Value-added tax (VAT) settlement is a tax obligation for VAT holders aimed at calculating VAT credits or debits for a specific tax period. VAT must be calculated and paid for all relevant activities, determining the amounts for both invoices issued to customers and those received from suppliers. This article explains in detail what a VAT settlement is, how and when it is paid, and the penalties for nonpayment.

What’s in this article?

- What is VAT settlement?

- Deadlines for payment of VAT settlement

- How to calculate VAT settlement

- How to make the payment for the VAT settlement

- Penalties for failure to pay VAT

What is VAT settlement?

VAT settlement is a mandatory tax obligation for all activities subject to VAT. It involves the calculation of the VAT credit or debit for a given period in order to determine the amount, if any, to be paid to the Treasury. All VAT payers must calculate a settlement, except for those who are enrolled in advantageous tax regimes, such as the flat-rate regime.

The correct VAT settlement amount is calculated by subtracting the total VAT on invoices received from suppliers from the total VAT on invoices issued to customers. If the result is a positive number, it indicates VAT is due, which means the taxpayer must make a payment to the Italian Revenue Agency (Agenzia delle Entrate). If the result is a negative number, it indicates a VAT credit to be carried forward to the next tax period.

Deadlines for payment of VAT settlement

Monthly and quarterly VAT settlement

Depending on the accounting regime chosen (i.e., normal or simplified), payment can be made either monthly or quarterly. Note that only amounts from deductible transactions should be taken into account.

For taxpayers following the normal regime, the standard payment schedule for VAT settlement is monthly. Quarterly VAT settlement is subject to limits and is reserved for VAT holders with annual revenues below €400,000 for service activities and €800,000 for other types of activities. In the case of quarterly payment, any tax liability is subject to an interest increase of 1%. Quarterly taxpayers can still opt for monthly payment.

If the monthly settlement amount is €100 or less, the payment is deferred to the next period but must be made no later than December 16 of the same year (as stipulated in Article 9 of Legislative Decree No. 1 of 08/01/2024).

When is VAT settlement made?

Businesses and freelancers who are required to pay VAT monthly must do so by the 16th of each month. Categories that opt for quarterly settlement must pay VAT by the 16th of the second month following the end of the quarter. The dates are:

- First quarter: May 16

- Second quarter: August 16

- Third quarter: November 16

- Fourth quarter annual VAT return: March 16 of the following year

Specific taxpayers with quarterly settlements

Certain businesses qualify for an exception that allows them to elect to pay quarterly, regardless of the above revenue limits and without incurring the 1% interest charge. These are as follows:

- For-hire trucking companies

- Owners of fuel distribution facilities

- Businesses providing services to the public

- Health and arts professionals

How to calculate VAT settlement

Here are two examples for calculating the VAT settlement payable: one for a monthly VAT settlement and another for a quarterly VAT settlement.

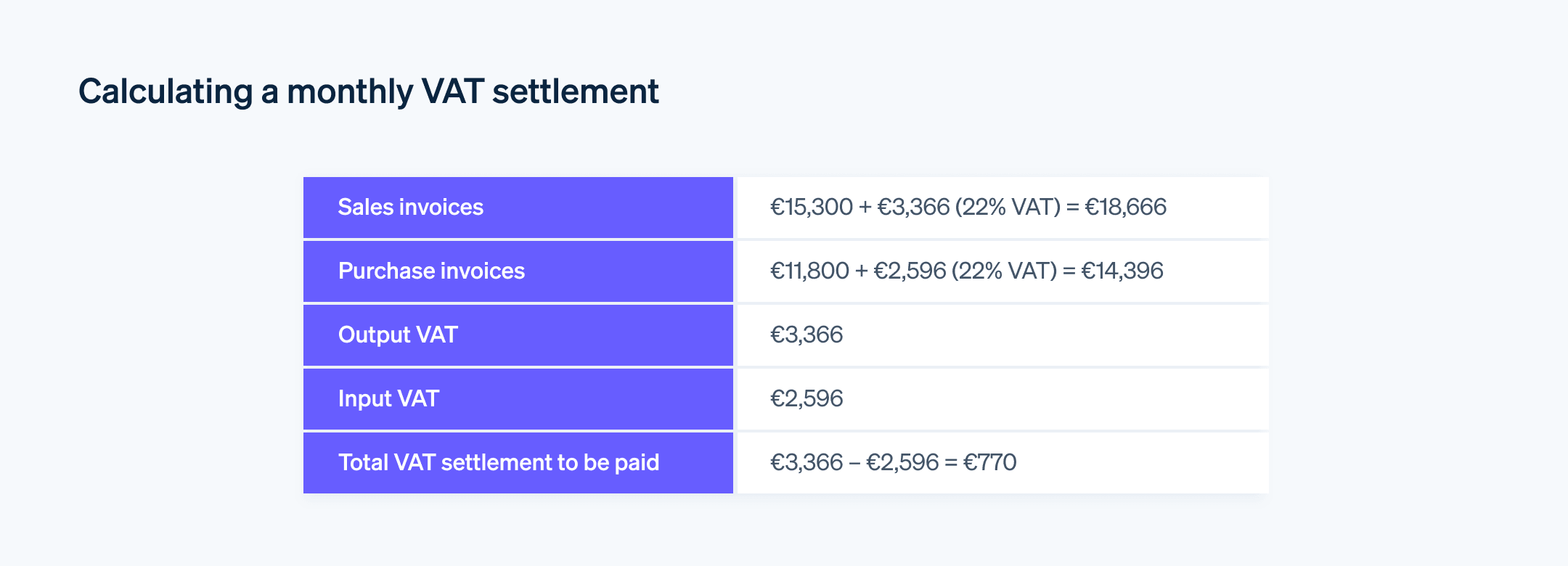

How to calculate a monthly VAT settlement

In June 2023, a company purchased products from suppliers for a total of €11,800 plus 22% VAT. In the same month, the company sold products to customers for €15,300 plus 22% VAT.

To determine the VAT settlement amount, the VAT on invoices received is subtracted from the VAT on invoices issued. The result is as follows:

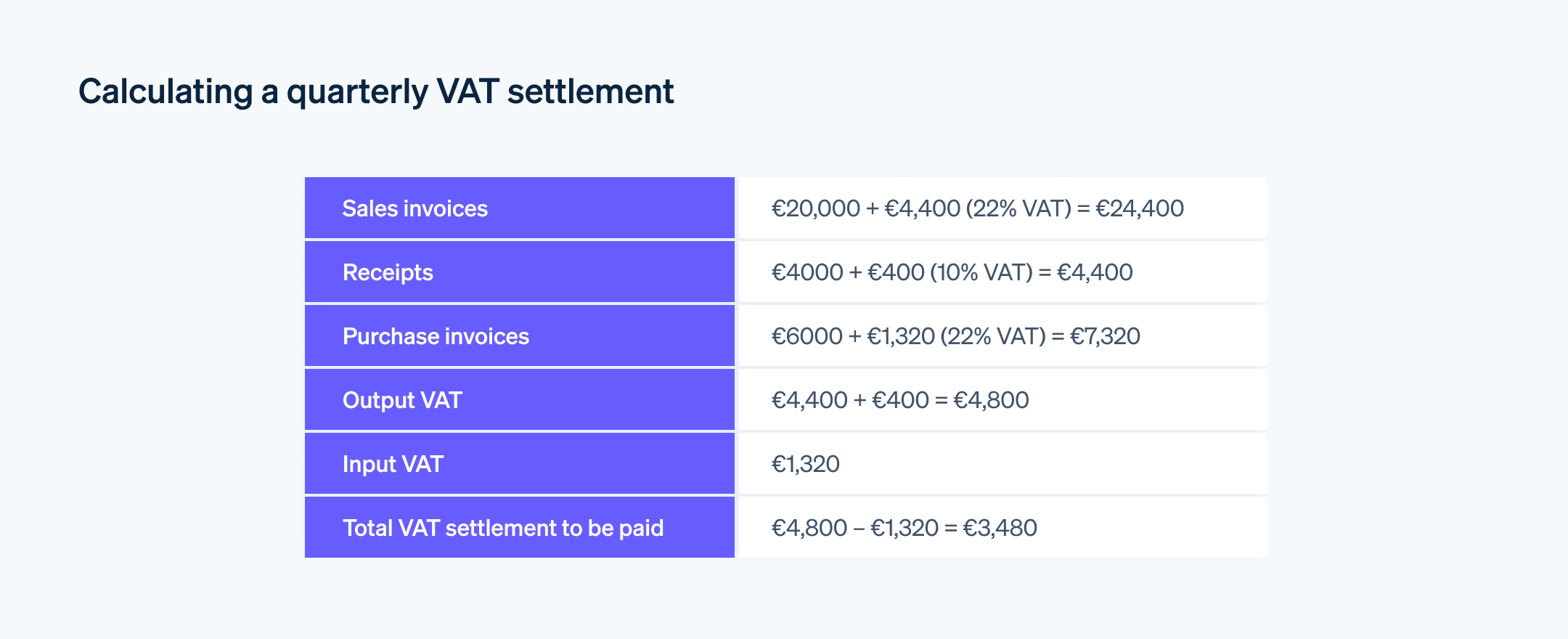

How to calculate a quarterly VAT settlement

Between April and June 2023, a company issued sales invoices totaling €20,000 plus 22% VAT and received payments totaling €4,000 plus 10% VAT. During the same period, the company sold products to customers and recorded purchase invoices totaling €6,000 plus 22% VAT.

Here’s how to calculate the VAT settlement amount:

Quarterly interest of 1% is added to this:

3,480 × 1% = 34.8

Total payable on August 16:

€3,480 + 34.8 = €3,514.80

How to make the payment for VAT settlement

Payment of the VAT due must be made electronically using Form F24. When filling in the form, the correct tax codes must be indicated, as they vary according to the time of payment and the month in which the payment is made:

Monthly settlement: The codes range from 6001–6012, with the last two digits varying according to the month in which the payment is made.

Quarterly settlement: The codes are 6031, 6032, 6033, and 6034, with the last digit varying according to the quarter in which the payments are made.

Finally, code 6035 is used to identify the VAT on account, which is an advance payment of the tax due at the end of the year. You can also consult all the tax codes on the Italian Revenue Agency website.

Keeping up with changing tax regulations can be a challenge for your business. To meet this need, automated tools such as Stripe Tax are available that generate detailed reports useful for filing tax returns and can work seamlessly with just a few clicks or a single line of code.

Penalties for failure to pay VAT

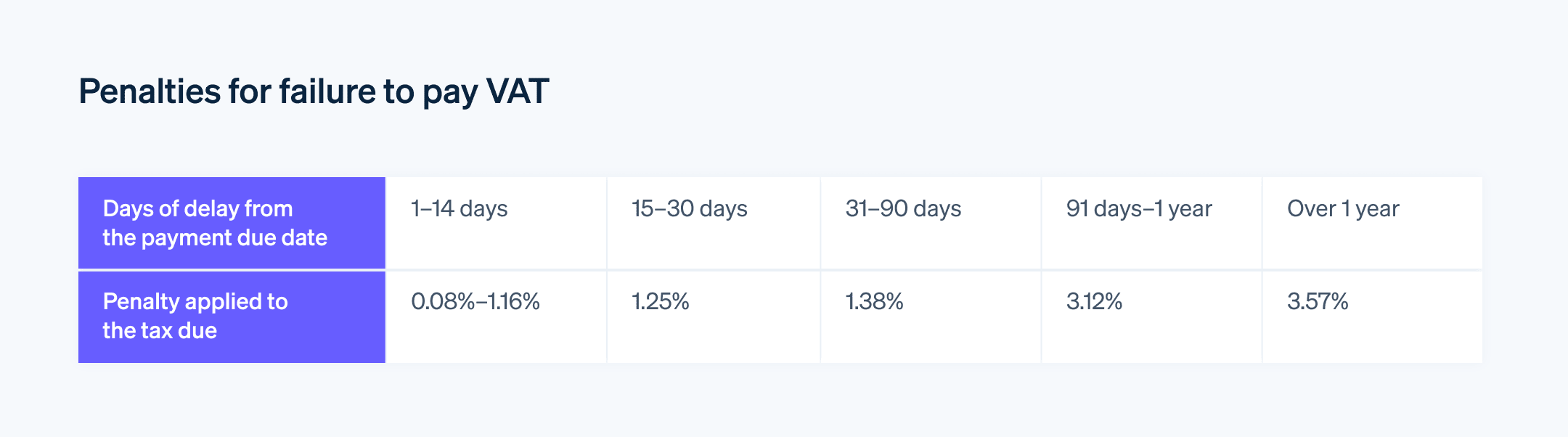

With regard to the nonpayment of VAT, a penalty of 25% of the unpaid or late tax is provided for in Article 13 of Legislative Decree No. 471/97 (as amended by Legislative Decree No. 87 of 06/14/2024, which took effect on September 1, 2024). The taxpayer can use the voluntary correction procedure to benefit from a reduction of the penalties by regularizing the omitted payments.

If the payment was omitted or made more than 90 days after the due date, the standard 25% penalty applies. If payment is made within 90 days of the violation or filing deadline, the penalty for failure to pay the VAT settlement is reduced to 50% (12.5% of the tax). If payment is made within 14 days, the 12.5% penalty is further reduced by 0.83% for each day of delay.

In addition to the penalties, the taxpayer must pay interest at the statutory annual rate from the date the payment was due until the date it is actually paid. For 2024, the interest rate was 2.5%, and it is 2% for 2025. Here are the interest rates for recent years:

January 1, 2019–December 12, 2019: 0.8%

January 1, 2020–December 12, 2020: 0.05%

January 1, 2021–December 12, 2021: 0.01%

January 1, 2022–December 12, 2022: 1.25%

January 1, 2023–December 12, 2023: 5%

From January 1, 2024: 2.5%

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.