所有在西班牙经营的公司必须遵循其间接税义务,例如商品和服务的增值税 (VAT) 以及直接税。直接税通常基于公司利润,被称为“直接”税,因为公司直接向西班牙税务局 (AEAT) 支付这些款项。

两种最常见的直接税是针对个人的所得税(IRPF,或“impuesto sobre la renta de las personas físicas”)和针对公司的公司所得税(IS,或“el impuesto de sociedades”)。

大多数公司选择或需要使用表格 202 以分期形式缴纳公司所得税,部分公司则选择一次性付款。无论哪种情况,它们都必须通过表格 200 提交年度公司所得税申报表。

目录

- 什么是表格 200,它的用途是什么?

- 谁必须提交表格 200?

- 谁可以豁免提交表格 200?

- 提交表格 200 的截止日期是什么时候?

- 表格 200 可以延迟提交吗?

- 如何提交表格 200?

什么是表格 200,它的用途是什么?

表格 200(在西班牙称为“Modelo 200”)是公司用于向 AEAT 申报年度经济回报并结算公司所得税的税表。结算时需要详细列出收入、支出和扣减,以确定最终应付款项。

公司通过表格 200 结算公司所得税义务,无论是以分期付款还是一次性支付的方式。在前一种情况下,由于公司每季度向 AEAT 付款,提交表格后的应付金额会低得多。

谁必须提交表格 200?

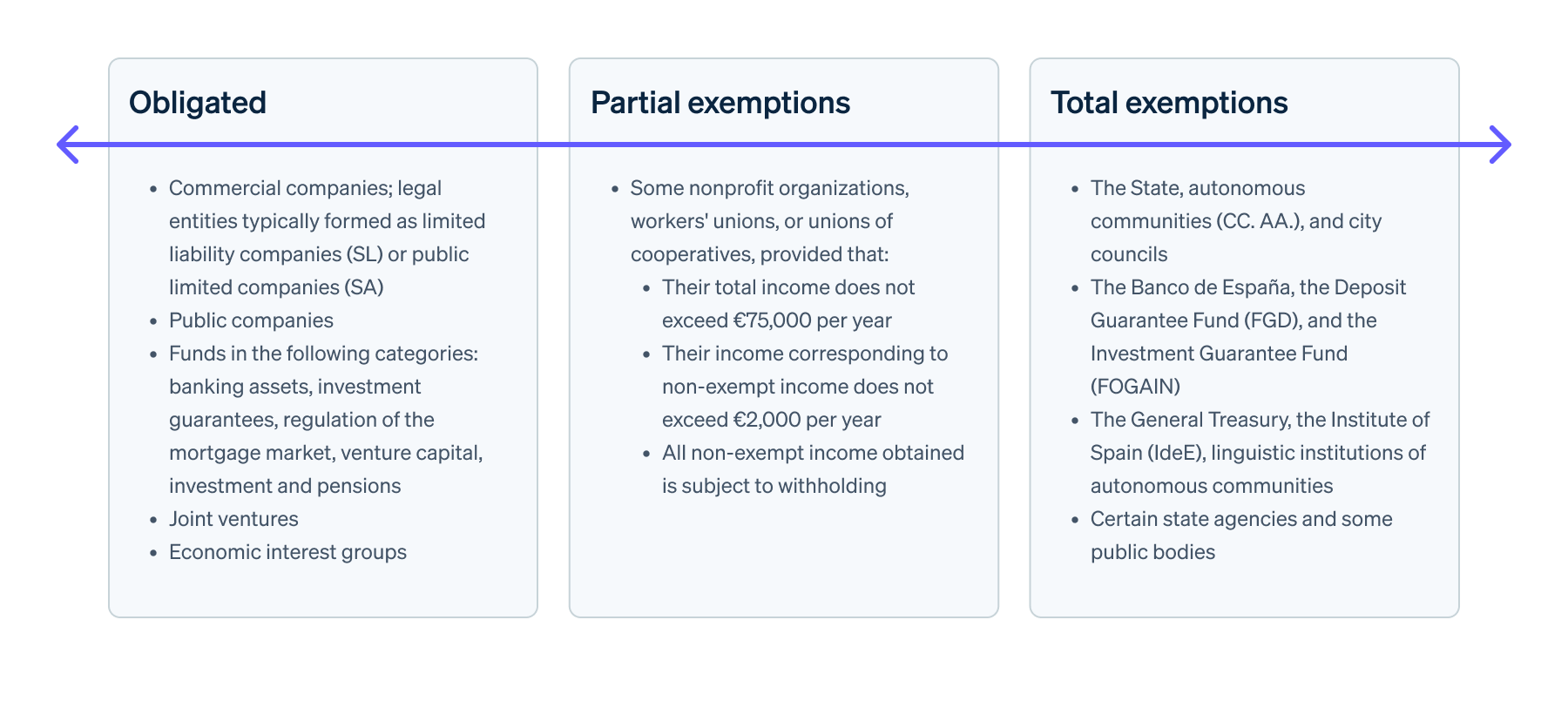

为了清晰说明,下表列出了必须提交表格 200 的实体及享有部分或全部豁免的实体:

在西班牙,作为纳税实体,符合公司所得税条件的公司和纳税人必须提交表格 200。以下是完整列表:

谁可以豁免提交表格 200?

虽然大多数法人实体和纳税人必须提交 200 表格,但部分实体享有全部或部分豁免。

全部豁免

全部豁免指公司无需填写表格 200,因为无须缴纳公司所得税。这适用于以下实体:

- 国家、自治区 (CC.AA.) 和市议会及其自治实体。

- 西班牙银行、存款担保基金 (FGD)和投资担保基金 (FOGAIN)。

- 管理社保的总财政部及其他管理机构。

- 西班牙研究院 (IdeE) 及其官方皇家学院。同样,自治区内拥有官方语言并具有与西班牙皇家学院 (RAE) 类似目的的语言机构。

- 某些国家机构及部分公共机构,包括西班牙广播电视公司 (RTVE) 和西班牙数据保护局 (AEPD),以及《1997 年第 6 号法》第九和第十补充条款中提到的实体。

部分豁免

部分免除公司所得税的实体,如某些非营利组织、工会或合作社联合会,无需提交表格 200,前提是:

- 总收入不超过每年 75,000 欧元

- 非免税收入所得不超过每年 2,000 欧元

- 所有获得的非免税收入均需预扣税

提交表格 200 的截止日期是什么时候?

如果不适用全部或部分豁免,则必须在规定的截止日期内提交表格 200,具体取决于税务期的结束时间。通常提交时间与日历年一致,但并非总是如此。根据税务期的不同,截止日期如下:

- 如果税务期与日历年一致,表格 200 的提交从 7 月 1 日开始,到 7 月 25 日截止。

- 如果与日历年不一致,提交期限为税务期结束 6 个月后的 25 个日历日内。例如,如果公司在 2024 年 10 月 31 日结束财年,必须在 2025 年 5 月 1 日至 5 月 25 日之间提交表格 200。

请注意,尽管可以选择不同的公司财年起止日期,但如果与日历年一致,提交更为便捷。无论如何,财年必须持续 12 个月。

若公司解散,则需在解散完成后 6 个月内提交表格 202。

表格 200 可以延迟提交吗?

根据《2003 年第 58 号法》,可以延迟任何税款,但公司所得税并不在部分例外情况之列。可以通过表格 200 延迟此税的年度结算,只要债务不是由表格 202 产生的分期付款引起的。换句话说,如果债务源于表格 200 而非表格 202 的分期付款,则可以延迟公司所得税。

提交附带延期申请的表格 200 很简单。如果在截止日期之前无法付款,可按照 AEAT 视频中的说明操作。然而,请注意,通过表格 200 分期付款(与表格 202 处理的分期不同)会产生滞纳利息,在 2024 年,滞纳利息为未付金额的 4.0625%。

如何提交表格 200?

AEAT 提供专门为以电子方式提交表格 200 而开发的在线服务:只需使用您的数字证书或 Cl@ve 访问 Sociedades Web 门户即可。

登录后,门户将引导您逐步填写各个字段。请注意,在输入有关您公司的所有信息后,包括您的税号 (NIF)、公司名称、CNAE(国家经济活动分类)代码以及贵公司在纳税期间拥有的平均员工人数——您将看到一个“申请”按钮,该按钮将自动保存您目前输入的所有数据。在点击按钮之前,请确保所有信息都正确无误。

然后,您可以通过附加 XML 文件或手动输入信息来导入公司的会计数据。

虽然表格 200 可能是一份数据密集型文件,但由于 AEAT 开发的特定网站,填写它通常很简单。如果您需要任何其他信息,请查看 AEAT 官方频道上的视频说明。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。