背景

支付法规旨在通过帮助预防洗钱、欺诈和逃税等犯罪行为,构建更安全、更有保障的金融生态系统。全球金融监管机构执行 “客户身份验证”(KYC) 要求,确保从特定业务类型的商业实体及其人员处收集并验证身份信息。金融服务监管机构、银行卡组织和其他金融机构经常更新这些信息收集要求。最近,美国要求的验证信息已经更新,您可以在 所需验证信息页面 上查看最新要求。

对于平台而言,持续应对此类合规复杂性可能会带来操作和技术层面的双重压力。因此,我们对 Stripe 的 API 进行了升级,让您可以在即将生效的要求影响到用户之前,轻松查看和监控这些要求。

Connect 更新动态

随着时间的推移,金融合作伙伴和监管要求将不断演变。鉴于这一现实,我们希望确保 Stripe 和您的企业能够维持一流的合规计划,同时尽可能顺利地进行必要的更改。我们正在推出 Future Requirements,这是一项新的 API 功能,可以让您更加顺畅地适应不断变化的合规要求,并最大限度地提高您的 Connect 子账户的用户体验。

请注意,这些更改将要求 更新您的 Stripe 集成。

轻松掌握最新信息

我们新的 Future Requirements API 功能可在要求生效前为您展示 Connect 子账户即将发生的要求变更。这样,您就可以更轻松地了解在平台上注册的新用户可能需要做出哪些用户入驻变更,并显示现有用户是否需要共享任何其他信息。

Future Requirements 在账户、人员和功能对象上引入了一个新字段:

- future_requirements:一个新 API 字段,结构与现有的要求哈希值相同。该字段将显示 Connect 子账户的未来要求。

对 Stripe 集成的影响

如果要入驻 Custom 账户,则需要对集成进行更改。

具体来说,您可能需要更新入驻流程,以收集并验证补充信息。您还需要集成 Future Requirements,以确保您能适应不断变化的合规要求。最后,您可能需要为先前已入驻的账户收集额外信息,以满足美国 Stripe 账户更新后的验证要求。

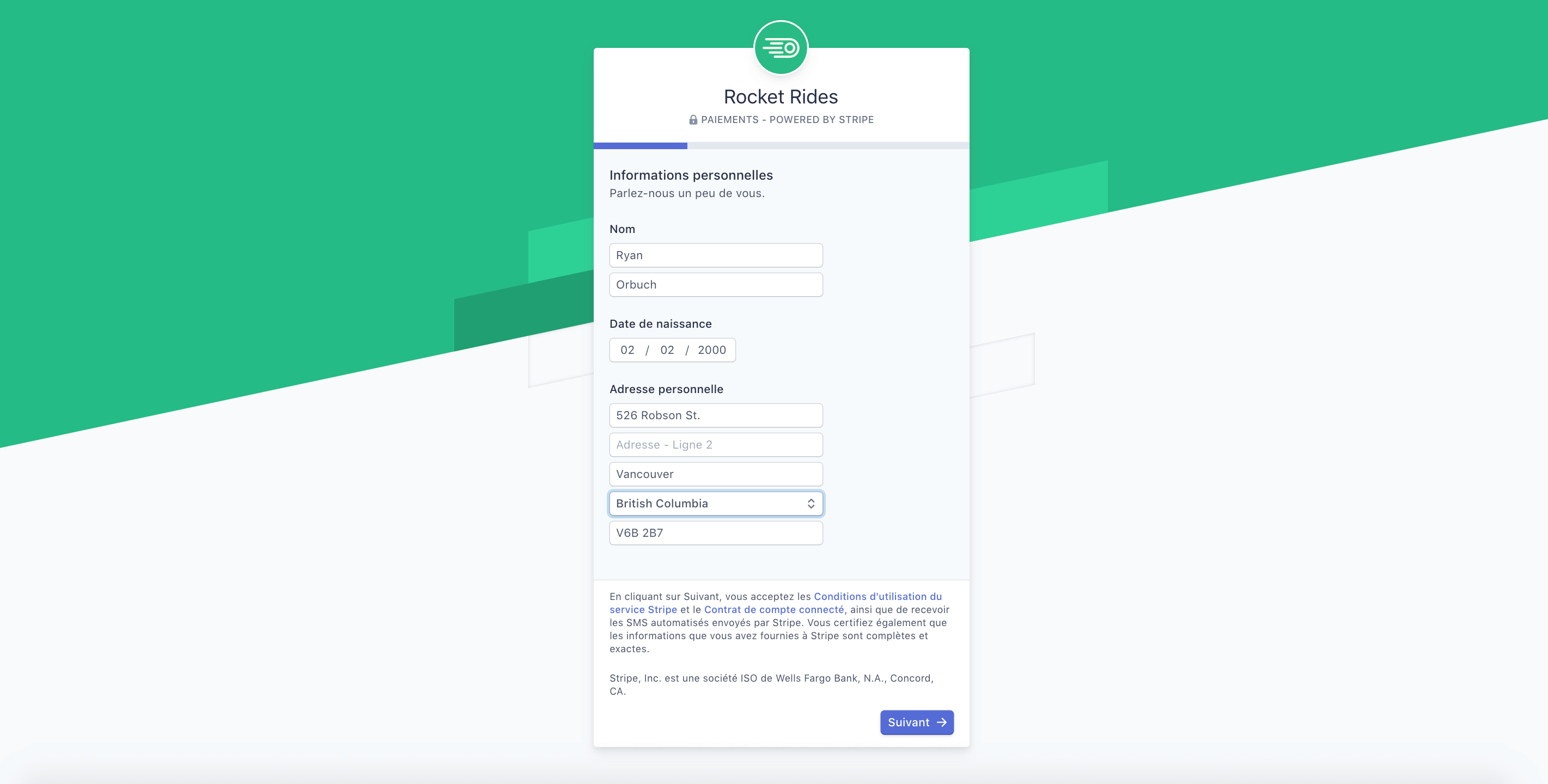

另外,我们经过转换优化的入驻工具可取代您自行设计身份验证流程的需要,并能动态适应多个市场中的特定合规要求。我们建议您使用这些预先构建的入驻流程,帮助您快速收集所需身份信息,并尽快完成用户入驻,而无需自行构建或维护流程。

配备桌面和移动功能的设计支持多种语言和国家/地区,并可在当地合规要求发生变化时自动更新。表单可以定制以匹配您公司的品牌形象,并可轻松与您现有的注册流程集成,从而提供从始至终一致的用户体验。

Connect Onboarding 流程可根据您的商业模式和当地合规要求,安全地从您的关联账户中收集所需信息。

后续步骤

请访问您的管理平台 查看这将如何影响您的集成。对您的集成进行更改将需要额外的开发资源,因此我们强烈建议您尽快开始。

如何获得帮助

更新 Stripe 集成对您的平台至关重要,我们可以提供帮助。

- 访问您的个性化 Stripe 管理平台。

- 如有疑问,请通过 24/7 聊天、电话和电子邮件支持 与我们联系。

- 查看我们的 Dev Chat,了解更多 Connect 新功能。