Background

Payments regulations aim to create a safer, more secure financial ecosystem by helping prevent crimes like money laundering, fraud, and tax evasion. Financial regulators around the world enforce Know Your Customer (KYC) requirements to ensure that identity information is collected and verified from certain types of businesses and their company personnel. These information collection requirements are frequently updated by financial service regulators, card networks, and other financial institutions. Recently, required verification information in the United States has been updated, and you can view the latest requirements on the Required verification information page.

For platforms, managing this ongoing complexity can feel burdensome both at an operational and technical level. That's why we've upgraded Stripe's API to allow you to easily see and monitor upcoming requirements before they impact your users.

Updates to Connect

Financial partner and regulatory requirements will continue to evolve over time. Given this reality, we want to ensure that Stripe and your business maintain a best-in-class compliance program, while making necessary changes as smooth as possible. We're introducing Future Requirements, a new API feature that makes adapting to evolving compliance requirements a smoother process and maximizes the user experience for your connected accounts.

Please note that these changes will require updates to your Stripe integration.

Stay current with ease

Our new Future Requirements API feature shows previews of upcoming requirement changes for your connected accounts well before the requirement goes into effect. This makes it easier to see what user onboarding changes you may need to make for new users signing up on your platform, and shows if existing users need to share any additional information.

Future Requirements introduces a new field on the account, person, and capabilities objects:

- future_requirements: A new API field duplicating the shape of the existing requirements hash. This field will display upcoming requirements for the connected account.

What this means for your Stripe integration

If you're onboarding custom accounts, you'll need to make changes to your integration.

Specifically, you may need to update your onboarding flow to collect and validate additional information. You'll also need to integrate Future Requirements to ensure you are adapting to evolving requirements. Finally, you may need to collect additional information for previously onboarded accounts to satisfy the updated required verification information for US Stripe accounts.

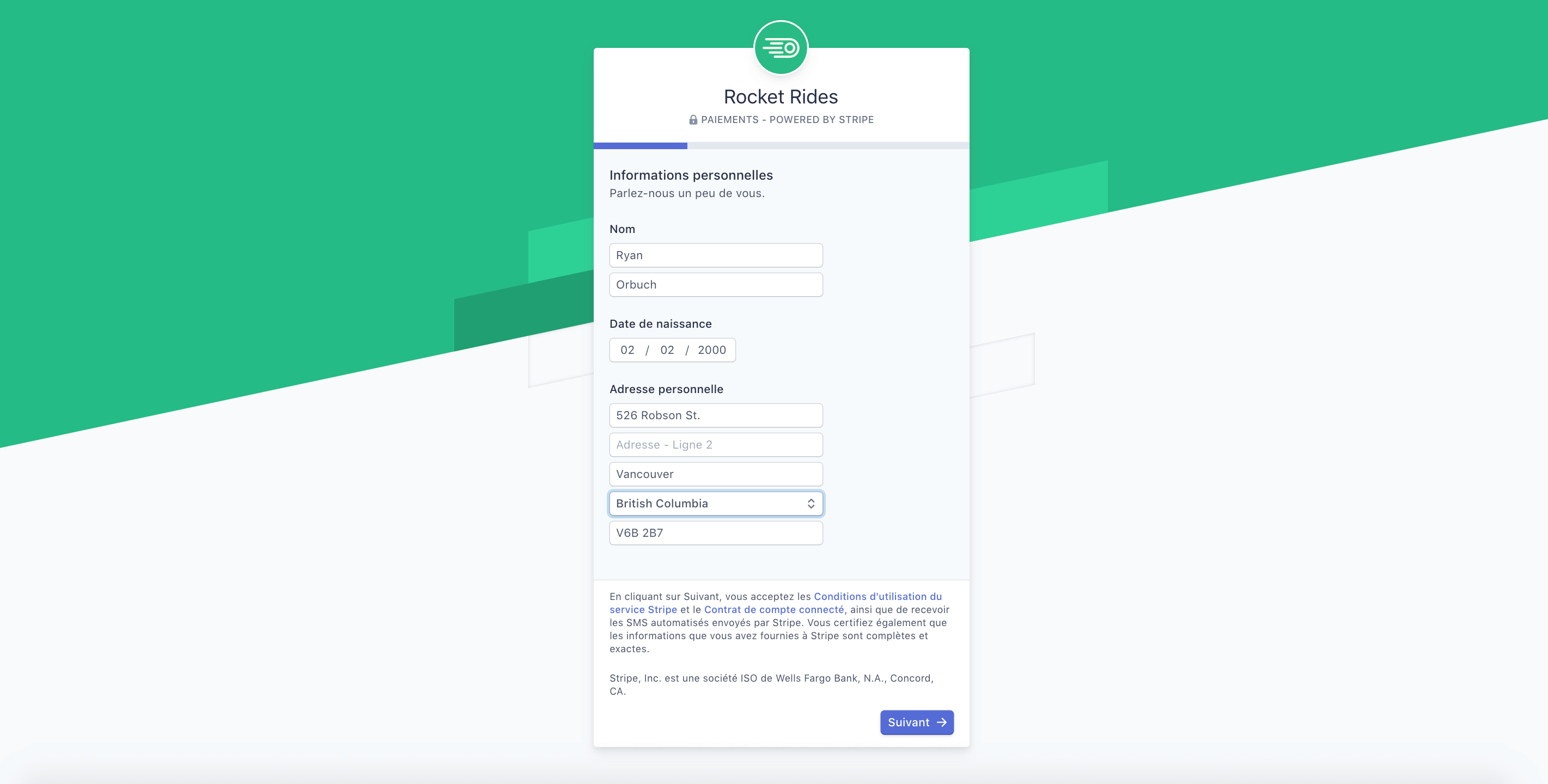

Alternatively, our conversion-optimized onboarding tools replace the need for you to design your own identity verification flows and dynamically adapt to specific compliance requirements in multiple markets. We recommend that you use these prebuilt onboarding flows to help you collect required identity information and onboard your users as quickly as possible without needing to build or maintain your own flows.

The desktop- and mobile-ready design supports multiple languages and countries, and automatically updates whenever local compliance requirements change. The form can be customized to match your company's branding and easily integrates with your existing sign-up flow for a consistent user experience from start to finish.

The Connect onboarding flow securely collects required information from your connected accounts, based on your business model and local compliance requirements.

Next steps

Visit your Dashboard to see how this will impact your integration. Changes to your integration will require additional development resources, so we strongly recommend that you get started as soon as possible.

How to get help

Updating your Stripe integration is an important step for your platform, and we're here to help.

- Visit your personalized Stripe Dashboard.

- Reach out with questions through 24/7 chat, phone, and email support.

- View our Dev Chat to learn more about new Connect features.