The RIB is a key document for making direct debits or receiving payments in France, and it can often be confusing. What is the RIB? Why do you need to provide it? Is it dangerous to give this document to a stranger? In this article, we answer the most frequently asked questions and explain how to obtain and use a RIB.

What’s in this article?

- What is a RIB and what information does it contain?

- What is the purpose of a RIB?

- What is the difference between a RIB number and an IBAN?

- What is the difference between a RIB number and a bank account number?

- How do you find your bank identity statement?

- Where can you find a sample RIB?

- What are the risks of providing your bank identity statement?

What is a RIB and what information does it contain?

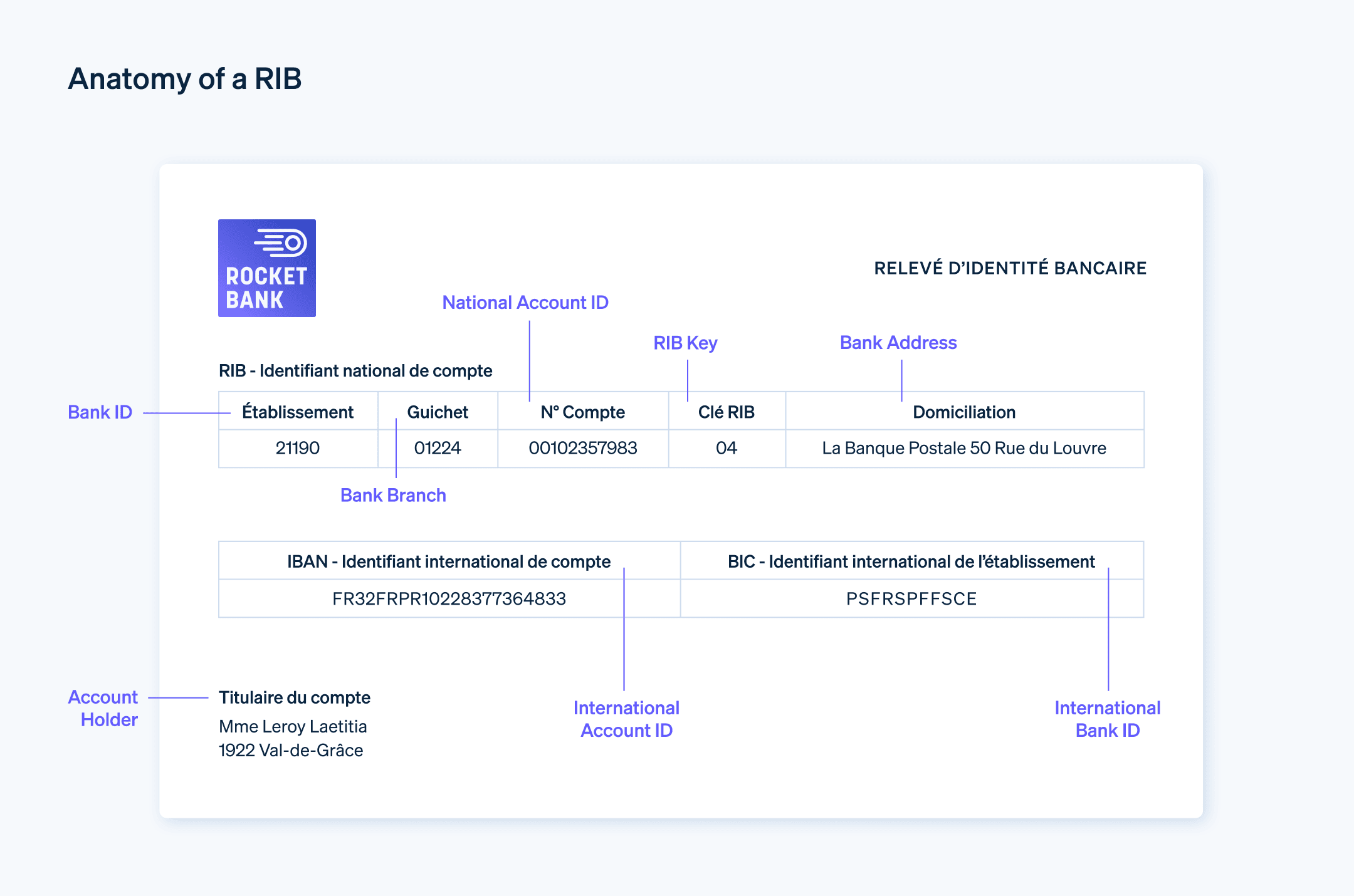

RIB is an acronym that stands for “relevé d’identité bancaire” in French (or “bank identity statement” in English). It is a document that identifies an account holder and their bank details. The RIB includes:

- The name of the account holder

- The name of the bank (where the account is managed, in letters)

- The bank code (where the account is managed, a five-digit code)

- The routing number (the branch that the account is affiliated to, a five-digit code)

- The account number (11 digits)

- The RIB key (two digits used to check the validity of the account)

- The IBAN of the account (a 27-character code that identifies the French bank account internationally)

- The BIC or “Bank Identifier Code” (a code that identifies the bank internationally)

It is important not to confuse the RIB with the RIB number. The RIB is a document that summarizes the above information. By contrast, the RIB number is made up of the bank code, routing number, account number, and RIB key—which identify the bank account nationally.

What is the purpose of a RIB?

The RIB serves as the bank account’s identity card, summarizing all of the key information about the account. It allows the account holder to share their bank details error-free.

The RIB is fundamental in order to receive bank transfers and make secure direct debits in France. For example, you need to provide one to pay your rent, utility bills, or a salary. You will also need to provide one to receive payment (from a customer or your employer). RIBs can also be sent to public bodies such as the French social security body or the Caisse d’Allocations familiales (CAF) to receive benefits.

What is the difference between a RIB number and an IBAN?

IBANs are standardized alphanumeric codes identifying a bank account internationally. IBAN stands for “International Bank Account Number.” IBANs are required for all international transactions. However, the RIB number is the bank ID specific to France, made up of the bank code, routing number, account number, and RIB key. Both the IBAN and the RIB number appear on the RIB.

You can find out more about IBANs and checking IBANs in our articles on the subject.

What is the difference between a RIB number and a bank account number?

Like an IBAN, the bank account number is simply an item of banking information that appears on the RIB. In France, an account number consists of 11 digits and is part of the RIB.

How do you find your bank identity statement?

Your bank will systematically provide you with a free RIB when you open your account. You can also find it in your checkbook, online in your bank’s customer area, or on your mobile application. Depending on the features available, some of your bank’s ATMs let you access a copy of your RIB. Alternatively, you can request a copy from your bank teller.

Where can you find a sample RIB?

Crédit Industriel et Commercial (CIC) provides a sample RIB online, divided into three parts: the RIB number, IBAN, and BIC. You can also access the sample RIB provided by BNP Paribas.

To learn about the difference between BIC and SWIFT codes, read our article on the subject.

What are the risks of providing your bank identity statement?

Be careful when providing your RIB: it’s important not to give it to just anyone. This document contains a lot of personal data. In the event of identity theft, contact your bank as soon as possible.

Note that your account cannot be debited without your authorization. If a scammer steals your RIB, you will still need to authorize the charge.

To reduce fraud attempts, many businesses are taking advantage of automated anti-fraud tools. You can entrust your payments to Stripe Payments, an integrated payment system designed to reduce fraud risk by using advanced machine learning algorithms. Get started with Stripe today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.