Challenge

Headquartered in Stuttgart, Germany, APCOA is the leading European parking operator, managing over 1.6 million parking spaces in more than 13,000 locations across 12 European countries. For over 50 years, APCOA has invested in providing sustainable mobility options by integrating EV charging stations, urban mobility, and logistics into its parking locations to improve customers’ lives. Today, the company provides six digital solutions to power its parking and urban offerings, including APCOA FLOW and APCOA Connect for automated parking payments via app; EV Charging; Prebook for advanced parking; control fees to manage fines; and ScanPay, a QR code payment option.

APCOA managed these solutions across its European markets, each with its own separate payment service provider (PSP), user flow, and data business model. The approach created a disjointed payment experience for APCOA customers using its solutions in multiple countries. APCOA also had issues maintaining a global view of payments and technology performance, making it challenging to plan its roadmap and improve its customer offerings.

The company’s flagship offering, APCOA FLOW, uses advanced automated number-plate recognition (ANPR) technology to process payments automatically as customers drive in and out of parking locations. However, customers driving across international borders needed separate accounts to pay for parking and services in each country, inhibiting the app’s seamless nature.

APCOA wanted to unify its markets and consolidate on one payments platform to power its digital solutions across its 12 operating countries. To accomplish this, the company needed a new payments partner to provide more reliable digital products that improve company operations and integrate more seamlessly into its customers’ daily lives.

Solution

In 2023, APCOA selected Stripe to power its digital transformation. Stripe’s robust technology and payments industry expertise made it an easy choice. “Stripe is a digital partner, not just a PSP. The partnership, service, and reliability of other partners just wasn’t the same,” said Peter Minev, APCOA’s chief technology and product officer.

APCOA also liked how easy Stripe was for developers. “I had never experienced that level of documentation,” said Jürgen Letsch, an APCOA program manager. “Stripe has an API for so many things; it’s not something you typically see.”

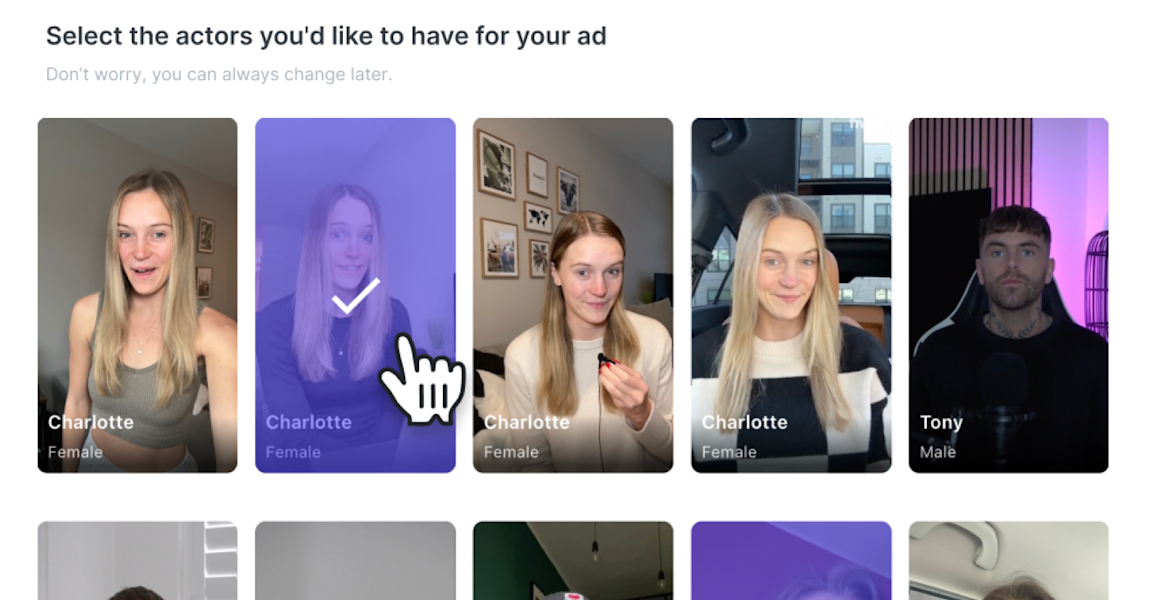

APCOA implemented Stripe Payments across its six digital solutions to align its payment experience. To improve the checkout and offer more payment options, the company implemented Stripe’s Optimized Checkout Suite, including the Payment Element—a secure, embeddable UI component that dynamically surfaces the most relevant payment methods for each transaction. With the Optimized Checkout Suite, APCOA could add local payment methods such as SEPA Direct Debits, BLIK, and P24 directly from the Stripe Dashboard. APCOA also implemented the Express Checkout Element to surface one-click digital wallets and enabled Link, Stripe’s accelerated checkout solution that securely saves and auto-fills the subscriber’s address and payment details.

To improve APCOA FLOW’s multicountry customer parking experience, APCOA implemented Stripe Connect. With Connect, each APCOA operating country maintains a separate Stripe account on the backend, while customers use a single account on the frontend across all countries. The structure helps countries maintain local compliance, manage reconciliations, and offer customers preferred and local payment methods with a holistic view for APCOA leadership.

APCOA partnered with Stripe’s professional services team to guide its transformation. “Companies should always partner with professional services for complex integrations,” said Minev. “For us, it was never a question. The stakes were too high.”

In January 2024, APCOA’s leadership, which included representatives from its 12 operating countries, and leads from the Stripe professional services team gathered in Stuttgart for a two-day kickoff workshop. They used the Stripe adoption framework, which is designed by Stripe professional services to help Stripe users take a more holistic approach to their digital transformation.

Stripe professional services worked directly with local leads from APCOA’s operating countries to capture requirements and structure Stripe accounts to ensure alignment for cross-country payment flows, local compliance, and use of preferred and local payment methods. “I’m used to taking ownership of things; with Stripe, it’s a whole different experience,” said Letsch.

Results

Unified payments experience improves reporting and planning

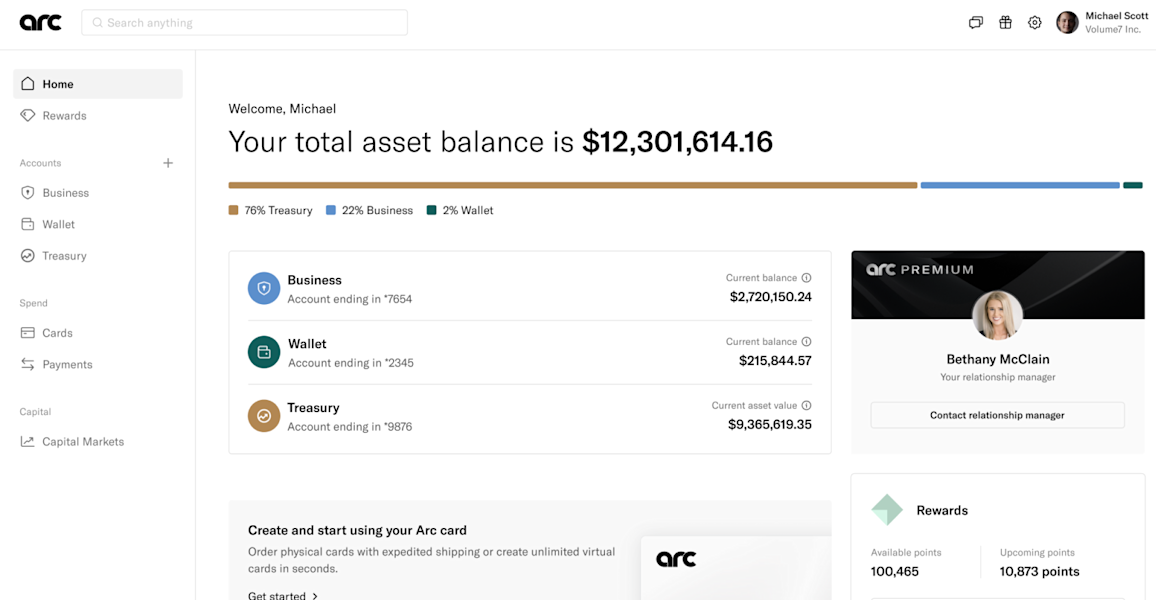

APCOA now provides a consistent and unified payments solution across its operating countries to improve the customer experience and simplify APCOA’s operations and management processes. A shared data model plus unified and consistent reporting available in the Stripe Dashboard make it easier for APCOA to plan for its future.

Optimized Checkout Suite helps APCOA see results faster with new payment methods

The Optimized Checkout Suite has made it easier for APCOA to quickly add new payment methods based on local market preferences, such as BLIK and P24, to its ScanPay, Prebook, and EV Charging solutions. APCOA has seen weeks and, in some cases, even months of savings in implementation time.

Single-account experience for cross-border parking with Connect

With Connect, APCOA improved the APCOA FLOW app’s original multiple-account structure. APCOA FLOW now provides users with a consistent and unified app experience wherever they access the app, enabling these customers to use their preferred payment methods across different countries. Customers and local APCOA markets also benefit from a consistent fee structure across the countries. “Our customers won’t have to do anything; it’s the same account. The app will upgrade and work everywhere we have launched,” said Minev.

Faster transformation with Stripe expertise

Partnering with Stripe professional services helped APCOA accelerate its transformation by helping its teams accomplish implementation tasks faster. In some cases, professional services helped the company save up to weeks on a single task, such as implementing APCOA FLOW connected accounts.

I felt the whole time that we had an engaged partner invested in APCOA’s success. [Stripe] regularly hosted workshops to educate us and partnered with us in problem-solving, bringing in different functions as needed. They always knew how to drive us forward.