การชําระเงินผ่านร้านสะดวกซื้อคือวิธีการชําระเงินสำหรับลูกค้าและธุรกิจต่างๆ ที่ร้านสะดวกซื้อทั่วประเทศ โดยวิธีการชําระเงินนี้เป็นวิธีที่คุ้นเคยสำหรับคนจํานวนมากในญี่ปุ่น ลูกค้าชําระเงินที่ร้านสะดวกซื้อเพราะสามารถชําระเงินได้ทุกเมื่อและมีความอุ่นใจ การชำระเงินผ่านร้านสะดวกซื้อถือเป็นวิธีการชำระเงินที่ต้องมีให้บริการ โดยเฉพาะสำหรับลูกค้าที่ไม่มีบัตรเครดิตหรือไม่ต้องการกรอกข้อมูลบัตรทางออนไลน์ หากคุณเป็นเจ้าของธุรกิจกําลังพิจารณาจะนําระบบการชําระเงินของร้านสะดวกซื้อไปใช้ โปรดตรวจสอบว่าคุณเข้าใจวิธีการใช้งานและเลือกระบบที่เหมาะกับธุรกิจของคุณ

บทความนี้ให้ข้อมูลอะไรบ้าง

- สองวิธีหลักสําหรับการชําระเงินที่ร้านสะดวกซื้อ

- ธุรกิจที่ควรพิจารณาใช้การชําระเงินผ่านร้านสะดวกซื้อ

- ประเด็นที่ควรพิจารณาเมื่อตัดสินใจว่าจะนําเสนอการชําระเงินผ่านร้านสะดวกซื้อหรือไม่

สองวิธีหลักสําหรับการชําระเงินที่ร้านสะดวกซื้อ

คุณเลือกซื้อสินค้าออนไลน์ด้วยวิธีการชําระเงินผ่านร้านสะดวกซื้อหรือไม่ แม้ว่าคุณจะมีบัตรเครดิต แต่เมื่อคุณซื้อจากเว็บไซต์ที่ไม่เป็นที่รู้จัก คุณอาจลังเลที่จะชำระเงินด้วยบัตรเครดิตเนื่องด้วยเหตุผลด้านความปลอดภัย และชําระเงินที่ร้านสะดวกซื้อหรือใช้วิธีการชําระเงินอื่นแทน

การชําระเงินที่ร้านสะดวกซื้อมีอยู่ 2 วิธีหลักๆ ได้แก่ วิธีการชําระเงินโดยใช้สลิปการชําระเงิน และหมายเลขการชําระเงินแบบไม่ใช้กระดาษ ทั้งสองวิธีนี้มีข้อดีและข้อเสียต่างกัน เมื่อพิจารณาว่าควรใช้วิธีการชําระเงินแบบใด ให้พิจารณาจากปัจจัยต่างๆ เช่น ต้นทุนและกลุ่มเป้าหมาย

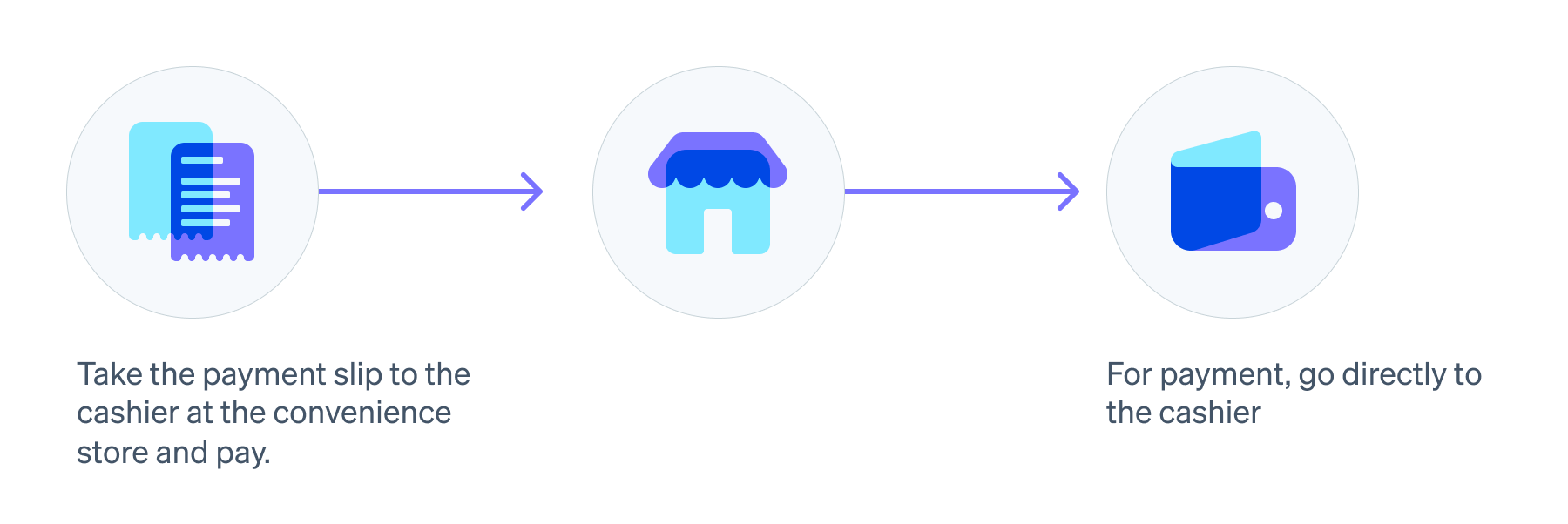

การชําระเงินด้วยสลิปการชําระเงิน (สลิปกระดาษ) ที่ร้านสะดวกซื้อ: วิธีการชําระเงินด้วยสลิปการชำระเงิน

การชําระเงินที่ร้านสะดวกซื้อโดยใช้สลิปการชําระเงิน คือวิธีที่ธุรกิจและลูกค้าใช้ในการชอปปิงออนไลน์ บิลค่าสาธารณูปโภค การชําระเงินด้านภาษี ฯลฯ มาเป็นเวลานาน ลูกค้านําสลิปการชําระเงินไปที่ร้านสะดวกซื้อแล้วจ่ายค่าธรรมเนียม

ข้อดีของวิธีการชําระเงินด้วยสลิปการชำระเงิน: วิธีการชําระเงินที่ร้านสะดวกซื้อทั่วไปช่วยให้ลูกค้าที่ไม่ต้องการชําระเงินออนไลน์ดำเนินการชําระเงินได้อย่างง่ายดาย

ข้อเสียของวิธีการชําระเงินด้วยสลิปการชำระเงิน: ธุรกิจจะต้องพิมพ์ จัดการ และส่งสลิปการชําระเงิน และหากไม่มีการชําระเงิน ธุรกิจจะต้องออกสลิปนั้นอีกครั้ง ปริ้นท์ออกมา และส่งทางไปรษณีย์ ในกรณีที่เป็นสลิปการชําระเงินสําหรับการชําระเงินทั่วไปทางไปรษณีย์ ซึ่งธุรกิจมักจะใช้สําหรับการซื้อสินค้าจากคําสั่งซื้อทางไปรษณีย์ ลูกค้าจะชําระเงินหลังจากที่ได้รับสินค้าแล้วเท่านั้น และมีความเสี่ยงที่การชําระเงินอาจไม่สําเร็จ

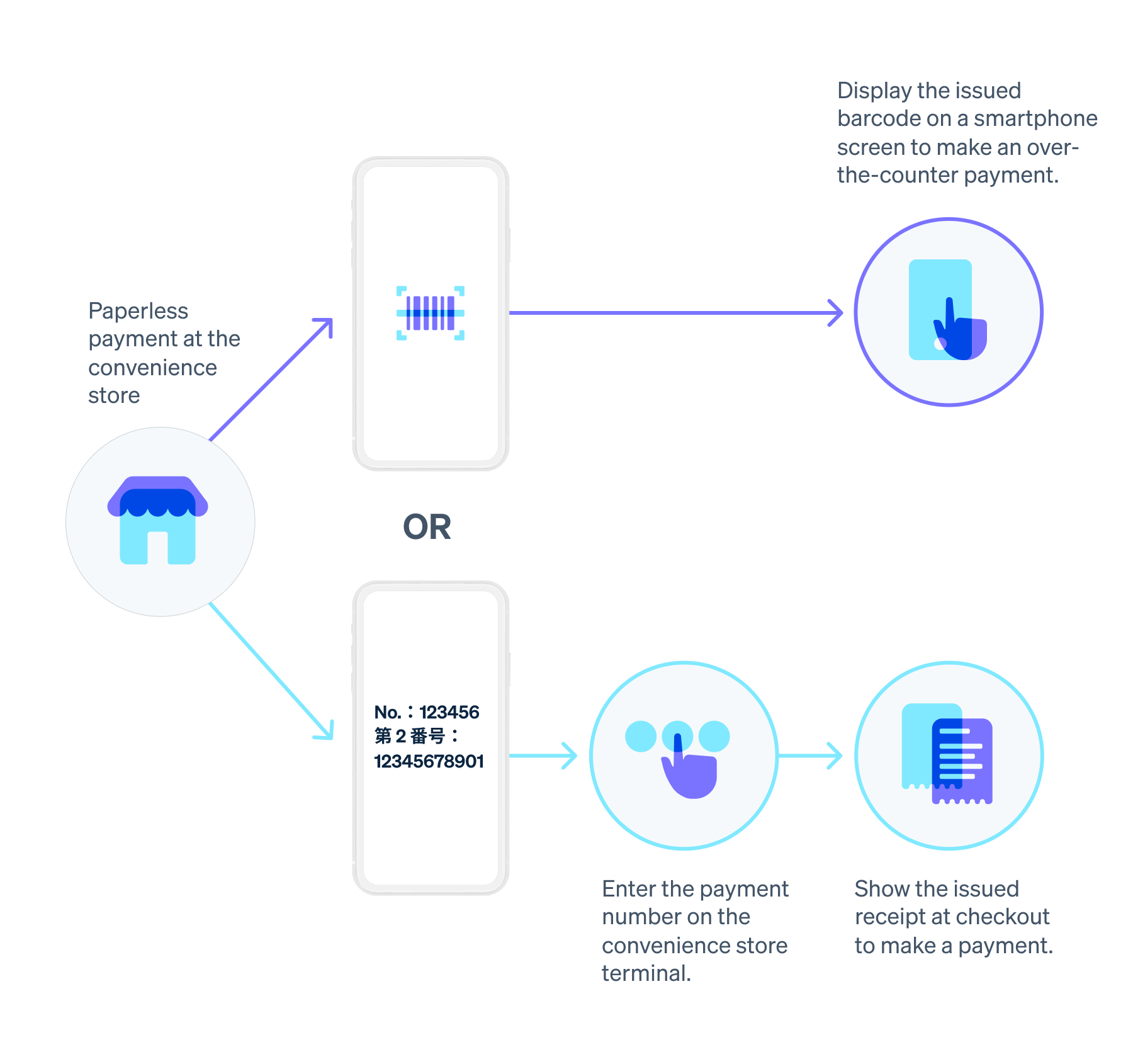

การชําระเงินแบบไร้กระดาษผ่านเว็บโดยใช้วิธีชำระด้วยหมายเลขการชำระเงิน

ระบบหมายเลขชําระเงินคือวิธีชําระค่าสินค้าที่ร้านสะดวกซื้อโดยใช้หมายเลขใบเสร็จที่ออกเมื่อซื้อสินค้าออนไลน์ ฯลฯ หรือบาร์โค้ดที่แสดงบนสมาร์ทโฟน

ข้อดีของการชําระเงินที่ร้านสะดวกซื้อแบบไร้กระดาษ: เนื่องจากการเรียกเก็บเงินแบบไร้กระดาษเกิดขึ้นทางออนไลน์โดยใช้อีเมล ธุรกิจจึงสามารถออกหมายเลขการชําระเงินทางออนไลน์ได้โดยไม่ต้องยุ่งยากกับการออกเอกสาร พิมพ์ และส่งให้ทางไปรษณีย์ แม้ว่าลูกค้าจะไม่สามารถชําระเงินได้ภายในวันที่กําหนด แต่ธุรกิจก็สามารถออกหมายเลขชําระเงินทางออนไลน์ได้อีกครั้ง ผู้ใช้สมาร์ทโฟนใช้การชําระเงินที่ร้านสะดวกซื้อแบบไร้กระดาษได้ง่ายกว่าเนื่องจากใช้ร่วมกับสมาร์ทโฟนได้

ข้อเสียของการชําระเงินที่ร้านสะดวกซื้อแบบไร้กระดาษ: บริษัทประมวลผลการชําระเงินหลายแห่งให้บริการชําระเงินที่ร้านสะดวกซื้อแบบการชําระเงินล่วงหน้า ในกรณีนี้ ธุรกิจจะรอให้ผู้ซื้อชําระเงินก่อนแล้วจึงจัดส่งสินค้า อย่างไรก็ตาม หากลูกค้าไม่คุ้นเคยกับการใช้เทอร์มินัลของร้านสะดวกซื้อหรือชําระเงินทางออนไลน์ ลูกค้าอาจพบว่าขั้นตอนการชําระเงินยุ่งยากและทําการซื้อได้ยาก

Stripe นําเสนอระบบไร้กระดาษที่สามารถดำเนินการทางออนไลน์ได้

Stripe ใช้วิธีการชําระเงินแบบไร้กระดาษที่เรียกว่า การชําระเงินที่ร้านสะดวกซื้อ ซึ่งธุรกิจสามารถดำเนินธุรกิจออนไลน์ผ่านอีเมลหรือวิธีการอื่นๆ ได้เพื่อลดภาระของตนเอง เนื่องจากไม่จําเป็นต้องพิมพ์และส่งสลิปการชําระเงินทางไปรษณีย์ จึงสามารถออกหมายเลขการชําระเงินทางออนไลน์ได้อีกครั้งแม้ว่าจะไม่มีการชําระเงินและสลิปหมดอายุไปแล้ว อีกทั้งยังไม่มีปัญหาอย่างเช่นการทำสลิปการชำระเงินหายอีกด้วย

ลูกค้าไม่จําเป็นต้องเลือกสาขาร้านสะดวกซื้อล่วงหน้าเมื่อชําระเงินออนไลน์และสามารถใช้บริการที่สาขาของร้านสะดวกซื้อทั้ง 4 แห่งดังนี้ FamilyMart, Lawson, MINISTOP และ Seicomart

นอกจากนี้คุณยังสามารถทําการซื้อโดยใช้การชําระเงินที่ร้านสะดวกซื้อจากเว็บไซต์อีคอมเมิร์ซต่างๆ ที่ใช้ Stripe Connect เช่น แพลตฟอร์มอีคอมเมิร์ซทั่วโลก

หากคุณเป็นธุรกิจที่วางแผนจะใช้ระบบการชําระเงินผ่านร้านสะดวกซื้อ ให้ดูที่หน้าการชําระเงินที่ร้านสะดวกซื้อของ Stripe และหน้าค่าธรรมเนียมสําหรับธุรกิจทุกขนาด

ธุรกิจที่ควรพิจารณาใช้การชําระเงินผ่านร้านสะดวกซื้อ

จากการสำรวจแนวโน้มการใช้การสื่อสาร (ฉบับครัวเรือน) ซึ่งกระทรวงกิจการภายในและการสื่อสารได้ดำเนินการในปี 2023 พบว่า "การชำระเงินด้วยบัตรเครดิต" เป็นวิธีการชำระเงินที่นิยมใช้มากที่สุด โดยอยู่ที่ 76.7% รองลงมาคือ "การชำระเงินด้วยเงินอิเล็กทรอนิกส์" ที่ 38.5% และ "การชำระเงินที่ร้านสะดวกซื้อ" ที่ 34.7%

เนื่องจากสัดส่วนของการชําระเงินที่ร้านสะดวกซื้อเพิ่มสูงขึ้นเรื่อยๆ การนําการชําระเงินที่ร้านสะดวกซื้อมาใช้จึงสามารถเพิ่มโอกาสการขายได้ ต่อไปนี้คือประเภทของธุรกิจที่ควรนําการชําระเงินที่ร้านสะดวกซื้อไปใช้

ผู้ที่มีฐานลูกค้าที่หลากหลาย

การชําระเงินเหล่านี้เหมาะสําหรับธุรกิจที่ต้องการเข้าถึงกลุ่มอายุที่หลากหลาย ตั้งแต่คนหนุ่มสาวที่ไม่ใช้บัตรเครดิตกับผู้สูงอายุที่กังวลในการกรอกรายละเอียดบัตรเครดิตทางออนไลน์

ร้านค้าออนไลน์

เมื่อเลือกร้านค้าจากเว็บไซต์อีคอมเมิร์ซหลายแห่ง ลูกค้าจํานวนมากมีแนวโน้มที่จะหลีกเลี่ยงการซื้อของที่ร้านค้าที่พวกเขาไม่สามารถชําระเงินด้วยเงินสดได้ ธุรกิจอีคอมเมิร์ซมีโอกาสพิจารณาที่จะนําการชําระเงินผ่านร้านสะดวกซื้อมาใช้ และการนําเสนอวิธีการชําระเงินที่หลากหลายมีแนวโน้มที่จะนําไปสู่การขายด้วย

ธุรกิจที่ให้ความสําคัญกับความพึงพอใจของลูกค้า

วิธีการชำระเงินที่หลากหลายอาจเป็นที่น่าสนใจสำหรับธุรกิจที่ต้องการเพิ่มความพึงพอใจของลูกค้าและเพิ่มการรักษาลูกค้า ตัวอย่างเช่น วิธีนี้อาจเป็นที่น่าสนใจสำหรับธุรกิจที่ต้องการป้องกันไม่ให้ลูกค้าเลิกใช้บริการ เช่น บริการแบบสมัครสมาชิกที่ต้องการให้ลูกค้าใช้ผลิตภัณฑ์และบริการของตนต่อไปโดยรักษาความสัมพันธ์กับพวกเขา

ผู้ประกอบการธุรกิจที่เกี่ยวข้องกับโครงสร้างพื้นฐาน

โดยอาจเป็นสิ่งจําเป็นสําหรับผู้ให้บริการภาครัฐที่จัดการการชําระเงินค่าไฟฟ้า แก๊ส น้ำ การสื่อสาร และสาธารณูปโภคอื่นๆ เพื่อให้บริการระบบการชําระเงินที่ร้านสะดวกซื้อซึ่งมีอยู่แล้ว

ประเด็นที่ควรพิจารณาเมื่อตัดสินใจว่าจะนําเสนอการชําระเงินผ่านร้านสะดวกซื้อหรือไม่

การชําระเงินที่ร้านสะดวกซื้ออาจไม่พร้อมให้บริการ ทั้งนี้ขึ้นอยู่กับผลิตภัณฑ์หรือบริการ คุณควรพิจารณาประเด็นเหล่านี้ก่อนใช้วิธีการชำระเงินนี้

ผลิตภัณฑ์และบริการที่มียอดเกินวงเงินสูงสุดที่สามารถชําระได้ที่ร้านสะดวกซื้อ

จํานวนเงินที่ชำระได้ที่ร้านสะดวกซื้อจํากัดให้ไม่เกิน 300,000 เยน ดังนั้นธุรกิจที่จัดการผลิตภัณฑ์และบริการที่มีค่าใช้จ่ายมากกว่า 300,000 เยนไม่จําเป็นต้องเสนอการชําระเงินที่ร้านสะดวกซื้อ

สินค้าและบริการที่มีราคาต่ำ

การชําระเงินในร้านสะดวกซื้อมักจะเรียกเก็บค่าธรรมเนียมสําหรับธุรกรรมขนาดเล็ก ดังนั้นหากผลิตภัณฑ์หรือบริการมีมูลค่าน้อย ผู้ประกอบการธุรกิจอาจต้องแบกรับภาระจํานวนมาก การตัดสินใจเกี่ยวกับการเสนอระบบการชําระเงินของร้านสะดวกซื้อขึ้นอยู่กับข้อพิจารณาด้านผลกําไร

ธุรกิจที่มีปัญหาในการรักษาสินค้าคงคลัง

สำหรับการชำระเงินล่วงหน้าที่ร้านสะดวกซื้อ โดยทั่วไปแล้วต้องใช้เวลาหลายวันกว่าลูกค้าจะชำระเงิน หากสินค้าคงคลังมีจำกัดหรือยากที่จะรักษาสินค้าคงคลังเนื่องจากระบบหรือโมเดลของธุรกิจ สินค้าคงคลังอาจหมดลงในขณะที่ธุรกิจกำลังรอการชำระเงิน ด้วยเหตุนี้ ธุรกิจจึงไม่สามารถจัดส่งสินค้าได้และอาจต้องยกเลิกการชำระเงิน ส่งผลให้ความพึงพอใจของลูกค้าลดลงและต้นทุนเพิ่มขึ้น

การลดความเสี่ยงนั้นถือเป็นสิ่งสำคัญ โดยการนำเสนอบริการที่ไม่ต้องกังวลเรื่องสินค้าคงคลัง หรือการนำระบบที่ช่วยให้คุณรักษาสินค้าคงคลังไว้ล่วงหน้ามาใช้

การชําระเงินผ่านร้านสะดวกซื้อมีการใช้กันอย่างแพร่หลายในญี่ปุ่นมานานแล้ว ทั้งลูกค้าและธุรกิจต่างๆ ต่างก็ตระหนักถึงความสะดวกในการใช้งาน

วิธีนี้เป็นที่นิยมในอุตสาหกรรมอีคอมเมิร์ซซึ่งธุรกิจต้องการเข้าถึงฐานลูกค้าที่หลากหลาย ดังนั้นธุรกิจหลายแห่งจึงได้เสนอการชําระเงินที่ร้านสะดวกซื้อเพื่อตอบสนองลูกค้าที่ให้ความสําคัญกับความน่าเชื่อถือและความสะดวกสบาย

Stripe ลดความยุ่งยากในการใช้งานการชําระเงินที่ร้านสะดวกซื้อ โดยลดเวลาในการดำเนินการให้เหลือเพียง 2 สัปดาห์ ธุรกิจที่นำ Stripe ไปใช้และผู้ใช้ Stripe ครั้งแรกสามารถเริ่มรับชำระเงินจากร้านสะดวกซื้อได้อย่างรวดเร็ว เข้าไปที่หน้าโครงสร้างค่าบริการสําหรับธุรกิจทุกขนาดเพื่อศึกษาข้อมูลเพิ่มเติมเกี่ยวกับการติดตั้งใช้งานระบบนี้

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ