The Italian tax authority subjects certain taxpayers with financial assets abroad to a wealth tax on the value of those holdings. This is called “Tax on the Value of Financial Assets Abroad”, or IVAFE (“Imposta sul Valore delle Attività Finanziarie all’Estero” in Italian). Such changes are based on the value of assets (the taxpayer’s net worth), unlike those based on earnings generated over a specific period, such as personal income tax (IRPEF) or corporate income tax (IRES) in Italy. This article will explore IVAFE, who has to pay it, the applicable rates, and how to submit a return.

What’s in this article?

- What is IVAFE?

- What foreign financial assets must be declared?

- What assets are excluded from IVAFE?

- How is IVAFE calculated?

- IVAFE in individuals’ tax returns

- How is IVAFE paid?

What is IVAFE?

Decree Law no. 201/11 introduced IVAFE. When first introduced the tax applied exclusively to individuals, but since 1 January 2020, non-commercial entities and simple companies in Italy, which must declare investments and assets under Article 4 of Decree Law no. 167/1990 (a process known as tax monitoring), are also subject to IVAFE. Therefore, foreign financial assets held by these taxpayers are now subject to the tax.

What are considered “financial assets” in this case? They include all financial activities and instruments that generate capital or miscellaneous income from foreign sources.

IVAFE tax rates

For all assets, excluding current accounts and savings deposits, the tax authority applies IVAFE at a rate of 0.2%. For financial products held in countries with a preferential tax regime, as identified by Decree 04/05/1999 (as amended) of the Ministry of Economy and Finance, the rate for IVAFE in 2024 is 0.4% annually (Budget Law 2024 - Article 1, paragraph 91, letter b).

For current accounts and savings deposits individuals hold abroad, the IVAFE is set at a flat amount of €34.20. For entities other than individuals, the tax is set at €100. Entities must pay the tax only if the average annual balance of account statements or savings deposits exceeds €5,000.

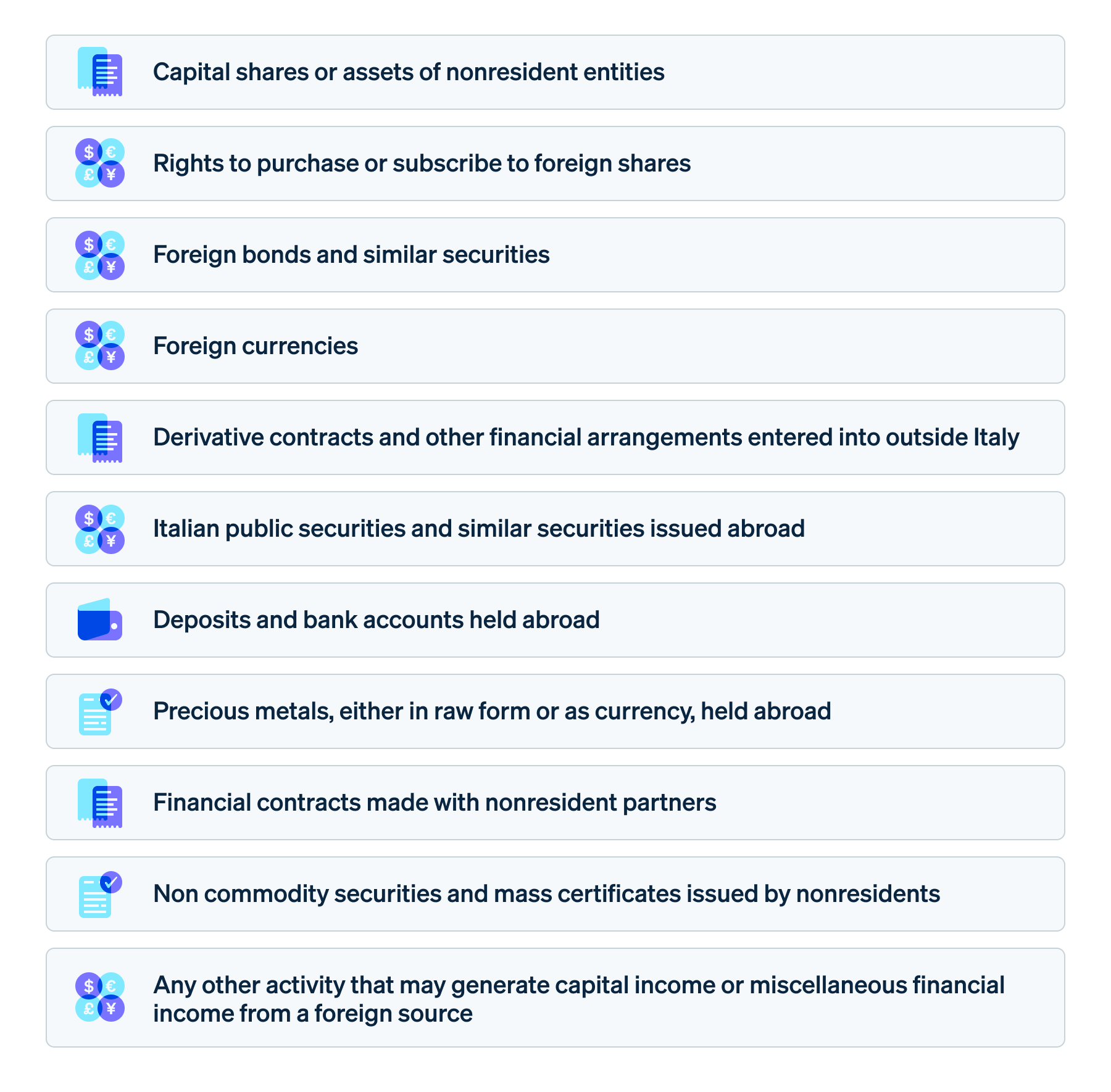

What foreign financial assets must be declared?

The legislation requires businesses to report assets subject to tax monitoring in part RW of the Income PF Form. This reporting might then lead to an obligation to pay IVAFE. Let’s take a look at the foreign financial assets that a business must declare in part RW of the Income PF Form:

- Capital shares or assets of non-resident entities (e.g. foreign companies or legal entities such as foundations trusts)

- Financial contracts made with non-resident partners, such as loans, carryovers, repurchase agreements, securities lending, and life insurance policies arranged with foreign insurers

- Rights to purchase or subscribe to foreign shares or similar financial instruments

- Foreign bonds and similar securities

- Italian public securities and similar equities issued abroad

- Non-commodity securities and mass certificates issued by non-residents, including units of collective investment schemes (OICR)

- Foreign currencies

- Deposits and bank accounts held abroad, regardless of funding source, such as through salary, pension, or compensation credits

- Derivative contracts and other financial arrangements entered into outside Italy

- Precious metals, either in raw form or as currency, held abroad

- Any other activity that could generate capital or miscellaneous financial income from a foreign source

Businesses must also report Italian financial assets they hold abroad (e.g. government securities issued in Italy, shareholdings in resident entities, and other financial instruments issued by them) in part RW because these assets might generate miscellaneous income.

List of foreign financial assets requiring tax declaration:

What assets are excluded from IVAFE?

The tax authority does exclude some financial assets from the application of IVAFE. These are:

- Supplementary pension schemes organised or managed by companies and institutions governed by foreign law.

- Assets held abroad but managed by financial intermediaries based in Italy.

- Foreign assets physically held by the taxpayer in Italy.

How is IVAFE calculated?

The standard method for determining the taxable base for IVAFE is for taxpayers to calculate it based on the market value of their financial assets as of the last day of the calendar year. If the Italian resident no longer holds these investments on 31 December of the relevant year, they must determine the market price at the end of the holding period.

For financial assets listed on regulated markets, taxpayers need to use the market value as of 31 December or at the end of the holding period. For investments not traded on regulated markets, or in cases where listed assets have been delisted, use the nominal amount or, if unavailable, the redemption amount, no matter if officially restated for reference. If you cannot get either the nominal and redemption value, determine the taxable base by the purchase price of the securities.

To calculate the IVAFE advance payment, use 100% of the tax amount determined for the previous year. For instance, if the balance tax was €150, the advance payment must also be €150. In this case, you must pay the advance in two instalments, since the value exceeds the €103 threshold.

Double taxation and tax credit

If the taxpayer has paid an estate tax in the country where the financial products, current accounts, or savings accounts are held, they can deduct a tax credit (Article 19, paragraph 21, Decree Law no. 201/11) equal to the amount of estate tax paid abroad when calculating the IVAFE. In any case, the credit cannot exceed the amount owed in Italy.

However, this credit for IVAFE is not applicable if a double taxation agreement is in place with the country where you house the financial asset, and this agreement covers wealth taxes. In this case, the holder’s country of residence determines the applicable rate.

IVAFE in individuals’ tax returns

Individuals holding financial assets abroad must report them when filing their tax return. This can be done in part RW of the Income PF Form or, starting in 2024, in part W of Form 730/2024 dedicated to tax monitoring, which is identical to part RW.

Although IVAFE is a wealth tax, its calculation and settlement follow the same regulatory provisions that apply to personal income tax (IRPEF). Taxpayers must make a payment both on account and on balance. Additionally, an advance payment is required if the amount indicated in part RW6, column 1, for IVAFE in the PF Income Form exceeds the €52 threshold. If the amount is below this threshold, only the balance needs to be settled.

If the IVAFE advance exceeds €103 (Article 17, paragraph 3, of DPR no. 435/2001), it must be paid in two instalments:

- The first instalment, equal to 40%, is due by the deadline for filing the previous year’s tax return, which is 30 June.

- The second instalment, covering the remaining balance after deducting the first, is due by 30 November.

If not paying in instalments, the entire amount must be settled in one lump sum by 30 November.

Staying current with constantly changing regulations can be challenging for your business. Tools such as Stripe Tax can simplify compliance by generating detailed reports useful for filing tax returns.

How is IVAFE paid?

VAT-registered taxpayers must pay IVAFE using form F24, which must be submitted electronically. This can be done directly using the F24 web or F24 online software provided by the Agenzia delle Entrate (the Italian revenue agency) – via Fisconline or Entratel channels – through your credit institution’s home banking services, or through an authorised intermediary.

Non-VAT holders can also pay using a paper F24 form at banks, branches of Poste Italiane, and collection agents, as long as they are not using offsetting credits. However, submitting the paper F24 form when using tax credits for compensation is still possible, but only at collection agents.

The following tax codes need to be used for IVAFE payments:

- 4043: Tax on the value of financial assets held abroad by individuals residing in Italian territory – art. 19, c. 18, DL. n. 201/2011 ratified, as amended by L. n. 214/2011 and subsequent modifications – BALANCE

- 4047: Tax on the value of financial assets held abroad by individuals residing in Italian territory – art. 19, c. 18, DL. n. 201/2011 ratified, as amended by L. n. 214/2011 and subsequent modifications – DEPOSIT FIRST INSTALMENT

- 4048: Tax on the value of financial assets held abroad by individuals residing in Italian territory – art. 19, c. 18, DL. n. 201/2011 ratified, as amended by L. n. 214/2011 and subsequent modifications – DEPOSIT SECOND INSTALMENT OR SINGLE LUMP-SUM DEPOSIT

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.