Os códigos BIC e SWIFT são importantes para transferências internacionais e desempenham um papel fundamental nos pagamentos globais. Neste artigo, fornecemos uma visão geral abrangente de ambos os termos e explicamos as diferenças entre eles, bem como como esses códigos são estruturados.

Neste artigo:

- O que é SWIFT?

- O que é um código SWIFT?

- Onde encontrar o código SWIFT?

- O que é o BIC?

- Onde encontrar o BIC?

- Código SWIFT e BIC: quais as diferenças?

- Código SWIFT e IBAN: quais as diferenças?

- É possível localizar o BIC com o IBAN?

O que é SWIFT?

"SWIFT" significa "Sociedade para Telecomunicações Financeiras Interbancárias Mundiais". É uma rede que possibilita transações financeiras internacionais e mensagens entre instituições financeiras. Foi fundada em 1973 e está sediada na Bélgica. A rede SWIFT é popular entre os bancos devido ao seu alcance global e altos padrões de segurança. Em 2022, cerca de 11,25 bilhões de mensagens criptografadas foram enviadas por meio do SWIFT por bancos em todo o mundo.

O que é um código SWIFT?

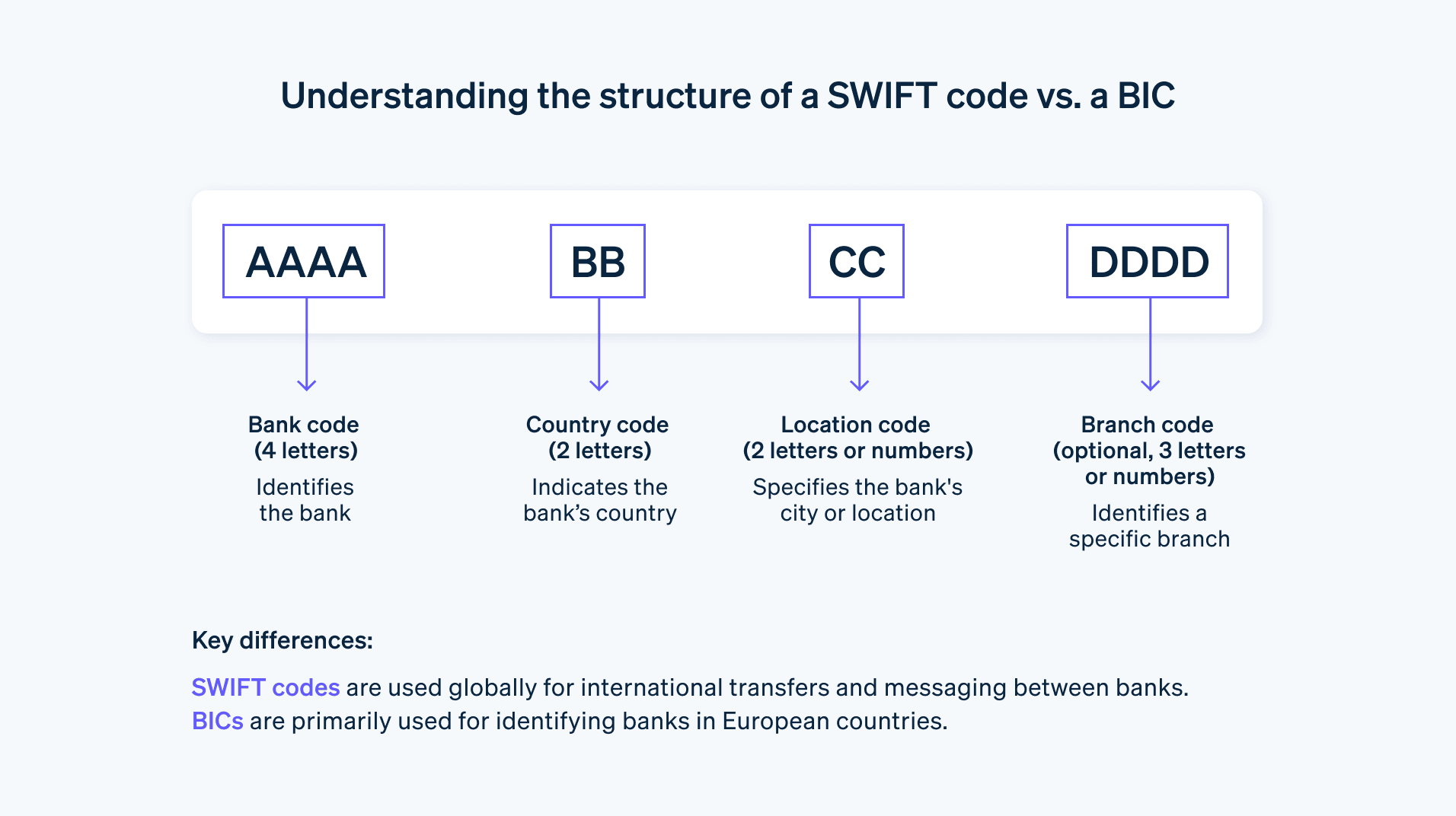

É necessário um código SWIFT para simplificar as transferências globais entre bancos. É um identificador único composto por 8 ou 11 caracteres e contém informações sobre o banco ao qual pertence. Ele permite transações rápidas e eficientes entre bancos em todo o mundo.

O código SWIFT é composto por quatro seções: o código bancário (quatro letras), o código do país (duas letras), o código de localização (duas letras ou números) e, opcionalmente, um código de agência (três letras ou números). Se o código tiver 11 caracteres, isso significa que ele contém informações adicionais necessárias para a transferência.

A maioria dos bancos tem seu próprio código SWIFT, facilmente identificado. Se você ou seus clientes desejam fazer uma transferência internacional, você precisa saber o código SWIFT do seu banco e do destinatário.

Onde encontrar o código SWIFT?

O código BIC ou SWIFT pode ser encontrado pesquisando o nome da instituição online ou entrando em contato diretamente com seu banco. O código SWIFT também pode ser encontrado no site da sua instituição financeira sob detalhes de contato ou pode ser solicitado diretamente ao seu banco. É importante usar o código BIC ou SWIFT correto porque você pode pagar as taxas da transferência e mesmo assim não conseguir efetuar a transação.

O que é BIC?

BIC significa "Bank Identifier Code" (Código Identificador Bancário) e é um código de classificação internacional de oito dígitos usado para identificar instituições financeiras. É uma chave de instituição de quatro dígitos e um identificador de país de dois dígitos, além de dois dígitos opcionais. O código BIC costuma ser usado em transferências internacionais, transferências eletrônicas de fundos (EFTs) e SEPA instruções de pagamento para identificar os bancos envolvidos, garantindo uma transação tranquila.

O BIC é um padrão aceito globalmente, e garante tranquilidade para os clientes em transações com instituições de crédito dentro de seu próprio país ou com bancos parceiros no exterior. Na maioria dos casos, o BIC e o SWIFT são iguais.

Assim como o IBAN (International Bank Account Number), o formato de número de conta nacional mais sort codes (Reino Unido) ou números de trânsito (Canadá), o BIC define precisamente a conta bancária do beneficiário para pagamentos internacionais. Esse processo também ajuda a permitir que as transferências monetárias sejam processadas com mais rapidez e precisão e evita atrasos ou mal-entendidos. O BIC é um dos elementos mais importantes para o processamento de pagamentos internacionais.

Onde encontrar o BIC?

É possível identificar o BIC de várias formas. A mais simples é encontrar o número em plataformas online contendo informações relevantes. Há também a opção de perguntar diretamente ao banco. Isso geralmente faz sentido para instituições financeiras com presença global. A maioria dos bancos também oferece uma calculadora BIC em seu site. O último método é procurar o código em diretórios especiais; tenha cuidado e use apenas fontes conhecidas para evitar que dados incorretos sejam obtidos.

Código SWIFT e BIC: quais as diferenças?

O código SWIFT e o BIC costumam ser usados um no lugar do outro. No entanto, existem diferenças fundamentais entre eles. O BIC é usado apenas para bancos europeus, mas os códigos SWIFT são usados em todo o mundo. Por outro lado, o código SWIFT é outra forma do BIC – eles têm funções semelhantes, mas não são idênticos.

O código SWIFT é um identificador único usado pelos bancos para processar transferências internacionais. O BIC é um número de identificação diferente usado pelos bancos. O BIC identifica o banco do destinatário ao fazer uma transferência internacional de fundos, enquanto o código SWIFT atua como um formato geral para transferir mensagens, independentemente da conta do destinatário.

O código SWIFT e o BIC também estão estruturados de forma diferente. O BIC contém informações sobre a identidade do banco e o país em que está sediado. O código SWIFT, por outro lado, contém informações sobre o nome e endereço do banco, bem como distrito e município.

O código SWIFT tem 8 a 11 caracteres divididos em quatro seções: os quatro primeiros caracteres representam um código bancário, seguidos por dois caracteres representando o código do país (ISO 3166-1), dois caracteres representando um código de localização (ISO 3166-2) e três letras ou números que constituem o número da agência. O BIC, por outro lado, é composto por 8 ou 11 caracteres compostos pelo código do país, sort code, código de localização e, opcionalmente, um número da agência.

O código SWIFT é utilizado, em particular, para transferências internacionais, enquanto o BIC serve como um indicador geral para os bancos. O BIC pode ser considerado equivalente ao código SWIFT, mas nem todo BIC é um código SWIFT.

Código e IBAN SWIFT: quais as diferenças?

O IBAN é um código de número de conta padronizado internacionalmente que identifica especificamente cada conta dentro do sistema. Ele consiste em um mínimo de 15 caracteres e combina formatos de número de conta local com informações adicionais, como identificadores de país e dígitos de verificação. Transferências estrangeiras não podem ser processadas sem um IBAN.

A diferença entre um código SWIFT ou BIC e um IBAN é que um BIC identifica apenas a instituição de crédito, não fornece nenhum dado de cliente ou informação de conta. Em contrapartida, o IBAN apresenta informações pormenorizadas sobre o titular da conta e a própria conta.

Para transferir dinheiro através de fronteiras nacionais ou internacionais, tanto o BIC quanto o IBAN precisam ser fornecidos corretamente.

É possível obter o BIC a partir do IBAN?

Não é possível obter o BIC pelo IBAN. O IBAN simplesmente representa um número de conta padronizado internacionalmente e contém informações sobre o país, o banco e a conta. Já o BIC é um código emitido individualmente para cada banco com informações sobre a localização e o nome do banco.

Para obter o BIC para um determinado banco, você deve visitar o site do banco ou entrar em contato com seu departamento de atendimento ao cliente. No entanto, também existem ferramentas online que você pode usar para pesquisar o BIC. Para usá-los, basta digitar o IBAN, e a ferramenta encontra automaticamente o BIC relevante.

Tanto o IBAN quanto o BIC são necessários para transferências internacionais. Sem essas informações, uma transferência não pode ser executada corretamente e pode resultar em taxas adicionais ou atrasos.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.