BIC and SWIFT codes are important for international transfers and play a key role in global payments. In this article, we provide a comprehensive overview of both terms and explain the differences between them, as well as how these codes are structured.

What's in this article?

- What is SWIFT?

- What is a SWIFT code?

- Where can you find the SWIFT code?

- What is BIC?

- Where can you find a BIC?

- SWIFT codes and BIC: How are they different?

- SWIFT code and IBAN: How are they different?

- Can you get the BIC from the IBAN?

What is SWIFT?

"SWIFT" stands for "Society for Worldwide Interbank Financial Telecommunication". It's a network that enables international financial transactions and messaging between financial institutions. It was founded in 1973 and is headquartered in Belgium. SWIFT is popular among banks due to its global reach and high security standards. In 2022, around 11.25 billion encrypted messages were sent through SWIFT by banks across the world.

What is a SWIFT code?

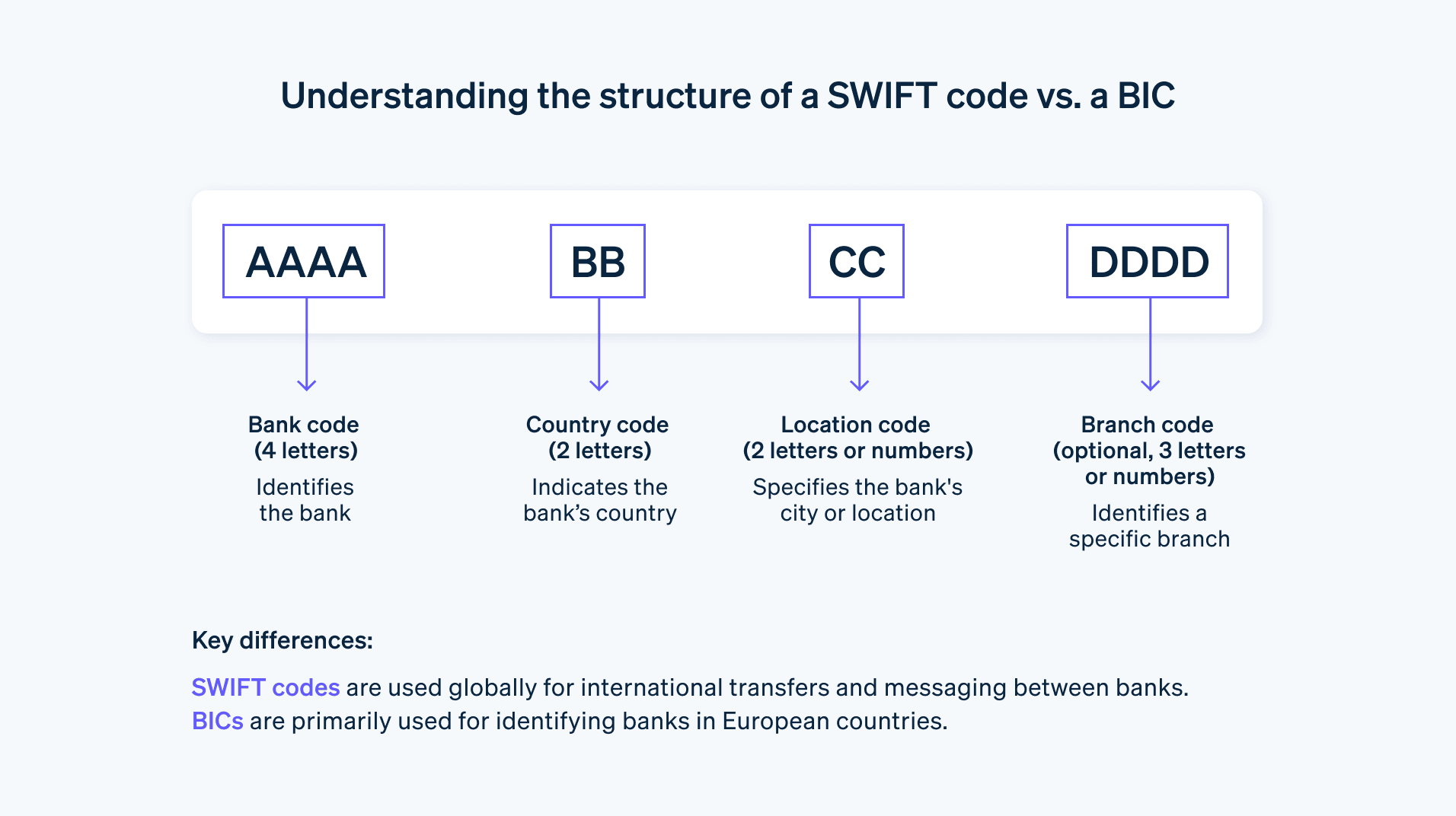

A SWIFT code is needed to simplify global transfers between banks. It is a unique identifier consisting of 8 or 11 characters and contains information about the bank that it belongs to. It enables fast and efficient transactions between banks across the globe.

A SWIFT code is made up of four sections: the bank code (four letters), the country code (two letters), the location code (two letters or numbers) and an optional branch code (three letters or numbers). If the code is 11 characters long, this means that it contains additional information required for the transfer.

Most banks have their own SWIFT code that can be identified easily. If you or your customers want to make an international transfer, you need to know the SWIFT code for your bank and for the recipient.

Where can you find the SWIFT code?

You can find the BIC or SWIFT code by searching for the name of the institution online or by contacting your bank directly. The SWIFT code can also be found on the website of your financial institution under their contact details. Alternatively, it can be requested directly from your bank. It is important to use the correct BIC or SWIFT code or you may be charged fees for your transfer, and the transaction will not be processed.

What is BIC?

BIC stands for "Bank Identifier Code" and is an eight-digit international sort code that is used to identify financial institutions. It consists of a four-digit institution key and a two-digit country identifier, plus two optional digits. A BIC code is generally included in international transfers, electronic funds transfers (EFTs) and SEPA payment instructions to identify the banks involved, guaranteeing a smooth transaction.

BICs are a globally accepted standard, and customers can expect consistency whether they're transacting with credit institutions within their own country or with partner banks abroad. In most cases, the BIC and the SWIFT code are the same.

Combined with the IBAN (International Bank Account Number) – the national account number format, plus sort codes (UK) or transit numbers (Canada) – the BIC precisely defines the recipient's bank account for international payments. This process also helps enable monetary transfers to be processed more quickly and accurately, and prevents potential delays or misunderstandings. The BIC is one of the most important elements for processing international payments.

Where can you find a BIC?

A BIC can be identified in several different ways. The simplest way is to find the number on online platforms that contain the relevant information. There is also the option of asking the bank directly. This often makes sense for financial institutions with a global presence. Most banks also offer a BIC calculator on their website. The last method is to search for the code in special directories. However, exercise caution with this method and only use known sources to prevent incorrect data from being obtained.

SWIFT codes and BIC: How are they different?

SWIFT codes and BIC are often used interchangeably. However, there are key differences between them. The BIC is only used for European banks, while SWIFT codes are used around the world. On the other hand, the SWIFT code is another form of the BIC – they have similar functions but are not identical.

The SWIFT code is a unique identifier that is used by banks to process international transfers. The BIC is a different identification number used by banks. The BIC identifies the recipient's bank when making an international funds transfer, whereas the SWIFT code acts as a general format for transferring messages regardless of the recipient's account.

The SWIFT code and BIC are also structured differently. The BIC contains information about the identity of the bank and the country in which it is based. The SWIFT code, on the other hand, contains information about the name and address of the bank, as well as its county and municipality.

The SWIFT code consists of 8 to 11 characters divided into four sections: the first four characters represent a bank code, followed by two characters representing the country code (ISO 3166-1), two characters representing a location code (ISO 3166-2) and three letters or numbers constituting the branch number. The BIC, on the other hand, consists of 8 or 11 characters made up of the country code, sort code, location code and an optional branch number.

The SWIFT code is used in particular for international transfers, whereas the BIC serves as a general indicator for banks. The BIC can be considered to be equivalent to the SWIFT code, but not every BIC is a SWIFT code.

SWIFT code and IBAN: How are they different?

The IBAN is an internationally standardised account number code that specifically identifies every account within the system. It consists of a minimum of 15 characters and combines local account number formats with additional information, such as country identifiers and check digits. Foreign transfers cannot be processed without an IBAN.

The difference between a SWIFT code or BIC and an IBAN is that a BIC only identifies the credit institution – it does not provide any customer data or account information. In contrast, the IBAN sets out detailed information about the account holder and the account itself.

In order to transfer money across national or international borders, both the BIC and IBAN need to be provided correctly.

Can you get the BIC from the IBAN?

It is not possible to get the BIC from the IBAN. The IBAN simply represents an internationally standardised account number and contains information about the country, bank and account. The BIC, by contrast, is a code that is issued individually to each bank and contains information about the location and name of the bank.

To obtain the BIC for a particular bank, you should either visit the bank's website or contact its customer service department. However, there are also online tools that you can use to search for the BIC. To use these, you simply need to enter the IBAN and the tool will find the relevant BIC automatically.

Both the IBAN and the BIC are needed for international transfers. Without this information, a transfer cannot be executed properly and may result in additional fees or delays.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.