C corporations (C corps) remain one of the most common corporate structures in the United States. In September 2023 alone, the US Census Bureau reported nearly 473,000 new business applications, and of the 32,000 or so that will result in fully formed corporate entities, many will become C corps. Though the motivation for forming a C corp is clear—to take advantage of opportunities for growth and set the business up for success—the process of forming a C corp is more opaque.

Below, we’ll unpack the key steps involved in forming a C corp. If you’re considering this corporate structure, here’s what you need to know about its attributes and benefits and how to make it the legal framework for your business.

What’s in this article?

- What is a C corp?

- Key attributes of a C corp

- Benefits of forming a C corp

- How to form a C corp

- How Stripe can help

What is a C corp?

A C corp is a type of business entity, formed under state law, that establishes the business as distinct from its owners or shareholders. As a C corp, the business earns money and pays taxes at corporate rates, while the shareholders are liable only for paying taxes on their investment, which shields them from direct corporation liabilities.

Key attributes of a C corp

Like other corporate structures, C corps are defined by their unique attributes and implications for businesses, which are important to understand as you evaluate whether a C corp is the best-fit corporate structure for your business. Here is what a C corp structure means for businesses:

Separate legal entity: A C corp operates as an independent entity, distinct from its owners or shareholders.

Limited liability: Shareholders’ financial responsibility is limited to their investment, which protects personal assets from business debts.

Double taxation: The corporation pays taxes on its profits. When these profits are distributed as dividends, shareholders pay taxes on their personal returns.

Shareholder structure: A C corp can have an unlimited number of shareholders, and shares can be publicly traded.

Perpetual existence: The corporation continues to exist even if the owners or shareholders change or die.

Management structure: Shareholders elect a board of directors, who in turn appoint officers to manage daily operations.

Benefits of forming a C corp

Choosing a corporate entity is one of the most impactful decisions a business can make because the structure directly influences growth potential, tax implications, and stakeholder relationships. The C corp is a popular choice for businesses in a range of industries, particularly those that hope to scale or seek external investment. Here are some of the perks that come with choosing to incorporate as a C corp:

Limited liability protection: Shareholders have a protective barrier between their personal assets and business debts. This protection can offer peace of mind in the face of lawsuits or if the business faces financial challenges.

Growth potential through stock issuance: C corps can issue different classes of stock, which allows them to raise capital from investors. This is particularly attractive to venture capitalists and private equity investors.

No shareholder restrictions: Unlike other business entities, C corps don’t have restrictions on the number of shareholders they can have. This feature can be significant for companies that are considering going public.

Attracting talent with stock options: Offering stock options or shares can be a compelling incentive to attract and retain top-tier talent, especially for sectors in which competition for skilled professionals is high.

Perpetual existence: A C corp maintains its business continuity regardless of shareholder changes, which can be advantageous for long-term planning.

Tax flexibility with retained earnings: Though double taxation is often regarded as a drawback, C corps can choose to retain earnings and reinvest in the business, which can sometimes lead to a lower effective tax rate.

C corps offer an appealing combination of financial flexibility, growth opportunities, and a shield against certain risks. For businesses considering significant expansion or those seeking to make themselves as attractive as possible for investors, the C corp is a compelling choice. Once you’ve identified a C corp as the most advantageous option for your business based on your goals and priorities, it’s time to begin incorporating your business as a C corp.

How to form a C corp

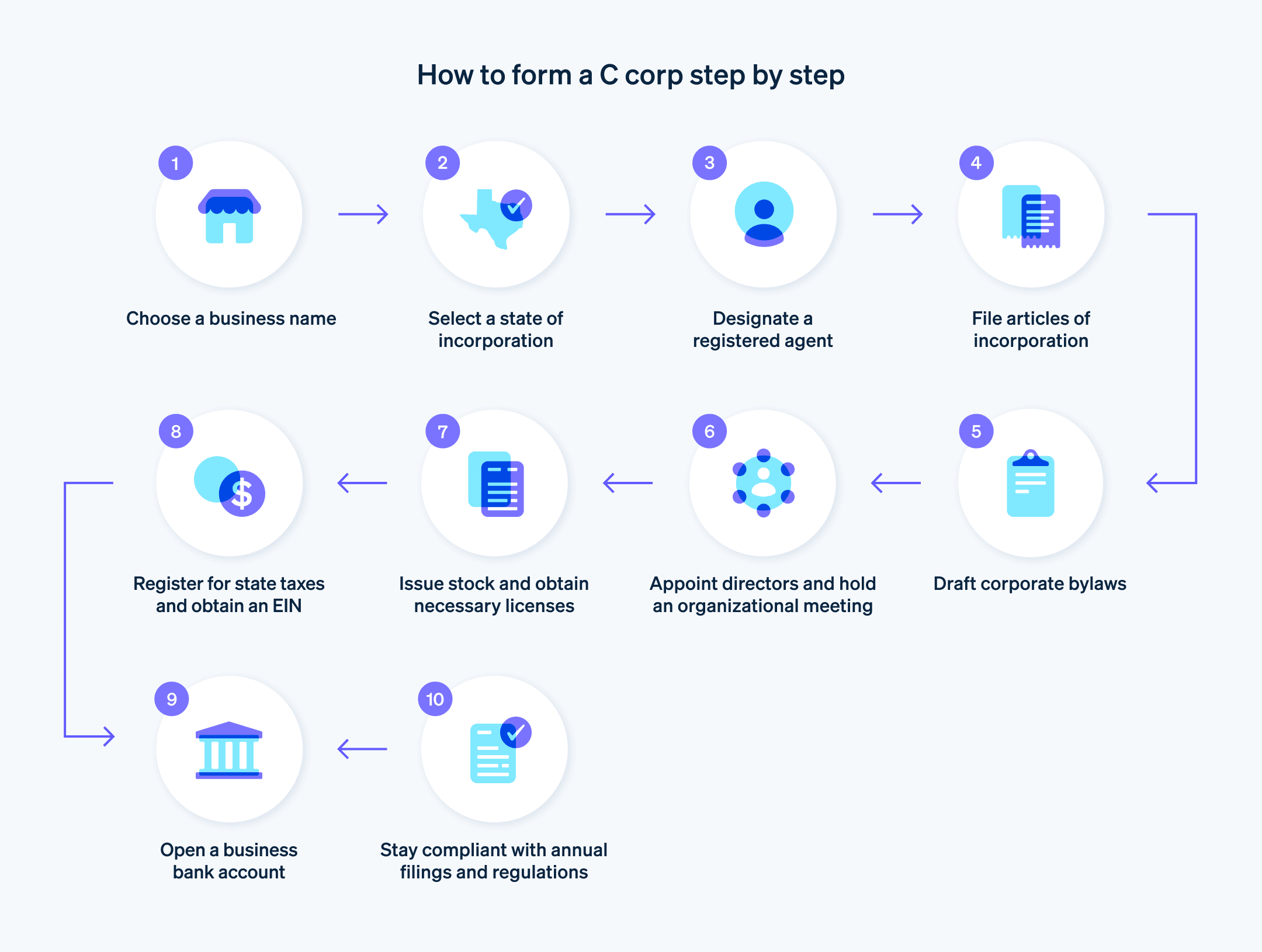

Setting up a C corp is a structured process that requires diligence, organization, and a keen understanding of state and federal requirements. It might seem tedious at times, but failure to adhere to the appropriate protocols will only complicate the process. Here’s a rundown of the steps involved in forming a C corp:

1. Choose a business name

Forming a C corp begins with selecting a business name. It’s important that the name distinguishes the corporation from other entities registered in the state of incorporation. Most states will also have stipulations around the inclusion of specific designations within the name, such as “corporation,” “incorporated,” “limited,” or abbreviations of these terms, signaling the business’s formal status as a corporate entity.

2. Select a state of incorporation

Deciding where to incorporate is pivotal. While many businesses default to the state in which they are based because of convenience and familiarity, some gravitate toward certain states that are renowned for their favorable business environments. Delaware, for instance, is a popular choice because of its advanced and flexible corporate laws, while Nevada offers benefits in terms of tax structures. California is another popular choice.

3. Designate a registered agent

Every C corp needs a registered agent, an individual or entity responsible for receiving legal papers, including litigation-related documents or official state communications. To qualify, the agent must maintain a physical address within the state of incorporation and be at the business during regular business hours to receive and respond to official notices.

4. File articles of incorporation

This foundational document encompasses fundamental details such as the business name, address, designated registered agent, and nature and number of stocks to be issued. A business must file the articles with the secretary of state’s office or a similar governing body and pay a filing fee to formalize the corporation’s status.

5. Draft corporate bylaws

Bylaws serve as the corporation’s internal rulebook. They dictate the operational procedures, delineate the rights and obligations of the shareholders, officers, and directors, and lay out the administrative framework of the business. Maintaining detailed and clear bylaws is important for transparency and conflict resolution.

6. Appoint directors

Directors play a pivotal role in steering the corporation and making significant decisions. Initially, the incorporator or a group of individuals involved in forming the corporation usually will appoint the directors. Typically, these initial appointees hold their positions until the corporation’s first official shareholder meeting, when shareholders will elect the board of directors.

7. Conduct an organizational meeting

This initial meeting acts as a launchpad for the corporation’s activities. Here, the directors adopt the previously drafted bylaws, appoint corporate officers to manage the daily operations, and address other pertinent startup matters while keeping detailed meeting minutes.

8. Issue stock

C corps issue shares to raise capital and provide ownership stakes. These shares, defined in the articles of incorporation, are distributed to initial shareholders and serve as evidence of their ownership in the corporation.

9. Apply for licenses and permits

The nature and location of the business dictate the licenses and permits it requires. From city business licenses to specialized permits, these legal documents authorize the corporation to operate within its industry and locale.

10. Register for state taxes

Tax obligations vary from state to state. If the state imposes a sales tax and the corporation deals in taxable goods or services, it must obtain a sales tax permit to collect tax from customers.

11. Obtain an employer identification number (EIN)

An EIN, often compared to a Social Security number for businesses, is a federal tax ID that the IRS issues. This number is a prerequisite for many business activities, from hiring employees to filing federal tax returns.

12. Open a business bank account

Combining personal and business funds can be a serious mistake, with the potential to undermine the limited liability shield that a corporation provides. Opening a dedicated business bank account is key to maintaining clear financial boundaries.

13. Stay compliant

Forming a C corp is just the beginning of a business’s journey. To maintain its status, a corporation must consistently adhere to state mandates. This includes keeping updated corporate records, conducting and documenting annual meetings, and ensuring all licenses and permits remain current.

How Stripe can help

Stripe Atlas makes it simple to incorporate and set up your company so you’re ready to charge customers, hire your team, and fundraise as quickly as possible.

Fill out your company details in the Stripe Atlas form in less than 10 minutes. Then, we’ll incorporate your company in Delaware, get your IRS tax ID (EIN) for you, help you purchase your shares in the new company with one click, and automatically file your 83(b) tax election. Atlas offers multiple legal templates for contracts and hiring and can also help you open a bank account and start accepting payments even before the IRS assigns your tax ID.

Atlas founders also gain access to exclusive discounts at leading software partners, one-click onboarding with select partners, and free Stripe payments processing credits. Start your company today.

The Stripe Atlas application

It takes less than 10 minutes to fill out the details of your new company. You’ll choose your company structure (C corporation, limited liability company, or subsidiary) and pick a company name. Our instant company name checker will let you know if it’s available before you submit your application. You can add up to four additional cofounders, decide how you split equity between them, and reserve an equity pool for future teammates if you choose. You’ll appoint officers, add an address and phone number (founders are eligible for one year of a free virtual address if you need one), and review and sign your legal documents in one click.

Forming the company in Delaware

Atlas will review your application and file your formation documents in Delaware within one business day. All Atlas applications include expedited 24-hour processing service at the state, for no extra fee. Atlas charges $500 for your formation and your first year of registered agent services (a state compliance requirement), and $100 each year thereafter to maintain your registered agent.

Getting your IRS tax ID (EIN)

After your formation in Delaware is complete, Atlas will file for your company’s IRS tax ID. Founders who provide a US Social Security number, US address, and US phone are eligible for expedited processing; all other users will receive standard processing. For standard orders, Atlas calls the IRS to retrieve the EIN for you, using real-time IRS data to determine when your filing is likely to be available. You can read more about how Atlas retrieves your EIN and view current tax ID ETAs.

Purchasing your shares in the company

After Atlas forms the company, we’ll automatically issue shares to the founders and help you purchase them so you formally own your share in the company. Atlas allows founders to purchase their shares with intellectual property in one click and reflect this in your company documents, so you don’t need to mail and track cash or check payments.

Filing your 83(b) tax election

Many startup founders choose to file an 83(b) tax election to potentially save on future personal taxes. Atlas can file and mail your 83(b) tax election in one click for both US and non-US founders—no trip to the post office required. We’ll file it using USPS Certified Mail with tracking, and you’ll get a copy of your signed 83(b) election and proof of filing in your Dashboard.

Partner perks and discounts

Atlas partners with a range of third-party tools to offer special pricing or access to Atlas founders. We offer discounts on engineering, tax and finance, compliance, and operations tools, including OpenAI and Amazon Web Services. Atlas also partners with Mercury, Carta, and AngelList to provide faster, automatic onboarding using your Atlas company information, so you can get ready to bank and fundraise even faster. Atlas founders may also access discounts on other Stripe products, including up to one year of free credits toward payments processing.

Read our Atlas guides for startup founders, or learn more about Stripe Atlas and how it can help you set up your new business quickly and easily. Start your company now.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.