Every company operating in Spain must stay current with its indirect tax obligations, such as value-added tax (VAT) on goods and services, as well as direct taxes. Direct taxes are typically based on business profits and are named so because companies pay these amounts directly to the Spanish tax agency (AEAT).

The two most common direct taxes are personal income tax (IRPF, or “impuesto sobre la renta de las personas físicas”) for individuals and corporate income tax (IS, or “impuesto de sociedades”) for companies.

Most companies choose to or are required to settle corporate income tax in instalments using Form 202, while others pay it in one lump sum. In both cases, they must file their annual corporate income tax return using Form 200.

What’s in this article?

- What is Form 200, and what is it for?

- Who has to file Form 200?

- Who is exempt from filing Form 200?

- What is the deadline for filing Form 200?

- Can Form 200 be deferred?

- How do I file Form 200?

What is Form 200, and what is it for?

Form 200 (known in Spain as “Modelo 200”) is a tax return that companies must file to report their annual economic returns to the AEAT and settle corporate income tax on any profits. Settling this involves detailing earnings, expenses, and deductions to determine the final amount payable.

Companies use Form 200 to settle corporate income tax obligations, whether paid in installments or as a single payment. In the first case, the amount due after submitting this form will be much lower because the company has been making quarterly payments to the AEAT.

Additionally, keep in mind that sometimes, similar to VAT refunds, corporate tax might be refunded if you’ve overpaid, and the AEAT will reimburse the difference.

Who has to file Form 200?

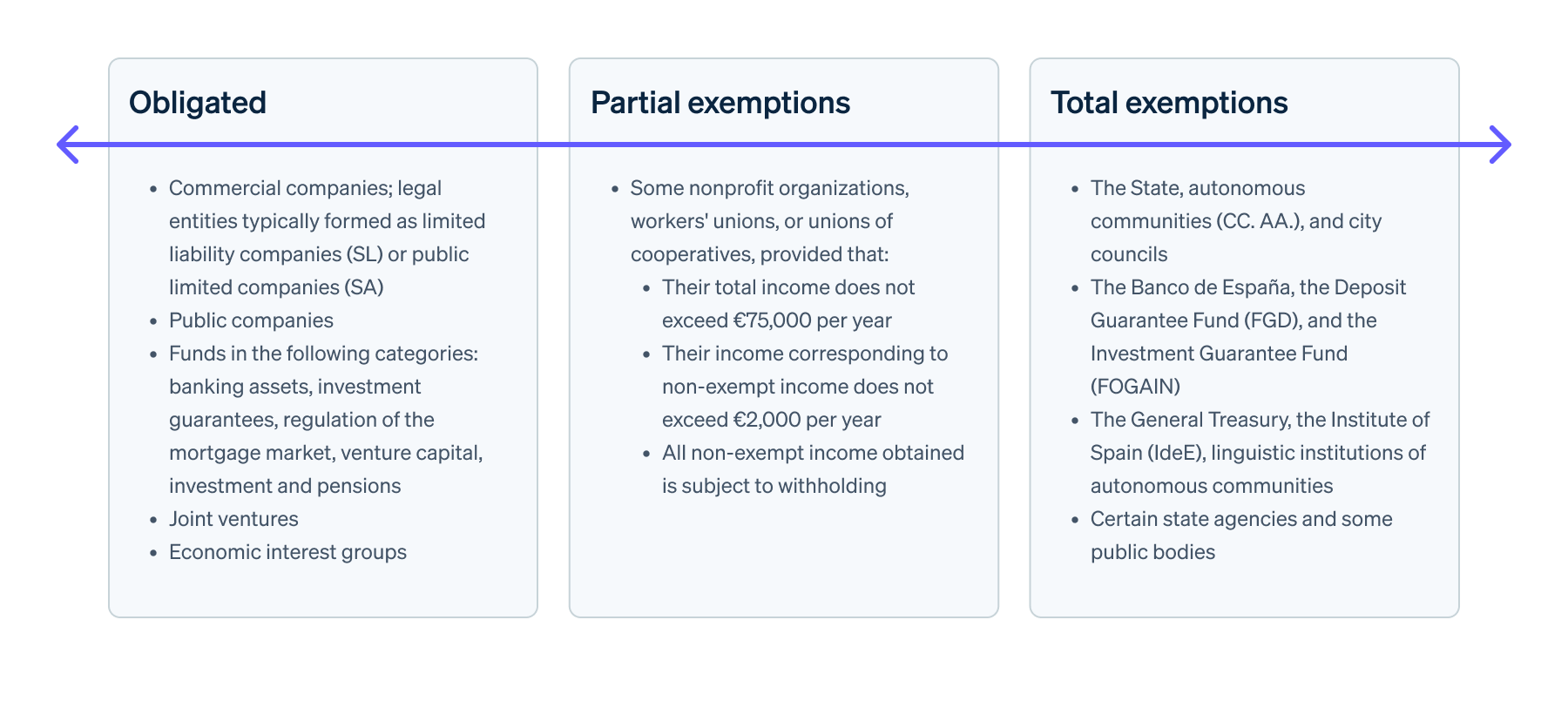

To provide a clear overview, the following table outlines those obliged to file Form 200, as well as entities with partial or total exemptions:

Filing Form 200 is mandatory for companies and taxpayers based in Spain who are considered taxable entities subject to corporate income tax. Here is the complete list:

- Commercial companies, meaning legal entities typically formed as limited liability companies (SL, or “sociedades limitadas”) or public limited companies (SA, or “sociedades anónimas”)

- Public companies, regardless of whether they are dependent on the state, an autonomous community, a province, or a locality

- Funds in the following categories: banking assets, investment guarantees, regulation of the mortgage market, venture capital, investment funds, and pensions

- Joint ventures

- Economic interest groups

Who is exempt from filing Form 200?

Although most legal entities and taxpayers must file Form 200, there are some total and partial exemptions.

Total exemptions

Total exemptions mean a company can forgo completing Form 200 because there is no corporate income tax to pay. This applies to these entities:

- The state, autonomous communities (CC. AA.), and city councils, along with their autonomous entities.

- The Banco de España, the Deposit Guarantee Fund (FGD), and the Investment Guarantee Fund (FOGAIN).

- The General Treasury and other entities that manage social security.

- The Institute of Spain (IdeE) and its official Royal Academies. Similarly, linguistic institutions of autonomous communities that have their official language and purposes similar to those of the Royal Spanish Academy (RAE).

- Certain state agencies, some public bodies, including the Spanish Radio and Television Corporation (RTVE) and the Spanish Data Protection Agency (AEPD), and entities mentioned in the ninth and tenth additional provisions of Law 6/1997.

Partial exemptions

Entities partially exempt from corporate income tax, such as some non-profit organisations, workers’ unions, or unions of co-operatives, are not required to file Form 200 provided that:

- Their total income does not exceed €75,000 per year

- Their earnings corresponding to non-exempt income does not exceed €2,000 per year

- All non-exempt income obtained is subject to withholding

What is the deadline for filing Form 200?

If total or partial exemptions don’t cover your case, you must file Form 200 within the specified deadlines, which vary based on the end of your tax period. Although in most cases the filing period coincides with the calendar year, that’s not always the case. Here’s how the deadlines vary depending on the tax period:

- If it matches the calendar year, the deadline for filing Form 200 starts on 1 July and ends on 25 July.

- If it differs from the calendar year, the deadline is still 25 calendar days, starting 6 months after the end of the tax period. For example, if your company closes its fiscal year on 31 October 2024, you must file Form 200 between 1 May and 25 May 2025.

Bear in mind that while you can choose different start and end dates for your company’s fiscal year, filing is more straightforward if you align it with the calendar year. Regardless, your fiscal year must always last 12 months.

If a company dissolves, it must submit Form 202 six months after the dissolution is finalised.

Can Form 200 be deferred?

Under Law 58/2003, you can defer any tax debt, and while there are some exceptions, corporate income tax is not one of them. You can postpone the annual settlement of this tax using Form 200, provided the debt you owe to the AEAT does not result from Form 202. In other words, you can defer corporate income tax if the debt arises from Form 200 and not from the instalment payments of Form 202.

Submitting Form 200 with a deferral request is straightforward. If you can’t make the payment by the deadline mentioned, follow the instructions in this AEAT video. However, note that paying it in instalments via Form 200 (unlike the instalments processed with Form 202) incurs late payment interest, which in 2024 is 4.0625% of the outstanding amount.

How do I file Form 200?

The AEAT provides an online service developed explicitly for filing Form 200 electronically: it is as simple as accessing the Sociedades Web portal with your digital certificate or Cl@ve.

After logging in, the portal will guide you through the individual fields to be filled in step by step. Please note that after entering all the information about your company – including your Tax Identification Number (NIF), company name, CNAE (National Classification of Economic Activities) code, and the average number of employees your company has had during the tax period – you will see an “Apply” button that will automatically save all the data you have entered so far. Make sure that all the information is correct before clicking the button.

You can then import your company’s accounting data by attaching an XML file or entering the information manually.

Although Form 200 can be a very data-intensive document, filling it in is generally straightforward, thanks to the specific website developed by the AEAT. If you need any additional information, check out the video instructions on the AEAT’s official channel.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.