Contexte

Les réglementations en matière de paiement visent à créer un écosystème financier plus sûr et plus sécurisé en contribuant à prévenir les crimes tels que le blanchiment d’argent, la fraude et l’évasion fiscale. Les régulateurs financiers du monde entier appliquent les exigences de connaissance du client (KYC) afin de garantir que les informations d’identité sont collectées et vérifiées auprès de certains types d’entreprises et de leur personnel. Ces exigences en matière de collecte d’informations sont fréquemment mises à jour par les régulateurs des services financiers, les réseaux de cartes et d’autres institutions financières. Récemment, les informations de vérification requises aux États-Unis ont été mises à jour. Vous pouvez consulter les dernières exigences sur la page Informations de vérification requises.

Pour les plateformes, la gestion de cette complexité permanente peut s’avérer fastidieuse, tant sur le plan opérationnel que technique. C’est pourquoi nous avons mis à niveau l’API de Stripe afin de vous permettre de visualiser et de surveiller facilement les exigences à venir avant qu’elles n’aient un impact sur vos utilisateurs.

Mises à jour de Connect

Les exigences des partenaires financiers et des organismes de réglementation continueront d’évoluer au fil du temps. Compte tenu de cette réalité, nous voulons nous assurer que Stripe et votre entreprise maintiennent un programme de conformité de premier ordre, tout en apportant les modifications nécessaires de la manière la plus harmonieuse possible. Nous introduisons Future Requirements, une nouvelle fonctionnalité API qui facilite l’adaptation aux exigences de conformité en constante évolution et optimise l’expérience utilisateur pour vos comptes connectés.

Veuillez noter que ces modifications nécessiteront des mises à jour de votre intégration Stripe.

Restez à jour en toute simplicité

Notre nouvelle fonctionnalité Future Requirements API affiche des aperçus des modifications à venir concernant les exigences applicables à vos comptes connectés bien avant leur entrée en vigueur. Cela vous permet de voir plus facilement les modifications à apporter à l’inscription des nouveaux utilisateurs qui s’inscrivent sur votre plateforme et indique si les utilisateurs existants doivent partager des informations supplémentaires.

La fonctionnalité Future Requirements introduit un nouveau champ dans les objets de type compte, personne et capacités :

- future_requirements : un nouveau champ API reproduisant la structure du hachage des exigences existantes. Ce champ affichera les exigences à venir pour le compte connecté.

Les implications pour votre intégration Stripe

Si vous inscrivez des comptes Custom, vous devrez apporter des modifications à votre intégration.compte.

Plus précisément, vous devrez peut-être mettre à jour votre processus d’inscription des utilisateurs afin de collecter et de valider des informations supplémentaires. Vous devrez également intégrer les exigences futures afin de vous assurer que vous vous adaptez à l’évolution des exigences. Enfin, vous devrez peut-être collecter des informations supplémentaires pour les comptes déjà inscrits afin de satisfaire aux nouvelles exigences en matière d’informations de vérification pour les comptes Stripe aux États-Unis.

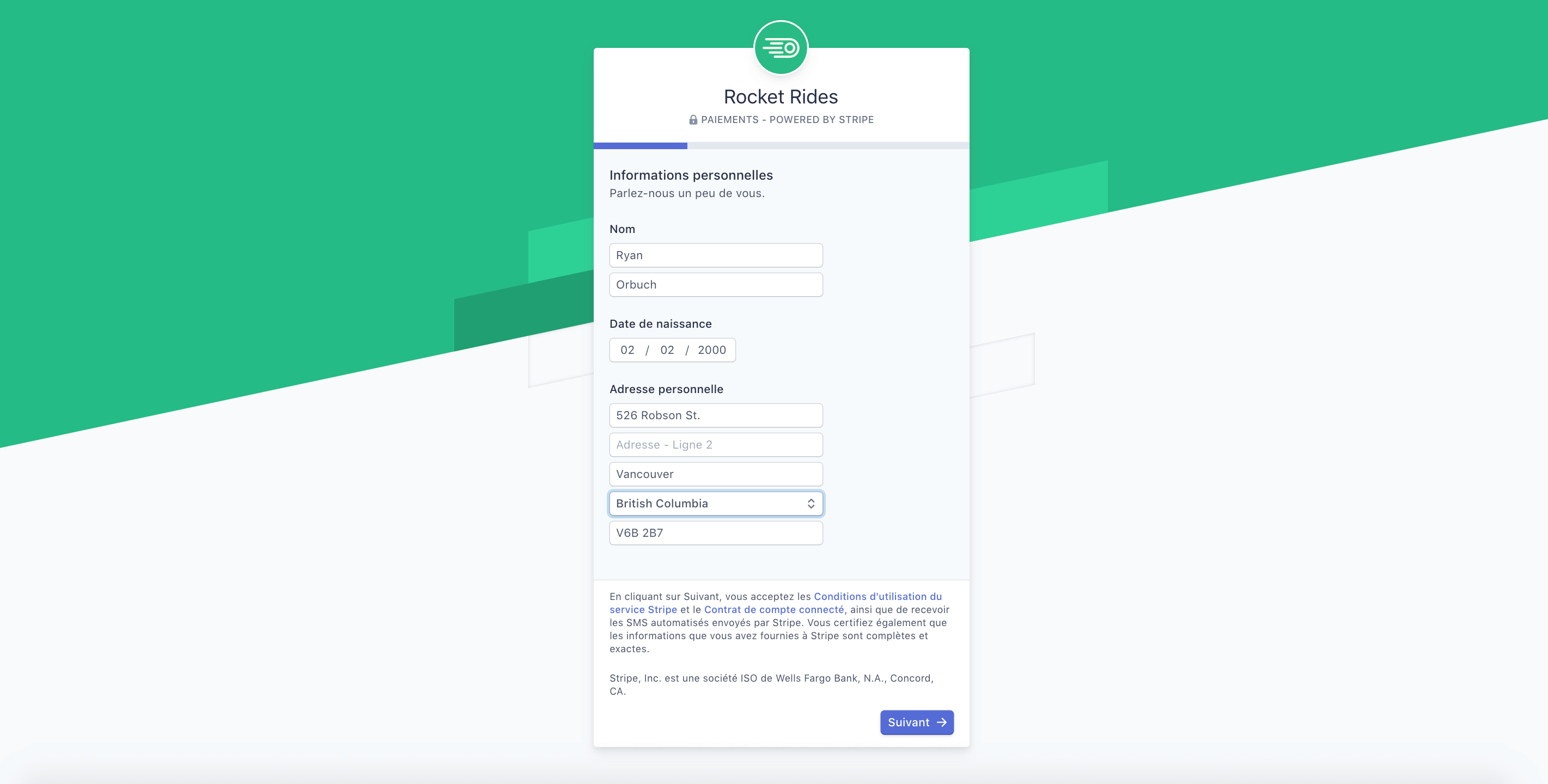

Par ailleurs, nos outils d’inscription des utilisateurs optimisés pour la conversion vous évitent d’avoir à concevoir vos propres processus de vérification d’identité et s’adaptent de manière dynamique aux exigences de conformité spécifiques à plusieurs marchés. Nous vous recommandons d’utiliser ces processus d’inscription prédéfinis pour vous aider à collecter les informations requises sur l’identité et à inscrire vos utilisateurs aussi rapidement que possible, sans avoir à élaborer ou à gérer vos propres processus.

La conception adaptée aux ordinateurs de bureau et aux appareils mobiles prend en charge plusieurs langues et pays, et se met automatiquement à jour chaque fois que les exigences locales en matière de conformité sont modifiées. Le formulaire peut être personnalisé pour correspondre à l’image de marque de votre entreprise et s’intègre facilement à votre processus d’inscription existant afin d’offrir une expérience utilisateur cohérente du début à la fin.

Le flux de Connect Onboarding recueille les informations requises de vos comptes connectés de manière sécurisée, sur la base de votre modèle économique et des exigences locales en matière de conformité.

Prochaines étapes

Rendez-vous sur votre Dashboard pour voir l’impact sur votre intégration. Les modifications apportées à votre intégration nécessiteront des ressources de développement supplémentaires. Nous vous recommandons donc vivement de commencer dès que possible.

Obtenir de l’aide

La mise à jour de votre intégration Stripe est une étape importante pour votre plateforme, et nous sommes là pour vous aider.

- Visitez votre site personnalisé Stripe Dashboard.

- Posez vos questions via notre service d’assistance disponible 24 h/24 et 7 j/7 par clavardage, téléphone et courriel.

- Consultez notre Dev Chat pour en savoir plus sur les nouvelles fonctionnalités de Connect.