L’administration fiscale italienne soumet certains contribuables ayant des avoirs financiers à l’étranger à un impôt sur la fortune sur la valeur de ces avoirs. C’est ce qu’on appelle « l’impôt sur la valeur des actifs financiers à l’étranger » ou IVAFE (« Imposta sul Valore delle Attività Finanziarie all’Estero » en italien). Ces changements sont basés sur la valeur des actifs (la valeur nette du contribuable), contrairement à ceux basés sur les revenus générés sur une période donnée, tels que l’impôt sur le revenu des personnes physiques (IRPEF) ou l’impôt sur les sociétés (IRES) en Italie. Cet article explorera l’IVAFE, qui doit la payer, les taux applicables et comment soumettre une déclaration.

Que contient cet article?

- Qu’est-ce que l’IVAFE?

- Quels avoirs financiers étrangers doivent être déclarés?

- Quels sont les actifs exclus de l’IVAFE?

- Comment calcule-t-on l’IVAFE?

- L’IVAFE dans les déclarations de revenus des particuliers

- Comment l’IVAFE est-elle payée?

Qu’est-ce que l’IVAFE?

Le décret-loi n° 201/11 a introduit l’IVAFE. Lors de son introduction, la taxe s’appliquait exclusivement aux personnes physiques, mais depuis le 1er janvier 2020, les entités non commerciales et les sociétés simples en Italie, qui doivent déclarer leurs investissements et leurs actifs en vertu de l’article 4 du décret-loi n° 167/1990 (un processus connu sous le nom de surveillance fiscale), sont également soumis à l’IVAFE. Par conséquent, les avoirs financiers étrangers détenus par ces contribuables sont désormais assujettis à cette taxe.

Qu’est-ce qui est considéré comme un « actif financier » dans ce cas? Ils comprennent toutes les activités et instruments financiers qui génèrent du capital ou des revenus divers de sources étrangères.

Taux d’imposition de l’IVAFE

Pour l’ensemble des avoirs, à l’exception des comptes courants et des dépôts d’épargne, l’administration fiscale applique l’IVAFE au taux de 0,2 %. Pour les produits financiers détenus dans des pays à régime fiscal préférentiel, tel qu’identifié par le décret 04/05/1999 (tel que modifié) du ministère de l’Économie et des Finances, le taux de l’IVAFE en 2024 est de 0,4 % par an (Loi budgétaire 2024 - Article 1, paragraphe 91, lettre b).

Pour les comptes courants et dépôts d’épargne que les particuliers détiennent à l’étranger, l’IVAFE est fixée à un montant forfaitaire de 34,20 €. Pour les entités autres que les personnes physiques, la taxe est fixée à 100 €. Les entités ne doivent payer la taxe que si le solde annuel moyen des relevés de compte ou des dépôts d’épargne est supérieur à 5 000 euros.

Quels sont les avoirs financiers étrangers qui doivent être déclarés?

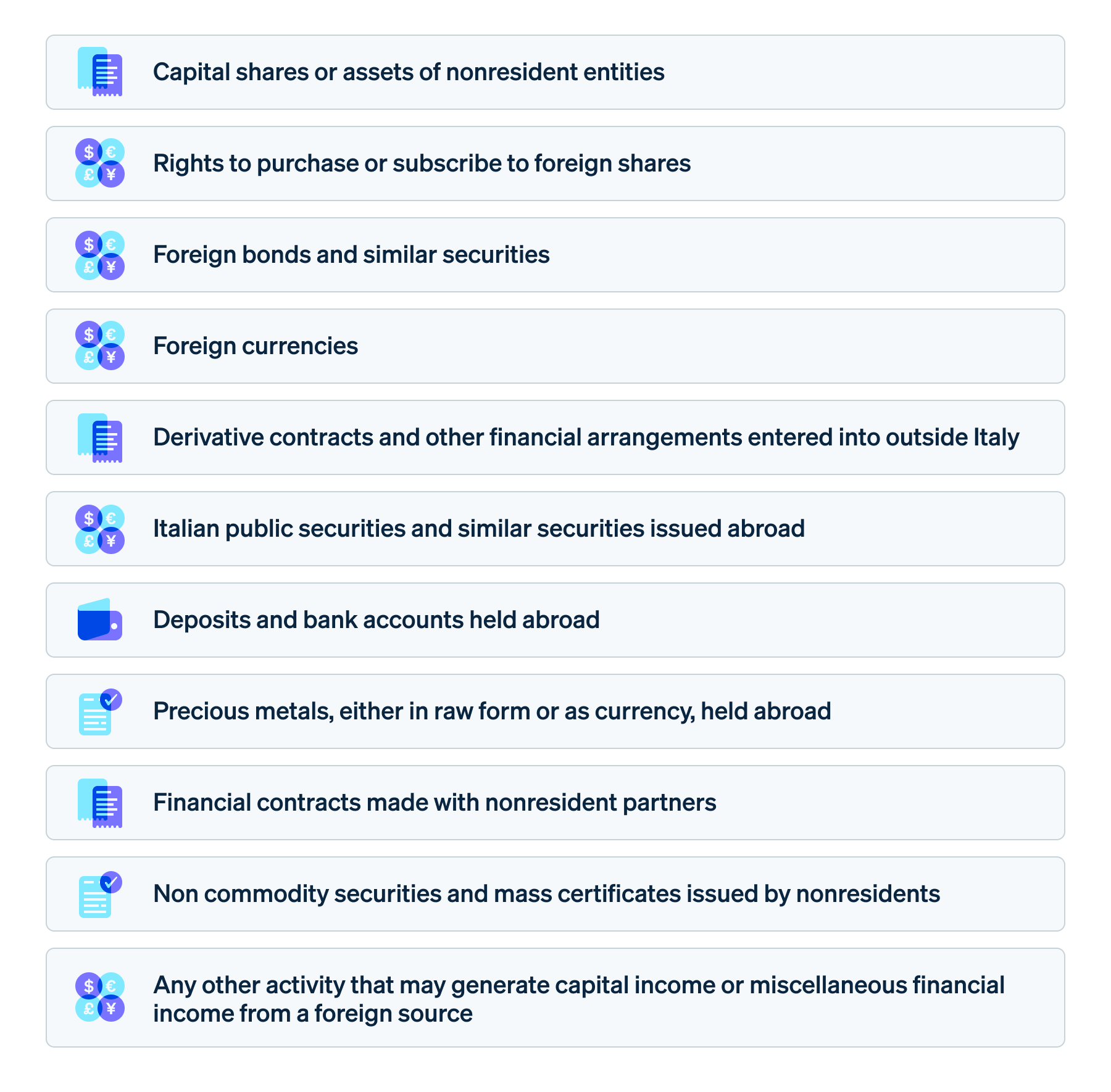

La loi oblige les entreprises à déclarer leurs actifs soumis à une surveillance fiscale dans la partie RW du formulaire PF sur le revenu. Cette déclaration peut alors conduire à une obligation de payer l’IVAFE. Jetons un coup d’œil aux actifs financiers étrangers qu’une entreprise doit déclarer dans la partie RW du formulaire PF sur le revenu :

- Actions de capital ou actifs d’entités non résidentes (par exemple, des sociétés étrangères ou des entités juridiques telles que des fondations et des fiducies)

- Contrats financiers conclus avec des partenaires non-résidents, tels que les prêts, les reports, les conventions de pension, les prêts de titres et les polices d’assurance-vie conclues avec des assureurs étrangers

- Droits d’achat ou de souscription d’actions étrangères ou d’instruments financiers similaires

- Obligations étrangères et titres assimilés

- Titres publics italiens et actions similaires émises à l’étranger

- Valeurs mobilières hors matières premières et certificats de masse émis par des non-résidents, y compris les parts de placements collectifs de capitaux (OICR)

- Devises étrangères

- Dépôts et comptes bancaires détenus à l’étranger, quelle que soit la source de financement, par exemple sous forme de crédits de salaire, de pension ou de rémunération

- Contrats dérivés et autres arrangements financiers conclus en dehors de l’Italie

- Métaux précieux, bruts ou monétaires, détenus à l’étranger

- Toute autre activité susceptible de générer du capital ou des revenus financiers divers d’origine étrangère

Les entreprises doivent également déclarer les actifs financiers italiens qu’elles détiennent à l’étranger (par exemple, les titres d’État émis en Italie, les participations dans des entités résidentes et d’autres instruments financiers émis par elles) dans la partie RW, car ces actifs peuvent générer des revenus divers.

Liste des actifs financiers étrangers soumis à déclaration fiscale :

Quels sont les actifs exclus de l’IVAFE?

L’administration fiscale exclut certains actifs financiers de l’application de l’IVAFE. Il s’agit des actifs suivants :

- Les régimes de retraite complémentaire organisés ou gérés par des sociétés et des institutions de droit étranger.

- Les actifs détenus à l’étranger, mais gérés par des intermédiaires financiers basés en Italie.

- Les avoirs étrangers détenus physiquement par le contribuable en Italie.

Comment calcule-t-on l’IVAFE?

La méthode standard pour déterminer la base imposable de l’IVAFE consiste pour les contribuables à la calculer sur la base de la valeur marchande de leurs actifs financiers au dernier jour de l’année civile. Si le résident italien ne détient plus ces investissements au 31 décembre de l’année concernée, il doit déterminer le prix du marché à la fin de la période de détention.

Pour les actifs financiers cotés sur les marchés réglementés, les contribuables doivent utiliser la valeur de marché au 31 décembre ou à la fin de la période de détention. Pour les investissements qui ne sont pas négociés sur des marchés réglementés, ou dans les cas où des actifs cotés ont été retirés de la cote, utilisez le montant nominal ou, s’il n’est pas disponible, le montant du rachat, même s’il est officiellement retraité à titre de référence. Si vous ne pouvez obtenir ni la valeur nominale ni la valeur de rachat, déterminez la base imposable en fonction du prix d’achat des titres.

Pour calculer le paiement anticipé de l’IVAFE, utilisez 100 % du montant de l’impôt déterminé pour l’année précédente. Par exemple, si l’impôt sur le solde était de 150 €, le paiement anticipé doit également être de 150 €. Dans ce cas, vous devez payer le paiement anticipé en deux versements, puisque la valeur dépasse le seuil de 103 €.

Double imposition et crédit d’impôt

Si le contribuable a payé un impôt sur les successions dans le pays où les produits financiers, les comptes courants ou les comptes d’épargne sont détenus, il peut déduire un crédit d’impôt (article 19, paragraphe 21, décret-loi n° 201/11) égal au montant des droits de succession payés à l’étranger lors du calcul de l’IVAFE. Dans tous les cas, le crédit ne peut pas dépasser le montant dû en Italie.

Toutefois, ce crédit d’impôt pour l’IVAFE n’est pas applicable si une convention de double imposition est en place avec le pays où vous hébergez l’actif financier, et que cette convention couvre l’impôt sur la fortune. Dans ce cas, c’est le pays de résidence du titulaire qui détermine le taux applicable.

L’IVAFE dans les déclarations de revenus des particuliers

Les particuliers qui détiennent des actifs financiers à l’étranger doivent les déclarer lors du dépôt de leur déclaration de revenus. Cela peut se faire dans la partie RW du formulaire Income PF ou, à partir de 2024, dans la partie W du formulaire 730/2024 dédiée au suivi fiscal, qui est identique à la partie RW.

Bien que l’IVAFE soit un prélèvement sur la fortune, son calcul et son règlement suivent les mêmes dispositions réglementaires que celles qui s’appliquent à l’impôt sur le revenu des personnes physiques (IRPEF). Les contribuables doivent effectuer un paiement à la fois sur l’acompte et sur le solde. En outre, un paiement anticipé est requis si le montant indiqué dans la partie RW6, colonne 1, pour IVAFE dans le formulaire de revenu PF dépasse le seuil de 52 €. Si le montant est inférieur à ce seuil, seul le solde doit être réglé.

Si le paiement anticipé de l’IVAFE dépasse 103 € (article 17, paragraphe 3, du DPR n° 435/2001), elle doit être versée en deux versements :

- Le premier versement, égal à 40 %, est exigible avant la date limite de production de la déclaration de revenus de l’année précédente, soit le 30 juin.

- Le deuxième versement, qui couvre le solde restant après déduction du premier, est dû au plus tard le 30 novembre.

Si vous ne payez pas en plusieurs versements, le montant total doit être réglé en une seule fois au plus tard le 30 novembre.

Se tenir au courant de l’évolution constante des réglementations peut s’avérer difficile pour votre entreprise. Des outils tels que Stripe Tax peuvent simplifier la conformité en générant des rapports détaillés utiles pour remplir les déclarations de revenus.

Comment l’IVAFE est-elle payée?

Les contribuables assujettis à la TVA doivent régler l’IVAFE au moyen du formulaire F24, qui doit être soumis par voie électronique. Cela peut être fait directement à l’aide du logiciel F24 web ou F24 online fourni par l’Agence italienne des impôts, via les canaux Fisconline ou Entratel, via votre crédit services bancaires à domicile de l’établissement, ou par le biais d’un intermédiaire autorisé.

Les contribuables non assujettis à la TVA doivent également la payer à l’aide d’un formulaire F24 papier dans les banques, les agences de Poste Italiane et les agents de recouvrement, à condition qu’ils n’utilisent pas de crédits compensatoires. Toutefois, il est toujours possible de soumettre le formulaire papier F24 lors de l’utilisation de crédits d’impôt pour la compensation, mais uniquement auprès des agents de recouvrement.

Les codes fiscaux suivants doivent être utilisés pour les paiements de l’IVAFE :

- 4043 : Impôt sur la valeur des avoirs financiers détenus à l’étranger par des personnes physiques résidant sur le territoire italien – art. 19, ch. 18, DL. n. 201/2011 ratifiée, telle que modifiée par L. n. 214/2011 et modifications subséquentes – SOLDE

- 4047 : Impôt sur la valeur des avoirs financiers détenus à l’étranger par des personnes physiques résidant sur le territoire italien – art. 19, ch. 18, DL. n. 201/2011 ratifiée, telle que modifiée par L. n. 214/2011 et modifications subséquentes – DÉPÔT PREMIER VERSEMENT

- 4048 : Impôt sur la valeur des avoirs financiers détenus à l’étranger par des personnes physiques résidant sur le territoire italien – art. 19, ch. 18, DL. n. 201/2011 ratifiée, telle que modifiée par L. n. 214/2011 et modifications subséquentes – DÉPÔT DEUXIÈME VERSEMENT OU VERSEMENT FORFAITAIRE UNIQUE

Le contenu de cet article est fourni uniquement à des fins informatives et pédagogiques. Il ne saurait constituer un conseil juridique ou fiscal. Stripe ne garantit pas l'exactitude, l'exhaustivité, la pertinence, ni l'actualité des informations contenues dans cet article. Nous vous conseillons de consulter un avocat compétent ou un comptable agréé dans le ou les territoires concernés pour obtenir des conseils adaptés à votre situation particulière.