Een nauwkeurige en snelle facturatie verhoogt de administratieve efficiëntie en zorgt voor een constante cashflow door betalingsachterstanden te verminderen. Echter, onduidelijke factuurmails kunnen leiden tot vertraagde betalingen of geschillen, waardoor de relatie tussen onderneming en klant onder druk komt te staan.

Bij facturatie gaat het niet alleen om op tijd betaald worden, maar ook om het behoud van de reputatie van de onderneming en een positieve ervaring die prettig is voor zowel de onderneming als de klant. Een goed geschreven factuurmail bevat alle benodigde gegevens, zoals de factuurdatum, betalingsinstructies, geaccepteerde betaalmethoden en een gespecificeerde lijst van de geleverde diensten.

Hieronder lees je in het kort hoe je effectieve factuurmails schrijft die zorgen voor tijdige betalingen en het vertrouwen van klanten behouden.

Wat staat er in dit artikel?

- Wat is een factuurmail?

- Belangrijke onderdelen van factuurmails

- Een factuur schrijven

- Een factuurmail schrijven

- Sjabloon voor factuurmails

- Hoe Stripe Invoicing kan helpen

Wat is een factuurmail?

Een factuurmail is een formele communicatie die ondernemingen verzenden om betaling te vragen voor geleverde goederen of diensten. In plaats van papieren facturen per post te verzenden, versturen bedrijven factuurmails elektronisch.

Een goed gestructureerde factuurmail zorgt voor een snelle betaling en bevat alle benodigde betalingsdetails om verwarring te voorkomen.

Belangrijke onderdelen van factuurmails

Een effectieve factuurmail bevat meerdere elementen die de communicatie transparant, betrouwbaar en bruikbaar maken. Dit zijn de belangrijkste onderdelen:

- Duidelijke onderwerpregel: Schrijf een duidelijke, beschrijvende onderwerpregel zodat de ontvanger direct weet wat de bedoeling van de e-mail is. Bijvoorbeeld: 'Factuur #12345 van ABC Bedrijf' of 'Betaalverzoek voor diensten in maart'.

- Identificatie van de afzender: Verstuur de e-mail vanaf een herkenbaar adres, bij voorkeur een adres dat de naam of het websitedomein van de onderneming bevat. Zo loop je minder risico dat de e-mail als spam wordt gemarkeerd of door de ontvanger over het hoofd wordt gezien.

- Persoonlijke begroeting: Gebruik de naam van de ontvanger of bedrijfsnaam in de begroeting om een link te leggen en aan te geven dat de e-mail geen algemeen of geautomatiseerd bericht is.

- Factuurspecificaties: Geef details, zoals de factuurdatum, het factuurnummer, het verschuldigde totaalbedrag en de vervaldatum van de betaling, prominent weer, zodat de ontvanger snel weet over welke betaalverplichting het gaat.

- Gedetailleerde uitsplitsing: Specificeer de diensten of producten die je hebt geleverd en geef voor transparantie ook de kosten per dienst of product weer. Dit gedeelte kan in de hoofdtekst van de e-mail of in een bijgevoegd document staan.

- Betaalinstructies en -methoden: Geef de geaccepteerde betaalmethoden weer, of dat nu een creditcard, bankoverschrijving, cheque of een andere optie is.

- Links of bijlagen: Geef duidelijk aan of je de factuur als ingesloten link of bijlage hebt verstrekt en voeg duidelijke instructies toe over hoe de factuur kan worden geopend.

- Contactgegevens: Verstrek contactgegevens voor vragen over facturatie, zodat ontvangers op een eenvoudige manier problemen kunnen aanpakken, fouten kunnen oplossen of om opheldering kunnen vragen.

- Algemene voorwaarden: Vermeld alle relevante voorwaarden, zoals kosten voor te late betaling of kortingen voor vroegtijdige betaling, om ontvangers volledig te informeren over de gevolgen van hun handelen of het nalaten daarvan.

- Duidelijke call-to-action: Voeg een directe opdracht toe, zoals 'Verwerk deze betaling vóór [uiterste datum]' of 'Klik hier om nu te betalen'. Zo leid je de ontvanger naar de volgende stap.

Elk onderdeel draagt bij aan de effectiviteit van een factuurmail. Samen zorgen ze voor communicatie over facturatie die compleet, begrijpelijk en bruikbaar is.

Een factuur schrijven

Wees nauwkeurig en professioneel bij het maken van een factuur. Hier vind je een overzicht van de stappen en best practices voor facturatie:

- Bereid de factuur voor: Verzamel alle noodzakelijke gegevens, zoals geleverde diensten, betalingsvoorwaarden en factuurdatum. Als je regelmatig facturen uitstuurt, overweeg dan om boekhoud- of facturatiesoftware te gebruiken, zoals Stripe Invoicing, om het facturatieproces te automatiseren en efficiënt te beheren.

- Controleer de factuur: Elke factuur moet kloppen. Controleer alle details nauwkeurig, met name informatie over de ontvanger, kosten. betaalinstructies en betalingstermijnen. Fouten kunnen leiden tot geschillen en ongewenste vertragingen.

- Verstuur de factuur: Bezorg de factuur op een manier die past bij je onderneming, of dat nu per e-mail is, met de fysieke post of via diensten voor digitale bezorging die worden aangeboden door facturatieplatforms. Welke methode je ook kiest, zorg ervoor dat je de factuur naar de juiste persoon of afdeling stuurt en op het juiste moment.

- Volg facturen proactief op: Soms zien klanten facturen over het hoofd. Stuur systematische herinneringen, idealiter vóór de vervaldatum, om betalingen op tijd te ontvangen. Als de betaling achterstallig is, ga dan door met regelmatige follow-ups.

- Documenteer het betalingsbewijs: Nadat je een betaling hebt ontvangen, documenteer je deze onmiddellijk in je boekhoudsysteem. Dit helpt bij de fiscale compliance en levert waardevolle gegevens op voor toekomstige financiële planning.

- Pak achterstallige betalingen aan: Als een factuur onbetaald blijft, bepaal dan wat je volgende stappen zijn. Opties zijn onder meer het in rekening brengen van kosten voor te late betaling of het tijdelijk stopzetten van diensten. Verwijs altijd naar de voorwaarden die op de factuur staan vermeld en houd je aan eventuele afspraken die je met de klant hebt gemaakt.

Een factuurmail schrijven

E-mails over facturen kunnen de toon zetten voor de transactie. Een effectieve factuurmail moet de aandacht van de klant trekken, duidelijkheid bieden en aanzetten tot tijdig handelen. Zo stel je deze e-mails op:

- Zorg voor duidelijkheid in de onderwerpregel: Je onderwerpregel moet de inhoud van de e-mail duidelijk beschrijven. Denk bijvoorbeeld aan 'Factuur #12345 van [je bedrijfsnaam]' of 'Facturatiegegevens voor [maand/dienst]'.

- Begroet de ontvanger op een vertrouwde manier: Begin met een persoonlijke begroeting. Gebruik de naam van de ontvanger om zo een band te smeden en duidelijk te maken voor wie de e-mail bedoeld is.

- Kom ter zake: Vermeld direct na je begroeting het doel van de e-mail. Bijvoorbeeld: "In de bijlage vind je de factuur voor de diensten die zijn verleend in [maand/voor dienst]."

- Vermeld belangrijke details: Geef een kort overzicht van de belangrijkste factuurgegevens. Denk aan het totaalbedrag, een vervaldatum voor de betaling en een korte beschrijving van de diensten of producten.

- Voeg de factuur bij: Voeg de factuur altijd als pdf bij of bied een beveiligde link om deze online te bekijken. Dit zorgt voor leesbaarheid op verschillende platforms en apparaten.

- Geef een overzicht van de betaalmethoden: Geef aan hoe de ontvanger de betaling kan voltooien. Of het nu gaat om een bankoverschrijving, creditcardbetaling of een andere methode, zorg dat je duidelijke instructies geeft.

- Uit je dankbaarheid: Zelfs bij routinematige zakelijke transacties kan een eenvoudig "Bedankt voor je vertrouwen in ons" positieve relaties in stand houden.

- Bied hulp: Geef tot slot aan dat je bereid bent om te helpen. Bijvoorbeeld: "Mocht je vragen hebben of meer informatie willen, neem dan vooral contact met ons op."

- Voeg je handtekening toe: Als laatste voeg je je professionele handtekening toe. Deze moet je naam, functie en zakelijke contactgegevens bevatten.

- Lees de e-mail na: Controleer voordat je de e-mail verzendt of deze duidelijk is en de informatie klopt. Dit laat je professionaliteit en aandacht voor detail zien.

Met deze aanpak krijg je een generieke factuur die in de meeste gevallen zal volstaan. Je moet je aanpak voor het maken van facturen echter aanpassen aan je onderneming, je klanten en hoe je verwacht dat betalingstransacties zullen plaatsvinden.

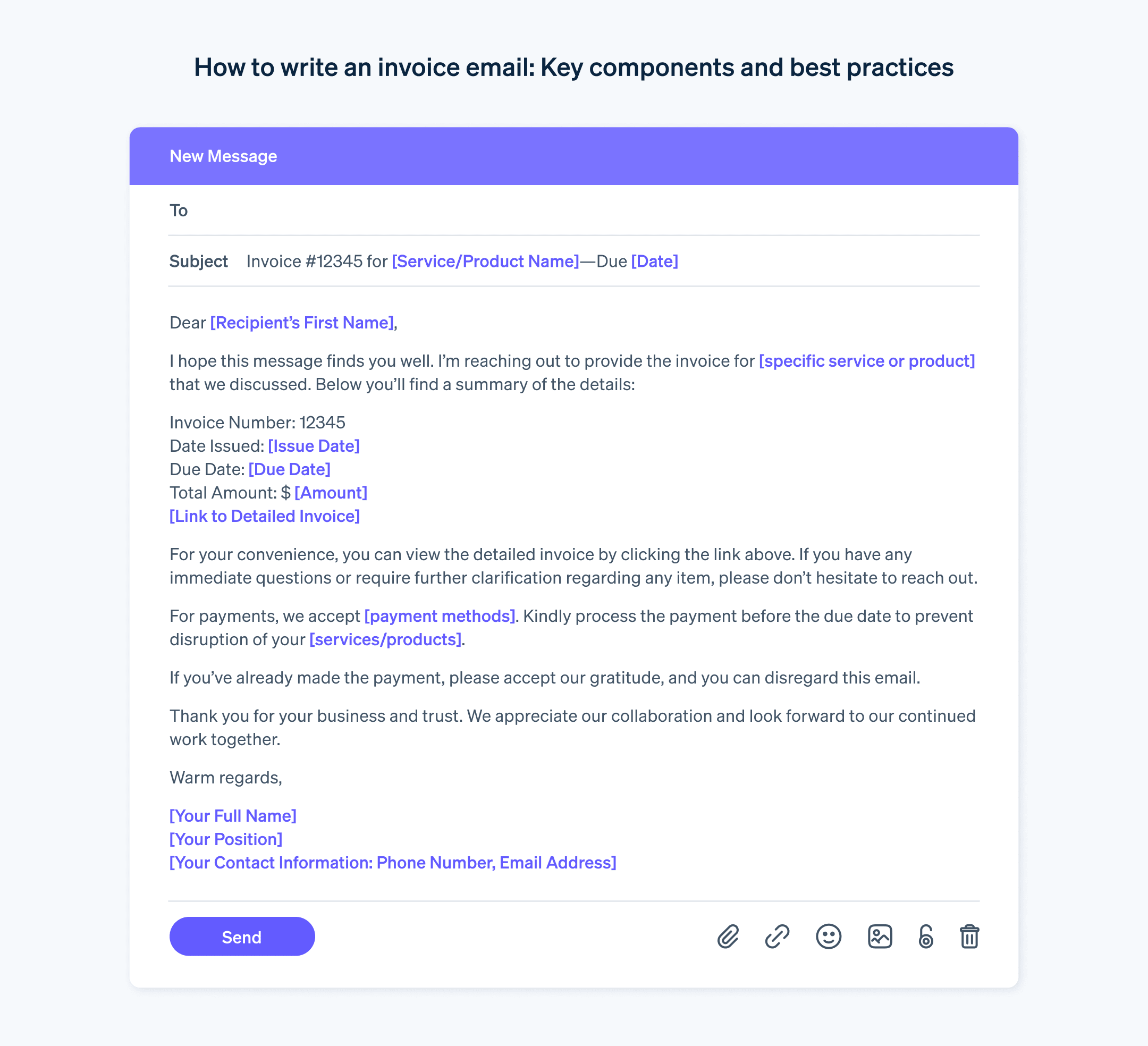

Sjabloon voor factuurmails

De onderstaande sjabloon voor factuurmails is slechts een voorbeeld. Het is niet aangepast aan de stem van je merk, het type onderneming dat je runt, de producten of diensten die je levert of de aard van je relatie met klanten. Je kunt de onderstaande sjabloon aanpassen aan je onderneming en zakelijke behoeften. Je kunt bijvoorbeeld een betaallink opnemen voor online transacties, bankrekeninggegevens verstrekken voor bankoverschrijvingen of ontvangers de opdracht geven om in te loggen op een klantenportaal om factuurbetalingen te bekijken en te verwerken.

Hier is een basissjabloon voor een factuurmail:

De voordelen van Stripe Invoicing

Stripe Invoicing biedt een uitgebreide set tools waarmee je facturen efficiënter kunt maken, versturen en betaald krijgt. Met Stripe Invoicing kun je:

- Ontvang sneller betalingen: laat klanten facturen direct online betalen met de voor conversie geoptimaliseerde afrekenomgeving van Stripe.

- Automatiseer facturatieworkflows: Je kunt eenvoudig eenmalige of terugkerende facturen maken, aanpassen en verturen, zonder dat je hoeft te programmeren. Stripe Invoicing houdt betalingen automatisch bij, verstuurt herinneringen en verwerkt terugbetalingen.

- Configureer voor je behoeften: Stripe Invoicing kan worden geconfigureerd, zodat je aan bepaalde lokale opmaakvereisten van facturen voldoet.

- Integreer met je tools: Stripe Invoicing sluit naadloos aan op je bestaande boekhoud- en bedrijfsbeheersoftware van derden.

- Stroomlijn activiteiten: Verminder handmatige gegevensinvoer en administratieve overhead door factuurgegevens automatisch te synchroniseren met je boekhoudsysteem.

Bekijk de Stripe Invoicing-documentatie voor meer informatie over hoe Stripe je kan helpen je facturatie te stroomlijnen, zodat je sneller wordt betaald.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.