Challenge

For more than 30 years, Unanet has been centralizing important business processes and digitally transforming manual tasks for government contractors and architecture, engineering, and construction (AEC) firms. The company got its start providing electronic time-tracking software to replace paper time sheets for government contractors, but gradually developed enterprise resource planning (ERP) and customer relationship management (CRM) solutions for a wide range of project-based businesses.

Finance and accounting are key components of the company’s ERP software, yet Unanet saw that its customers were still dealing with a major slowdown in their accounts receivable (AR) process: delivering and tracking the status of invoices was time-consuming and manual, and clients mostly paid invoices with paper checks.

Besides exposing customers to delayed payments and the risk of fraud and errors, these offline payments represented a missing piece in Unanet’s software offering—a gap that the company wanted to eliminate. “At the end of day, ERP software is about workflow automation, so adding payments was a natural extension of the accounts receivable workflow,” said Steve Karp, Unanet’s senior vice president and head of financial products.

However, adding an online payments feature wouldn’t offer much improvement if Unanet customers still had to manually track the status of invoices, attempt to collect from late payers, and reconcile payments with customer account information. That meant that any payments technology had to fully integrate with Unanet’s ERP software to create the complete workflow the company envisioned. The payment system also had to handle the larger invoice sizes typically found in government contracts and AEC projects, which are often tens of thousands—or even hundreds of thousands—of dollars.

Solution

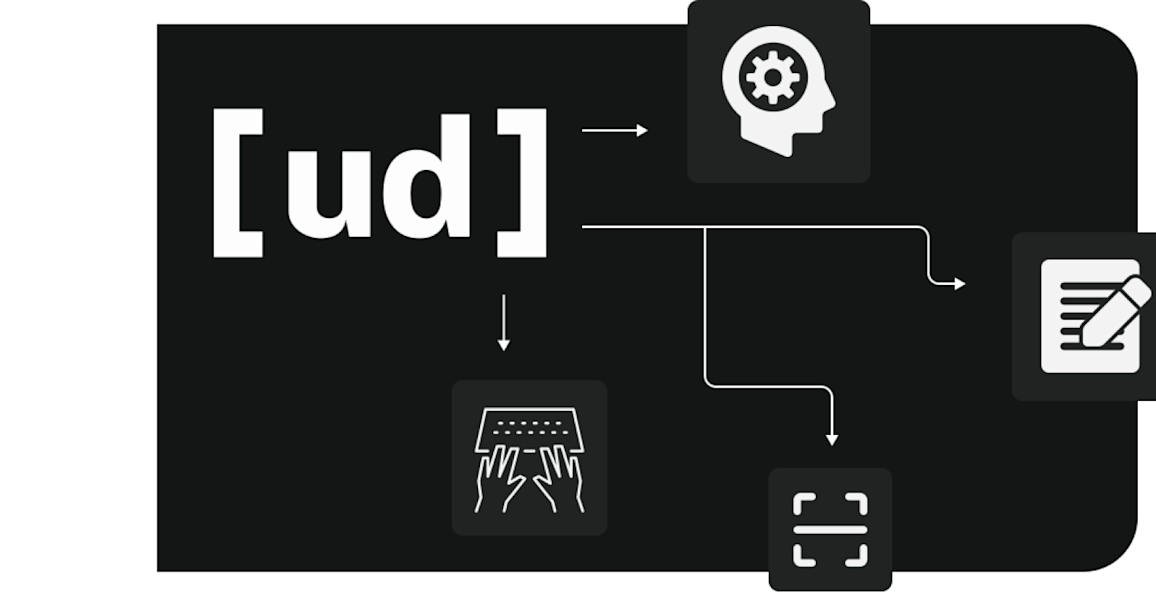

Unanet used Stripe Connect to integrate a payments solution into a new product it calls “AR Automation,” a subscription add-on service to its ERP software that provides end-to-end automation of the accounts receivable process.

Connect’s features offered an ideal solution for Unanet’s needs, including APIs that made it easy to integrate payments into the company’s ERP software, built-in onboarding tools, and platform controls that allow for ongoing payments optimization. With Connect, Unanet was able to build and launch AR Automation in four months.

One of the biggest advantages of the Connect platform, according to Karp, was the “hybrid” nature of its technology: it offered a combination of plug-and-play components along with powerful development tools that allowed Unanet to customize its integration. “It’s a unique combination: it’s not totally off the shelf, and it doesn’t have to be completely custom engineered,” said Karp.

Using Connect, Unanet designed AR Automation to allow its customers to natively send electronic invoices that include a link to a Stripe-powered payment portal, which accepts secure ACH or credit card payments. Users can also schedule automatic reminder emails with a “pay now” link connected directly to the payments portal. For one-time bills where there is no invoice, Unanet customers can log those payments directly into their payments portal.

Since Stripe data is fully integrated with Unanet’s ERP platform, all payments received through the portal are automatically posted and reconciled to the correct invoice number and customer account. Unanet also took advantage of its Stripe data integration to create a collections dashboard, which gives customers detailed financial insights such as AR balance, AR turnover ratio, and AR aging.

Creating an onboarding process was also easy with Connect’s customizable onboarding user interface. Through an embedded app in the ERP system, Unanet customers can easily configure their payment preferences, specifying details such as whether they want to accept ACH, credit cards, or both; whether to absorb or pass on credit card fees; and transaction size limits. These preferences can be set at the global level, or only for specific customers, projects, or invoices. Once Unanet customers set up their preferences, Stripe automatically manages other onboarding tasks, such as Know Your Customer (KYC) obligations and ensuring other compliance requirements and standards.

Since rolling out AR Automation, Karp and his team have taken advantage of Connect’s flexibility to optimize the payments feature for their customers’ needs. Working closely with Stripe, Unanet increased the ACH limit to accommodate larger invoice amounts and higher weekly transaction velocities. Unanet has also improved its customers’ payment options by adding pre-authorized debits for transactions in Canada. In both cases, Karp noted, Connect’s features and the development support offered by Stripe have helped Unanet achieve its vision for a fully automated accounts receivable workflow. “The level of technical and business support we receive has been impressive,” said Karp.

Results

Accelerating payments and delivering financial benefits to Unanet customers

Adding the electronic payment option to Unanet’s automated invoicing tool has transformed the accounts receivable function for an industry where the vast majority of clients were still paying by check. AR Automation users have seen improvements such as a 30-day decrease in Days Sales Outstanding (DSO) and a 20% increase in cash flow.

Creating an integrated, end-to-end solution

Stripe’s developer-friendly features, including its APIs and embedded components, helped Unanet build payments as a native capability within its existing ERP platform. That full integration gives Unanet more control over how it customizes the payments function within the software suite and provides more flexibility for future improvements. “The fact that Stripe can so easily fit into this broader workflow we’re engineering—that’s the value for us and for our customers,” said Karp. “Some of our competitors bought off-the-shelf payment solutions, and now they’re dependent on someone else’s product and roadmap.”

A growing user base

With growing adoption of AR Automation, Unanet has gained both an additional revenue stream, as well as a powerful new feature to retain ERP customers. Since launch, Unanet has seen a 40% increase in active users for AR Automation and a 55% increase in invoices delivered through the system. Payment processing volume has grown 50%, and the average transaction size has increased 25%.

Stripe is helping us grow our business. AR Automation is a better product because we have a great technical partner and a great business partner.