There are many ways to send domestic payments quickly and easily, but sending payments internationally can involve more complexity, longer processing times, and potentially higher fees. Despite these added hurdles, international payments – specifically electronic funds transfers – are becoming more important as cross-border payments are expected to jump from $190 trillion US dollars (USD) in 2023 to $290 trillion USD by 2030.

This guide will cover what you need to know about international transfers: how they work, average processing times, and common factors that cause delays.

What’s in this article?

- How international electronic funds transfers work

- Average international electronic funds transfer times

- Why international electronic funds transfers might be delayed

- How to send international electronic funds transfers

How international wire transfers work

While sending an international wire transfer is relatively straightforward, it involves the use of international banking networks and often requires currency conversion. Here’s an overview of the process.

How international electronic funds transfers work

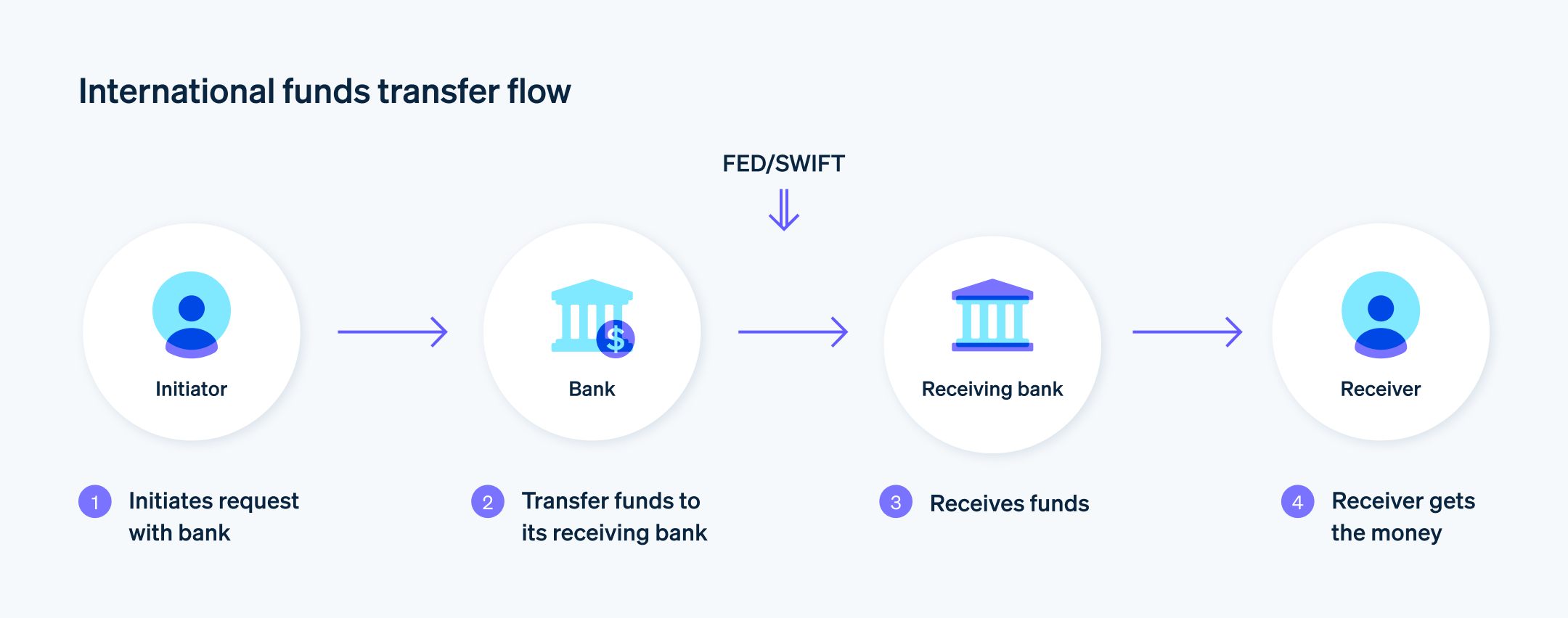

Although sending an international electronic funds transfer is relatively straightforward, it involves the use of international banking networks and often requires currency conversion. Here’s an overview of the process.

Initiation: As the sender, you initiate the electronic funds transfer through your bank (this can be done online, through a mobile app, or by visiting the bank branch). You provide the following details for the transfer:

- Recipient’s full name

- Recipient’s address

- Recipient’s bank name, address, and country

- Recipient’s account number and type (savings/current)

- Recipient’s routing number (US) or BIC/SWIFT code (international bank identifier)

- Reason for transfer (optional)

- Recipient’s full name

Interbank communication: Your bank will communicate with the recipient’s bank using the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network, a secure messaging system for international financial transactions that assigns unique SWIFT codes to each participating bank.

Intermediary banks optional: Depending on the route, your bank might use intermediary banks to move the funds closer to the recipient’s bank. Each intermediary charges a fee, adding to the overall cost.

Currency exchange: If sending in a currency that's different from the recipient’s account currency, your bank will convert the funds at their foreign exchange rate, which may include a markup compared to mid-market rates. Make sure you ask about the exchange rate before finalising the transfer.

Completion: Once the funds reach the recipient’s bank, they are credited to the recipient’s account.

Fees

Sending fee: Your bank will charge a fee for initiating the electronic funds transfer. This fee can vary depending on the bank, transfer amount, and currency.

Receiving fee: The recipient’s bank might also charge a fee for receiving the transfer.

Intermediary bank fees: If intermediary banks are involved, they may charge additional fees.

Foreign exchange fee: If the transfer involves currency conversion, your bank might apply a markup on the exchange rate.

Average international electronic funds transfer times

Generally, international electronic funds transfers are not as fast as domestic transfers. While domestic electronic funds transfers can be completed within one business day, international transfers typically take one to five business days, and they can take longer depending on a variety of factors. In rare cases, a perfectly executed transfer can reach the recipient within a single business day. But in situations with extensive fraud checks, multiple corrections due to incorrect details, currency exchanges, or transfers initiated outside operating hours, transfers can take a week or even longer to complete. For example, transfers between North America and Europe are typically settled quickly, because transfers between regions with direct connections are often faster. Meanwhile, transfers between Europe and Africa may take longer because of additional compliance checks and potential delays with intermediary banks.

Some banks offer same-day or expedited international electronic funds transfers for a fee. This service can reduce the average transfer time to within 24 hours, under the following conditions:

Early initiation: The transfer is initiated during the bank’s business hours.

No currency conversion: Same-day transfers are generally limited to specific currencies or countries with direct relationships.

Why international electronic funds transfers might be delayed

International transfers can be delayed for a variety of reasons, ranging from security checks to bank operating hours. Here are some common factors to consider.

Fraud prevention

To minimise the risk of fraudulent transactions, banks and financial institutions have security measures in place. These measures can delay transfer times, especially when additional verification is needed.

Know Your Customer (KYC) checks: These ensure the sender’s and recipient’s identities are verified to prevent money laundering or terrorism financing.

Anti-Money Laundering (AML) policies: Transactions are monitored for unusual or suspicious activity (such as an unusually high transaction amount or irregular transaction pattern), leading to additional scrutiny and possible delays.

Sanctions and blacklists: Banks check that neither the sender nor recipient appears on government sanctions lists or watchlists.

Incorrect or incomplete details

Even a minor typo in recipient information can cause the transfer to bounce, resulting in delays and requiring the sender to reinitiate it with corrected details. In worst-case scenarios, extensive back-and-forth communication may be required.

Incorrect bank details: If the account number, SWIFT code, or International Bank Account Number (IBAN) is incorrect, it's likely that the transfer will be rejected or rerouted and require manual intervention to complete.

Invalid beneficiary information: Errors in the recipient’s name or address can lead to delays or even failed transfers.

Discrepancies in instructions: Any inconsistency in the transfer instructions can cause banks to put the transfer on hold for clarification.

Holidays and weekends

Transfers initiated outside bank operating hours will experience delays. Depending on the specific situation and the banks involved, the wait could be anywhere from one additional business day to a full week.

Holidays: Banks typically do not process transfers on public holidays, whether in the sending or receiving country. If a transfer is initiated just before a public holiday, processing might be delayed. Some banks also have additional bank holidays that can impact processing times.

Weekends: Most international electronic funds transfers are processed only on business days. If a transfer is initiated on a Friday, it might not be completed until Monday or Tuesday.

Currency exchange

Currency conversion can also affect transfer times, especially if the exchange involves less commonly traded currencies.

Conversion time: Any kind of currency conversion can add one or more days to the processing timeline, and even longer if the involved currencies are less commonly traded. If the recipient’s bank doesn’t usually hold the sending currency, it might need to source the currency from another institution.

Exchange rate fluctuations: Banks may delay transfers to secure favorable exchange rates or manage risks from currency fluctuations.

Time zones

Time zones affect the coordination between banks in different regions.

- Operating hours: Banks in different time zones have different business hours, which can cause delays if the transfer is initiated when the receiving bank is closed.

Bank relationships

If the sending and receiving banks have a direct relationship, the transfer is usually quicker. When intermediary banks are involved, it can take longer because of additional processing.

Multiple intermediaries: If multiple intermediary banks are involved, each one must process the transfer, adding extra time to the overall process.

Processing times: Different banks may have varying processing times, which affects the speed of the transfer.

Transfer methods

The method of initiating the transfer can affect the speed of processing.

Manual processing: If a transfer requires manual intervention, it can take longer to process.

Automated systems: Automated transfers are generally faster, but delays can occur if there’s a system glitch or downtime.

Destination country

The country to which the transfer is sent can also affect processing times.

Country-specific regulations: Some countries have stricter regulations that require more thorough documentation or checks, which can extend the transfer time.

Banking infrastructure: Countries with less developed banking systems may experience slower processing times due to technical limitations.

How to send international electronic funds transfers

Before initiating an international electronic funds transfer, there are a few steps to take to ensure your transfer goes smoothly. Here’s how to send an international electronic funds transfer.

Choose a bank or electronic funds transfer service

Traditional banks: Most banks offer international electronic funds transfer services. Fees can be higher than those offered by other providers.

Online payment services: Platforms such as PayPal, Wise, and Western Union can perform international electronic funds transfers with potentially lower fees and faster processing times than traditional banks.

Specialised transfer services: Companies specialising in international electronic funds transfers might offer more competitive rates and better currency exchange rates than traditional banks.

Gather necessary information

Recipient’s full name and address: Ensure the name matches the name on the recipient’s bank account to avoid delays.

Recipient’s bank details: Include the bank’s name, address, and SWIFT/BIC code. For many countries, the IBAN is also required.

Recipient’s account number or IBAN: This identifies the specific account into which the funds will be transferred.

Transfer amount and currency: Note the payment amount, including currency. Verify the exchange rate and understand any conversion fees.

Verify compliance requirements

KYC checks: Some banks require Know Your Customer identity verification for the sender and recipient.

AML regulations: Be prepared for additional scrutiny if the transfer is unusually large or occurring in an irregular frequent pattern.

Initiate the wire transfer

Visit the bank or use online banking: Most banks offer online electronic funds transfer services, but you might need to visit a branch for transfers requiring additional verification.

Fill in the transfer form: Provide all necessary information including recipient contact information, bank information, and the transfer amount. Ensure accuracy to avoid delays.

Authorise the transfer: Depending on the bank, you might need to sign a form, provide additional identity verification, or authorise the transfer via a secure code.

Pay the fees: These typically include the electronic funds transfer fee and any currency conversion fees. Payment methods can vary by bank and whether you’re initiating online or in person.

Obtain confirmation and tracking information

Confirmation of transfer: The bank or service should provide a receipt or confirmation with details of the transfer.

Tracking number: Some banks provide a tracking number for international electronic funds transfers so you can monitor the transfer’s progress.

Notify the recipient

Expected time frame: Let the recipient know when to expect the funds based on the average transfer time.

Required information: Provide any additional information the recipient might need to claim the funds or avoid delays.

Monitor the transfer

Check transfer status: Use any tracking information provided to track the transfer’s progress.

Follow up with the bank: If the transfer takes longer than expected, contact the bank for an update.

Address any delays or issues

Contact the bank or service: Contact to the bank or service to understand the cause of the delay and determine what steps you should take to resolve it.

Resubmit or correct errors: If there are errors in the transfer details, you might need to correct them and resubmit the request.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.