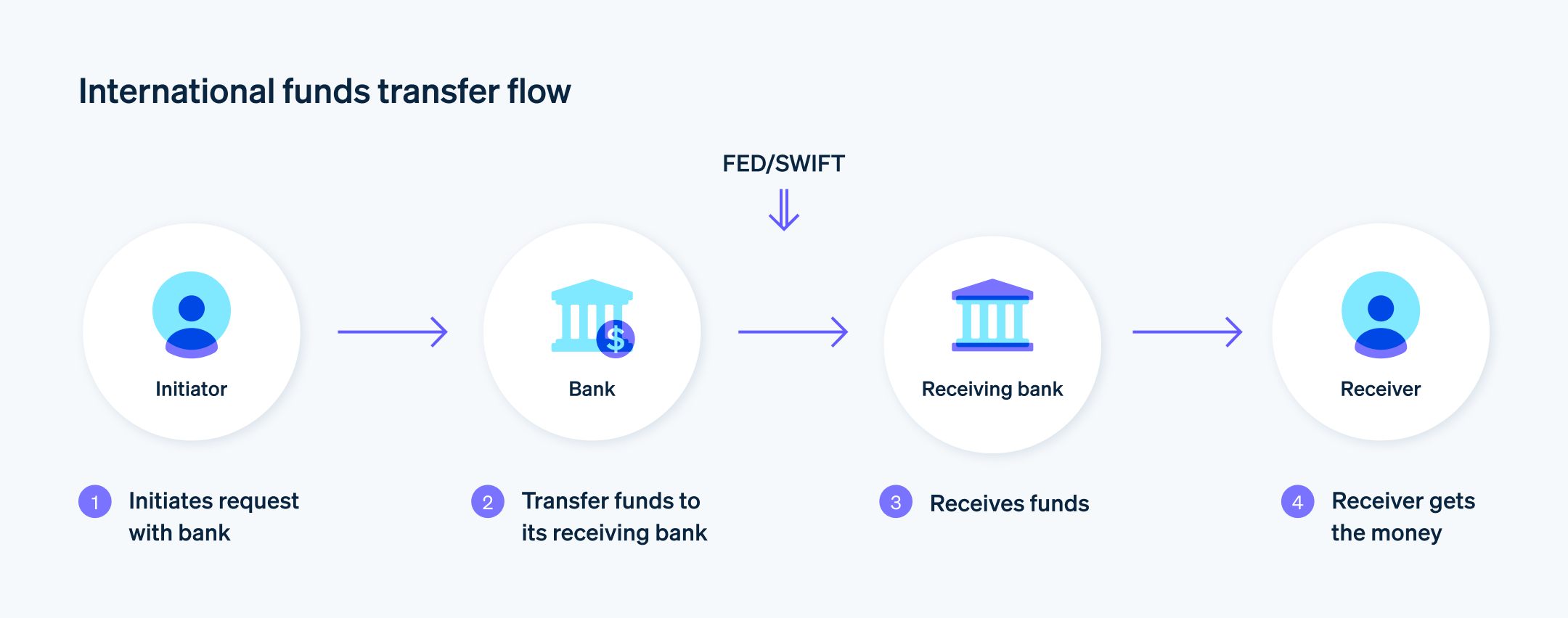

While sending an international wire transfer is relatively straightforward, it involves the use of international banking networks and often requires currency conversion. Here’s an overview of the process.

国际电汇的运作方式

虽然发送国际电汇相对简单,但它涉及使用国际银行网络,并且通常需要进行货币兑换。以下是该过程的概述:该过程概述如下。

发起: 作为发送方,您通过您的银行发起电汇(可以在线、通过移动应用或访问银行分行进行)。您需要提供以下转账信息:

- 收款人姓名

- 收款人地址

- 收款人银行名称、地址和国家/地区

- 收款人账号和账户类型(储蓄/支票账户)

- 收款人路径号码(美国)或 BIC/SWIFT 代码(国际银行标识符)

- 转账理由(可选)

- 收款人姓名

银行间通讯: 您的银行将通过全球银行间金融电信协会 (SWIFT) 网络与收款人银行进行沟通,这是一个用于国际金融交易的安全消息系统,为每个参与银行分配独特的 SWIFT 代码。

中介银行(可选): 根据具体路径,您的银行可能会使用中介银行将资金转移到接近收款人银行的地方。每个中介银行都会收取费用,这会增加总费用。

货币兑换: 如果转账使用的货币与收款人账户的货币不同,您的银行将按其外汇汇率转换资金,汇率可能会比中间市场汇率有所加价。在完成转账之前,务必询问汇率。

完成: 一旦资金到达收款人银行,它们将被存入收款人账户。

费用

汇款费用: 您的银行将收取发起电汇的费用。该费用可能会根据银行、转账金额和货币种类有所不同。

接收费用: 收款人的银行也可能会收取接收转账的费用。

中介银行费用: 如果涉及中介银行,它们可能会收取额外的费用。

外汇费用: 如果转账涉及货币兑换,您的银行可能会对汇率加收费用。

国际电汇的平均时间

通常,国际电汇的速度不如国内转账快。尽管国内电汇通常在一个工作日内完成,但国际转账通常需要 1 到 5 个工作日,且根据不同因素,处理时间可能更长。在极少数情况下,一个完美执行的转账可以在一个工作日内到达收款人。但在涉及广泛的欺诈检查、因信息错误而需要多次更正、货币兑换或在非工作时间发起转账的情况下,转账可能需要一周甚至更长时间才能完成。例如,北美与欧洲之间的转账通常会迅速结算,因为这些地区之间有直接的连接,转账速度较快。而欧洲与非洲之间的转账可能需要更长时间,因为涉及更多的合规检查,以及可能的中介银行延迟。

一些银行提供当天或加急的国际电汇服务,但需要支付费用。此服务可将平均转账时间缩短至 24 小时以内,前提是:

提前发起: 转账在银行的营业时间内发起。

无需货币兑换: 当天转账通常仅限于特定货币或与特定国家/地区有直接关系的转账。

为什么国际电汇可能会延迟

国际转账可能会因各种原因而延迟,从安全检查到银行的营业时间等。以下是一些常见的因素,您需要考虑:

欺诈预防

为了最大限度地减少欺诈性交易的风险,银行和金融机构会采取安全措施。这些措施可能会延迟转账时间,尤其是在需要额外验证时。

客户身份验证 (KYC) 检查: 这些检查确保发送方和收款方的身份得到验证,以防止洗钱或资助恐怖主义行为。

反洗钱 (AML) 政策: 银行会监控交易是否存在异常或可疑活动(如交易金额异常高或交易模式不规则),从而导致额外的审查和可能的延迟。

制裁和黑名单: 银行会检查发送方和收款方是否出现在政府的制裁名单或观察名单上。

信息不正确或不完整

即使是收款信息中的一个小错误,也可能导致转账失败,从而导致延迟,并需要发送方重新发起并提供正确的详细信息。在最坏的情况下,可能需要反复沟通。

银行信息错误: 如果账号、SWIFT 代码或国际银行账号 (IBAN)错误,转账很可能会被拒绝或重新转发,并且需要人工干预才能完成。

收款人信息无效: 收款人的姓名或地址错误可能会导致延迟或甚至转账失败。

指示不一致: 转账指示中的任何不一致,都可能导致银行暂停转账,等待进一步的确认。

假期和周末

在银行非营业时间发起的转账会遭遇延迟。具体情况取决于相关银行,等待时间可能从额外的一个工作日到一整周不等。

假期: 银行通常不会在公共假期处理转账,无论是在发送方还是接收方所在的国家/地区。如果转账在公共假期前发起,处理可能会延迟。一些银行还有额外的银行假期,这些假期也会影响处理时间。

周末: 大多数国际电汇仅在工作日处理。如果转账是周五发起,可能要等到周一或周二才会完成。

货币兑换

货币兑换也可能影响转账时间,尤其是涉及不太常交易的货币时。

兑换时间: 任何类型的货币兑换都可能会使处理时间延长一天或更长时间,如果涉及的货币是较少交易的货币,时间可能会更长。如果收款银行没有储备这种货币,则可能需要从其他机构调取。

汇率波动: 银行可能会延迟转账,以确保获得有利的汇率,或管理货币波动带来的风险。

时区

时区会影响不同地区银行之间的协调。

- 营业时间: 不同时区的银行营业时间不同,如果转账在接收银行关闭时发起,可能会导致延迟。

银行关系

如果发送行和接收行有直接的关系,转账通常会更快。当涉及中介银行时,处理时间可能会更长,因为需要额外的处理步骤。

多个中介银行: 如果涉及多个中介银行,每个中介银行都需要处理转账,从而增加整体处理时间。

处理时间: 不同的银行可能有不同的处理时间,这会影响转账的速度。

转账方式

发起转账的方式也可能影响处理速度。

手动处理: 如果转账需要人工干预,处理时间可能会更长。

自动化系统: 自动化转账通常更快,但如果出现系统故障或停机,仍然可能会导致延迟。

目标国家/地区

转账的目标国家/地区也可能影响处理时间。

国家/地区特定的法规: 一些国家/地区有更严格的法规,需要更全面的文件或检查,这可能会延长转账时间。

银行基础设施: 银行系统不太发达的国家/地区可能由于技术限制,经历更慢的处理时间。

如何发送国际电汇

在发起国际电汇之前,有一些步骤需要采取,以确保您的转账顺利进行。以下是发起国际电汇的步骤:

选择银行或电汇服务

传统银行: 大多数银行提供国际电汇服务。手续费通常高于其他提供商。

在线支付服务: 平台如 PayPal、Wise 和 Western Union 等可以进行国际电汇,手续费可能低于传统银行,且处理时间更快。

专业转账服务: 专门从事国际电汇的公司可能提供比传统银行更具竞争力的汇率和更好的货币兑换率。

收集必要的信息

收款人的姓名和地址: 确保收款人姓名与其银行账户上的姓名匹配,以避免延迟。

收款人的银行信息: 包括银行名称、地址和 SWIFT/BIC 代码。对于许多国家/地区,还需要国际银行账号 (IBAN)。

收款人的账号或 IBAN: 这用于标识接收资金的具体账户。

转账金额和货币: 标明付款金额,包括货币。确认汇率并了解任何兑换费用。

验证合规要求

KYC 检查: 一些银行要求对汇款人和收款人进行“客户身份验证” (KYC)。

反洗钱 (AML) 规定: 如果转账金额异常大或频繁发生,准备接受额外的审查。

发起电汇

访问银行或使用网上银行: 大多数银行提供在线电汇服务,但对于需要额外验证的转账,可能需要亲自到银行办理。

填写转账表格: 提供所有必要的信息,包括收款人联系方式、银行信息和转账金额。确保信息准确,以避免延迟。

授权转账: 根据银行要求,您可能需要签署表格、提供额外的身份验证,或通过安全码授权转账。

支付费用: 这些费用通常包括电汇手续费和任何货币兑换费用。支付方式因银行以及是线上还是线下发起而异。

获取确认和跟踪信息

转账确认: 银行或服务应提供一份收据或确认函,包含转账的详细信息。

跟踪号码: 一些银行提供国际电汇的跟踪号码,您可以通过该号码跟踪转账的进度。

通知收款人

预计时间框架: 根据平均转账时间,让收款人知道预计何时可以收到款项。

所需信息: 提供收款人可能需要的任何额外信息,以便领取款项或避免延迟。

监控转账

检查转账状态: 使用提供的任何跟踪信息来跟踪转账的进度。

跟进银行: 如果转账比预期时间长,联系银行获取最新信息。

解决任何延迟或问题

联系银行或服务: 联系银行或服务,了解延迟原因,并确定您应该采取哪些步骤来解决问题。

重新提交或更正错误: 如果转账详情有错误,您可能需要更正信息并重新提交请求。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。