Accurate and prompt invoicing increases administrative efficiency and maintains a steady cash flow by reducing payment delays. However, unclear invoice emails can lead to delayed payments or disputes, straining the business-customer relationship.

Invoicing is not just about getting paid on time – it’s also about preserving the company’s reputation and maintaining positive, mutually fulfilling experiences for the business and the customer. A well-written invoice email should include all the necessary details, such as the invoice date, payment instructions, accepted payment methods, and an itemised list of the services provided.

Below is a quick guide on how to write effective invoice emails, ensuring timely payments and sustaining customer trust.

What’s in this article?

- What is an invoice email?

- Key components of invoice emails

- How to write an invoice

- How to write an invoice email

- Invoice email template

- How Stripe Invoicing can help

What is an invoice email?

An invoice email is a formal communication that companies send to request payment for goods or services rendered. Instead of sending paper invoices through the post, businesses send invoice emails electronically.

A well-structured invoice email ensures prompt payment and provides all the necessary payment details to avoid confusion.

Key components of invoice emails

An effective invoice email includes multiple elements that make the communication transparent, trustworthy, and actionable. Here are the key components:

- Clear subject line: Write a straightforward, descriptive subject line to immediately inform the recipient about the email’s intent. Examples might include “Invoice no. 12345 from ABC Ltd.” or “Payment Request for March Services”.

- Sender identification: Send the email from a recognisable address, preferably one that incorporates the business’s name or website domain to reduce the risk of it being marked as spam or overlooked by the recipient.

- Personalised greeting: Use the recipient’s name or business name in the greeting to establish a connection and signal that the email isn’t a generic or automated message.

- Invoice specifics: Prominently display details such as the invoice date, invoice number, total amount due, and payment due date, making it easy for the recipient to quickly understand their obligations.

- Detailed breakdown: Itemise the services or products you have delivered, along with their individual costs, to provide transparency. This section can be in the email body or in an attached document.

- Payment instructions and methods: List acceptable methods of payment, whether that’s a credit card, bank transfer, cheque, or another option.

- Links or attachments: Clearly indicate if you’ve provided the invoice as an embedded link or attachment, and include straightforward instructions on how to access it.

- Contact information: Provide contact information for any billing-related questions to give recipients an easy way to address concerns, resolve errors, or seek clarifications.

- Terms and conditions: Explicitly state any relevant terms, such as late fees or early payment discounts, to fully inform recipients of the implications of their actions or inactions.

- Clear call to action: Add a direct prompt, such as “Please process this payment by [due date]” or “Click here to pay now” to guide the recipient to the next step.

Each component contributes to an invoice email’s effectiveness. When combined, they create a billing communication that is comprehensive, easily understandable, and actionable.

How to write an invoice

Be precise and professional when creating an invoice. Here’s an overview of the steps and best practices for invoicing:

- Prepare the invoice: Collect any necessary data, such as services provided, payment terms, and invoice date. If you regularly issue invoices, consider using an accounting or invoicing software, such as Stripe Invoicing, to automate and manage the invoicing process efficiently.

- Review the invoice: Every invoice should be accurate. Double-check all details, especially recipient information, costs, and payment instructions and deadlines. Mistakes can cause disputes and unwanted delays.

- Send the invoice: Choose a delivery method that reflects your business, whether it’s sending an email, mailing a paper invoice, or using the digital delivery services offered by invoicing platforms. No matter which method you choose, make sure you send the invoice to the right person or department and to send it at the right time.

- Follow up proactively: Sometimes customers overlook invoices. Send systematic reminders, ideally before the due date, to keep payments on time. If payment becomes overdue, continue with regular follow-ups.

- Document the payment receipt: Once you receive a payment, document it immediately in your accounting system. This helps with tax compliance and provides valuable data for future financial planning.

- Address overdue payments: If an invoice remains unpaid, decide on your next steps. Options include charging late fees or temporarily halting services. Always reference the terms stated in the invoice and uphold any agreements made with the customer.

How to write an invoice email

Invoice emails can set the tone for the transaction. An effective invoice email should capture the customer’s attention, provide clarity, and prompt timely action. Here’s how to craft a well-written invoice email:

- Ensure clarity in the subject line: Your subject line should clearly describe the email content. Consider using formats such as “Invoice no. 12345 from [Your Company Name]” or “Billing Details for [Month/Service]”.

- Greet with familiarity: Start with a personalised greeting. Use the recipient’s name, fostering a connection and signaling the email’s intended audience.

- Get to the point: Immediately after your greeting, mention the purpose of the email. For instance, “Attached is the invoice for services rendered for [Month/Service]”.

- Include important details: Provide a brief overview of the most important invoice details. This might include the total amount, a payment due date, and a brief description of the services or products.

- Attach the invoice: Always attach the invoice as a PDF or provide a secure link to view it online. This ensures readability across various platforms and devices.

- Outline payment methods: Detail how the recipient can complete the payment. Whether it’s a bank transfer, credit card payment, or another method, provide clear instructions.

- Express gratitude: Even in routine business transactions, a simple “Thank you for your business” can maintain positive relationships.

- Offer assistance: End with a note indicating your willingness to help. For example, “Should you have any questions or require further details, please don’t hesitate to contact us.”

- Include your signature: Finish with your professional signature. This should include your name, position, and company contact details.

- Proofread: Before sending the email, review it for clarity and accuracy. It will reflect your professionalism and attention to detail.

This approach will create a well-written invoice email that will work in most cases. Each business should refine their invoicing process based on their unique requirements.

For businesses handling multiple clients, offering flexible payment methods, or working with long-term contracts, it’s important to customise invoice templates to reflect specific payment instructions, late payment fees, and accepted payment methods.

Additionally, if your business experiences frequent late payments, setting up automated payment reminders and outlining clear payment terms can encourage prompt payment.

Invoice email template

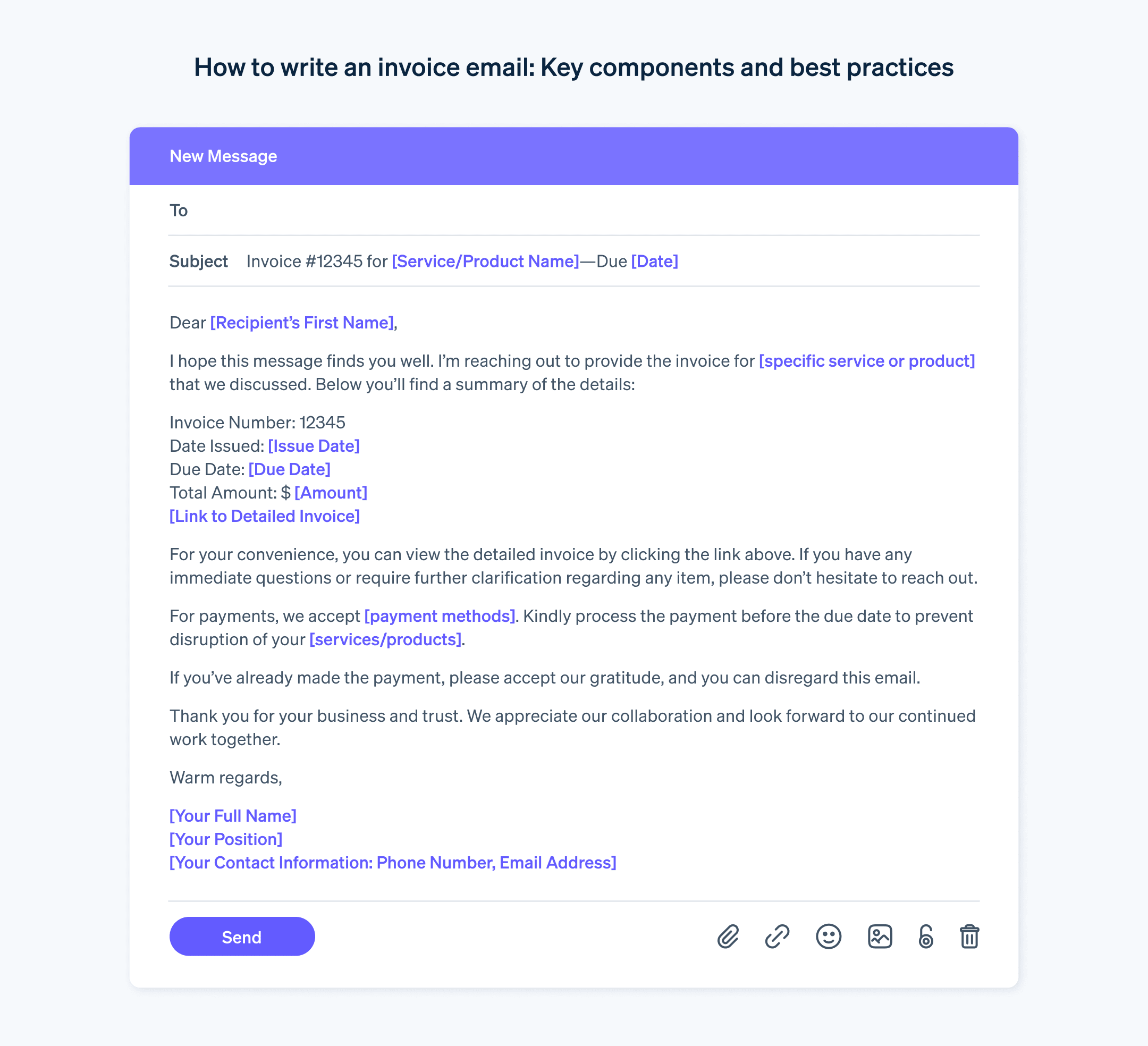

The invoice email template below is just an example. It doesn’t include customisation for brand voice, the type of business you run, the products or services you provide, or the nature of your relationship with clients. Feel free to personalise the template below to fit your business and its needs. For example, you could include a payment link for online transactions, provide bank account details for wire transfers, or instruct recipients to log in to a client portal to view and process invoice payments.

Here’s a basic template for an invoice email:

How Stripe Invoicing can help

Stripe Invoicing provides a comprehensive set of tools to help you create, send, and get paid on invoices more efficiently. With Stripe Invoicing, you can:

- Get paid faster: Allow customers to pay invoices online instantly with Stripe’s conversion-optimised checkout experience.

- Automate billing workflows: Easily create, customise, and send one-off or recurring invoices – with no code required. Stripe Invoicing automatically tracks payments, sends reminders, and handles refunds.

- Configure for your needs: Stripe Invoicing is configurable to help you meet certain local invoicing formatting requirements.

- Integrate with your tools: Stripe Invoicing seamlessly connects with your existing third-party accounting and business management software.

- Streamline operations: Reduce manual data entry and administrative overhead by automatically syncing invoice data with your accounting system.

See the Stripe Invoicing documentation to learn more about how Stripe can help streamline your invoicing so you get paid faster.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.