Choosing a payment gateway is a major consideration for any business that processes transactions online or accepts electronic payments. Not only does a business’s selection of a payment gateway define much of its payment experience—both on the customer-facing side and internally—but it also determines how much the business will pay to accept payments. Payment gateway fees can significantly impact the overall profitability and cost structure of a business: since every transaction incurs a cost, the choice of a payment gateway and the associated fees can make a substantial difference in net revenue.

As businesses grow and scale, their transaction volume increases, which can amplify the impact of these fees. Below, we’ll note the fees associated with using Stripe. These costs are subject to change, so when you’re ready to begin your search, it’s a good idea to double-check the fees for every provider.

What’s in this article?

- What is a payment gateway?

- What are payment gateway fees?

- Stripe’s payment gateway fees

What is a payment gateway?

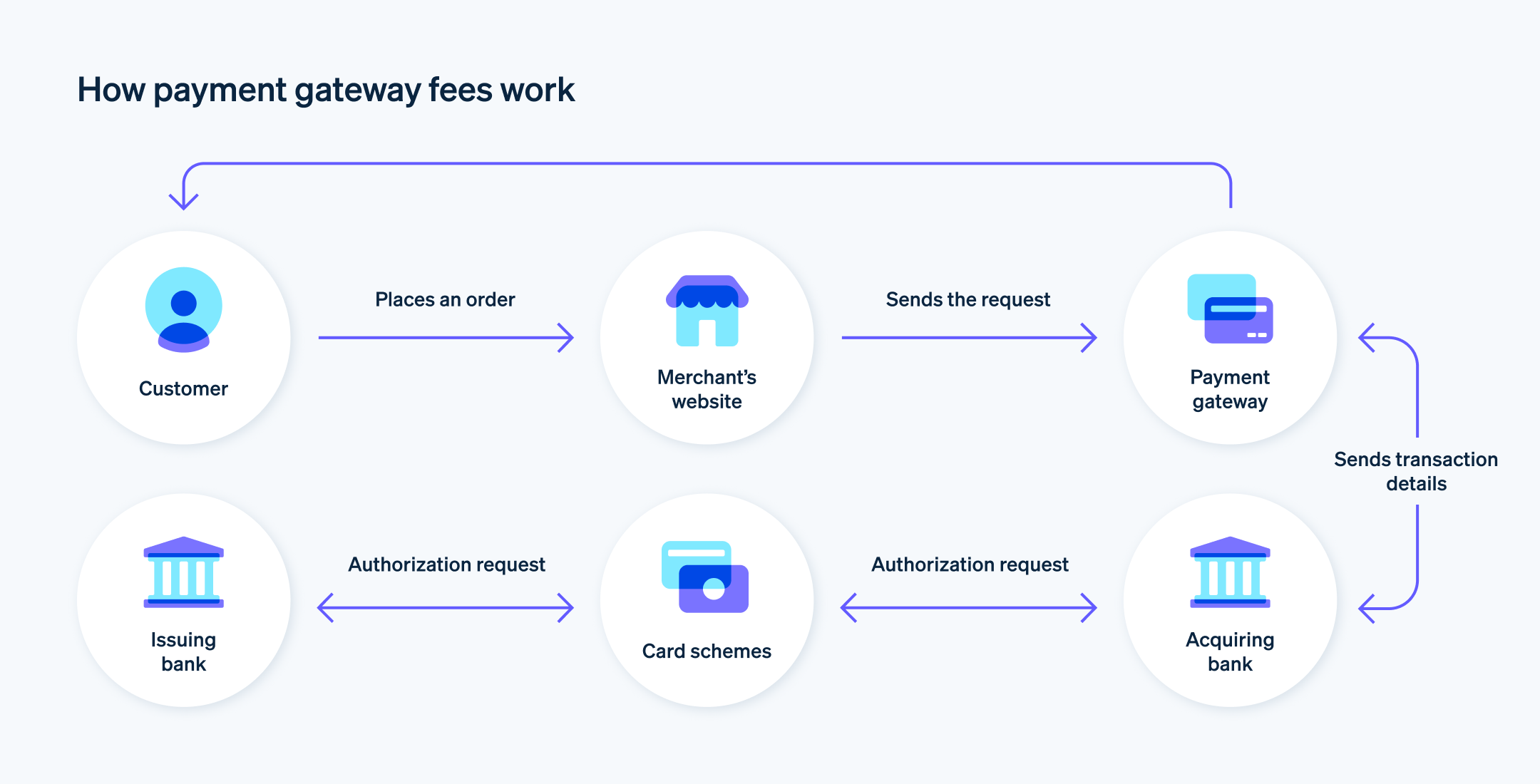

A payment gateway is a service that processes credit card transactions for online and brick-and-mortar stores. Think of it as a digital version of a point-of-sale (POS) terminal you might see in a retail store. When a customer pays for a product or service, the payment gateway encrypts the sensitive payment information and sends it between the bank that issued the card and the business’s bank, making sure that the transaction is valid. The payment gateway acts as an intermediary, ensuring that the transaction is carried out securely and promptly.

A payment gateway is necessary for any online business that wants to accept credit card or direct payments. This technology, which keeps customer information secure as it moves between the business and the payment processor, is a key component in the ecommerce transaction process. There are a variety of options available, each with their own features designed to fit the needs of different business types. In addition, global transaction value from digital payments is expected to total almost $14.8 trillion by 2027, highlighting the growing demand for reliable payment gateways.

What are payment gateway fees?

Payment gateway fees are the costs businesses incur while using a payment gateway’s services, specifically when it comes to processing credit card transactions. These fees can be broken down into several types:

Setup fees

This is a one-time cost that a business pays when it first creates an account with a payment gateway. This fee covers the initial configuration and integration of the payment gateway with the business’s sales system.Transaction fees

Payment gateways charge these fees every time a transaction is processed. They can be a fixed amount for each transaction, a percentage of the sale amount, or sometimes both. This fee compensates the gateway for processing the transaction.Monthly fees

Some payment gateways charge businesses a recurring monthly fee for access to their services, regardless of the number of transactions processed.Chargeback fees

When a customer disputes a charge and a transaction is reversed, the business may incur a chargeback fee. This fee covers the administrative work involved in managing the dispute.Refund fees

If a business issues a refund, some gateways might charge a refund fee. This fee covers the cost of returning funds to the customer.PCI compliance fees

Payment Card Industry Data Security Standard (PCI DSS) compliance is mandatory for businesses that handle credit card transactions. Some gateways might charge a fee for maintaining this security standard.Termination fees

If a business decides to cancel their account before the end of a contract term, they may need to pay a termination fee. This compensates the gateway for the early end of the service agreement.Miscellaneous fees

Payment gateways may charge other fees for additional services, such as international transactions, currency conversion, or using premium services such as advanced fraud protection. These fees can vary from one payment gateway to the next.

Different payment gateways have their own fee structures, and businesses typically select a service based on how these costs align with their sales volume and business model. Some payment gateways might have lower transaction fees but charge higher monthly fees, making them more suitable for businesses with a high number of transactions. Others might have no monthly fee but higher transaction costs, which could be more economical for businesses with lower sales volumes.

It’s important for businesses to review these fees carefully to determine the most cost-effective solution for their particular situation.

Stripe’s payment gateway fees

Here’s a list of the fees Stripe charges businesses for various payment processing services:

Transaction fees

ACH direct debit transactions

Card account updater: For saved customers, Stripe automatically updates expired or renewed card information for a fee.

Stripe includes machine learning models to help increase authorization rates for accounts with custom pricing.

Instant payouts

Dispute charges: This is also known as a chargeback fee.

Stripe does not charge setup fees or monthly fees, and there are no hidden costs associated with Stripe’s standard pricing model.

Click here for detailed pricing information.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.