O imposto sobre consumo é pago indiretamente ao governo por empresas em nome dos clientes.

Portanto, embora o imposto sobre o consumo seja essencialmente arcado pelo cliente, o recebimento do imposto pela empresa no momento da compra de bens ou serviços cria uma obrigação de pagar o imposto sobre o consumo recolhido.

Para que as empresas tributáveis paguem corretamente o imposto sobre vendas, elas devem calcular o valor devido e pagá-lo à autoridade fiscal. Por isso, é importante entender como calcular corretamente o imposto sobre vendas para garantir que você siga os procedimentos adequados.

Este artigo explica as fórmulas usadas para calcular o imposto sobre o consumo para declarações fiscais japonesas, incluindo o método de tributação regular, o método de tributação simplificada e a exceção especial de 20%.

Neste artigo:

- Como é calculado o imposto sobre o consumo?

- Dois métodos principais de cálculo do imposto sobre o consumo e a exceção especial de 20%

- Entenda como calcular o imposto sobre consumo e entregar uma declaração de imposto de renda

- Perguntas frequentes

Entenda as alterações fiscais de 2025 para empresas globais

Nosso guia mais recente trata das próximas mudanças fiscais globais que podem afetar sua empresa em 2025. Saiba como adaptar-se e manter a conformidade em um cenário regulatório altamente dinâmico. Saiba mais.

Como é calculado o imposto sobre o consumo?

O imposto sobre o consumo é pago pelas empresas em nome dos clientes. As empresas tributáveis devem pagar o imposto sobre o consumo recebido dos clientes à repartição fiscal adequada.

Normalmente, a parte aplicável do crédito fiscal de compra é deduzida antecipadamente. Note-se que o método de cálculo do imposto sobre o consumo é basicamente "imposto de consumo sobre vendas tributáveis" menos "imposto de consumo sobre as compras tributáveis, etc." (Consulte "Método de tributação regular").

Qual é a base tributária do imposto sobre o consumo?

A chave para entender como calcular o imposto sobre o consumo é conhecer a base tributária sobre o consumo.

A base tributária para o imposto sobre o consumo é o valor da contraprestação pela transferência da propriedade tributável em uma transação no Japão. O imposto sobre o consumo de bens e serviços é calculado multiplicando-se a base tributária pela alíquota tributária, de modo que o valor da base tributária é o valor usado como base para calcular o valor do imposto sobre o consumo a ser pago (Agência Fiscal Nacional (NTA), “Base tributária”).

Em termos simples, a base tributável é o “valor das vendas tributáveis excluindo o imposto (vendas de transações tributáveis)”, que exclui o imposto sobre o consumo e o imposto sobre o consumo local.

Nota: Transferência de ativos tributáveis, etc. O valor da contraprestação é o valor recebido em troca da transferência de ativos, do empréstimo de ativos ou da prestação de serviços, que pode incluir direitos ou benefícios econômicos que não sejam dinheiro.

Dois métodos principais de cálculo do imposto sobre o consumo e a exceção especial de 20%

Ao preencher uma declaração de imposto sobre consumo, você deve calcular o valor exato do imposto devido.

De acordo com a NTA, você deve se preparar bem antes do prazo de declaração, porque uma declaração inverídica ou uma declaração atrasada pode resultar em impostos adicionais, impostos inadimplentes e outros impostos incidentais.

O método escolhido para o cálculo do imposto sobre o consumo depende das circunstâncias de cada empresa. Existem dois métodos principais: o método de tributação regular e o método de tributação simplificado. Outro método de cálculo usa a exceção especial de 20% estabelecida como medida transitória para o Sistema de Faturas para empresas que voluntariamente optaram por se tornar uma empresa tributável a partir de uma empresa isenta de impostos.

O método de tributação regular pode ser utilizado por qualquer empresa, independentemente do setor, como método geral de cálculo do crédito tributário para compras. Também conhecida como "tributação geral" ou "tributação principal".

O método de tributação simplificado é particularmente adequado para as pequenas empresas. Esse método é mais simples que o método de tributação regular, facilitando o cálculo do valor do imposto sobre o consumo a ser pago.

A exceção especial de 20% pode ser aplicada quando uma empresa isenta de impostos se inscreve voluntariamente no Sistema de Faturas e se torna uma empresa tributável, reduzindo o valor do imposto sobre o consumo pago para 20% do valor do imposto de consumo sobre as vendas. O período aplicável é o período tributável de 1º de outubro de 2023 a 30 de setembro de 2026, após o início do Sistema de Faturas.

Cada método de cálculo tributário sobre o consumo é descrito abaixo.

Método de tributação regular

O valor do imposto a pagar de acordo com o método regular de tributação é calculado subtraindo-se o “valor do imposto sobre vendas sobre compras e despesas” do “valor do imposto sobre vendas tributáveis” da empresa. Essa dedução é chamada de crédito fiscal de compra.

Fórmula da tributação regular

- Imposto de consumo a pagar = Imposto de consumo sobre as vendas tributáveis - Imposto de consumo sobre compras e despesas

O imposto sobre o consumo deve ser calculado separadamente para cada alíquota de 10% e 8%. Transações isentas de impostos não são excluídas.

Misturar vários itens de alíquotas em vendas e compras pode complicar os cálculos, especialmente para empresas que lidam diariamente com transações complexas. Além disso, o não recebimento de uma fatura qualificada no Sistema de Faturas pode resultar na não reivindicação do crédito fiscal de compra, complicando ainda mais os cálculos ao preencher as declarações fiscais.

O sistema tributário simplificado, um método mais simples de calcular o imposto sobre vendas, pode ser usado para evitar esse problema, mas somente se a empresa cumprir determinados requisitos.

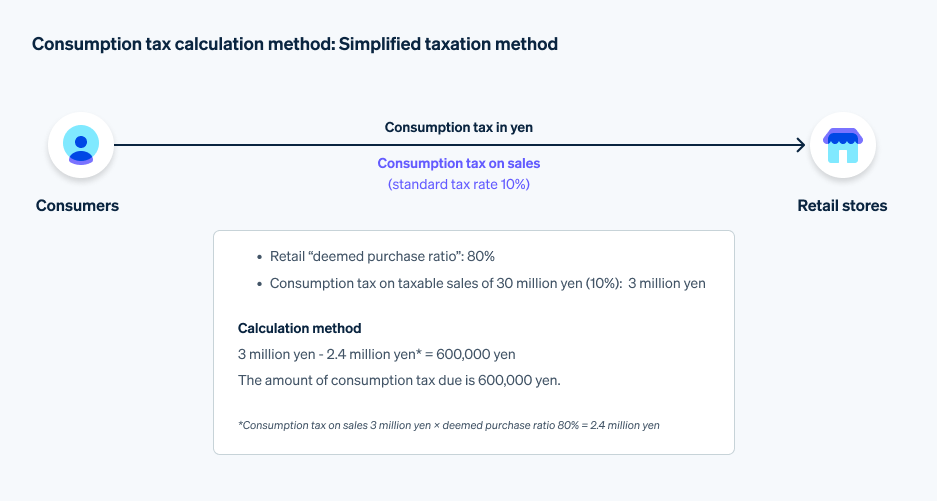

Método de tributação simplificado

O método de tributação simplificado calcula o valor do imposto devido com base apenas no "imposto de consumo sobre vendas tributáveis" e no "índice de compra presumida".

O método de tributação simplificado é permitido apenas para empresas tributáveis com vendas tributáveis de ¥ 50 milhões ou menos para o período padrão.

Para eleger o método de tributação simplificado, um formulário de eleição do sistema simplificado de tributação sobre o consumo deve ser apresentado à repartição fiscal apropriada até o dia anterior ao primeiro dia do período tributável. Mesmo que as vendas tributáveis para o período padrão sejam iguais ou inferiores a ¥ 50 milhões, o método de tributação simplificado não pode ser aplicado a menos que os procedimentos de declaração sejam concluídos previamente.

De acordo com o método de tributação simplificado, o montante do imposto sobre o consumo a pagar é calculado utilizando o rácio de compra considerado conforme descrito acima. No entanto, a tarifa varia de acordo com a categoria da empresa.

O índice de compras considerado para cada categoria de negócio é:

|

Segmentos de negócios

|

Taxa de compras considerada

|

Empresas visadas

|

|---|---|---|

| Empresas tipo 1 | 90% | Atacado (o negócio de comprar mercadorias de outras partes e vendê-los a outras empresas sem alterar sua natureza ou forma) |

| Empresas tipo 2 | 80% | Varejo (uma empresa que vende mercadorias compradas de outras partes sem alterar sua natureza ou forma e que não é uma empresa de tipo 1); agricultura, silvicultura e pesca (um negócio que envolve a transferência de alimentos e bebidas) |

| Empresas tipo 3 | 70% | Agricultura, silvicultura e pesca (excluindo empresas envolvidas na comercialização de alimentos e bebidas); mineração, construção e manufatura (incluindo comércio de manufaturados e varejo); e o termo "empresas concessionárias de energia elétrica" deve significar empresas concessionárias de energia elétrica, gás, aquecimento e água, excluindo as que se enquadram nos tipos de empresa 1 e 2 e na prestação de serviços mediante tarifas de processamento ou encargos similares |

| Empresas tipo 4 | 60% | Uma empresa que não se enquadra nos tipos 1, 2, 3, 5, ou 6, como um restaurante. As empresas que prestam serviços mediante uma tarifa de processamento ou outra tarifa similar, mas não se enquadram no tipo 3, também são consideradas empresas do tipo 4. |

| Empresa tipo 5 | 50% | Transportes e comunicações, finanças e seguros, e serviços (excluindo empresas que se enquadram na categoria de negócios de restaurante). Empresas que se enquadram nos tipos de empresa 1 a 3, excluindo as que se enquadram nos tipos de empresa de 1 a 3. |

| Empresa tipo 6 | 40% | Imobiliárias |

Materiais de referência: NTA, "Classificação comercial para o sistema de tributação simplificado"

Fórmula da tributação simplificada

- Imposto de consumo a pagar = Imposto de consumo sobre vendas tributáveis - (Imposto de consumo sobre vendas tributáveis x rácio de compra presumida)

Exemplo: Se as vendas tributáveis de um varejista forem de ¥ 30 milhões e o imposto sobre as vendas tributáveis for de 10% e nenhuma alíquota reduzida for aplicada

Como mostrado na tabela acima, o índice de compra considerado para varejistas é de 80%. Utilizando a fórmula de tributação simplificada, o valor do imposto sobre o consumo devido seria:

- ¥ 30 milhões × 10% - (¥ 30 milhões × 10% × 80%) = ¥ 600.000

O método de tributação simplificado não exige a separação de operações não tributáveis, e o cálculo do imposto sobre o consumo é mais simples do que o método de tributação regular, resultando em menos trabalho para as operações contábeis. Ao contrário do método de tributação regular, o sistema de faturamento não é afetado e, como faturas e outros documentos não são obrigatórios, as transações com empresas isentas de impostos podem continuar como antes.

No entanto, se houver um grande montante de imposto sobre o consumo a pagar nas compras e ele tiver sido calculado utilizando o rácio de compra presumido, o imposto sobre o consumo real a pagar pode ser mais elevado do que no método de tributação regular utilizando o crédito de compra. Além disso, se o método de tributação simplificado for selecionado, ele deve ser usado continuamente por pelo menos dois anos.

Ao escolher um método de cálculo de imposto sobre o consumo, selecione um que seja apropriado para sua situação com base nas perspectivas e no plano de negócios projetado da sua empresa.

Como calcular o imposto sobre o consumo usando a exceção especial de 20%

A exceção especial de 20%, introduzida como medida transitória para o Sistema de Faturas, aplica-se a empresas que mudaram de isentas de impostos para tributáveis. Ao apresentar uma declaração de imposto sobre o consumo, o contribuinte é obrigado a anexar uma declaração à declaração indicando que a isenção especial de 20% foi aplicada.

Materiais de referência: NTA "Guia de finalização do imposto sobre o consumo de exceção especial de 20% e do imposto sobre o consumo local"

Fórmula para calcular a exceção especial de 20%

- Imposto sobre o consumo a pagar = imposto sobre o consumo de vendas tributáveis x 20%*

Exemplo: Se as vendas tributáveis forem de ¥ 8 milhões e o imposto sobre o consumo sobre as vendas tributáveis for de ¥ 800.000 (10%), enquanto o imposto sobre o consumo sobre compras excluindo impostos for de ¥ 200.000 (10%) para um preço de compra de ¥ 2 milhões, então

- ¥ 800.000 × 20% = ¥ 160.000

Nas mesmas condições, se calcularmos o imposto sobre o consumo a pagar usando o método de tributação regular, verificaremos que o valor do imposto a pagar é de ¥ 600.000, o que é muito maior do que a exceção especial de 20%, como mostrado abaixo.

- ¥ 800.000 - ¥ 200.000 = ¥ 600.000

Quando uma empresa isenta de impostos altera seu status para tributável para se tornar uma empresa de faturamento qualificada, ela deve enviar um pedido de registro como empresa de faturamento qualificada com a caixa apropriada marcada no formulário ou enviar (somente durante o período tributável que inclui 1º de outubro de 2023 a 30 de setembro de 2029) a Notificação de eleição como operador comercial sujeito ao imposto sobre o consumo.

Empresários individuais e outras empresas isentas de impostos precisam considerar cuidadosamente se devem se inscrever no Sistema de Faturas com base no tamanho da empresa e nos lucros/perdas, pois há vantagens e desvantagens em cada uma delas.

Artigo relacionado: "Como pequenos empresários individuais podem usar o sistema de faturas no Japão"

Como calcular o imposto de consumo e fazer uma declaração tributária

Acima, explicamos como é calculado o imposto sobre o consumo.

Existem dois métodos principais de cálculo do imposto sobre o consumo: o método de tributação regular e o método de tributação simplificado; A isenção especial de 20% para determinados períodos é outra opção. Empresas tributáveis que são obrigadas a pagar imposto sobre o consumo são aconselhadas a entender esses métodos de cálculo fiscal e preparar suas declarações de impostos para pagar o valor correto do imposto.

Se uma empresa que havia sido isenta se tornar uma empresa tributável para fins de conformidade com o Sistema de Faturas, recomenda-se usar a exceção especial de 20% durante o período de vigência.

À medida que as circunstâncias mudam e a necessidade de transformação digital (DX) aumenta, uma maneira de lidar com o imposto sobre vendas é usar um software de cálculo que suporte várias alíquotas e considerar a introdução de funções para automatizar a contabilidade para realizar o trabalho administrativo relacionado ao imposto sobre vendas de forma tranquila e eficiente.

A Stripe oferece o Stripe Tax com cálculo automático de impostos sobre vendas, que pode ser personalizado. Todas as transações eletrônicas automatizam o processamento de impostos, permitindo aumentar a eficiência operacional.

Perguntas frequentes

P: Como calcular o imposto sobre o consumo a partir do imposto interno (preço incluindo imposto)?

R: O método de cálculo exigido para uma declaração de imposto sobre consumo é baseado no valor da base tributável (vendas tributáveis antes dos impostos). Também é útil conhecer o método de cálculo para verificar o imposto sobre o consumo a partir do preço do produto "imposto interno", que é o preço original mais o imposto sobre vendas.

Para impostos internos, divida o preço do item por (1 + alíquota). Isso nos permite calcular o preço sem imposto e, em seguida, multiplicá-lo pela alíquota aplicável para encontrar o imposto sobre vendas.

Por exemplo, a fórmula para um produto com alíquota padrão de 10% e imposto interno de ¥ 11.000 é:

- Preço incluindo impostos ¥ 11.000 ÷ (1 + 0,1 [Cálculo do preço sem impostos]) × alíquota de 10% (0,1) = ¥ 1.000

Se o imposto sobre consumo for de 8% com a alíquota reduzida, a fórmula é dividir o preço do produto por 1,08:

- Preço incluindo impostos ¥ 10.800 ÷ (1 + 0,08 [Cálculo do preço sem impostos]) × alíquota de 8% (0,08) = ¥ 800

P: Quais operações estão sujeitas ao imposto sobre consumo?

R: Há vários requisitos para transações tributáveis para as quais o imposto sobre consumo deve ser pago no Japão, incluindo transações realizadas no Japão e transações realizadas por uma empresa. Para obter mais informações, consulte o artigo relacionado "O que é uma transação de imposto sobre consumo tributável?"

P: Qual é o prazo para declarar e pagar o imposto sobre consumo?

R: A data de vencimento para declaração e pagamento do imposto sobre vendas é a mesma, e para as pessoas jurídicas é dentro de 2 meses a partir do dia seguinte ao final do ano fiscal (o último dia do mês fiscal). Por exemplo, se o ano fiscal começa em 1º de abril de cada ano e termina em 31 de março de cada ano, o vencimento do pagamento é 31 de maio de cada ano.

Por outro lado, para empresários individuais, a data de vencimento é 31 de março do ano seguinte (ou na segunda-feira seguinte, se cair em um sábado ou domingo). Observe também que a data de vencimento é diferente da data de vencimento da declaração do imposto de renda (15 de março).

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.