Deferred revenue is an accounting concept that provides a snapshot of a business’s financial health and operational agility. In subscription-based or prepayment business models, deferred revenue is an especially informative metric for stakeholders ranging from CFOs to investors.

The importance of deferred revenue also extends beyond the balance sheet to other business concerns, including liquidity, regulatory compliance, and valuation. A nuanced understanding of deferred revenue can improve transparency in financial reporting and inform strategic decisions.

Below, we’ll cover the financial implications of deferred revenue. Here’s what you should know.

What’s in this article?

- What is deferred revenue?

- What accounting principles are involved in deferred revenue?

- Deferred revenue vs. accrued revenue

- How deferred revenue affects financial statements

- How to manage and track deferred revenue

- Risks with deferred revenue and how to mitigate them

What is deferred revenue?

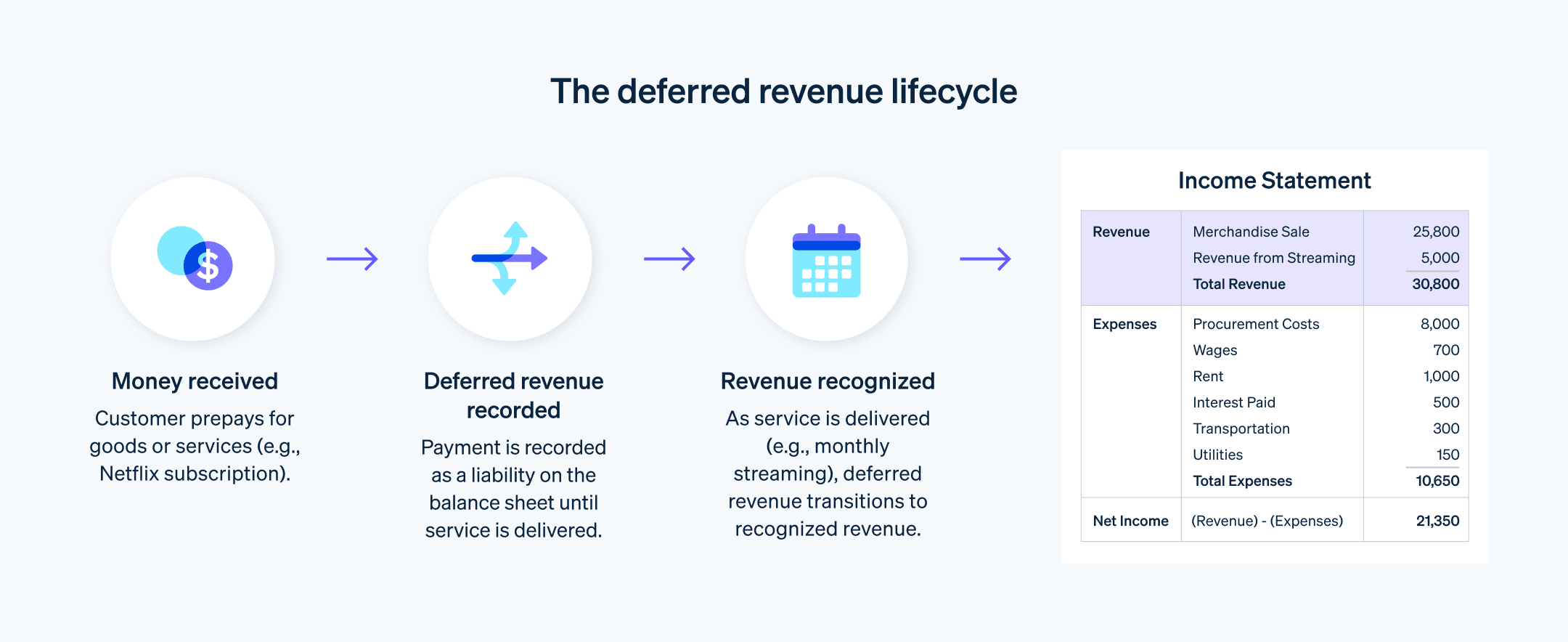

Deferred revenue is money you’ve received but haven’t yet earned. When you finally deliver what you promised, you can then move that money over to the revenue column in your financial statement.

For instance, consider a subscription service such as Netflix. When someone pays for a month or a year up front, that money doesn’t instantly turn into “revenue.” After all, Netflix still has to provide a month’s or a year’s worth of streaming services. The payment sits on the books as deferred revenue, and it transforms into recognized revenue as the service is delivered over time. (For a detailed example of what this looks like for a major subscription-based company, check out Roblox’s financial report for the second quarter of 2023.)

Which accounting principles are involved in deferred revenue?

Two generally accepted accounting principles (GAAPs) are involved with deferred revenue: revenue recognition and accrual accounting.

Revenue recognition principles define when and how a business’s revenue should be recognized. Revenue recognition defines the accounting period to which a business’s revenue and expenses are attributed.

The accrual accounting principle, which falls under the revenue recognition umbrella, states that revenues and expenses should be recognized in the financial statements that correspond to when they are earned—regardless of when payment is received. In other words, accrual accounting focuses on the timing of the work that a business does to earn revenue, rather than focusing on the timing of payment. So if you run a subscription service—such as a software-as-a-service (SaaS) business—you recognize revenue as you provide each month of service, shifting money from the deferred revenue account to the earned revenue account as you go.

Deferred revenue can impact your tax liability depending on the tax regulations in your jurisdiction. Generally, you won’t owe taxes on that deferred revenue until you’ve actually earned it. It’s a nice perk that offers some leeway for planning and resource allocation.

Deferred revenue also has implications for financial reporting. It’s featured on your balance sheet as a liability, and anyone evaluating the financial health of your business—investors, financial analysts, or potential acquirers—will look at this line item. A high amount of deferred revenue might indicate strong customer commitment and loyalty, but it might also suggest a lot of deliverables are pending.

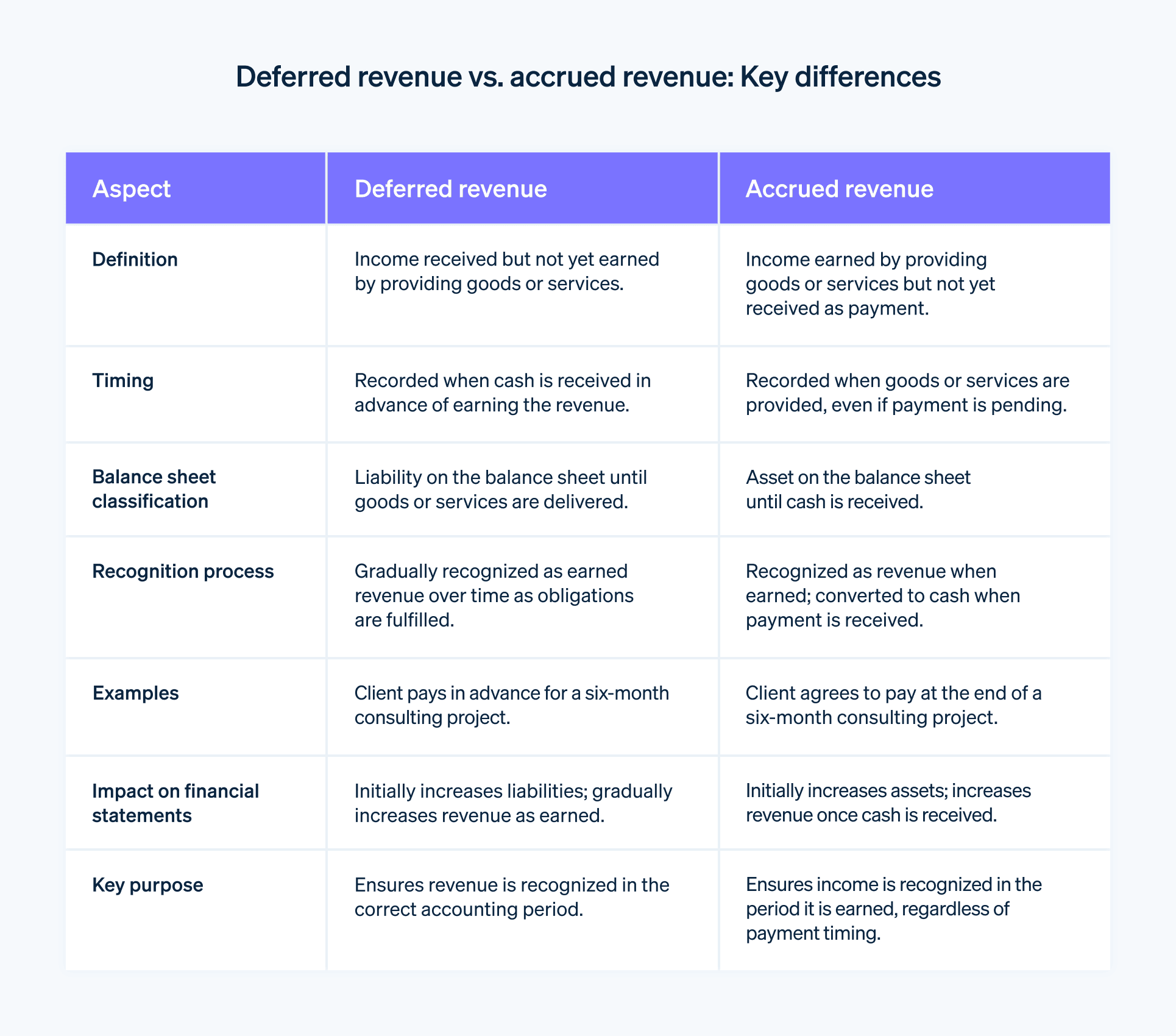

Deferred revenue vs. accrued revenue

Deferred revenue and accrued revenue are two different concepts, but they are both rooted in the principle of accrual accounting and serve a common goal of making your financials as accurate as possible. They relate to the timing of revenue recognition, serving as placeholders on your balance sheet until you’ve either earned or paid what’s due.

Deferred revenue is recorded as income you’ve received, but haven’t yet earned by providing goods or services. Once those are provided, deferred revenue is then recognized as earned revenue. However, accrued revenue is the opposite. Accrued revenue is income you’ve earned by providing goods or services, but haven’t yet been paid for. It appears as an asset on your balance sheet. When the cash eventually comes in, that asset is converted into recognized revenue.

Imagine you run a consulting business. If a client pays you in advance for a six-month project, that payment initially goes into deferred revenue. As you complete the work each month, you’ll gradually move amounts from deferred revenue to earned revenue.

Now, let’s say another client agrees to pay you at the end of a six-month project. You’ll provide the consulting services each month without receiving payment, and you’ll record this as accrued revenue. When you finally get paid, the accrued revenue is recognized as received revenue.

These concepts help maintain the integrity of your financial statements. They let you match your income and expenses to the periods in which they were earned or incurred, not merely when cash was exchanged. Both deferred and accrued revenue require meticulous tracking and management. They directly influence metrics for profitability and cash flow, which are key to operational planning and strategic decision-making.

How deferred revenue affects financial statements

Deferred revenue affects your financial statements in a variety of ways:

Appears as a liability on the balance sheet

When you get paid for a good or service you haven’t delivered yet, this payment isn’t considered revenue right away. Instead, it goes into a deferred revenue account and is classified as a liability on your balance sheet. This is because you owe your customer something—be it a product or a service—at a future date.Shifts to earned revenue over time

As you deliver that product or provide that service, revenue moves from the deferred revenue account to the earned revenue section of your income statement. In accounting terms, this reflects gradual “earning” of that revenue as you fulfill your commitments.Influences key performance indicators

Metrics such as liquidity ratios can be impacted by the amount of deferred revenue. For example, a large amount of deferred revenue can suggest future financial stability, given that it’s money already collected. But those funds are a promise of future services or goods, so they also imply an obligation to deliver.Impacts cash flow but not immediately taxable

Although deferred revenue contributes to positive cash flow, it usually isn’t subject to income taxes until it becomes earned revenue. This can provide some breathing room for financial planning and resource allocation.Factors into valuation and due diligence

Anyone scrutinizing your company’s financial health—investors, analysts, potential buyers—will pay attention to deferred revenue. High levels indicate committed customers, but they also mean you have deliverables to fulfill. This can sway valuations and inform decisions on investments or mergers.Needs to be tracked to meet compliance standards

It’s important to accurately track deferred revenue for adhering to evolving compliance standards. These standards include the Financial Accounting Standards Board’s 2021 rule mandating that acquiring companies recognize deferred revenue of acquirees on the date of acquisition.Requires attentive management

Deferred revenue needs ongoing management to ensure appropriate amounts are moved to earned revenue as obligations are met. This requires good bookkeeping practices and in-depth knowledge of your company’s revenue cycles.

Understanding how deferred revenue interacts with your financial statements has practical implications for managing your company’s finances and can significantly influence how external parties perceive your business.

How to manage and track deferred revenue

The process of managing and tracking deferred revenue will become simpler with the right methods and tools. Here’s a step-by-step guide:

Get a comprehensive view of all revenue

Review what you’ve earned already and what you expect to earn in the future. With a platform such as Stripe, you can see all your revenue sources at a glance—subscriptions, invoices, and transactions are all clearly labeled and easily accessible. If you have revenue sources outside of Stripe, there are ways to incorporate those, too.Use automated reports and dashboards

Choose an accounting or payment system that updates in real time and gives you a snapshot of where your business stands financially. For instance, Stripe’s revenue recognition feature provides charts, tables, and journal entries that give you a quick but detailed look. The “revenue waterfall” is especially handy. It breaks down revenue by month and shows what’s been recognized and what’s deferred.Customize based on your business needs

Individual businesses have different accounting requirements. Choose a system where you can set rules for different revenue types. With Stripe, you can make adjustments such as excluding certain fees or handling tax treatments. The platform also allows historical adjustments, which can be key if you need to revisit past records.Stay audit-ready

Nobody loves audits, but they’re a part of business life. Make it easier on yourself by choosing a system that lets you review finances with ease. Stripe’s platform, for example, allows you to effortlessly trace recognized and deferred revenue back to the individual invoices and customers. This kind of transparency can save a lot of headaches later on.

With the right tools for managing and tracking revenue, such as Stripe’s solutions, you’ll be well-equipped to keep everything in order. Make sure to always keep your specific business requirements at the center of your decision-making process, and choose the systems and methods that fulfill your needs.

Risks with deferred revenue and how to mitigate them

Deferred revenue represents money received from customers for goods or services that haven’t yet been delivered. As straightforward as it might sound, managing this financial element poses several risks that businesses must be aware of. Directly addressing these risks can make a significant difference in a company’s financial health and customer relationships.

Misreporting

When deferred revenue isn’t recorded accurately, the entire financial picture can become distorted. Think of a software company that gets paid up front for a year-long subscription. If this income is immediately recognized rather than deferred and spread out over the year, the company might appear more profitable than it truly is. This discrepancy can lead to flawed business decisions based on inflated revenue figures.

To counter this, many businesses turn to reliable accounting systems. Platforms such as Stripe have been designed with features that automate the process of revenue recognition. This automation reduces human error, ensuring that financial statements are a true representation of the company’s position.

Audit complications

The complexities of deferred revenue can make audits more challenging, especially if there’s any ambiguity in the records. Consider a magazine publisher with subscribers spanning various contract lengths and start dates. If auditors can’t easily track payments and corresponding delivery obligations, the audit process becomes painstaking.

Solutions such as Stripe offer traceability that links recognized and deferred revenue directly to specific invoices and customer agreements. Such transparency can simplify the audit process, making it less stressful and more efficient.

Cash flow ambiguity

Cash management is more complex with deferred revenue. A business might have a substantial inflow of cash from prepayments, leading it to believe it has more liquid assets than it can actually use. For instance, a gym collecting yearly membership fees in January might be tempted to invest heavily or expand. But if it doesn’t factor in the cost of providing fitness services to these members throughout the year, it could run into liquidity issues in the future.

Regularly monitoring the cash-to-revenue ratio is one way to combat this. Stripe offers features such as the revenue waterfall chart, which provides a breakdown of recognized versus deferred revenue on a month-by-month basis. With such insights, businesses can plan expenditures more judiciously.

Customer expectations

Lastly, it’s important to manage customer expectations when dealing with deferred revenue. Customers who prepay do so with a certain level of trust, expecting timely delivery of the promised goods or services. Let’s say a person pays up front for a 10-session yoga class package. If they’re constantly dealing with canceled sessions or subpar instructors, their trust erodes, possibly leading to refund requests or negative reviews.

To mitigate this, businesses should strictly track all deliverables and commitments, ensuring they consistently meet or exceed customer expectations.

While deferred revenue presents challenges, proactive management and the right tools can help businesses address these challenges effectively. Solutions such as Stripe can simplify some of these complexities, making it easier for businesses to stay on top of their obligations and maintain a positive relationship with their customer base.

Learn more about revenue recognition with Stripe.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.