O RIB é um documento essencial para fazer débitos diretos ou receber pagamentos na França, e muitas vezes pode ser confuso. O que é o RIB? Por que você precisa fornecê-lo? É perigoso entregar esse documento a um estranho? Neste artigo, respondemos às perguntas mais frequentes e explicamos como obter e usar um RIB.

Neste artigo:

- O que é um RIB e quais informações contém?

- Qual a finalidade de um RIB?

- Qual é a diferença entre um número RIB e um IBAN?

- Qual é a diferença entre um número RIB e um número de conta bancária?

- Como encontrar sua declaração de identidade bancária?

- Onde encontrar um exemplo de RIB?

- Quais são os riscos de fornecer sua declaração de identidade bancária?

O que é um RIB e quais informações contém?

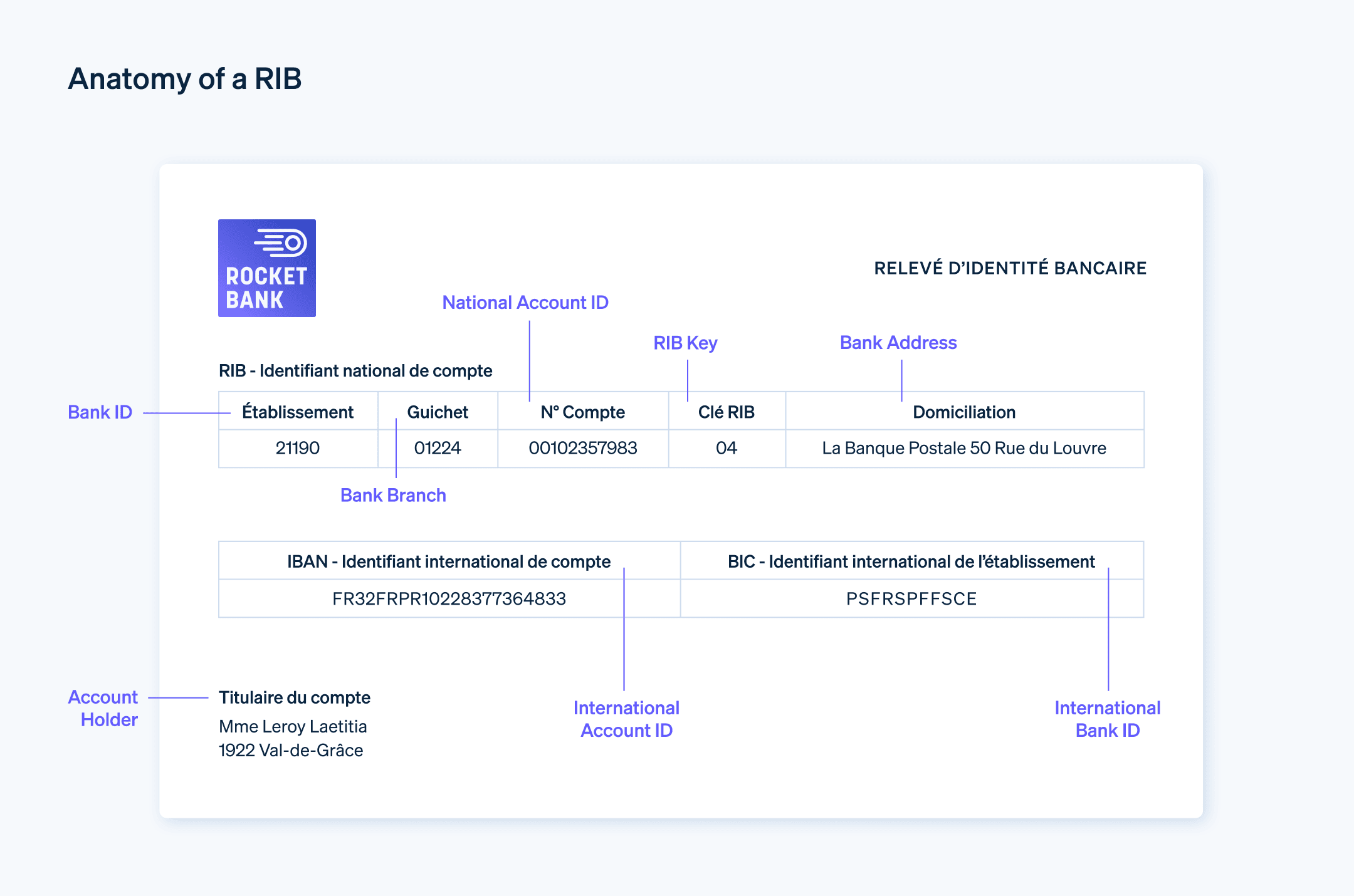

RIB é um acrônimo que significa "relevé d'identité bancaire" em francês (ou "declaração de identidade bancária" em português). É um documento que identifica um titular de conta e seus dados bancários. O RIB inclui:

- O nome do titular da conta

- O nome do banco (onde a conta é administrada, em letras)

- O código do banco (onde a conta é administrada, um código de cinco dígitos)

- O routing number (a agência à qual a conta é filiada, um código de cinco dígitos)

- O número da conta (11 dígitos)

- A chave RIB (dois dígitos usados para verificar a validade da conta)

- O IBAN da conta (um código de 27 caracteres que identifica a conta bancária francesa internacionalmente)

- O BIC ou "código identificador bancário" (um código que identifica o banco internacionalmente)

É importante não confundir o RIB com o número RIB. O RIB é um documento que resume as informações acima. Por outro lado, o número RIB é composto pelo código bancário, routing number, número da conta e chave RIB, que identificam a conta bancária nacionalmente.

Qual a finalidade de um RIB?

O RIB serve como carteira de identidade da conta bancária, resumindo todas as principais informações sobre ela. Ele permite que o titular da conta compartilhe seus dados bancários sem erros.

O RIB é fundamental para receber transferências bancárias e fazer débitos automáticos seguros na França. Por exemplo, você precisa fornecer um para pagar seu aluguel, contas de serviços públicos ou um salário. Você também precisará fornecer um para receber o pagamento (de um cliente ou seu empregador). Os RIBs também podem ser enviados a órgãos públicos, como o órgão francês de seguridade social ou ao Caisse d'Allocations familiales (CAF) para receber benefícios.

Qual é a diferença entre um número RIB e um IBAN?

IBANs são códigos alfanuméricos padronizados que identificam uma conta bancária internacionalmente. IBAN significa "International Bank Account Number" (número de conta bancária internacional). Os IBANs são obrigatórios para todas as transações internacionais. No entanto, o número RIB é o ID bancário específico da França, composto pelo código do banco, routing number, número da conta e chave RIB. O IBAN e o número RIB aparecem no RIB.

Saiba mais sobre IBANs e verificação de IBANs em nossos artigos sobre o assunto.

Qual é a diferença entre um número RIB e um IBAN?

Assim como um IBAN, o número da conta bancária é simplesmente um item de dados bancários que aparece no RIB. Na França, o número de uma conta tem 11 dígitos e faz parte do RIB.

Como encontrar sua declaração de identidade bancária?

Seu banco fornecerá sistematicamente um RIB gratuito quando você abrir uma conta. Você também pode encontrá-lo no seu talão de cheques, online, na área de clientes do seu banco ou no seu aplicativo móvel. Dependendo dos recursos disponíveis, alguns dos caixas eletrônicos do seu banco permitem que você acesse uma cópia do seu RIB. Você também pode solicitar uma cópia do caixa do banco.

Onde encontrar um exemplo de RIB?

O Crédit Industriel et Commercial (CIC) fornece um exemplo de RIB online, dividido em três partes: o número RIB, o IBAN e o BIC. Você também pode acessar o exemplo de RIB fornecido pelo BNP Paribas.

Para saber mais sobre a diferença entre os códigos BIC e SWIFT, leia nosso artigo sobre o assunto.

Quais são os riscos de fornecer sua declaração de identidade bancária?

Tenha cuidado ao fornecer seu RIB: é importante não entregá-lo a qualquer pessoa. Este documento contém muitos dados pessoais. Em caso de roubo de identidade, entre em contato com seu banco o mais rápido possível.

Observe que sua conta não pode ser debitada sem sua autorização. Se um golpista roubar seu RIB, você ainda precisará autorizar a cobrança.

Para reduzir as tentativas de fraude, muitas empresas estão aproveitando as ferramentas antifraude automatizadas. Você pode confiar seus pagamentos ao Stripe Payments, um sistema de pagamentos integrado projetado para reduzir o risco de fraude usando algoritmos avançados de machine learning. Comece a usar a Stripe hoje.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.