A convenience store payment is a method of payment customers and businesses use at convenience stores nationwide, and the payment method is familiar to many people in Japan. Customers use convenience store payments because of being able to make payments at any time and the peace of mind they provide. Convenience store payments are an indispensable payment method, especially for customers who do not have credit cards or are reluctant to enter card details online. If you are a business owner considering introducing a convenience store payment system, make sure you understand how it works and choose a system that fits your business.

What’s in this article?

- Two main methods for convenience store payments

- Businesses that should consider using convenience store payments

- Points to consider when deciding whether to offer convenience store payments

Two main methods for convenience store payments

Have you paid for online shopping with a convenience store payment method? Even if you have a credit card, when you buy from a site that is not well known, you might hesitate to pay by credit card for security reasons and instead pay at a convenience store or use another payment method.

There are two main methods for convenience store payments: the payment slip method, which uses a payment slip, and the paperless payment number method. Both have advantages and disadvantages. When considering which payment method to use, take into account factors such as cost and target audience.

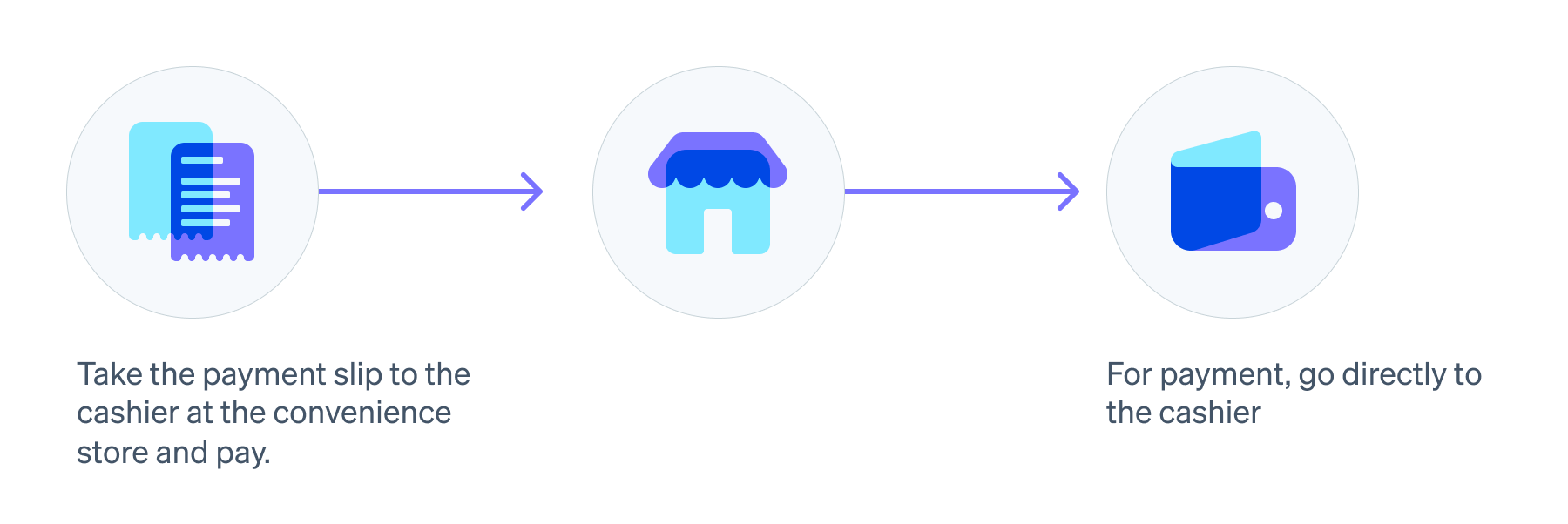

Payment slip (paper slip) payment at convenience stores: Payment slip method

Payment at convenience stores using payment slips is a method businesses and customers have used for a long time for online shopping, utility bills, tax payments, etc. Customers take the payment slip to the convenience store and pay a fee.

Advantages of the payment slip method: A conventional convenience store payment method makes it easy for customers who are not used to paying online to make payments.

Disadvantages of the payment slip method: Businesses will need to print, manage, and send payment slips, and if there are no payments, they will have to repeatedly issue, print, and mail them. In the case of payment slips for general postal payment, which businesses often use for mail-order purchases, the customer pays only after they receive their goods, and there is a risk the payment might not go through.

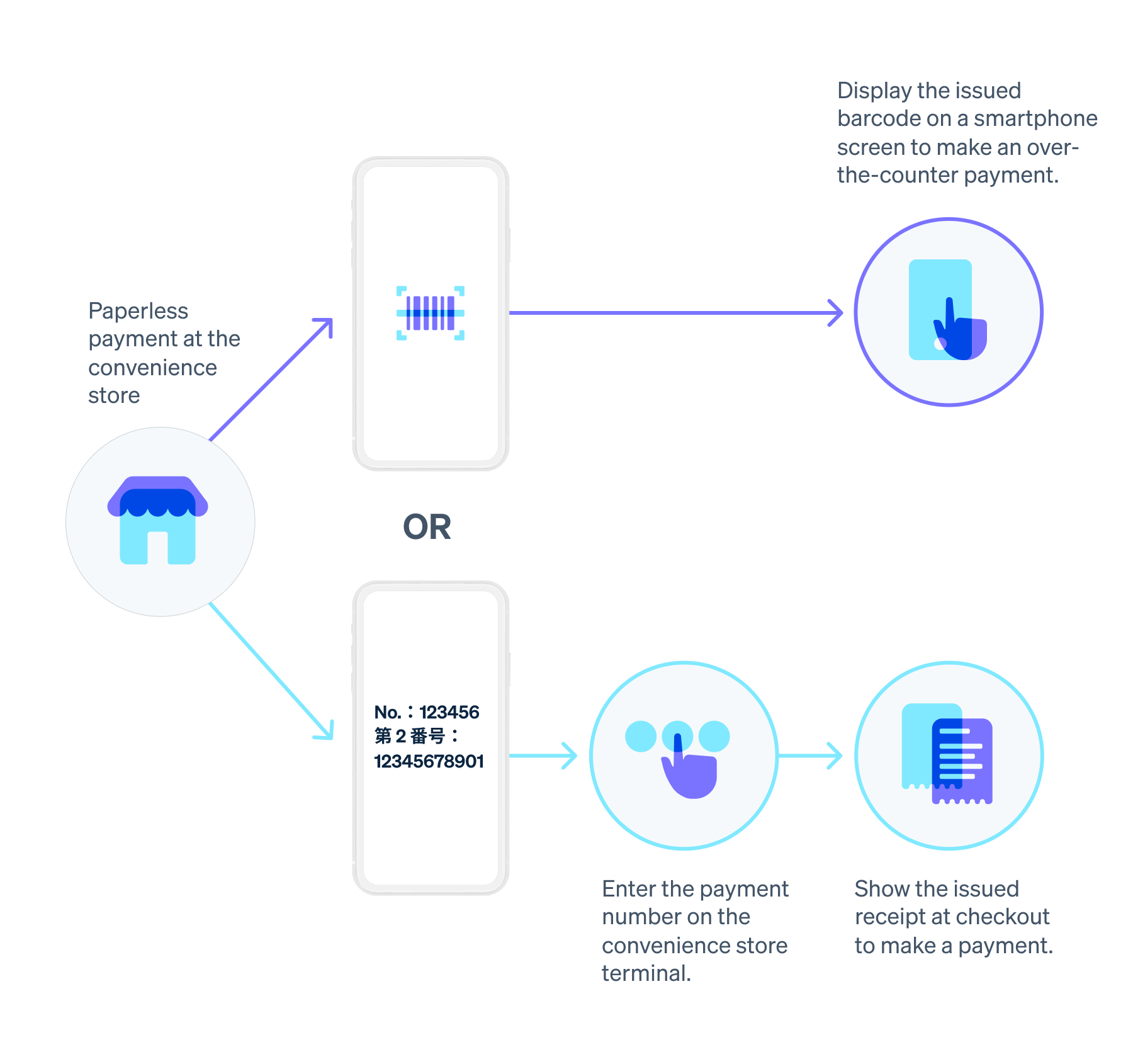

Paperless payment via the web using the payment number method

The payment number system is a method of paying for items at convenience stores using a receipt number issued when online shopping, etc., or a barcode displayed on a smartphone.

Advantages of paperless convenience store payments: Because paperless billing occurs online using email, businesses can issue payment numbers online without the hassle of issuing, printing, and mailing them. Even if a customer is unable to make their payment by the due date, the business can reissue the payment number online. Paperless convenience store payments are easier for the smartphone generation because they are compatible with smartphones.

Disadvantages of the paperless convenience store payments: Many payment processing companies offer prepayment-type convenience store payments. In this case, the business waits for the purchaser to pay before delivering the goods. However, if customers are not accustomed to using convenience store terminals or making payments online, they might find the payment process difficult and give up on making a purchase.

Stripe offers a paperless system that can be performed online

Stripe uses a paperless payment method called convenience store payment that businesses can complete online via email or other means to reduce the burden on businesses. Because it is not necessary to print and post payment slips and it is possible to reissue payment numbers online even if there is no payment and the validity period has expired, problems such as the loss of payment slips are unlikely.

Customers do not need to select a convenience store chain in advance when making online payments and can use any of the four convenience store chains: FamilyMart, Lawson, MINISTOP, and Seicomart.

You will also be able to make purchases using convenience store payments from various ecommerce sites that use Stripe Connect, such as global ecommerce platforms.

If you are a business thinking about using a convenience store payment system, refer to the Stripe convenience store payment page and the fees for businesses of all sizes page.

Businesses that should consider using convenience store payments

According to the Communications Usage Trend Survey (Household Edition) the Ministry of Internal Affairs and Communications conducted in 2023, “credit card payment” was the most common payment method at 76.7%, followed by “payment by electronic money” at 38.5%, and “payment at a convenience store” at 34.7%.

Because the proportion of convenience store payments continues to be high, introducing convenience store payments can expand sales opportunities. Here are the types of businesses that should consider implementing convenience store payments:

Those with a diverse customer base

These payments are suitable for businesses that want to reach a wide range of age groups, from young people who do not use credit cards to older people who are worried about entering credit card details online.

Online shops

When choosing a store from among the many ecommerce sites, a significant number of customers likely avoid shopping at stores where they cannot pay in cash. There are opportunities for ecommerce businesses to consider introducing payment via convenience stores, and offering a wide range of payment methods is more likely to lead to sales.

Businesses that place importance on customer satisfaction

A variety of payment methods can be attractive for businesses that want to improve customer satisfaction and increase customer retention. For example, it is attractive for businesses that want to prevent customers from leaving, such as subscription-based services that want customers to continue using their products and services by maintaining a relationship with them.

Infrastructure-related business operators

It might become essential for public service providers that handle payments for electricity, gas, water, communications, and other utilities to offer established convenience store payment systems.

Points to consider when deciding whether to offer convenience store payments

Depending on the product or service, convenience store payment might not be available. Consider these points before implementing the method:

Products and services that exceed the maximum amount that can be paid for at a convenience store

The amount payable at a convenience store is limited to a maximum amount of ¥300,000. Therefore, businesses that only handle products and services that cost over ¥300,000 do not need to offer convenience store payments.

Low prices for goods and services

Convenience store payments often charge a fee for small transactions, so if the products or services provided have small values, the business operator might be subject to a huge burden. The decision about offering a convenience store payment system is based on profit margin considerations.

Businesses that have difficulty securing inventory

With prepaid convenience store payments, it is not uncommon for several days to pass before the customer makes a payment. If inventory is limited or it is difficult to secure inventory because of the system or business model, inventory could deplete while the business waits for payment. As a result, businesses will find it impossible to deliver the goods and might have to cancel payment, leading to a decrease in customer satisfaction and an increase in costs.

It is important to reduce risk by offering a service that does not require you to worry about inventory or by introducing a system that lets you secure inventory in advance.

Convenience store payments have been widely used in Japan for a long time, and customers and businesses alike recognize their ease of use.

They are particularly popular in the ecommerce industry, in which businesses want to reach a diverse customer base, so many businesses have offered convenience store payments to cater to customers who place importance on reliability and convenience.

Stripe simplifies implementing convenience store payments, shortening the time needed to do so to as little as two weeks. Businesses that have implemented Stripe and first-time Stripe users can start accepting convenience store payments quickly. See the pricing structure for businesses of all sizes page to find out more about implementing this system.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.