Data from consulting firm Grand View Research shows that Europe’s dropshipping market share reached 20.8% of global sales in 2023, exceeding €55 billion – an all-time high. The firm’s data suggests that dropshipping will continue to expand rapidly across the continent, with a predicted compound annual growth rate (CAGR) of 20.8% from 2024 to 2030. The dropshipping sector is also expected to generate revenues of more than €210 billion in Europe.

E-commerce is thriving in Spain, in particular. A survey on the use of Information and Communications Technologies (ICT) and e-commerce in businesses conducted by the National Statistics Institute (INE) shows that 30.7% of companies in Spain with at least 10 employees sold products online in 2023; these sales generated a total of more than €385 million.

As the e-commerce sector continues to grow in Spain, it can be helpful to understand the dropshipping model, including its specific operational, legal, and fiscal characteristics. Here are key things you need to know if you’re considering starting a dropshipping business in Spain.

What’s in this article?

- What is dropshipping?

- Is dropshipping legal in Spain?

- What taxes have to be paid when dropshipping in Spain?

- What are the requirements for dropshipping in Spain?

What is dropshipping?

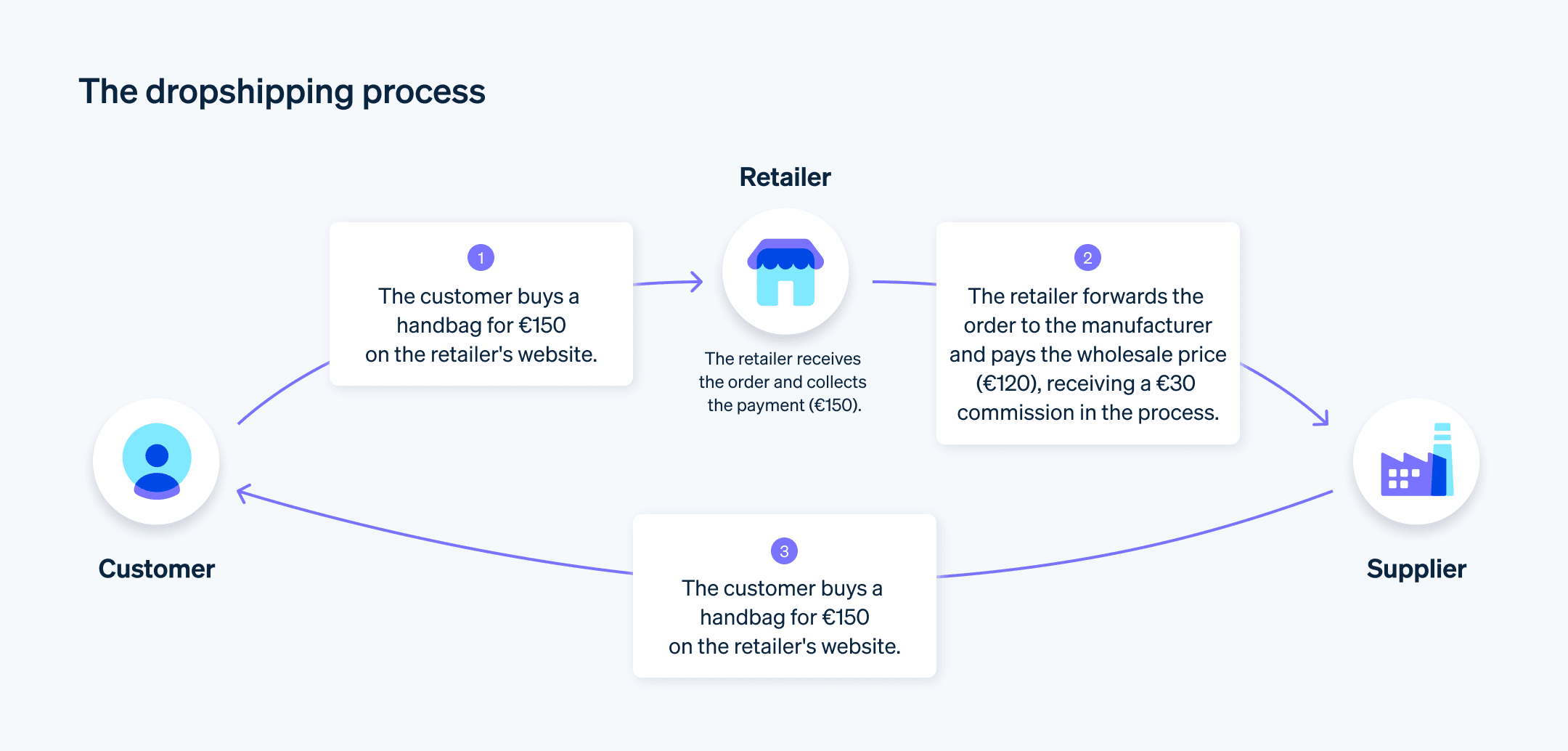

Dropshipping is a business model in which the supplier (e.g. a manufacturer or wholesaler) ships its products directly to the customer. This allows the dropshipping business (i.e. the retailer) selling the products to operate without having to stock or handle any inventory.

Since dropshippers – unlike traditional e-commerce businesses – do not handle their own inventory, there is no need for warehouses or internal supply chain management. The primary role of the dropshipper is to sell products and ensure that the supplier delivers those products to the customer. This arrangement allows the supplier to gain more retail customers for its goods; meanwhile, the dropshipper makes a profit purchasing goods from the supplier at wholesale prices and taking a commission on sales. While the supplier handles the production and shipping of orders, the customer pays the dropshipper, which acts as an intermediary in the process.

Is dropshipping legal in Spain?

In Spain, there are no regulations that prohibit individuals or companies from selling products as intermediaries without handling them, so dropshipping is perfectly legal. However, in order to ensure that a dropshipping business operates legally, it is important to comply with certain requirements.

- Register as a freelancer: To register as a freelancer, you must complete Form 036, providing details such as the Trade Income Tax (IAE) category that corresponds to your business activity. Although there is no specific category for dropshipping businesses, the most appropriate one for this business model is "Catalogue or postal order retail trade of miscellaneous products".

- Comply with regulations on consumer rights: Even if you are not responsible for managing the products you sell, you must ensure that your customers can exercise their consumer rights, such as returning products due to breaches of contract or processing guarantees. Consumer regulations establish these conditions through laws such as the General Law for the Protection of Consumers and Users, included in Royal Decree Law 1/2007.

- Ensure the protection and processing of data: Both the European Parliament, through Regulation 2016/679, and the government in Spain, through the Organic Law on Personal Data Protection (LOPD), require retailers to ensure the proper handling of customers’ personal data.

- Fulfil fiscal and tax obligations: Like any other business activity, dropshipping in Spain involves a series of fiscal and tax obligations. In the next section, we will analyse these obligations in detail.

When dropshipping in Spain you have to pay the following taxes:

VAT

Value-added tax (VAT) is an indirect tax levied on the purchase of goods, which varies depending on factors such as the type of product, whether it is a purchase or sale, and the location of the customer and supplier.

VAT on dropshipping business purchases

|

Supplier location |

|

|---|---|

|

Spain |

You must pay the VAT rates in Spain that correspond to the products purchased. |

|

European Union (EU) |

Transactions are subject to the tax legislation of the supplier’s country of origin. Intra-community transactions (specifically, acquisitions) are exempt from VAT provided both parties are registered in the Register of Intra-community Operators (ROI). |

|

Outside the European Union |

Purchases are not subject to VAT if the importer is registered with the Import One Stop Shop (IOSS) and the value of the goods does not exceed €150. If both conditions are not met, the VAT is paid by the customer. |

VAT on dropshipping business sales

|

Customer location |

|

|---|---|

|

Spain |

You must pay the VAT rates in Spain that correspond to the products purchased. |

|

European Union (EU) |

If the customer is a private individual, particular rules for distance selling apply. If the customer is a business or professional registered in the ROI, transactions are exempt from VAT as they qualify as intra-community supplies. |

|

Outside the European Union |

Purchases are subject to the tax laws of the customer’s country of origin, but no VAT needs to be paid. However, the dropshipper should still include the transaction in their tax report despite it being exempt from VAT. |

If a dropshipping transaction does not take place in Spain for tax purposes (i.e., the customer is not located in the common territory and the goods are not delivered there), it will not be subject to what is known as the “special regime of the equivalence surcharge” applicable to retailers. Since this regime is mandatory in certain cases, you must provide invoices or other documentation to prove that the transactions took place outside Spanish territory.

For sales to private customers within the EU, the VAT One Stop Shop (VAT OSS) allows you to declare VAT in one place instead of filing separate VAT returns in each member state where your customers are located.

To ensure that the correct amount of VAT (or equivalent, such as US sales tax) is applied to your sales, Stripe Tax provides an automated solution for calculating and collecting tax in the more than 50 countries in which it operates. You can view the updated list of excluded territories for more details. You can activate Stripe Tax with a single click from your dashboard, and Stripe will take care of adding the required tax percentage, collecting the amount, and generating reports to make your future filings much easier.

In Spain, these are the tax forms you need for VAT filing:

- Form 303: Quarterly VAT return

- Form 390: VAT annual summary

- Form 349: Intra-community transactions

- Form 369: VAT OSS transactions

IRPF

Personal income tax (IRPF) is a direct tax on the taxpayer’s income. To calculate the income from a given activity, various methods are available, but only the normal direct assessment and simplified direct assessment methods are compatible with dropshipping in Spain. The following are the tax forms related to IRPF:

Corporate income tax (IS)

If you operate your business as a partnership rather than as a self-employed individual, you will also be required to pay corporate income tax (IS). This direct tax applies to the profits earned by companies and is reported using the following tax forms:

What are the requirements for dropshipping in Spain?

To dropship in Spain, you need:

- A supplier: The supplier holds the products you sell through dropshipping (either by storing or manufacturing them) and is responsible for fulfilling the orders placed by customers on your e-commerce platform. In the example depicted above, the supplier would be the manufacturer that makes the handbags and ships them directly to the customer.

- An online store: You need a sales channel to allow your customers to purchase your products. The most common approach is to set up an online store using an e-commerce platform such as Shopify or WooCommerce. It is also a good idea to promote your products on social media and include payment links so that customers can purchase directly from the platform.

- A payment system: When customers visit your site, they need to be able to complete their purchase and check out easily. When choosing the right payment platform, you should consider factors such as security, the ability to support your customers’ preferred payment methods, and integration with your e-commerce system. Stripe Payments, for example, supports more than 100 payment methods, offers industry-leading security certifications, and provides no-code tools so you can start selling online without writing any code.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.