Att söka finansiering är utmanande men nödvändigt för nystartade företag. Dagens entreprenörer har tillgång till flera källor till kapital. Crowdfunding, som har vuxit i popularitet under det senaste decenniet, demokratiserar finansieringsprocessen och ger tillgång till kapital där traditionella finansieringsalternativ kan komma till korta. 2023 uppskattades den globala marknaden för crowdfunding vara värd över 1,4 miljarder USD, en siffra som beräknas fördubblas till år 2030. Kickstarter, en ledande crowdfunding-plattform, hade i maj 2023 varit värd för över 592 000 projekt.

Crowdfunding utmärker sig för sin mångsidighet och räckvidd, vilket gör det möjligt för entreprenörer att samla in pengar från en bred publik. Förutom att säkra de nödvändiga ekonomiska resurserna hjälper crowdfunding också nystartade företag att få värdefull marknadsvalidering, etablera en gemenskap av tidiga supportrar och bygga en spännande engagemangsplattform för potentiella kunder, tidiga användare och till och med investerare.

Nedan kommer vi att diskutera egenskaperna, fördelarna och nackdelarna med de viktigaste typerna av crowdfunding. Att förstå dessa olika former är det första steget för att avgöra om crowdfunding kan vara rätt strategi för att finansiera ditt nystartade företag.

Vad innehåller den här artikeln?

- Vad är crowdfunding?

- Vilka är fördelarna med crowdfunding för företag?

- Typer av crowdfunding

- Belöningsbaserad crowdfunding

- Aktiebaserad crowdfunding

- Lånebaserad crowdfunding

- Donationsbaserad crowdfunding

- Belöningsbaserad crowdfunding

- Så väljer man rätt typ av crowdfunding

- Vilka är alternativen till crowdfunding?

Vad är crowdfunding?

Crowdfunding är ett sätt att samla in pengar för att finansiera projekt och företag genom kollektiva ansträngningar från vänner, familj, kunder, enskilda investerare och andra. Detta tillvägagångssätt bygger på samarbete mellan en stor grupp individer – främst online via sociala medier och crowdfunding-plattformar – och förlitar sig på tillgången till deras nätverk för att främja ökad räckvidd och exponering.

Crowdfunding är motsatsen till traditionella finansieringsmetoder, där ett projekt eller företag samlar in pengar från en liten, utvald grupp individer eller institutioner. Istället låter crowdfunding dig samla in pengar från enskilda investerare som är intresserade av ditt projekt eller företag, inklusive alla som är villiga att bidra med pengar för att stödja det. Dessa bidrag kan variera från mycket små till mycket stora belopp, beroende på projektets eller verksamhetens karaktär och den potentiella avkastningen.

Genom crowdfunding kan entreprenörer eller projektinitiativtagare utnyttja internets räckvidd för att samla in pengar för olika ändamål, t.ex. för att starta ett företag, utveckla en ny produkt, stödja en social fråga eller hjälpa individer i nöd.

Vilka är fördelarna med crowdfunding för företag?

Crowdfunding är ett innovativt sätt för nystartade företag att samla in de medel de behöver för att starta eller skala upp sina företag. Och genom att vända sig till en större målgrupp kan nystartade företag skörda en mängd ytterligare fördelar utöver förvärv av medel.

Framväxten av internet och sociala medier har gjort det enklare än någonsin att nå en stor målgrupp av potentiella investerare och finansiärer, som var och en bidrar med ett litet belopp till ett finansieringsmål. Detta tillvägagångssätt gör inte bara investeringsprocessen mer tillgänglig, utan ger också flera tydliga fördelar för nystartade företag.

Här är några av de viktigaste fördelarna:

Tillgång till kapital

Crowdfunding ger nystartade företag tillgång till kapital som de kanske inte hade kunnat få från traditionella finansieringskällor som banker eller venturekapitalister.Marknadsvalidering

Genom att presentera din idé för allmänheten kan du mäta deras intresse och se om din produkt är något som folk faktiskt skulle vilja ha. En framgångsrik crowdfunding-kampanj kan visa att det finns efterfrågan på din produkt eller tjänst och fungera som ett koncepttest för andra investerare och intressenter.Uppbyggnad av målgrupp

Med en crowdfunding-kampanj kan du nå ett stort antal personer, vilket hjälper dig att skapa medvetenhet och bygga en målgrupp. De som bidrar till din kampanj kommer sannolikt att bli dina mest passionerade kunder och högljudda förespråkare.Feedback och insikter

Genom crowdfunding-processen kan du få feedback på din produkt eller tjänst innan den lanseras officiellt. Finansiärer kan ge värdefulla insikter och förslag på förbättringar.Mindre risk

Jämfört med traditionella finansieringsmetoder kan crowdfunding vara mindre riskfyllt. Du lägger inte ut eget kapital eller tar på dig skulder, utan byter istället din produkt eller tjänst mot finansiering.Publicitet och marknadsföring

En framgångsrik crowdfunding-kampanj kan leda till betydande publicitet genom delningar och gilla-markeringar i sociala medier och täckning i traditionella medier.Möjligheter till samarbeten och nätverkande

Crowdfunding-kampanjer uppmärksammas ofta av branschledare, potentiella partner och till och med andra finansieringskällor. Denna synlighet kan leda till strategiska partnerskap och ytterligare investeringsmöjligheter.

Typer av crowdfunding

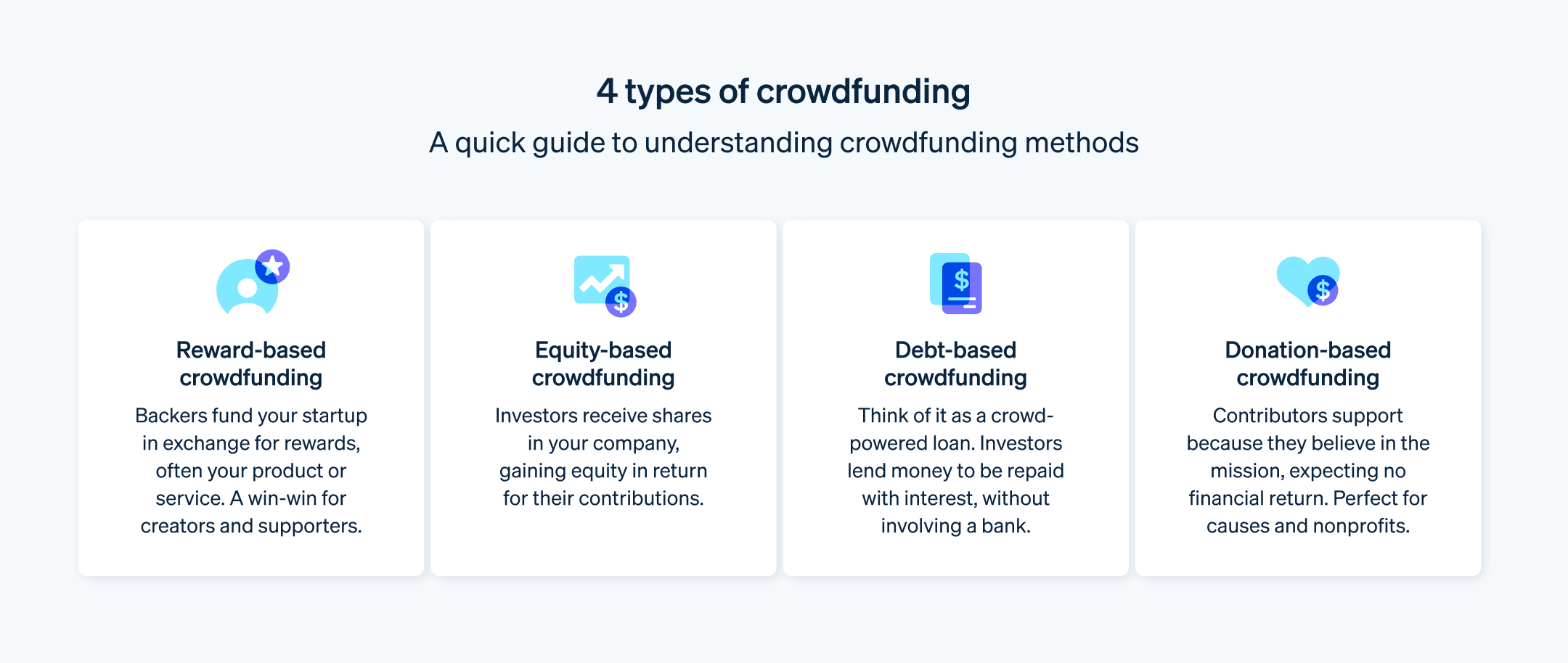

Det finns fyra huvudtyper av crowdfunding som nystartade företag kan välja mellan, var och en med unika fördelar och specifika användningsfall som den är mer lämpad att stödja. Här är en översikt över vad nystartade företag behöver veta:

Belöningsbaserad crowdfunding

Med belöningsbaserad crowdfunding bidrar finansiärer med pengar till ditt nystartade företag i utbyte mot en "belöning", vanligtvis en produkt eller tjänst som ditt företag erbjuder. Denna modell används vanligtvis av nystartade företag som lanserar en ny produkt eller tjänst och behöver finansiering för utveckling eller produktion. Exempel på belöningsbaserade crowdfunding-plattformar är Kickstarter och Indiegogo.

Belöningsbaserad crowdfunding är en populär metod för att samla in pengar, särskilt för kreativa projekt eller nya produktlanseringar. Nedan följer några av de viktigaste för- och nackdelarna.

Fördelar med belöningsbaserad crowdfunding:

Inget eget kapital offras: Till skillnad från aktiebaserad crowdfunding innebär belöningsbaserad crowdfunding inte att du ger upp ägandet i ditt företag.

Marknadsvalidering: Med hjälp av belöningsbaserad crowdfunding kan du bedöma marknadens intresse för din produkt eller tjänst. Om din kampanj lyckas är det ett gott tecken på att det finns en marknad för det du säljer.

Förhandsförsäljning och marknadsföring: Crowdfunding-kampanjer kan också fungera som en förhandsförsäljning av produkten, generera publicitet och generera en inledande kundbas.

Community-främjande: Crowdfunding-plattformar erbjuder ett sätt att kommunicera och engagera sig med finansiärer. Detta kan hjälpa till att bygga upp en gemenskap av supportrar som kan hjälpa till att berätta för andra om din produkt eller tjänst.

Nackdelar med belöningsbaserad crowdfunding:

Allt-eller-inget-finansiering: Många crowdfunding-plattformar fungerar på en allt-eller-inget-basis, vilket innebär att om du inte når ditt finansieringsmål får du inga pengar. Detta är inte alltid sant, men det är inte ovanligt.

Uppfylla belöningar: Det är viktigt att leverera utlovade belöningar, som kan vara mer tidskrävande eller kostsamma än väntat. Underlåtenhet att uppfylla belöningar kan leda till ett skadat rykte eller till och med ge supportrar skäl att be om sina pengar tillbaka.

Oförutsägbar framgång: Alla kampanjer lyckas inte, även om din idé är bra. Framgång kan bero på många faktorer, inklusive kampanjens kvalitet, timing och ren tur. Ett startupföretag kan investera mycket tid i att lansera en kampanj bara för att se den misslyckas. Dessutom kan en misslyckad kampanj felaktigt ge grundare intrycket att deras affärsidé inte är lönsam eller att det inte finns någon stark efterfrågan på marknaden.

Exponering av allmänheten: Din idé delas offentligt, vilket kan leda till att någon annan kopierar den. Du måste balansera behovet av publicitet med risken att avslöja för mycket.

Avgifter: Crowdfunding-plattformar tar vanligtvis ut en avgift på en procentandel av de insamlade medlen, och det kan tillkomma ytterligare behandlingsavgifter.

Aktiebaserad crowdfunding

Med aktiebaserad crowdfunding får finansiärer aktier i ditt företag i utbyte mot sin investering. Denna form av crowdfunding används oftast av nystartade företag med hög tillväxtpotential, eftersom den möjliggör insamling av större summor pengar i utbyte mot en andel i företagets framtida vinster. SeedInvest och CircleUp är populära plattformar för aktiebaserad crowdfunding.

Fördelar med aktiebaserad crowdfunding:

Större kapitalbelopp: Eftersom investerare köper en andel i företagets framtida framgång kan de vara villiga att bidra med större belopp än vid belöningsbaserad crowdfunding. Detta kan göra det möjligt för nystartade företag att samla in betydande summor.

Långsiktiga relationer med investerare: Till skillnad från belöningsbaserad crowdfunding, där relationen vanligtvis upphör när belöningen har levererats, kan aktiebaserad crowdfunding resultera i långsiktiga relationer med investerare som har ett egenintresse i företagets fortsatta framgång.

Tillgång till expertis och nätverk: Investerare tar ofta med sig sin egen expertis, erfarenhet och nätverk, vilket kan vara värdefulla resurser för företag i tidiga skeden.

Nackdelar med aktiebaserad crowdfunding:

Förlust av ägande: Genom att erbjuda aktier i ditt företag ger du bort en del av ditt ägande, vilket kan innebära att du delar kontroll och beslutsfattande med andra.

Komplexa regelverk: Aktiebaserad crowdfunding omfattas av mer komplexa lagar och regler än andra former av gräsrotsfinansiering. Detta kan kräva juridisk rådgivning och kan leda till betydande juridiska kostnader.

Ökade rapporteringskrav: Företag med många aktieägare måste ofta skicka ut regelbundna uppdateringar och finansiella rapporter till sina investerare. Detta kan vara tidskrävande och kräva ytterligare administrativa resurser.

Avkastningsstress: Till skillnad från belöningsbaserad crowdfunding, där finansiärer främst blir glada över att få produkten eller tjänsten, söker aktieinvesterare en ekonomisk avkastning på sin investering. Detta kan öka pressen på företaget att prestera och ge avkastning.

Risk för utspädning: Om du tar in mer aktiefinansiering i framtiden riskerar den andel av företaget som ägs av tidigare investerare (inklusive crowdfunding-investerare) att spädas ut. Detta kan leda till missnöje bland investerare om det inte hanteras på rätt sätt.

Lånebaserad crowdfunding

Lånebaserad crowdfunding, även kallat "peer-to-peer-utlåning" eller "P2P-utlåning", liknar ett traditionellt lån. Istället för att få ett lån från en bank får du ett lån från en grupp investerare. Startupföretaget går med på att betala tillbaka lånet, inklusive ränta, under en viss tidsperiod. LendingClub och Prosper är välkända plattformar för lånebaserad crowdfunding.

Fördelar med lånebaserad crowdfunding:

Bibehållande av ägande: Till skillnad från aktiebaserad crowdfunding behöver du med lånebaserad crowdfunding inte ge upp någon ägarandel i ditt företag. När lånet är återbetalt upphör din skyldighet gentemot dina investerare.

Snabbare process: Processen för att säkra ett lån genom lånebaserad crowdfunding kan vara snabbare än genom traditionella banker. Behörighetskraven kan också vara mindre stränga.

Fast återbetalningsplan: Du får en fast återbetalningsplan, vilket kan vara lättare att planera för än aktieplaceringarnas oförutsägbara natur.

Potentiellt lägre kostnader: Beroende på vilken ränta du får och lånets längd kan lånebaserad crowdfunding ibland vara en billigare finansieringsform än aktiebaserad crowdfunding eller andra typer av lån.

Nackdelar med lånebaserad crowdfunding:

Skyldighet att återbetala: Till skillnad från andra former av crowdfunding måste pengarna du samlar in genom lånebaserad crowdfunding betalas tillbaka med ränta. Detta är en fast kostnad som du måste planera för, oavsett hur bra det går för ditt företag.

Räntekostnader: Kostnaden för lånet inkluderar inte bara det belopp du lånar, utan också den ränta du kommer att betala under lånets löptid.

Kreditvärdighetsrisk: Om du inte kan betala tillbaka lånet kan din kreditvärdighet påverkas, vilket i sin tur kan påverka din möjlighet att säkra finansiering i framtiden.

Risk med inteckningslån: En del av den lånebaserade crowdfundingen kan kräva säkerheter eller personlig borgen. Om lånet inte betalas tillbaka riskerar du att förlora de tillgångar du har pantsatt som säkerhet.

Donationsbaserad crowdfunding

Denna modell används ofta av ideella organisationer, sociala entreprenörer och nystartade företag där "avkastningen på investeringen" inte är ekonomisk, utan en social nytta eller form av samhällsnytta. Finansiärer donerar pengar till projektet för att de tror på dess syfte, inte för att de förväntar sig en ekonomisk avkastning. GoFundMe är en välkänd insamlingsplattform för donationsbaserad crowdfunding.

Fördelar med donationsbaserad crowdfunding:

Ingen återbetalning eller aktiebyte: Eftersom finansiärer donerar pengarna till ditt projekt eller ändamål behöver du inte oroa dig för att betala tillbaka ett lån eller avstå en del av ditt företag.

Stöd till sociala ändamål: Donationsbaserad crowdfunding är särskilt effektiv för projekt eller ändamål som har ett socialt, välgörande eller samhällsrelaterat fokus. Folk är ofta villiga att donera pengar för att stödja ändamål som de bryr sig om.

Samhällsengagemang: Denna typ av crowdfunding kan vara ett bra sätt att bygga upp en gemenskap av supportrar som är känslomässigt investerade i ditt projekt eller din sak.

Nackdelar med donationsbaserad crowdfunding:

Begränsad attraktionskraft: Donationsbaserade kampanjer förlitar sig ofta på projektets eller sakens känslomässiga attraktionskraft, vilket kan begränsa deras exponering för en bredare publik. Dessa kampanjer kan vara mindre framgångsrika för kommersiella projekt.

Brist på garanterad finansiering: Precis som med andra typer av crowdfunding finns det ingen garanti för att du når ditt finansieringsmål. På vissa plattformar riskerar du att inte få några pengar alls om du inte når ditt mål.

Exponering av allmänheten: Precis som med andra typer av crowdfunding är din idé offentlig, vilket kan leda till att någon annan kopierar den.

Plattformsavgifter: Fastän pengarna du samlar in inte behöver betalas tillbaka, tar de flesta plattformar ut en avgift baserat på hur mycket pengar du samlar in.

Så väljer man rätt typ av crowdfunding

Att välja rätt typ av crowdfunding för ditt nystartade företag beror till stor del på vilken typ av verksamhet du har, dina mål och din förmåga att uppfylla kraven för varje crowdfunding-metod. Här är några faktorer att tänka på när du fattar ditt beslut:

Typ av verksamhet eller projekt

Om du lanserar en ny produkt eller tjänst kan belöningsbaserad crowdfunding vara det bästa alternativet. Om ditt företag har ett starkt socialt eller samhällsorienterat uppdrag kan donationsbaserad crowdfunding vara ett bra val. Om du skalar upp ett företag som redan har en viss dragkraft och du är villig att avstå eget kapital kan aktiebaserad crowdfunding vara det bästa alternativet. Om du är säker på din förmåga att betala tillbaka ett lån och vill behålla full äganderätt till ditt företag kan lånebaserad crowdfunding vara den bästa vägen.Ekonomiska behov och mål

Olika crowdfunding-metoder kan generera olika mycket kapital. För större belopp kan aktie- eller lånebaserad crowdfunding vara lämpligare. Om du behöver ett mindre belopp kan det räcka med belönings- eller donationsbaserad crowdfunding.Marknadsvalidering

Om du behöver testa din produkt på marknaden kan belöningsbaserad crowdfunding ge värdefull kundfeedback och validering.Ägande och kontroll

Om det är viktigt för dig att behålla full kontroll och ägande av ditt nystartade företag skulle förmodlingen belöningsbaserad, donationsbaserad eller lånebaserad crowdfunding vara att föredra framför aktiebaserad crowdfunding.Förmåga att fullgöra förpliktelser

Kan ni producera och leverera belöningsbaserade crowdfunding-belöningar i rätt tid? Är du säker på din förmåga att betala tillbaka ett lån vid användning av lånebaserad crowdfunding? Kan du hantera ett stort antal aktieägare för aktiebaserad crowdfunding?Juridiska och regulatoriska överväganden

Aktiebaserad och lånebaserad crowdfunding kan innebära mer komplexa rättsliga och regulatoriska krav än belönings- och donationsbaserad crowdfunding. Se till att du förstår dessa skyldigheter.

Vilka är alternativen till crowdfunding?

Nystartade företag har flera alternativ till crowdfunding, som kan delas in i två huvudkategorier: finansiering med lån och finansiering med eget kapital.

Finansiering med lån

- Banklån: Traditionella banklån är ett vanligt sätt att finansiera nystartade företag. Det kräver vanligtvis en solid affärsplan och säkerheter.

- Kreditlimit: Banker och kreditföreningar erbjuder också krediter, vilket ger företag flexibel tillgång till medel.

- Mikrolån: Ideella organisationer och onlinelångivare erbjuder mindre lån som ofta är lättare att få än traditionella banklån, särskilt för företag med begränsad kredithistorik.

Finansiering med eget kapital

- Affärsänglar: Affärsänglar är rika individer som investerar sina personliga pengar i nystartade företag i utbyte mot en aktieandel. De kan också bidra med expertis och branschkontakter.

- Venturekapitalister: Venturekapitalister är företag som investerar i nystartade företag och företag i tidiga skeden som de tror har hög tillväxtpotential. I gengäld kräver de vanligtvis en aktieandel och ofta en viss grad av kontroll över företaget.

- Private equity-företag: Dessa företag investerar i mogna företag i syfte att öka deras värde och sedan sälja dem med vinst. De kräver vanligtvis en betydande andel eller direkt ägande.

Förutom finansiering med lån och finansiering med eget kapital finns det andra vanliga sätt för nystartade företag att finansiera sin verksamhet:

Bidrag

Bidrag från myndigheter, stiftelser och företag är gratis pengar som inte behöver betalas tillbaka. De kan vara en bra finansieringskälla men är ofta mycket konkurrenskraftiga och kan kräva att vissa villkor uppfylls.Egen finansiering

Många entreprenörer finansierar till en början sina företag ur egen ficka. Det kan handla om sparande, kreditkort eller bostadslån.Vänner och familj

Företagare vänder sig ofta till vänner och familj för ekonomiskt stöd. Fastän detta kan vara ett bra sätt att komma igång är det viktigt att behandla det som en affärsuppgörelse för att undvika missförstånd och ansträngda relationer.Företagsacceleratorer och företagsinkubatorer

Dessa program tillhandahåller finansiering, mentorskap och resurser till nystartade företag, vanligtvis i utbyte mot en liten aktieandel.Strategiska partnerskap

Vissa startupföretag bildar strategiska partnerskap med större företag som tillhandahåller finansiering och resurser i utbyte mot något värdefullt, till exempel tillgång till innovativ teknik eller inträde på nya marknader.

Crowdfunding är bara ett av många sätt att finansiera ditt nystartade företag, och de flesta startupföretag är inte helt beroende av bara en finansieringsmetod. Se till att du förstår fördelarna och nackdelarna med varje metod och välj den som bäst passar din affärsmodell, dina ekonomiska behov och dina långsiktiga mål.

Så här kan Stripe Atlas hjälpa till

Stripe Atlas skapar ditt företags juridiska grund så att du kan samla in pengar, öppna ett bankkonto och ta emot betalningar från var som helst i världen inom två dagar.

Anslut dig till de över 75 000 företag som startats med hjälp av Atlas, inklusive startup-företag som stöds av toppinvesterare som Y Combinator, a16z och General Catalyst.

Ansök till Atlas

Att ansöka om att bilda ett företag med Atlas tar mindre än tio minuter. Du väljer din företagsstruktur, får bekräftelse omedelbart om ditt företagsnamn är tillgängligt och lägger till upp till fyra medgrundare. Du bestämmer också hur du delar upp aktier, skapar en reserv av eget kapital för framtida investerare och anställda, utser ledamöter och e-signerar sedan alla dina dokument. Alla medgrundare får e-postmeddelanden som bjuder in dem att e-signera sina dokument också.

Ta emot betalningar och banktjänster innan ditt EIN anländer

När du har startat ditt företag ansöker Atlas om ditt EIN. Grundare med socialförsäkringsnummer, adress och mobiltelefonnummer i USA är berättigade till snabb behandling av IRS, medan andra får standardbehandling, vilket kan ta lite längre tid. Dessutom aktiverar Atlas pre-EIN-betalningar och -banktjänster så att du kan börja ta emot betalningar och göra transaktioner innan ditt EIN anländer.

Kontantfritt aktieköp för grundare

Grundare kan köpa initiala aktier med hjälp av sina immateriella rättigheter (t.ex. upphovsrätt eller patent) istället för kontanter, med köpebevis som sparas i Atlas Dashboard. Dina immateriella rättigheter måste vara värda högst 100 USD för att kunna använda den här funktionen. Om du äger immateriella rättigheter över det värdet bör du rådgöra med en advokat innan du fortsätter.

Automatisk deklaration för val av skatt enligt 83(b)

Grundare kan lämna in en 83(b)-ansökan om val av skatt för att sänka skatten på personliga inkomster. Atlas lämnar in den åt dig – oavsett om du är en amerikansk grundare eller inte – med USPS Certified Mail och spårning. Du får en undertecknad 83(b)-ansökan och ett deklarationsbevis direkt i Stripe Dashboard.

Juridiska dokument för företag i världsklass

Atlas tillhandahåller alla juridiska dokument du behöver för att börja driva ditt företag. Atlas C corp-dokument är utformade i samarbete med Cooley, en av världens ledande advokatbyråer för venturekapital. Dessa dokument är utformade för att hjälpa dig att skaffa kapital omedelbart och säkerställa att ditt företag är juridiskt skyddat, vilket omfattar aspekter som ägarstruktur, aktiefördelning och efterlevnad av skatteregler.

Ett kostnadsfritt år med Stripe Payments, plus 50 000 USD i partnerkrediter och rabatter

Atlas samarbetar med partner på högsta nivå för att ge grundare exklusiva rabatter och krediter. Dessa inkluderar rabatter på viktiga verktyg för teknik, skatt, ekonomi, efterlevnad och verksamhet från branschledare som AWS, Carta och Perplexity. Vi ger dig också kostnadsfritt agenten som är registrerad i Delaware som du behöver under det första året. Som Atlas-användare får du dessutom tillgång till ytterligare Stripe-förmåner, inklusive upp till ett års gratis betalningsbehandling för upp till 100 000 USD i betalningsvolym.

Läs mer om hur Atlas kan hjälpa dig att starta ditt nya företag snabbt och enkelt och komma igång redan idag.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.