RIB 是进行直接扣款或接收付款的关键文件,但它往往令人困惑。什么是 RIB?为什么需要提供 RIB?将此文件交给陌生人是否存在风险?在本文中,我们将解答最常见的问题,并介绍如何获取和使用 RIB。

目录

- 什么是 RIB?它包含哪些信息?

- RIB 的用途是什么?

- RIB 号码与 IBAN 有何区别?

- RIB 号码与银行账号有何区别?

- 如何找到您的银行身份声明?

- 哪里可以找到 RIB 示例?

- 提供 RIB 存在哪些风险?

什么是 RIB?它包含哪些信息?

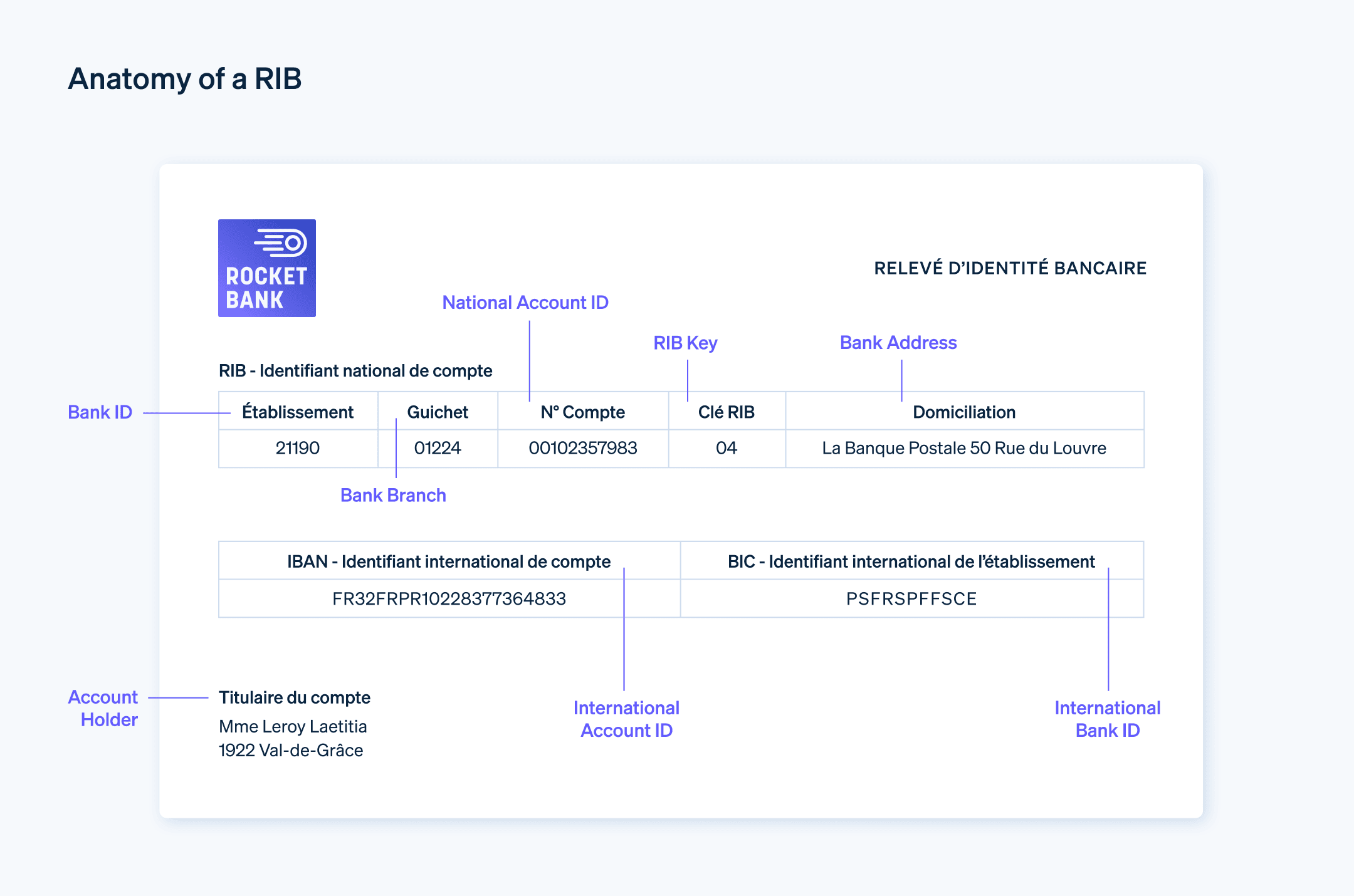

RIB 是法语 “relevé d’identité bancaire” 的缩写,英文为 “bank identity statement”(银行身份声明)。它是一份标识账户持有人及其银行信息的文件。RIB 包含以下信息:

- 账户持有人姓名

- 银行名称(以字母表示账户所属银行)

- 银行代码(账户所属银行的 5 位数代码)

- 分行代码(账户所属分行的 5 位数代码)

- 银行账号(11 位数)

- RIB 校验码(用于验证账户有效性的 2 位数代码)

- IBAN(国际银行账户号码)(法国银行账户的 27 位字符代码)

- BIC(银行识别代码)(用于国际识别银行的代码)

需要注意的是,RIB 与 RIB 号码不同。RIB 是一份文件,包含上述所有信息。而 RIB 号码由银行代码、分行代码、银行账号和 RIB 校验码组成,用于在法国境内标识银行账户。

RIB 的用途是什么?

RIB 充当银行账户的“身份证”,概述了账户的所有关键信息。它可以让账户持有人无误地共享银行信息。

RIB 是接收银行转账和进行安全直接扣款的基础。例如,您需要提供 RIB 来:支付房租、水电费或工资您还可以使用 RIB 接收付款(来自客户或雇主)RIB 还可用于向法国政府机构提交信息,例如:法国社会保障机构、家庭津贴基金 (Caisse d’Allocations familiales (CAF)) 以便接收福利或补助。

RIB 号码与 IBAN 有何区别?

IBAN 是用于国际银行账户识别的标准化字母数字代码。IBAN 的全称是“International Bank Account Number”(国际银行账号)。IBAN 适用于所有国际交易。但 RIB 号码仅适用于法国,由银行代码、分行代码、银行账户号码和 RIB 校验码组成。RIB 号码和 IBAN 都会出现在 RIB 文件中。

RIB 号码与银行账号有何区别?

与 IBAN 类似,银行账号只是 RIB 上的一个银行信息项。在法国,银行账号由 11 位数字组成,是 RIB 的一部分。

如何找到您的银行身份声明?

在开户时,银行会免费提供 RIB。您还可以在以下地方找到 RIB:支票簿、银行官网的个人账户管理页面、银行移动应用程序根据可用功能,部分银行 ATM 机也允许客户获取 RIB 副本。如果无法在线获取,您可以向银行柜台请求一份 RIB 副本。

哪里可以找到 RIB 示例?

法国工业与商业信贷银行 (CIC) 提供了一个 RIB 示例,该示例分为 三部分:RIB 号码、IBAN 和 BIC。您还可以访问法国巴黎银行 (BNP Paribas) 提供的 RIB 示例。

如果想了解 BIC 与 SWIFT 代码之间的区别,可以阅读我们的文章:

提供 RIB 存在哪些风险?

谨慎提供 RIB,不要随意将其交给陌生人。该文件包含大量个人数据。如果发生身份盗用,请尽快联系您的银行。

需要注意的是:未经您的授权,您的账户不会被扣款。即使诈骗者获取了您的 RIB,仍然需要您的授权才能扣款。

为了减少欺诈风险,许多企业开始使用自动防欺诈工具。您还可以使用 Stripe Payments,这是一个集成的支付系统,利用高级机器学习算法降低欺诈风险。立即注册 Stripe,确保您的支付安全!

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。