Om ervoor te zorgen dat ondernemingen hun steeds digitaler wordende klanten eenvoudige en veilige transacties kunnen aanbieden, moeten ze het onderscheid en de wisselwerking tussen betalingsverwerkers en betaalgateways onderzoeken.

Inzicht in de werking van deze componenten is cruciaal voor een soepele en betrouwbare betaalervaring. Hieronder bespreken we de belangrijkste verschillen tussen betalingsverwerkers en betaalgateways, hun respectieve rollen, hoe ze samenwerken en hoe Stripe hun functies op een uniforme, allesomvattende manier benadert voor platforms en ondernemingen.

Wat staat er in dit artikel?

- Wat is een betalingsverwerker?

- Wat is een betaalgateway?

- Wat zijn de verschillen tussen betalingsverwerkers en betaalgateways?

- Hoe werken betalingsverwerkers en betaalgateways samen?

- Hoe Stripe omgaat met betalingsverwerking en betaalgateways

Wat is een betalingsverwerker?

Een betalingsverwerker is een bedrijf of dienst die elektronische transacties tussen klanten en ondernemingen mogelijk maakt door creditcards, debitcards en andere digitale betaalmethoden te verwerken en autoriseren. Een betalingsverwerker treedt op als tussenpersoon tussen de bank van de klant (uitgevende bank of uitgever) en de bank van de onderneming (accepterende bank of accepteerder), die ervoor zorgt dat geld veilig wordt overgemaakt van de rekening van de klant naar het verkopersaccount.

Betalingsverwerkers spelen een belangrijke rol in e-commerce en retail door de betaalgegevens van de klant te verifiëren, te controleren op fraude, compliance met de relevante regelgeving te handhaven en uiteindelijk de transactie goed te keuren of te weigeren. Meestal brengen ze de onderneming kosten in rekening voor hun diensten, die kunnen bestaan uit een vergoeding per transactie of een percentage van het transactiebedrag.

Wat is een betaalgateway?

Een betaalgateway is een technologie of dienst die betaalgegevens veilig verzendt tussen de klant, de onderneming en de betalingsverwerker. Het fungeert als een brug tussen de partijen die bij een transactie betrokken zijn en maakt de uitwisseling van informatie mogelijk die nodig is voor het verwerken van betalingen. Een betaalgateway is het digitale equivalent van een POS-betaalterminal (POS) in een fysieke winkel.

Het gebruik van een betaalgateway zorgt ervoor dat gevoelige betalingsinformatie veilig wordt behandeld, aangezien betaalgateways zich houden aan strikte beveiligingsnormen en coderingsprotocollen, zoals de Payment Card Industry Data Security Standard (PCI DSS).

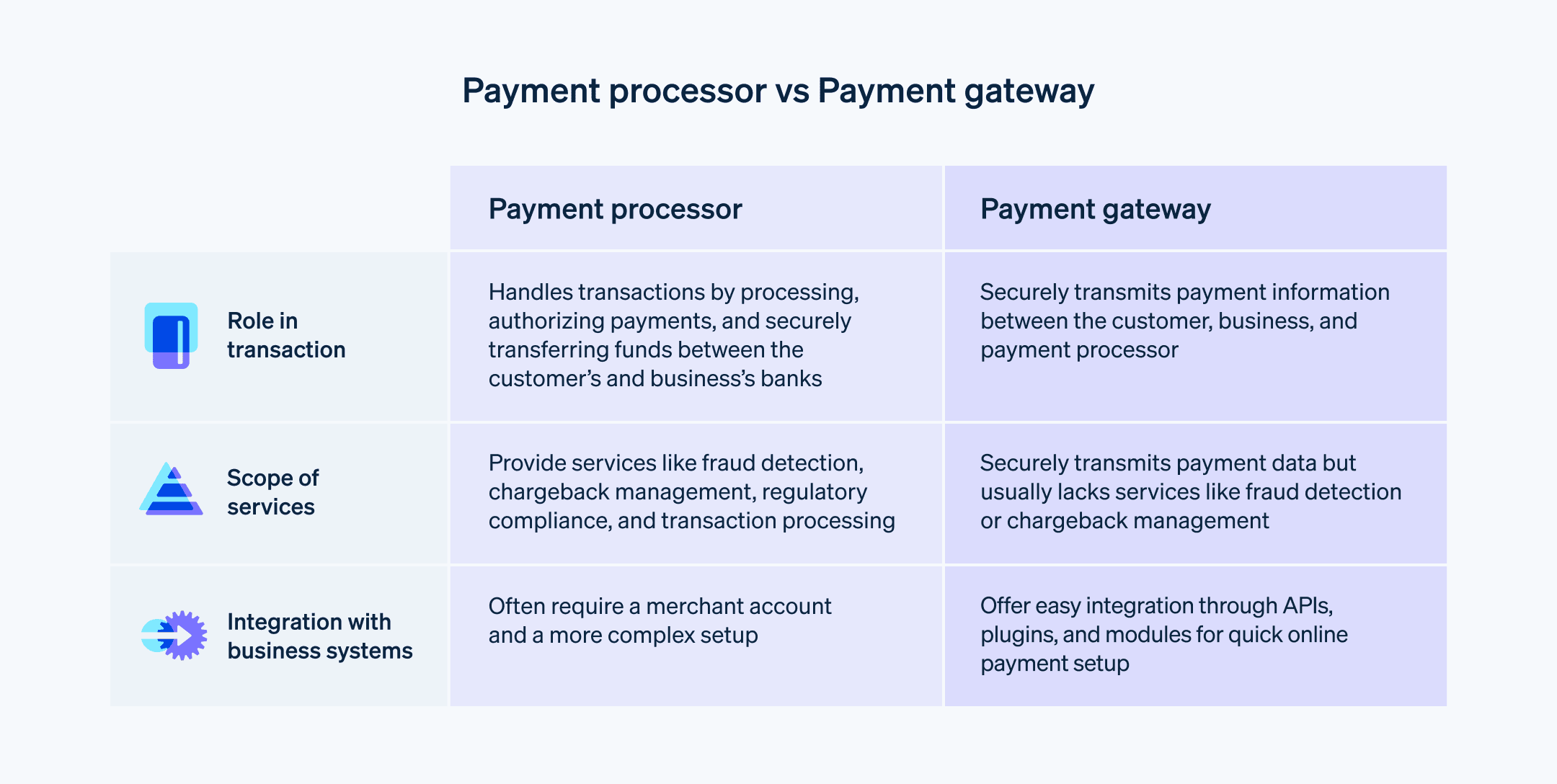

Wat zijn de verschillen tussen betalingsverwerkers en betaalgateways?

Zowel betalingsverwerkers als betaalgateways zijn belangrijke componenten van het ecosysteem voor elektronische betalingen, maar ze hebben verschillende functies. Dit zijn de belangrijkste verschillen:

Rol in het transactieproces

Betalingsverwerker: Een betalingsverwerker maakt de transactie mogelijk door betalingen te verwerken en te autoriseren, en zorgt voor de veilige overdracht van geld tussen de bank van de klant en de bank van de onderneming.

Betaalgateway: Een betaalgateway is het verbindende component dat verantwoordelijk is voor het faciliteren van communicatie en het veilig verzenden van betalingsinformatie tussen de klant, de onderneming en de betalingsverwerker.

Omvang van de diensten

Betalingsverwerker: Betalingsverwerkers bieden naast het verwerken van transacties een breed scala aan diensten, waaronder fraudedetectie, chargebackbeheer en naleving van betalingsvoorschriften.

Betaalgateway: Betaalgateways richten zich voornamelijk op de veilige overdracht van betaalgegevens en bieden doorgaans geen aanvullende diensten zoals fraudedetectie of chargebackbeheer.

Integratie met bedrijfssystemen

Betalingsverwerker: Betalingsverwerkers vereisen meestal dat ondernemingen een verkopersaccount openen om transacties te verwerken en kunnen complexere configuratieprocedures met zich meebrengen.

Betaalgateway: Betaalgateways bieden vaak eenvoudigere integratieopties voor ondernemingen, waaronder API's, plug-ins en kant-en-klare modules, zodat ondernemingen snel online betalingen kunnen accepteren.

Sommige bedrijven bieden zowel betalingsverwerkings- als betaalgatewaydiensten aan als onderdeel van een geïntegreerde oplossing. Stripe biedt bijvoorbeeld end-to-end betaaldiensten aan voor ondernemingen, zodat ze hun online transacties eenvoudiger kunnen beheren. Hieronder gaan we dieper in op de manier waarop Stripe omgaat met deze aspecten van betalingsfunctionaliteit.

Hoe werken betalingsverwerkers en betaalgateways samen?

Betalingsverwerkers en betaalgateways spelen verschillende, maar complementaire rollen bij het mogelijk maken van veilige en efficiënte elektronische transacties voor ondernemingen en klanten. Samen maken ze frictieloze communicatie en gegevensoverdracht tussen partijen mogelijk.

Hier volgt een stapsgewijs overzicht van hoe betalingsverwerkers en betaalgateways samenwerken tijdens een online transactie:

Klant initieert de transactie

Wanneer klanten klaar zijn om een aankoop te doen, voeren ze hun creditcardgegevens (of andere betaalgegevens) in op de website of app van de onderneming.De rol van de betaalgateway

De betaalgateway versleutelt op veilige wijze de betaalgegevens van de klant en stuurt deze naar de betalingsverwerker.Rol van betalingsverwerker

De betalingsverwerker ontvangt de versleutelde betaalgegevens van de betaalgateway en stuurt deze door naar de bank van de klant (de uitgevende bank) om autorisatie voor de transactie aan te vragen.Reactie van de uitgevende bank

De bank van de klant verifieert de betaalgegevens, controleert of er geld beschikbaar is en keurt de transactie goed of af op basis van de beoordeling. De uitgevende bank stuurt dit antwoord naar de betalingsverwerker.Communicatie tussen verwerker en gateway

De betalingsverwerker deelt de reactie van de bank (goedkeuring of afwijzing van de transactie) met de betaalgateway.Communicatie tussen gateway en onderneming

De betaalgateway stuurt de reactie door naar de website of app van de onderneming, die het juiste bericht aan de klant weergeeft (transactie goedgekeurd of geweigerd).Vereffening van geld

Als de transactie wordt goedgekeurd, coördineert de betalingsverwerker de overschrijving van het geld van de bankrekening van de klant naar de bankrekening van de onderneming. Dit proces, de vereffening genoemd, duurt meestal enkele werkdagen.

Gedurende dit hele proces werken de betaalgateway en de betalingsverwerker samen om gevoelige betalingsinformatie veilig en efficiënt te verwerken, terwijl ze zich houden aan industriestandaarden en coderingsprotocollen zoals PCI DSS.

Hoe Stripe omgaat met betalingsverwerking en betaalgateways

Stripe is een alles-in-één betaaldienstverlener die ondernemingen en platforms een gecombineerde betaalverwerking en betaalgatewayfunctionaliteit biedt. Door beide componenten in één gestroomlijnd platform te integreren, zorgt Stripe ervoor dat ondernemingen deze diensten niet meer afzonderlijk hoeven te zoeken en aan te schaffen. Deze aanpak biedt ondernemingen verschillende voordelen, waaronder:

Vereenvoudigde installatie

Met Stripe kunnen ondernemingen snel betalingen instellen en beginnen te accepteren, zonder dat ze aparte relaties hoeven aan te gaan met betalingsverwerkers. Dit maakt het gemakkelijker om aan de slag te gaan met online transacties.Naadloze integratie

Stripe biedt goed gedocumenteerde API's, plug-ins en kant-en-klare modules, waarmee ondernemingen de betaaloplossing van Stripe eenvoudig kunnen integreren in hun websites, apps en e-commerceplatforms. Hierdoor kunnen ondernemingen zich concentreren op hun kernactiviteiten in plaats van tijd te besteden aan de technische aspecten van betalingsverwerking.Verbeterde beveiliging

Stripe voldoet aan de hoogste beveiligingsnormen, onder andere aan PCI DSS, en gebruikt geavanceerde coderingstechnieken om gevoelige betaalgegevens te beschermen. Door de functies van de betaalgateway en de betalingsverwerker te consolideren, zorgt Stripe voor een consistent beveiligingsniveau in het hele transactieproces.Uniforme rapportage en beheer

Met de geïntegreerde oplossing van Stripe kunnen ondernemingen alle transactiegegevens, klantinformatie en betalingsanalyses openen en beheren vanuit een centraal dashboard. Dit vereenvoudigt het volgen en reconciliëren van transacties, waardoor het voor ondernemingen gemakkelijker wordt om hun prestaties te monitoren en datagestuurde beslissingen te nemen.Lagere kosten

Omdat Stripe de betaalgateway- en verwerkingsservices combineert, is het voor ondernemingen mogelijk om kosten te besparen door met één leverancier samen te werken. Stripe biedt transparante en concurrerende prijzen, die voor ondernemingen kosteneffectiever kunnen zijn in vergelijking met de kosten van het beheer van afzonderlijke relaties met gateways en verwerkers.Schaalbaarheid en flexibiliteit

Stripe ondersteunt een breed scala aan betaalmethoden en valuta's, zodat ondernemingen hun activiteiten eenvoudig wereldwijd kunnen uitbreiden. Het platform is ontworpen om met ondernemingen mee te groeien en ervoor te zorgen dat hun betaalinfrastructuur grotere transactievolumes en complexiteiten aankan.Voortdurende verbeteringen

Het Stripe-platform profiteert van regelmatige updates met nieuwe functies, verbeteringen en extra betalingsopties. Dit zorgt ervoor dat ondernemingen die Stripe gebruiken, de trends in de branche voor kunnen blijven en hun klanten de best mogelijke betaalervaring kunnen bieden.

Wil je meer weten over het verwerken van betalingen met Stripe en om aan de slag te gaan, klik dan hier.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.