รายรับที่รอการตัดบัญชีเป็นแนวคิดทางบัญชีที่ให้ภาพรวมสถานะทางการเงินของธุรกิจและความคล่องตัวในการดำเนินงาน ในรูปแบบธุรกิจที่มีโมเดลชำระเงินตามรอบบิลหรือชำระเงินล่วงหน้า รายรับที่รอการตัดบัญชีถือเป็นเมตริกซึ่งมอบข้อมูลที่เป็นประโยชน์อย่างยิ่งสำหรับผู้มีส่วนเกี่ยวข้อง ตั้งแต่ CFO ไปจนถึงนักลงทุน

ความสำคัญของรายรับที่รอการตัดบัญชีนั้นยังขยายออกไปนอกเหนือจากงบดุล โดยครอบคลุมไปจนถึงข้อกังวลทางธุรกิจอื่นๆ รวมถึงสภาพคล่อง การปฏิบัติตามกฎระเบียบ และการประเมินมูลค่า การทําความเข้าใจรายรับที่รอการตัดบัญชีคร่าวๆ อาจช่วยเพิ่มความโปร่งใสในการรายงานทางการเงินและการตัดสินใจเชิงกลยุทธ์

ด้านล่างนี้ เราจะอธิบายถึงผลกระทบทางการเงินของรายรับที่รอการตัดบัญชี ต่อไปนี้คือสิ่งที่คุณควรรู้

บทความนี้ให้ข้อมูลอะไรบ้าง

- รายรับที่รอการตัดบัญชีคืออะไร

- มีหลักการทำบัญชีใดบ้างที่เกี่ยวข้องกับรายรับที่รอการตัดบัญชี

- รายรับที่รอการตัดบัญชีเทียบกับรายรับค้างรับ

- รายรับที่รอการตัดบัญชีมีผลกับงบการเงินอย่างไร

- วิธีจัดการและติดตามรายรับที่รอการตัดบัญชี

- ความเสี่ยงของรายรับที่รอการตัดบัญชีและวิธีลดความเสี่ยง

รายรับที่รอการตัดบัญชีคืออะไร

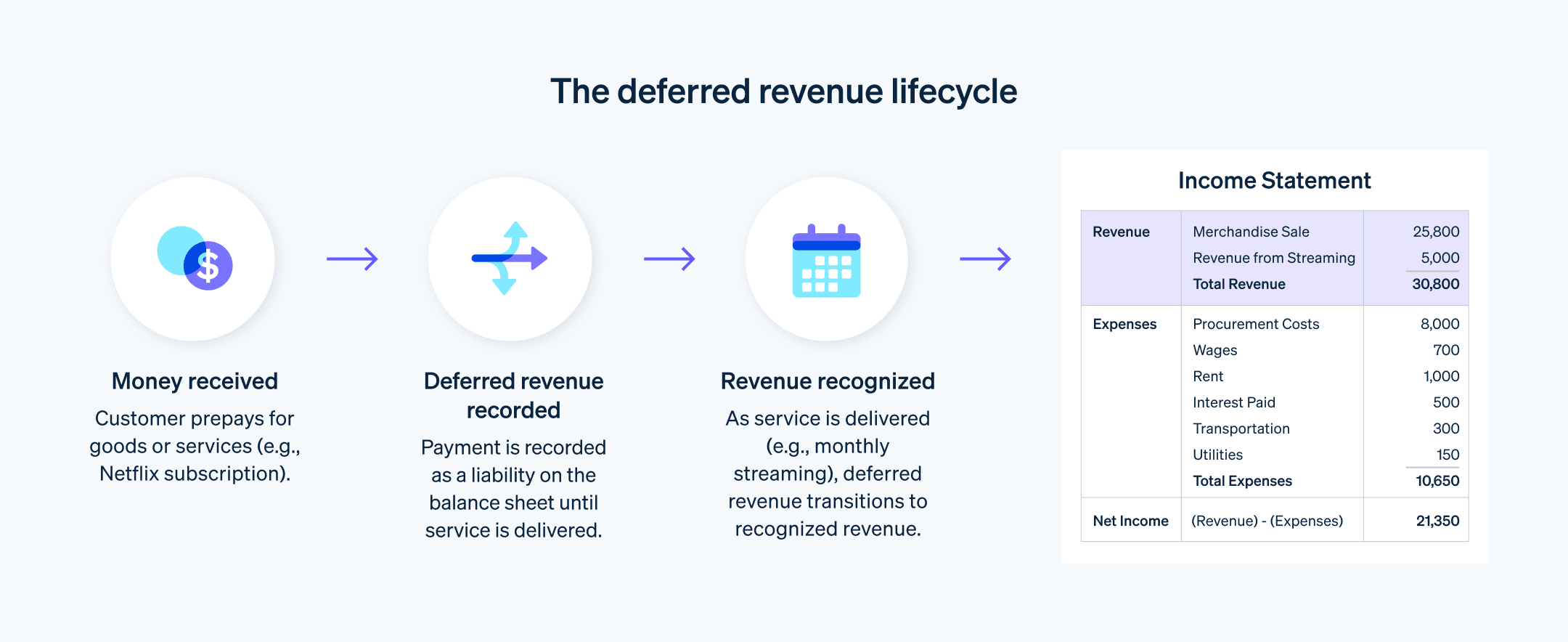

รายรับที่รอการตัดบัญชีคือเงินที่คุณได้รับแต่ยังไม่ได้รับ เมื่อคุณส่งมอบสิ่งที่คุณสัญญาไว้ในที่สุด คุณจะสามารถย้ายเงินนั้นไปที่คอลัมน์รายรับในงบการเงินของคุณได้

ตัวอย่างเช่น บริการแบบชำระเงินตามรอบบิล เช่น Netflix เมื่อมีคนชําระเงินล่วงหน้าหนึ่งเดือนหรือหนึ่งปี เงินนั้นจะไม่ได้เปลี่ยนเป็น "รายรับ" ในทันที อย่างไรก็ตาม Netflix ยังคงต้องให้บริการสตรีมมิงเป็นเวลาหนึ่งเดือนหรือหนึ่งปี การชำระเงินจะอยู่ในบัญชีเป็นรายรับที่รอการตัดบัญชี และจะถูกแปลงเป็นรายรับที่รับรู้เมื่อมีการส่งมอบบริการตามระยะเวลาที่กำหนด (สำหรับตัวอย่างโดยละเอียดว่าบริษัทที่สมัครสมาชิกรายใหญ่จะเป็นอย่างไร โปรดดูรายงานทางการเงินของ Roblox สำหรับไตรมาสที่สองของ 2023)

มีหลักการทำบัญชีใดบ้างที่เกี่ยวข้องกับรายรับที่รอการตัดบัญชี

หลักการบัญชีที่ยอมรับโดยทั่วไปสองประการ (GAAP) เกี่ยวข้องกับรายรับที่รอการตัดบัญชี: การรับรู้รายได้และการทำบัญชีแบบเกณฑ์คงค้าง

หลักการรับรู้รายรับจะกำหนดว่าควรรับรู้รายรับของธุรกิจเมื่อใดและอย่างไร การรับรู้รายรับจะกําหนดรอบการทําบัญชีที่ใช้ระบุรายรับและค่าใช้จ่ายของธุรกิจ

หลักการบัญชีแบบบัญชีค้างรับซึ่งอยู่ภายใต้หลักการการรับรู้รายรับ ระบุว่ารายรับและค่าใช้จ่ายควรได้รับการรับรู้ในงบการเงินที่สอดคล้องกับเวลาที่ได้รับ โดยไม่คำนึงว่าจะได้รับการชำระเงินเมื่อใด กล่าวอีกนัยหนึ่งคือ การทําบัญชีแบบเกณฑ์คงค้างจะเน้นที่กําหนดเวลาของงานที่ธุรกิจสร้างรายได้ แทนที่จะมุ่งเน้นไปที่ช่วงเวลาของการชําระเงิน ดังนั้น หากคุณให้บริการแบบชำระเงินตามรอบบิล เช่น ธุรกิจการให้บริการระบบซอฟต์แวร์ (SaaS) คุณรับรู้รายรับเมื่อให้บริการในแต่ละเดือน โดยเปลี่ยนเงินจากบัญชีรายรับที่รอการตัดบัญชีไปยังบัญชีรายรับที่ได้รับเมื่อเวลาผ่านไป

รายรับที่รอการตัดบัญชีอาจส่งผลกระทบต่อความรับผิดทางภาษีโดยขึ้นอยู่กับข้อบังคับด้านภาษีในเขตอํานาจศาลของคุณ โดยทั่วไปแล้ว คุณจะไม่ต้องเสียภาษีสําหรับรายรับที่รอการตัดบัญชีจนกว่าคุณจะได้รับยอดนี้จริง จึงเป็นสิทธิพิเศษที่ดีที่ให้อิสระในการวางแผนและจัดสรรทรัพยากร

รายรับที่รอการตัดบัญชียังมีนัยยะสําหรับการรายงานทางการเงินด้วย รายการดังกล่าวจะปรากฏในงบดุลของคุณในฐานะหนี้สิน และใครก็ตามที่กำลังประเมินสถานะทางการเงินของธุรกิจของคุณ ไม่ว่าจะเป็นนักลงทุน นักวิเคราะห์ทางการเงิน หรือผู้ที่อาจเข้าซื้อกิจการ จะพิจารณารายการนี้ รายรับที่รอการตัดบัญชีจำนวนมากอาจบ่งชี้ถึงความมุ่งมั่นและความภักดีของลูกค้า แต่ก็อาจบ่งบอกว่ายังมีงานส่งมอบอีกจำนวนมากที่รอดำเนินการอยู่เช่นกัน

รายรับที่รอการตัดบัญชีเทียบกับรายรับค้างรับ

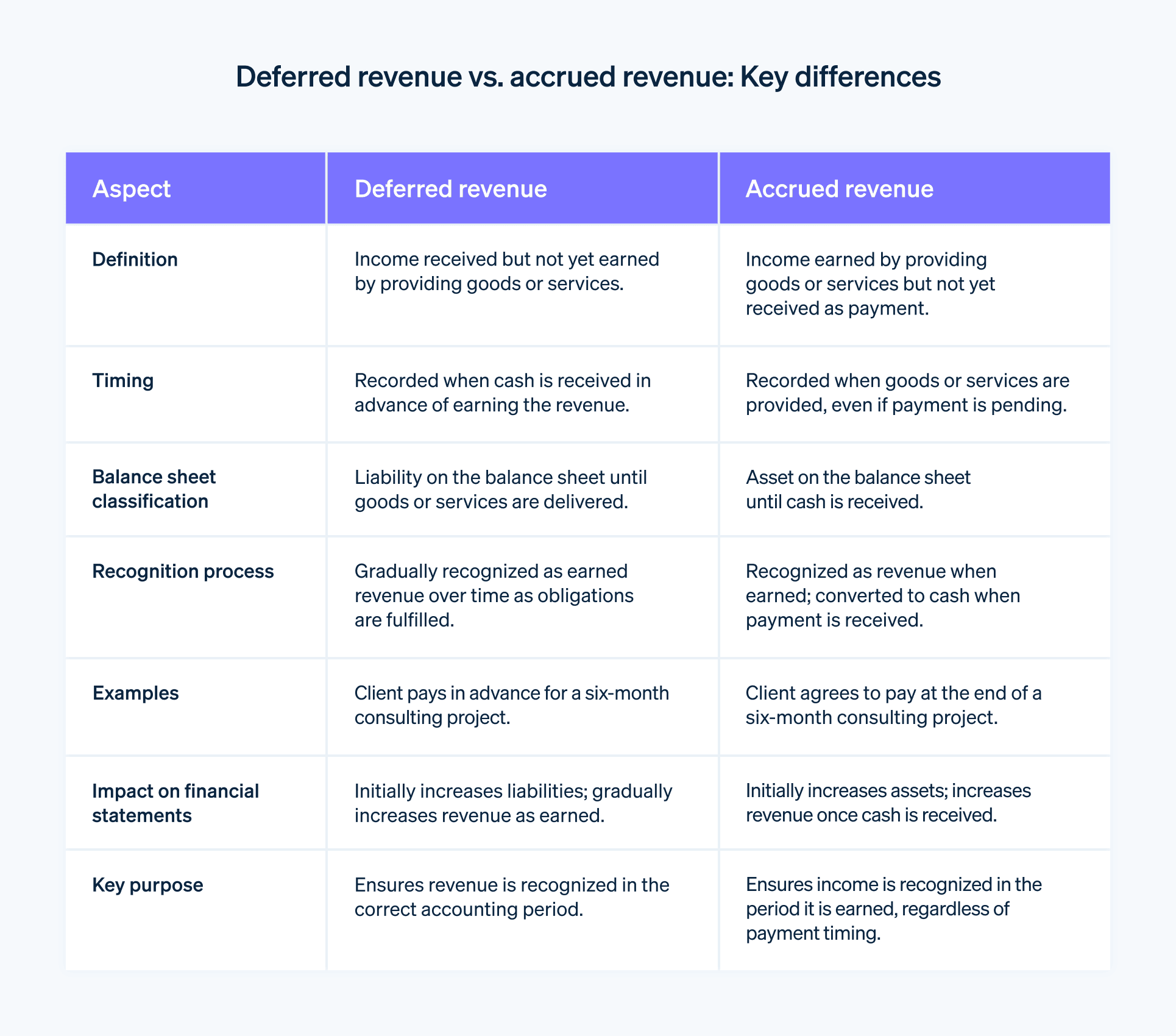

รายรับที่รอการตัดบัญชีและรายรับคงค้างเป็นแนวคิดสองแบบที่แตกต่างกัน แต่แนวคิดทั้งสองนั้นมีรากฐานอยู่ในหลักการการทําบัญชีแบบเกณฑ์คงค้างและมีเป้าหมายทั่วไปร่วมกันในการทําให้การเงินของคุณถูกต้องที่สุดเท่าที่จะเป็นไปได้ สิ่งเหล่านี้มีความเกี่ยวข้องกับช่วงเวลาของการรับรู้รายรับ โดยทำหน้าที่เป็นตัวยึดตำแหน่งในงบดุลของคุณจนกว่าคุณจะได้รับรายรับหรือมีการชำระเงินที่ครบกำหนด

รายรับที่รอการตัดบัญชีจะบันทึกเป็นรายรับที่คุณได้รับ แต่ยังไม่ได้รับจากการจัดหาสินค้าหรือบริการ หลังจากทำตามเงื่อนไขดังกล่าวแล้ว ระบบจะรับรู้รายรับที่รอการตัดบัญชีเป็นรายรับ อย่างไรก็ตาม รายรับคงค้างจะตรงกันข้าม รายรับคงค้างคือรายรับที่คุณได้รับจากการจําหน่ายสินค้าหรือบริการ แต่ยังไม่มีการชําระเงิน โดยจะแสดงเป็นสินทรัพย์ในงบดุลของคุณ เมื่อเงินสดเข้ามาในท้ายที่สุด สินทรัพย์นั้นก็จะถูกแปลงเป็นรายรับที่รับรู้

ลองนึกภาพว่าคุณทําธุรกิจให้คําปรึกษา หากลูกค้าชําระเงินล่วงหน้าสําหรับโครงการระยะเวลา 6 เดือน การชําระเงินดังกล่าวจะเข้าบัญชีรายรับที่รอการตัดบัญชีในตอนแรก เมื่อคุณทํางานเสร็จในแต่ละเดือน คุณจะทยอยย้ายยอดเงินจากรายรับที่รอการตัดบัญชีไปเป็นรายรับที่ได้รับ

ตอนนี้ ลองสมมติว่าลูกค้ารายอื่นตกลงที่จะจ่ายเงินให้คุณเมื่อสิ้นสุดโครงการหกเดือน คุณจะให้บริการคำปรึกษาทุกเดือนโดยไม่ได้รับการชำระเงิน และคุณจะบันทึกเป็นรายรับคงค้าง เมื่อคุณได้รับเงินในท้ายที่สุด ระบบจึงจะรับรู้รายรับคงค้างเป็นรายรับที่ได้รับ

แนวคิดเหล่านี้ช่วยรักษาความถูกต้องสมบูรณ์ให้งบการเงินของคุณ โดยช่วยให้คุณสามารถจับคู่รายรับและรายจ่ายกับช่วงเวลาที่ได้รับหรือเกิดขึ้น ไม่ใช่แค่เฉพาะเมื่อมีการแลกเปลี่ยนเงินสดเท่านั้น ทั้งรายรับที่รอการตัดบัญชีและรายรับคงค้างต้องอาศัยการติดตามและการจัดการอย่างพิถีพิถัน เนื่องจากเมตริกเหล่านี้มีอิทธิพลต่อเมตริกความสามารถในการทํากําไรและกระแสเงินสดโดยตรง จึงเป็นกุญแจสําคัญในการวางแผนการปฏิบัติงานและการตัดสินใจเชิงกลยุทธ์

รายรับที่รอการตัดบัญชีมีผลกับงบการเงินอย่างไร

รายรับที่รอการตัดบัญชีจะส่งผลต่องบการเงินในหลายๆ วิธีดังต่อไปนี้

ปรากฏเป็นหนี้สินในงบดุล

เมื่อคุณได้รับเงินสำหรับสินค้าหรือบริการที่คุณยังไม่ได้ส่งมอบ การชำระเงินนี้จะไม่ถือเป็นรายรับในทันที แต่จะเข้าบัญชีรายรับที่รอกาการตัดบัญชีและจัดเป็นหนี้สินในงบดุลของคุณ เนื่องจากคุณติดหนี้บางสิ่งบางอย่างต่อลูกค้าของคุณในอนาคต ไม่ว่าจะเป็นผลิตภัณฑ์หรือบริการการเปลี่ยนไปสู่รายรับเมื่อเวลาผ่านไป

เมื่อคุณส่งมอบผลิตภัณฑ์หรือให้บริการ รายรับจะถูกย้ายจากบัญชีรายรับที่รอการตัดบัญชีไปยังส่วนรายรับที่ได้รับในรายงานรายได้ของคุณ ในทางบัญชี นี่สะท้อนถึงการ "ได้รับ" รายรับอย่างค่อยเป็นค่อยไปเมื่อคุณปฏิบัติตามภาระผูกพันอิทธิพลต่อตัวบ่งชี้ประสิทธิภาพการทํางานหลัก

เมตริก เช่น อัตราส่วนสภาพคล่อง อาจได้รับผลกระทบจากจํานวนรายรับที่รอการตัดบัญชี ตัวอย่างเช่น รายรับที่ีรอการตัดบัญชีจํานวนมากสามารถบ่งชี้ถึงความมั่นคงทางการเงินในอนาคต เนื่องจากเป็นเงินที่จัดเก็บได้แล้ว แต่เงินทุนดังกล่าวถือเป็นคำมั่นสัญญาในการให้บริการหรือสินค้าในอนาคต ดังนั้นจึงยังแสดงถึงภาระผูกพันที่จะต้องส่งมอบด้วยส่งผลกระทบต่อกระแสเงินสด แต่ไม่ต้องเสียภาษีในทันที

แม้ว่ารายรับที่รอการตัดบัญชีจะก่อให้เกิดกระแสเงินสดเป็นบวก แต่โดยปกติแล้วจะไม่ต้องเสียภาษีเงินได้จนกว่ารายรับดังกล่าวจะกลายเป็นรายรับที่ได้รับจริงๆ จึงช่วยให้มีพื้นที่ในการวางแผนทางการเงินและการจัดสรรทรัพยากรได้ปัจจัยในการประเมินมูลค่าและการตรวจสอบข้อมูล

ใครก็ตามที่กำลังตรวจสอบสุขภาพทางการเงินของบริษัทของคุณ ไม่ว่าจะเป็นนักลงทุน นักวิเคราะห์ หรือผู้ที่อาจเป็นผู้ซื้อ จะต้องใส่ใจกับรายรับที่รอการตัดบัญชี โดยในภาพรวมนั้นบ่งชี้ถึงลูกค้าที่มีความมุ่งมั่น แต่ยังหมายความอีกด้วยว่าคุณมีงานส่งมอบที่ต้องปฏิบัติตาม ปัจจัยนี้อาจมีส่วนเกี่ยวข้องในการประเมินและตัดสินใจเกี่ยวกับการลงทุนหรือการควบรวมกิจการต้องมีการติดตามเพื่อให้ได้มาตรฐานการปฏิบัติตามข้อกําหนด

การติดตามรายรับที่รอการตัดบัญชีอย่างถูกต้องแม่นยําคือการยึดมั่นต่อมาตรฐานการปฏิบัติตามข้อกําหนดที่เปลี่ยนแปลงไป มาตรฐานเหล่านี้รวมถึงกฎเกณฑ์ของคณะกรรมการมาตรฐานการบัญชีทางการเงินปี 2021 ซึ่งกำหนดให้บริษัทที่เข้าซื้อกิจการต้องบันทึกรายรับที่รอการตัดบัญชีของผู้ถูกเข้าซื้อกิจการในวันที่เข้าซื้อกิจการต้องมีการจัดการที่เอาใจใส่

รายรับที่รอการตัดบัญชีต้องมีการจัดการอย่างต่อเนื่องเพื่อให้แน่ใจว่าจำนวนเงินที่เหมาะสมจะถูกโอนไปยังรายได้ที่ได้รับเมื่อปฏิบัติตามภาระผูกพัน ขั้นตอนนี้ต้องอาศัยแนวทางการทําบัญชีที่ดีและความรู้เชิงลึกเกี่ยวกับวงจรรายรับของบริษัท

การทำความเข้าใจว่ารายรับที่รอการตัดบัญชีมีปฏิสัมพันธ์กับงบการเงินของคุณอย่างไรนั้นมีผลในทางปฏิบัติต่อการจัดการการเงินของบริษัทของคุณ และสามารถส่งผลอย่างมากต่อมุมมองของบุคคลภายนอกที่มีต่อธุรกิจของคุณ

วิธีจัดการและติดตามรายรับที่รอการตัดบัญชี

กระบวนการจัดการและการติดตามรายรับที่รอการตัดบัญชีจะง่ายขึ้นเมื่อใช้วิธีการและเครื่องมือที่เหมาะสม ต่อไปนี้คือคําแนะนําแบบทีละขั้นตอน

ตรวจสอบภาพรวมของรายรับทั้งหมด

ตรวจสอบรายได้ที่คุณได้รับแล้วและสิ่งที่คุณคาดว่าจะได้รับในอนาคต เมื่อใช้แพลตฟอร์มเช่น Stripe คุณสามารถดูแหล่งที่มาของรายได้ทั้งหมดของคุณได้ในทันที ไม่ว่าจะเป็นการสมัครสมาชิก ใบแจ้งหนี้ และธุรกรรมต่างๆ จะถูกระบุไว้อย่างชัดเจนและเข้าถึงได้ง่าย หากมีแหล่งรายรับนอก Stripe คุณจะผสานการทํางานกับแหล่งดังกล่าวได้เช่นกันใช้รายงานและแดชบอร์ดอัตโนมัติ

เลือกระบบบัญชีหรือการชำระเงินที่อัปเดตแบบเรียลไทม์ และแสดงภาพรวมว่าธุรกิจของคุณมีสถานะทางการเงินเป็นอย่างไร ตัวอย่างเช่น ฟีเจอร์การรับรู้รายรับจะแสดงแผนภูมิ ตาราง และรายการบันทึกที่ช่วยให้คุณดูข้อมูลได้อย่างรวดเร็วและละเอียด นอจากนี้ "แผนภูมิลําดับขั้นเกี่ยวกับรายรับ" ก็ยังมีประโยชน์เป็นพิเศษ โดยจะแบ่งรายรับออกเป็นรายเดือน และแสดงรายรับที่รับรู้และรายรับที่รอการตัดบัญชีปรับแต่งตามความต้องการทางธุรกิจของคุณ

ธุรกิจแต่ละแห่งมีข้อกําหนดการทําบัญชีที่แตกต่างกัน ดังนั้น ให้เลือกระบบที่คุณจะตั้งกฎสําหรับรายรับประเภทต่างๆ ได้ เมื่อใช้ Stripe คุณสามารถทำการปรับเปลี่ยน เช่น ยกเว้นค่าธรรมเนียมบางรายการหรือดำเนินการด้านภาษีได้ นอกจากนี้แพลตฟอร์มยังอนุญาตให้ปรับยอดที่ผ่านมา ซึ่งอาจมีความสําคัญหากคุณต้องการกลับไปทบทวนบันทึกในอดีตเตรียมพร้อมสําหรับการตรวจสอบ

ไม่มีใครชอบการตรวจสอบ แต่กระบวนการนี้เป็นส่วนหนึ่งของเส้นทางการทำธุรกิจ ลดภาระงานให้ตัวคุณเองโดยเลือกใช้ระบบที่ช่วยให้คุณทำการตรวจสอบการเงินได้อย่างง่ายดาย ตัวอย่างเช่น แพลตฟอร์มของ Stripe ช่วยให้คุณสามารถติดตามรายได้ที่รับรู้และรอการตัดบัญชีกลับไปยังใบแจ้งหนี้และลูกค้ารายบุคคลได้อย่างง่ายดาย ความโปร่งใสเช่นนี้จะช่วยลดภาระปวดหัวได้มากในภายหลัง

ด้วยเครื่องมือที่เหมาะสมสำหรับการจัดการและติดตามรายรับ เช่น โซลูชันของ Stripe คุณจะพร้อมที่จะจัดการทุกอย่างให้เป็นระเบียบ ทั้งนี้ โปรดตรวจสอบให้แน่ใจว่าคุณจะยึดถือความต้องการเฉพาะทางธุรกิจเป็นศูนย์กลางในการตัดสินใจอยู่เสมอ และเลือกระบบและวิธีการที่ตอบสนองความต้องการของคุณ

ความเสี่ยงของรายรับที่รอการตัดบัญชีและวิธีลดความเสี่ยง

รายรับที่รอการตัดบัญชีคือเงินที่ได้รับจากลูกค้าสําหรับสินค้าหรือบริการที่ยังไม่ได้จัดส่ง แม้จะฟังดูตรงไปตรงมา แต่การจัดการองค์ประกอบทางการเงินนี้มีความเสี่ยงหลายประการที่ธุรกิจต้องตระหนักถึง การจัดการความเสี่ยงเหล่านี้โดยตรงสามารถสร้างความแตกต่างได้อย่างมีนัยสำคัญต่อสถานะทางการเงินของบริษัทและความสัมพันธ์กับลูกค้า

การรายงานที่ผิดพลาด

หากรายรับที่รอการตัดบัญชีไม่ได้รับการบันทึกอย่างถูกต้อง ภาพรวมทางการเงินทั้งหมดอาจบิดเบือนได้ ลองนึกถึงบริษัทซอฟต์แวร์ที่รับเงินล่วงหน้าสําหรับการสมัครใช้บริการเป็นระยะเวลานานหลายปี หากรับรู้รายได้นี้ทันทีแทนที่จะรอตัดในภายหลังและแบ่งออกไปตลอดทั้งปี บริษัทอาจดูมีกำไรมากกว่าที่เป็นจริง ข้อมูลที่ไม่ตรงกันนี้อาจนําไปสู่การตัดสินใจทางธุรกิจที่ผิดพลาด โดยอิงตามตัวเลขรายรับที่ไม่เพียงพอ

ธุรกิจจํานวนมากหันมาใช้ระบบการทำบัญชีที่น่าเชื่อถือเพื่อตอบโต้ปัญหานี้ แพลตฟอร์มอย่าง Stripe ได้รับการออกแบบมาให้มีฟีเจอร์ที่ดําเนินการรับรู้รายรับโดยอัตโนมัติ ระบบอัตโนมัตินี้จะช่วยลดข้อผิดพลาดของมนุษย์ ทำให้มั่นใจได้ว่างบการเงินจะแสดงสถานะของบริษัทได้อย่างแท้จริง

ความซับซ้อนในการตรวจสอบ

ความซับซ้อนของรายรับที่รอการตัดบัญชีสามารถทําให้การตรวจสอบมีความท้าทายมากยิ่งขึ้น สมมติว่ามีสำนักพิมพ์นิตยสารที่มีสมาชิกซึ่งมีระยะเวลาสัญญาและวันที่เริ่มต้นแตกต่างกัน หากผู้ตรวจสอบไม่สามารถติดตามการชำระเงินและภาระผูกพันในการจัดส่งที่สอดคล้องกันได้อย่างง่ายดาย กระบวนการตรวจสอบก็จะกลายเป็นเรื่องยาก

โซลูชันเช่น Stripe นำเสนอการตรวจสอบย้อนกลับที่เชื่อมโยงรายรับที่รับรู้และรอการตัดบัญชีกับใบแจ้งหนี้และข้อตกลงกับลูกค้าโดยตรง ความโปร่งใสดังกล่าวสามารถทําให้กระบวนการตรวจสอบง่ายขึ้น ลดภาระงานที่ตึงเครียด และช่วยประสิทธิภาพมากขึ้น

ความไม่ชัดเจนของกระแสเงินสด

การจัดการเงินสดจะซับซ้อนมากขึ้นหากมีรายรับที่รอการตัดบัญชี ธุรกิจอาจมีเงินสดขาเข้าจำนวนมากจากการชำระเงินล่วงหน้า ซึ่งทำให้เชื่อว่าตนเองมีสินทรัพย์สภาพคล่องมากกว่าที่สามารถใช้ได้จริง ตัวอย่างเช่น ฟิตเนสที่เรียกเก็บค่าธรรมเนียมการเป็นสมาชิกรายปีในเดือนมกราคมอาจอยากทำการลงทุนหรือขยายกิจการ แต่ถ้าหากไม่คำนึงถึงค่าใช้จ่ายในการให้บริการฟิตเนสแก่สมาชิกเหล่านี้ตลอดทั้งปี ก็อาจประสบปัญหาสภาพคล่องในอนาคต

การติดตามอัตราส่วนเงินสดต่อรายได้อย่างสม่ำเสมอถือเป็นวิธีหนึ่งในการแก้ไขปัญหานี้ Stripe นำเสนอฟีเจอร์ต่างๆ เช่น แผนภูมิรายรับแบบลำดับขั้น ซึ่งให้รายละเอียดระหว่างรายรับที่รับรู้และรายรับที่รอการตัดบัญชีในแต่ละเดือน ธุรกิจต่างๆ จะสามารถวางแผนรายจ่ายได้อย่างรอบคอบมากขึ้นด้วยข้อมูลเชิงลึกดังกล่าว

ความคาดหวังของลูกค้า

สุดท้ายนี้ สิ่งสำคัญคือการจัดการความคาดหวังของลูกค้าเมื่อต้องจัดการกับรายรับที่รอการตัดบัญชี ลูกค้าที่ชำระเงินล่วงหน้ามีความเชื่อมั่นในระดับหนึ่ง และคาดหวังว่าจะได้รับสินค้าหรือบริการตามที่สัญญาไว้ตรงเวลา สมมติว่ามีคนจ่ายเงินล่วงหน้าสําหรับแพ็กเกจคลาสโยคะ 10 เซสชัน แต่หากเซสชันถูกยกเลิกหรือได้พบผู้สอนไม่ได้มาตรฐานอย่างต่อเนื่อง ความไว้วางใจของพวกเขาก็จะลดลง ซึ่งอาจนำไปสู่การขอคืนเงินหรือการเขียนรีวิวเชิงลบ

เพื่อบรรเทาปัญหานี้ ธุรกิจต่างๆ ควรติดตามผลงานส่งมอบและข้อผูกพันทั้งหมดอย่างเคร่งครัด เพื่อให้แน่ใจว่าจะตอบสนองหรือดำเนินงานได้เกินความคาดหวังของลูกค้าอย่างสม่ำเสมอ

แม้ว่ารายได้ที่รอเวลาการตัดบัญชีจะนำมาซึ่งความท้าทาย การบริหารจัดการเชิงรุกและเครื่องมือที่เหมาะสมสามารถช่วยให้ธุรกิจจัดการกับความท้าทายเหล่านี้ได้อย่างมีประสิทธิภาพ โซลูชัน เช่น Stripe สามารถลดความซับซ้อนเหล่านี้ได้ ทำให้ธุรกิจต่างๆ สามารถปฏิบัติตามภาระผูกพันและรักษาความสัมพันธ์ที่ดีกับฐานลูกค้าได้ง่ายขึ้น

ดูข้อมูลเพิ่มเติมเกี่ยวกับการรับรู้รายรับด้วย Stripe

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ