The Spanish Central Business Register reported that as of early 2023, there were over 3.2 million active companies in Spain. That figure is probably higher now since official 2024 data on self-employed as well as small- and medium-sized enterprises (SMEs) without employees isn’t available yet, but the number of companies with at least one employee rose nearly 1% from June 2023 to June 2024.

Most of these businesses sell products or services subject to value-added tax (VAT), an indirect tax customers pay at purchase. Companies collect, then declare and pay to the Spanish tax agency (AEAT). Businesses must disclose the total collected amount quarterly to the AEAT using Form 303 (known in Spain as “Modelo 303”). In this guide, we’ll detail how this tax form works.

What’s in this article?

- What is Form 303, and what is it for?

- Who has to file Form 303?

- What is the deadline for filing Form 303?

- How to obtain Form 303 and where to submit it

- How to fill in Form 303

What is Form 303, and what is it for?

Form 303 is used for submitting quarterly VAT returns. Every three months, you must report to the AEAT how much VAT you’ve collected on sales and paid on purchases. This allows you to determine if you’ve paid more VAT than charged customers. If this is the case, you would be entitled to a refund or compensation; otherwise, you’d need to pay the difference to the AEAT.

On Form 303, specify the output (what you’ve charged your customers) and the input VAT (what you’ve paid for products or services needed for your business), along with other data we’ll describe later.

Who has to file Form 303?

Anyone engaged in a professional activity subject to VAT, such as self-employed individuals, entrepreneurs, companies, real estate developers, and landlords, must file Form 303, regardless of whether they had business operations during the tax period. For instance, if you run a seasonal business that operates exclusively in the summer (May to September), you must still file your first-quarter Form 303 to inform the AEAT that no invoicing occurred.

However, tax obligations differ for VAT-exempt activities such as health services or education. Only companies that provide exclusively VAT-exempt services aren’t required to file Form 303.

What is the deadline for filing Form 303?

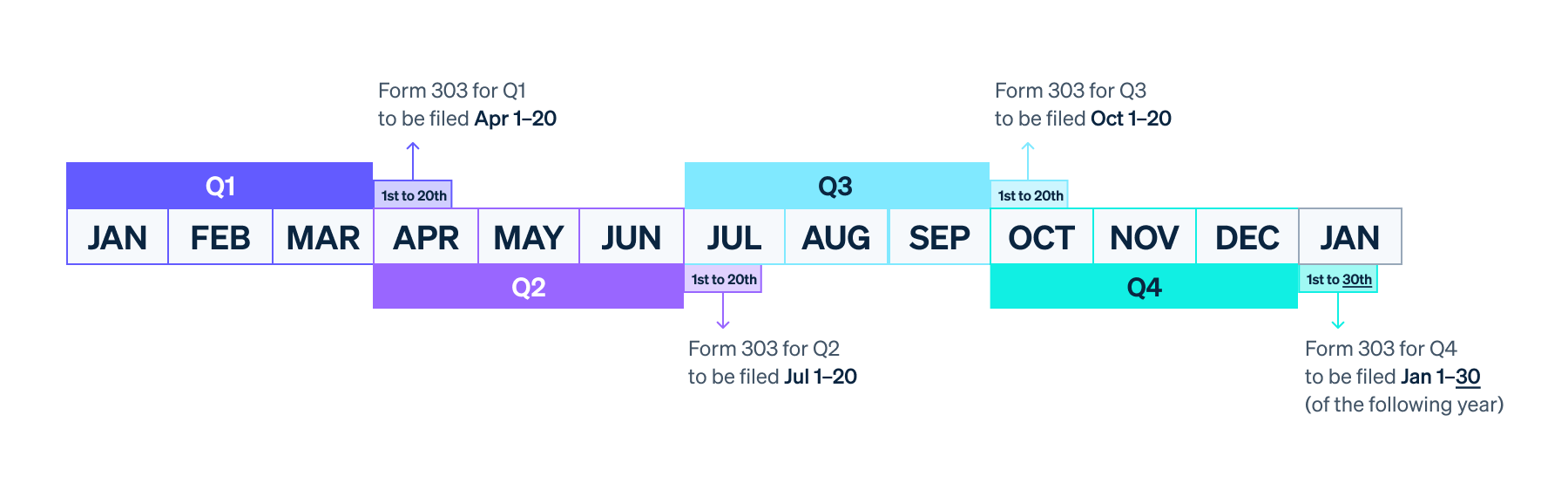

This form must be submitted every quarter, regardless of whether the company not conducted any business operations. Here are the dates when you can file each quarterly return:

- First quarter: Between 1 April and 20 April

- Second quarter: Between 1 July and 20 July

- Third quarter: Between 1 October and 20 October

- Fourth quarter: Between 1 January and 30 January of the following year

The taxpayer faces VAT penalties if Form 303 isn't filed by the deadlines. These include fines between 50% and 150% of the unpaid amount (if the AEAT notifies the company of the delay) or surcharges between 5% and 20% (if the company self-reports before receiving a notification), plus late payment interest of 4.0625%.

How to obtain Form 303 and where to submit it

You can complete Form 303 online via the AEAT website and submit it digitally through the portal using your Cl@ve, DNIe, digital certificate, or eIDAS (only for non-Spanish EU citizens) for identification.

Keep in mind that you can save changes as you fill in the different sections of Form 303, allowing you to continue with the return later if you don’t finish in one session. You can no longer file it in person, but you can download a PDF copy of your tax return once you’ve completed the online declaration.

How to fill in Form 303

Completing the form isn’t overly complex; it contains 8 sections and over 80 boxes. First, ensure you have all the invoices you’ve issued, each with the corresponding VAT amounts. You can use a tax automation tool such as Stripe Tax to ensure the VAT calculation is correct on all invoices. Stripe Tax allows you to automatically calculate and collect VAT on your business’s sales. Plus, you can use automatic updates to stay current with tax rate changes in any of the 50+ countries where it’s available (see the list of excluded territories).

First, choose your preferred electronic identification method from the AEAT website for the digital filing of Form 303. After confirming that your name and Tax Identification Number (NIF) are correct, select the fiscal year and the quarter for which you are filing this form. The AEAT portal will then guide you through the boxes you need to fill in step by step.

If you need more information about any particular box, please refer to the instructions published by the AEAT on their website’s Form 303 section.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.