Uma cobrança de pré-autorização é uma retenção temporária de um valor específico do saldo disponível de um cartão de crédito ou débito. Essa cobrança verifica se o cartão é válido e tem fundos suficientes para cobrir a transação. O valor é reservado pelo emissor do cartão, mas não é efetivamente transferido para a empresa. Normalmente, essa cobrança é usada em situações em que o valor final não é conhecido no momento da transação inicial, como em hotéis ou postos de gasolina.

A pré-autorização garante que a empresa possa cobrar posteriormente o valor real da transação. Depois que o valor final é avaliado e cobrado, a retenção de pré-autorização é liberada e o valor real é deduzido da conta. Se a compra não for concluída, o valor da pré-autorização é liberado de volta para o saldo disponível do cartão após um determinado período, que pode variar dependendo das políticas do emissor do cartão. Esse processo é uma prática padrão para verificar se um cartão está ativo e pode cobrir possíveis cobranças. De acordo com um relatório do Federal Reserve Bank of San Francisco, 31% de todos os pagamentos em 2022 foram feitos com cartões de crédito, enfatizando a importância do gerenciamento cuidadoso das cobranças de pré-autorização pelas empresas para garantir que as transações dos clientes sejam cobertas.

A seguir, discutiremos o que as empresas precisam saber sobre retenções de pré-autorização. Embora essas cobranças possam parecer um pequeno detalhe, elas têm implicações importantes na eficiência da experiência de pagamento e na segurança dos pagamentos como um todo.

Neste artigo:

- Quanto tempo dura uma cobrança de pré-autorização?

- Como funcionam as cobranças de pré-autorização?

- Cobranças de pré-autorização e transações com cartão de crédito

- Vantagens do uso de cobranças de pré-autorização

- Quais tipos de empresas costumam usar cobranças de pré-autorização?

Quanto tempo dura uma cobrança de pré-autorização?

Geralmente, uma cobrança de pré-autorização em um cartão de crédito ou débito dura de cinco a sete dias, mas essa duração pode variar dependendo das políticas do emissor do cartão e do tipo de transação. Alguns bancos podem manter a retenção por até 14 dias. No caso de determinadas empresas, como hotéis ou locadoras de veículos, a retenção pode permanecer por um período ainda maior, podendo chegar a 30 dias.

É importante saber que, se a transação real for processada antes do final do período de retenção, a retenção de pré-autorização será removida e substituída pela cobrança real. Se a transação não for concluída ou se for menor que o valor pré-autorizado, a retenção é liberada. Nesse caso, os fundos não utilizados são disponibilizados novamente na conta do titular do cartão. Esse prazo para a liberação de fundos também pode depender do tempo de processamento da empresa e do emissor do cartão.

Como funcionam as cobranças de pré-autorização?

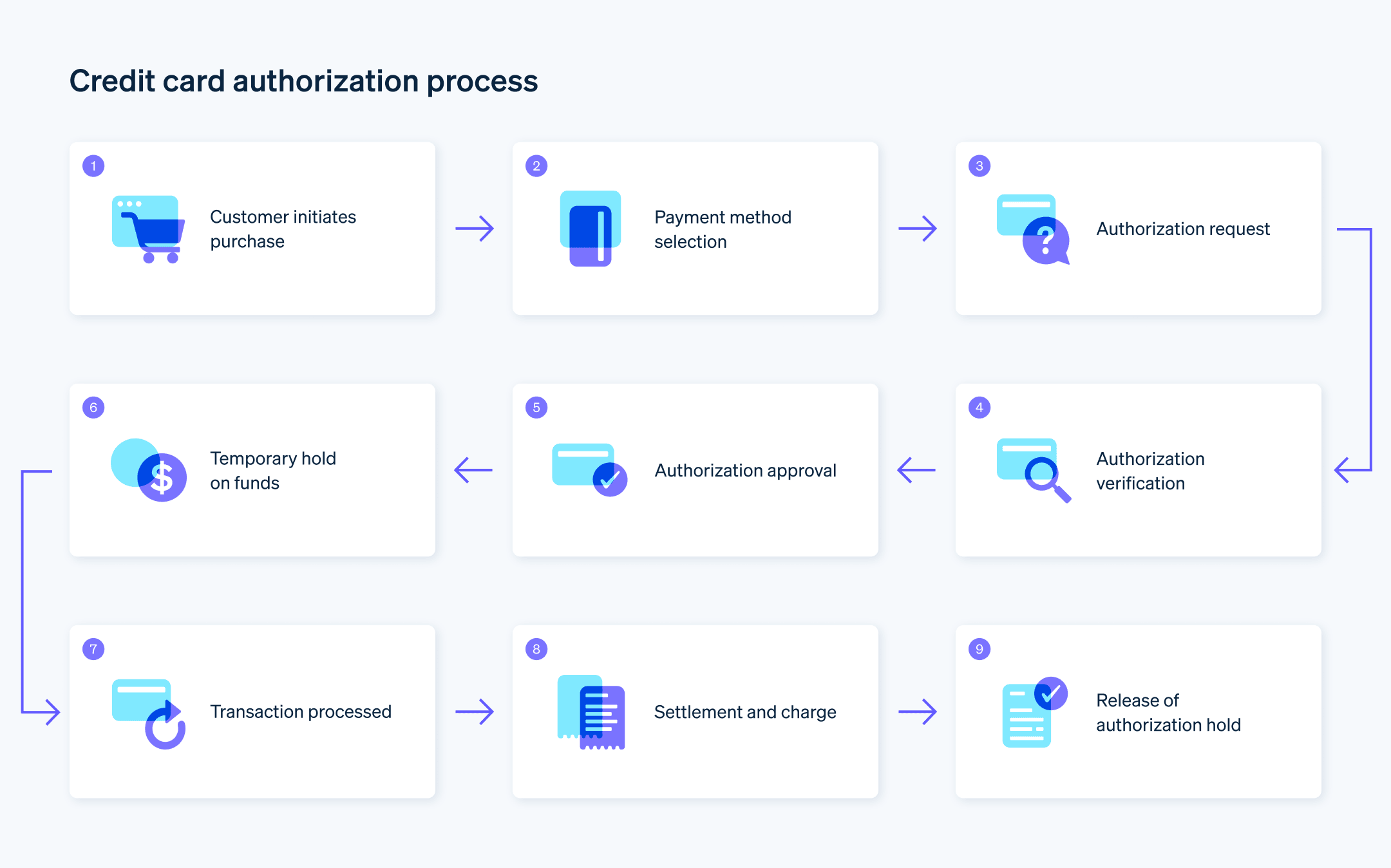

As cobranças de pré-autorização funcionam como um método para as empresas verificarem se um cartão está ativo e tem fundos suficientes para uma transação, especialmente quando o valor total ainda não é conhecido. Veja como o processo normalmente funciona:

Início da pré-autorização

Quando você usa seu cartão para uma transação em que o valor final não é conhecido antecipadamente (como em um posto de gasolina ou hotel), a empresa inicia uma pré-autorização. Trata-se, na prática, de uma retenção temporária de determinado valor no cartão.Retenção de fundos

O valor da pré-autorização não é uma cobrança real, mas uma retenção temporária. Esse valor é deduzido do seu saldo disponível, reservando esses fundos para a possível transação futura. O saldo real da conta não diminui nesse momento. O período de permanência da retenção de pré-autorização na sua conta pode variar. Ele depende das políticas da empresa e das práticas do emissor do cartão. Geralmente, varia de alguns dias a algumas semanas.Lançamento do valor final da transação

Assim que o valor final da sua compra for conhecido (por exemplo, quando você fizer checkout em um hotel), a empresa concluirá a transação. Nesse momento, a retenção de pré-autorização é substituída pela cobrança real do valor final.Liberação dos fundos não utilizados

Se o valor real da transação for menor que o valor pré-autorizado, ou se a transação for cancelada, a retenção dos fundos não utilizados será liberada. Isso significa que o valor pré-autorizado (ou a parte restante dele) ficará disponível novamente em sua conta.

Os titulares de cartão devem monitorar as retenções de pré-autorização, pois elas reduzem temporariamente o poder de compra do cartão, o que pode afetar compras futuras. As empresas implementam essas retenções como medida de segurança, principalmente quando entregam serviços ou produtos antes da cobrança final. É uma forma de proteção das empresas contra as incertezas nos pagamentos.

Cobranças de pré-autorização e transações com cartão de crédito

As cobranças de pré-autorização em cartões de crédito permitem que as empresas validem o cartão e garantam que os fundos necessários estão disponíveis. Esse processo começa quando uma empresa envia uma solicitação ao banco emissor do titular do cartão para verificar a disponibilidade de crédito. Em seguida, o banco cria uma reserva do valor solicitado no cartão. Essa retenção afeta o limite de crédito, mas não resulta em uma cobrança imediata na conta, o que significa que nenhuma dívida é incorrida na fase de pré-autorização.

Uma característica específica dos cartões de crédito, as pré-autorizações são uma verificação do limite de crédito do titular do cartão e não do saldo em sua conta bancária, como é o caso dos cartões de débito. Essa distinção é importante porque significa que as pré-autorizações reduzem o valor que o titular do cartão pode gastar posteriormente, mas não impactam os fundos reais de uma conta bancária até que a transação seja finalizada.

As diferenças no processamento de pré-autorizações entre os tipos de cartão estão relacionadas principalmente à origem dos fundos. Quando uma pré-autorização é aplicada a um cartão de débito, a retenção de fundos afeta o saldo da conta e pode levar a situações em que um titular do cartão pode receber um aviso de "fundos insuficientes" em outras transações. Por outro lado, as pré-autorizações de cartão simplesmente reduzem o crédito disponível.

Quando você usa cartões de crédito, a reserva de pré-autorização é cancelada assim que a cobrança real é processada e a cobrança real é aplicada à conta. Isso se reflete em uma transação que contribui para a dívida do titular do cartão. Se a cobrança final for menor que o valor pré-autorizado, a retenção restante é removida, restaurando o crédito temporariamente indisponível para o titular do cartão.

Diferentes emissores de cartão de crédito podem ter políticas variadas sobre quanto tempo uma retenção de pré-autorização pode durar antes de ser automaticamente removida. Caso uma empresa não finalize a transação, a retenção acabará expirando, mas o prazo para que isso aconteça pode variar de alguns dias a algumas semanas.

As empresas e os emissores de cartões se comunicam eletronicamente durante cada transação, e as pré-autorizações fazem parte dessa comunicação. Eles usam um conjunto de códigos e mensagens padronizados que permitem que essas retenções sejam aplicadas e, depois, finalizadas como cobranças reais ou liberadas.

O gerenciamento de pré-autorizações (equilibrar a segurança do pagamento com a experiência do cliente) é um aspecto essencial do gerenciamento de transações para empresas. Compreender o funcionamento das pré-autorizações ajudará você a otimizar o processamento e o sistema de pagamentos da sua empresa.

Vantagens do uso de cobranças de pré-autorização

As pré-autorizações fornecem uma rede de segurança financeira para empresas e clientes. Para as empresas, elas são uma forma de garantir que os clientes tenham os fundos ou créditos necessários antes que se comprometam a fornecer um serviço. Esta etapa é uma barreira de proteção contra contestações e estornos e é especialmente útil em setores como hotelaria ou locação de veículos, onde o custo total pode não ser conhecido desde o início. O bloqueio antecipado dos fundos ajuda a evitar surpresas e garante que os pagamentos cheguem à sua conta conforme o esperado.

Proteção contra cobranças inesperadas

Em setores onde a conta final pode variar significativamente (como em hotéis, onde os hóspedes podem usar o frigobar, ou na locação de veículos, com possíveis prorrogações de última hora), as pré-autorizações permitem que as empresas reservem um valor para cobrir os possíveis custos. Elas garantem que as empresas sejam remuneradas pelos serviços que prestam, além de agilizar o planejamento contábil e financeiro, permitindo previsões e orçamentos mais precisos.Maior transparência para os clientes

As pré-autorizações também podem melhorar a experiência do cliente, amenizando os imprevistos das cobranças. Ao garantir os fundos antecipadamente, as empresas podem fornecer serviços com a confiança de que serão pagas, permitindo que se concentrem em oferecer o melhor atendimento ao cliente, sem a preocupação constante de cobrar pagamentos.Benefícios para o cliente

As pré-autorizações podem ser vantajosas para os clientes porque fornecem uma maneira de assegurar os provedores de serviços sem que seja necessário fazer pagamentos imediatos. Elas oferecem aos clientes a flexibilidade de, na maioria dos casos, cancelar antes da cobrança quando o serviço não é mais necessário. Além disso, permitem verificar a situação da conta sem o impacto financeiro imediato de uma transação completa, ajudando a evitar gastos excessivos.Facilidade de operação

Com as pré-autorizações, as empresas podem reduzir o tempo gasto nas cobranças, simplificando o processo das transações com a garantia da disponibilidade dos fundos antes da prestação dos serviços. Essas cobranças também fornecem uma maneira mais organizada de gerenciar reservas, já que a retenção de fundos significa a confirmação do interesse pelo serviço.Planejamento financeiro simplificado

A gestão financeira para ambas as partes também melhora com as pré-autorizações. As empresas podem prever seus recebíveis com mais precisão, enquanto os clientes podem monitorar mais cuidadosamente seus gastos e disponibilidade de crédito ou fundos. O processo fornece uma camada de supervisão financeira que pode contribuir para um melhor planejamento orçamentário e financeiro.

Quais tipos de empresas costumam usar cobranças de pré-autorização?

Normalmente, as cobranças de pré-autorização são usadas por empresas em que o valor final de uma transação não é conhecido no início ou há um intervalo entre o início e a conclusão de um serviço. Alguns exemplos:

Hotéis e acomodações

Esses estabelecimentos geralmente usam pré-autorizações para cobrir possíveis despesas ou danos incidentais, retendo um valor no cartão de crédito dos hóspedes.Serviços de locação de veículos

As pré-autorizações são usadas para manter um valor que cubra a tarifa de aluguel, o seguro e um depósito de segurança para possíveis danos.Postos de combustível

Nos serviços de pagamento na bomba, uma pré-autorização é usada para verificar se o cartão tem fundos suficientes para cobrir a compra de combustível.Restaurantes

Principalmente em situações em que os clientes mantêm uma conta aberta, as pré-autorizações ajudam a confirmar a forma de pagamento antes do cálculo do total final.Lojas de varejo com itens de alto valor

Alguns varejistas podem pré-autorizar um valor de compra para garantir que os fundos estejam disponíveis antes de processar transações caras.Serviços online e assinaturas

Empresas que oferecem períodos de avaliação podem pré-autorizar um pequeno valor para verificar a forma de pagamento que será cobrada se a assinatura continuar após o período de teste.Agências de viagens e companhias aéreas

Nas reservas de viagens, as pré-autorizações são usadas com a finalidade de reter fundos para compras de passagens e possíveis tarifas por alterações ou cancelamentos.Serviços de locação

Podem incluir locação de equipamentos, locação de móveis ou qualquer serviço em que o custo final possa depender da condição de devolução do item alugado.

A pré-autorização pode ser adaptada a vários modelos de negócio, especialmente os que envolvem reservas, locações ou serviços de natureza variável.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.