Gain deeper insights faster with Stripe Sigma

Why Stripe Sigma

Get insights from your Stripe data powered by SQL and AI

Stripe Sigma empowers businesses to easily explore and analyse their Stripe data for faster business insights within the Stripe Dashboard.

Make data-driven decisions

Gain insights, track trends, and analyse patterns in your data down to the transaction level. Use SQL or natural language prompts to get instant answers to your business questions.

Create fully custom reports

Monitor your business by creating custom metrics and reports that fit your needs. Write SQL from scratch, start with a pre-built template, or modify existing reports with the help of our AI-powered assistant. Then, easily visualise your data by transforming reports into dynamic charts.

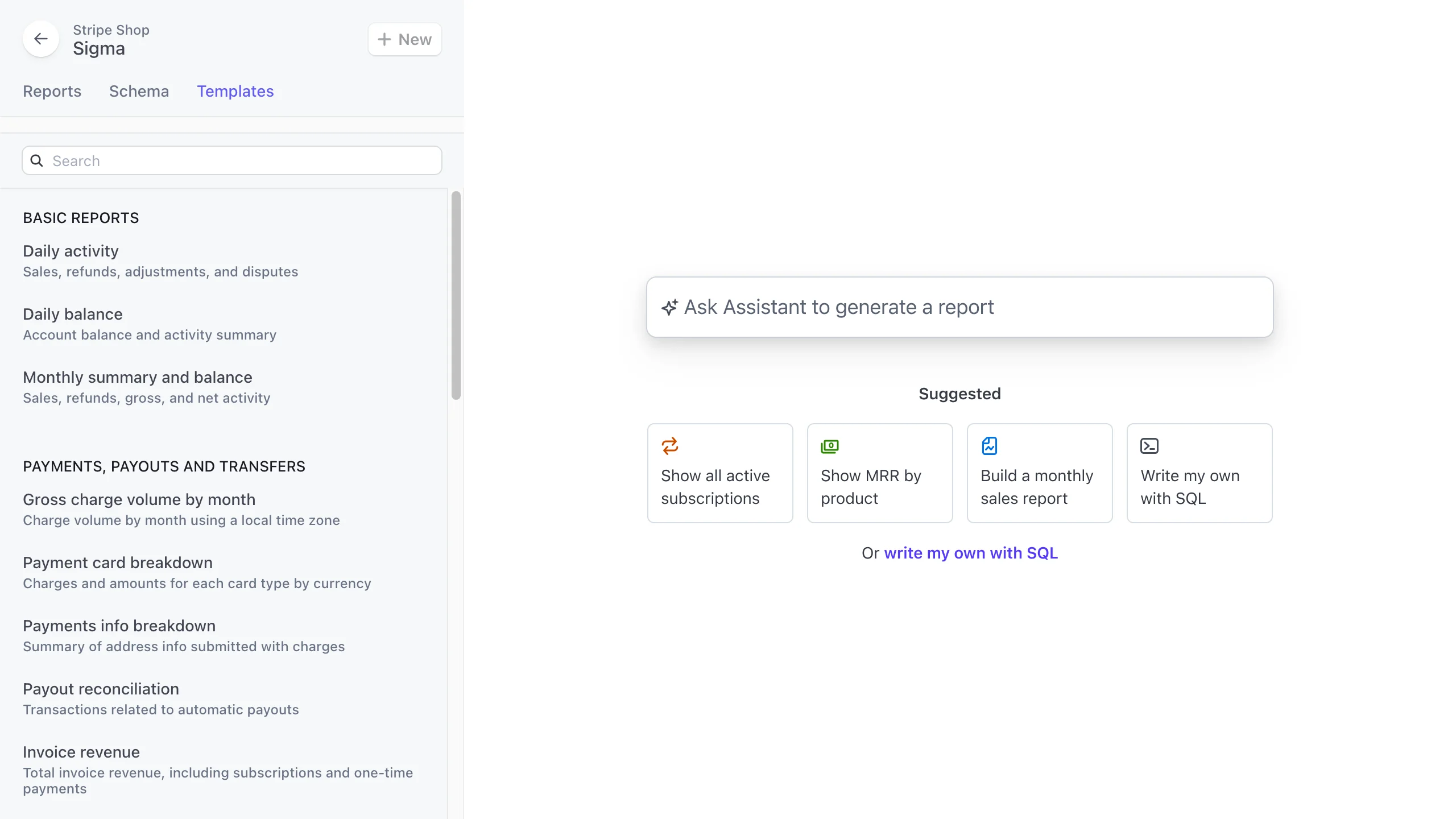

Get answers with AI

Use our AI-powered assistant to easily get answers to simple business questions. Ask a question in plain English and instantly get the query you need for a custom report – no coding required.

Collaborate with ease

Keep your teams in sync by sharing queries, publishing custom reports to the Stripe Dashboard and scheduling reports to be delivered directly to their inboxes.

Use cases

How teams use Stripe Sigma

From founders to finance teams, anyone can effortlessly pull insights from their Stripe data – SQL knowledge not required. Simply type in your question, and the AI-powered Sigma Assistant will transform it into a query and resulting report.

Business teams use Stripe Sigma to run their company more efficiently

Finance teams use Stripe Sigma to close the books faster.

Data teams use Stripe Sigma to analyse everything from ARPU to churn.

Product management uses Stripe Sigma to find new business opportunities.

Business Operations

What percentage of disputes did we contest?

Business Operations

What was our charge volume in February?

Business Operations

Which customers have not paid their invoices?

Finance

Which charges reconcile with our latest bank payout?

Finance

How much does cash flow change from month to month?

Finance

What is our company's daily balance?

Data Analysis

How many active customers do we have?

Data Analysis

Why do customers dispute payments?

Product Management

What are our most popular subscription plans?

Product Management

How many payments are made with each payment card brand?

Product Management

How much revenue comes from different customer channels?

Turn your data into actionable business insights

Learn how to use Stripe’s data tools to surface revenue opportunities and optimise your operations. This guide covers the key metrics that you can track to drive better business decisions.

Prebuilt templates

Optimised for fast answers

We’ve already written the queries for the most useful reports for different types of businesses. From computing ARPU to analysing the payment methods your customers prefer, you can jump in quickly by editing one of our pre-built templates or start from scratch to fully customise your report. Our built-in AI-powered assistant is also ready to help you build custom SQL queries.

Easy-to-use schema

Stripe data, at the ready

Quick sidebar access to a full map of the structure of your data stored in Stripe (including any additional metadata you send us) makes it easy to combine all the relevant data needed from across Stripe’s products – payments, payouts, customers, subscriptions, refunds, and more.

Payment Tables

balance_transactions_fee_details

balance_transactions

Preview the full schema

Designed for collaboration

Save and share queries with your team

Save frequently-used queries to run them again at any time or share a link to a useful query so that any of your team-mates can use it too.

How many customers do we have in France?

What was our charge volume last month?

Can you remind me how we calculate monthly recurring revenue?

Stripe Sigma has helped accelerate our financial close process. Instead of manually combining multiple data sources each month, we're now able to run a few simple queries in Sigma, enabling faster monthly reconciliation for credit card transactions.

Sigma gives us legitimate evidence to challenge a chargeback, whereas before Stripe, we had no visibility whatsoever. The new level of data and insight we can get out of Stripe compared to what we could get previously is just night and day. It really helped us improve and speed up our decision-making.

With a query that took less than 5 minutes to write, our team has been able to identify unpaid invoices and recapture tens of thousands of dollars of revenue – 8 percent of failed payments – in just two months.

Before Stripe Sigma, we built our own tool to analyse our Stripe data, but it took our engineers weeks to build, required ongoing work to maintain and update and it wasn't always accurate. Sigma now gives all our teams accurate data without any engineering work.

Have a data warehouse? Upgrade to Stripe Data Pipeline, with Stripe Sigma included.

If you use a data warehouse or cloud storage, you can use Data Pipeline to sync your Stripe data and reports to your storage destination, with complimentary access to Stripe Sigma included. New users get a free 30-day trial.

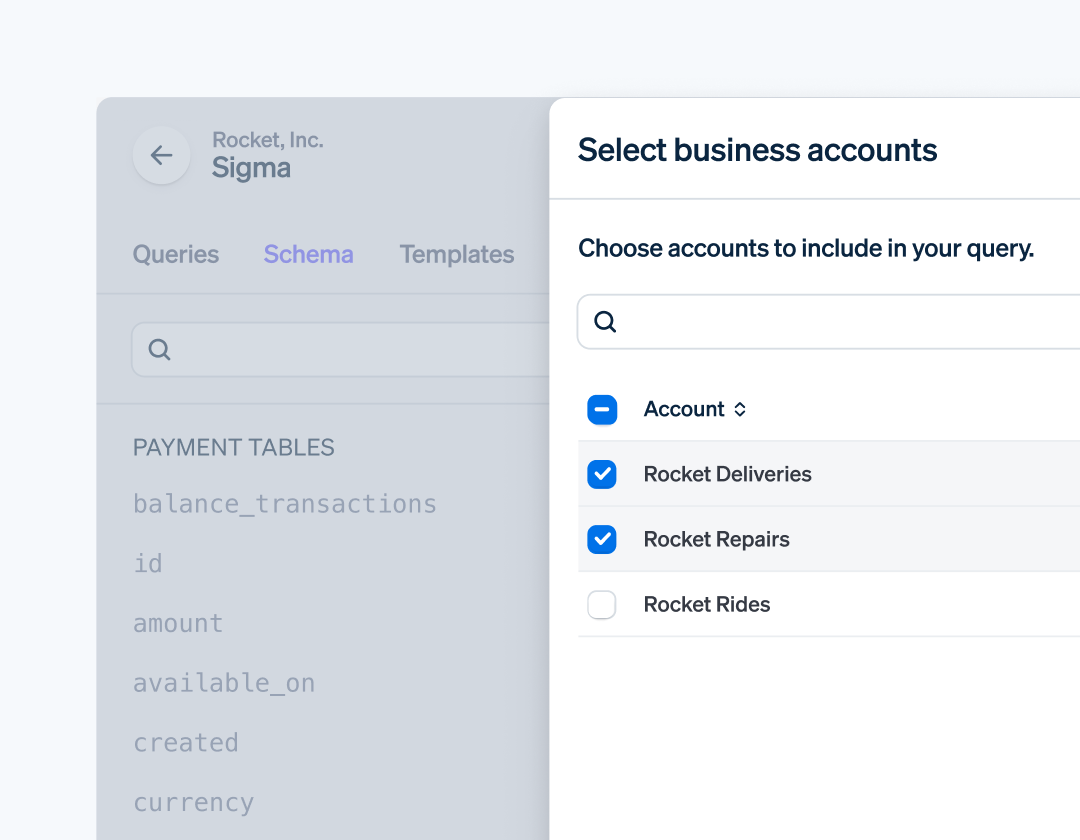

Streamlined account management and faster data analysis for your enterprise

With Stripe Organisations, centrally manage all lines of business or subsidiaries across multiple Stripe accounts in the Dashboard, and access new business insights by using Stripe Sigma to analyse data across all your accounts.

Ready to get started?

Analyse and create custom reports using your Stripe data.

Learn how it works

Details on how to build custom Stripe reports.

Connect Stripe to your data warehouse

Streamline your analytics and access additional insights by centralising your Stripe data in your data storage destination.