La taxe sur la consommation est versée indirectement à l’État par les entreprises pour le compte de leurs clients.

Par conséquent, si la taxe sur la consommation est essentiellement assumée par le client, la perception de la taxe par l’entreprise au moment de l’achat de biens ou de services crée pour elle une obligation de reverser la taxe perçue.

Pour que les entreprises assujetties à cette taxe la reversent correctement, elles doivent calculer le montant dû et le verser à l’administration fiscale. Il est donc important de comprendre comment calculer correctement la taxe sur les ventes afin de suivre les procédures appropriées.

Cet article explique les formules utilisées pour calculer la taxe sur la consommation au Japon, tant pour le régime normal que pour le régime simplifié et l’exception spéciale de 20 %.

Sommaire de cet article

- Modes de calcul de la taxe sur la consommation

- Deux principaux modes de calcul de la taxe sur la consommation, et l’exception spéciale de 20 %

- Comprendre comment calculer la taxe sur la consommation et remplir une déclaration

- Questions fréquemment posées

L’impact des évolutions fiscales de 2025 sur les entreprises

Notre nouveau guide passe en revue les principales évolutions fiscales à l’horizon en 2025. Votre entreprise sera-t-elle affectée ? Découvrez comment vous adapter et maintenir votre conformité dans un environnement réglementaire international en constante évolution. En savoir plus.

Modes de calcul de la taxe sur la consommation

La taxe sur la consommation est payée par les entreprises pour le compte de leurs clients. Les entreprises assujetties à la taxe doivent reverser la taxe sur la consommation reçue des clients à l’administration fiscale compétente.

En règle générale, la partie applicable du crédit de taxe sur les achats est déduite à l’avance. Notez que le mode de calcul de la taxe sur la consommation correspond essentiellement à la « taxe sur les ventes taxables » moins la « taxe sur les achats taxables, etc. ». (Voir « Régime normal »).

Assiette de la taxe sur la consommation

La clé pour comprendre comment calculer la taxe sur la consommation est de connaître la base d’imposition de la taxe sur la consommation.

Celle-ci correspond au montant du transfert d’un bien taxable dans le cadre d’une transaction au Japon. La taxe sur la consommation des biens et services est calculée en multipliant l'assiette par le taux de taxe, de sorte que le montant de l'assiette est le montant utilisé pour le calcul du montant de la taxe à payer (National Tax Agency (NTA), « Assiette fiscale »).

Autrement dit, l'assiette est le « montant des ventes taxables hors taxes (ventes résultant de transactions taxables) », qui exclut la taxe sur la consommation ainsi que la taxe sur la consommation locale.

Remarque : Transfert d’actifs taxables, etc. Le montant de la contrepartie est le montant reçu en échange du transfert d'actifs, du prêt d'actifs ou de la prestation de services, qui peut inclure des droits ou des avantages économiques autres que monétaires.

Deux principaux modes de calcul de la taxe sur la consommation, et l’exception spéciale de 20 %

Lorsque vous déclarer la taxe sur la consommation, vous devez calculer le montant exact de la taxe due.

Selon la NTA, vous devez vous préparer bien avant la date limite de dépôt, car une déclaration erronée ou tardive peut entraîner des taxes supplémentaires, des taxes en souffrance et d'autres taxes accessoires.

La méthode choisie pour calculer la taxe sur la consommation dépend de la situation de chaque entreprise ; il existe deux régimes principaux : le régime de taxe normal et le régime de taxe simplifié. Un autre mode de calcul fait appel à l’exception spéciale de 20 % établie à titre de mesure transitoire pour le système de facturation pour les entreprises exonérées de taxes qui ont volontairement choisi d'être assujetties à la taxe.

Le régime normal peut être utilisé par n’importe quelle entreprise, quel que soit son secteur d’activité, comme méthode générale de calcul du crédit de taxe sur les achats. Aussi connue sous le nom de « régime général » ou « régime principal ».

Le régime de taxe simplifié est particulièrement adapté aux petites entreprises. Plus simple que le régime normal, il facilite le calcul du montant de la taxe sur la consommation à payer.

L’exception spéciale de 20 % peut s’appliquer lorsqu’une entreprise exonérée de taxe s’inscrit volontairement au système de facturation et devient une entreprise assujettie à la taxe, ce qui réduit le montant de la taxe sur la consommation payée à 20 % du montant de la taxe sur les ventes. Veuillez noter que la période applicable est la période taxable comprise entre le 1er octobre 2023 et le 30 septembre 2026, après la mise en place du système de facturation.

Chaque mode de calcul de la taxe sur la consommation est décrit ci-dessous.

Régime normal

Le montant de la taxe payable sous le régime normal est calculé en soustrayant le « montant de la taxe versée sur les achats et les dépenses » du « montant de la taxe perçue sur les ventes taxables » de l’entreprise. Cette déduction s’appelle le crédit de taxe à l’achat.

Formule du régime normal

- Taxe sur la consommation à payer = Taxe perçue sur les ventes taxables - Taxe payée sur les achats et les dépenses

La taxe sur la consommation doit être calculée séparément pour les taux de taxe de 10 % et de 8 %. Les transactions exonérées de taxe sont exclues.

Les calculs peuvent être compliqués par la combinaison d’articles avec plusieurs taux de taxe dans les ventes et les achats, en particulier pour les entreprises qui traitent quotidiennement des transactions complexes. De plus, le fait de ne pas recevoir de facture admissible dans le cadre du système de facturation peut entraîner l'impossibilité de demander le crédit de taxe sur les achats, ce qui complique encore les calculs lors de la déclaration.

Le régime de taxe simplifié peut être utilisé pour éviter ce problème, mais seulement si l’entreprise répond à certaines exigences.

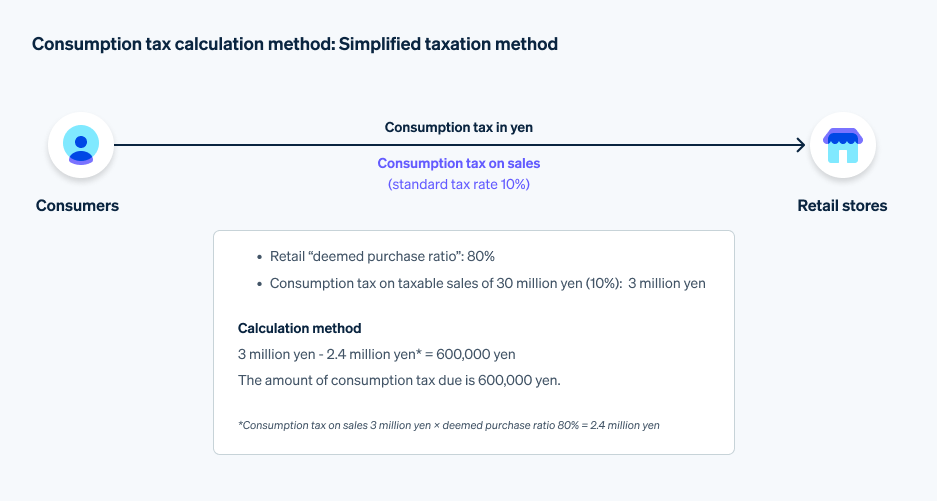

Régime simplifié

Le régime de taxe simplifié calcule le montant de la taxe due en considérant uniquement la « taxe perçue sur les ventes taxables » et le « ratio d’achat présumé ».

Le régime simplifié n’est autorisé que pour les entreprises assujetties à la taxe et dont le chiffre d’affaires taxable est inférieur ou égal à 50 millions de yens pour la période normale.

Pour choisir ce régime, un formulaire de sélection du régime simplifié de la taxe sur la consommation doit être soumis à l’administration fiscale compétente au plus tard la veille du premier jour de la période fiscale. Même si le chiffre d’affaires taxable pour la période normale est inférieur ou égal à 50 millions de yens, le régime simplifié ne peut être appliqué que si les procédures de déclaration sont effectuées au préalable.

Dans le cadre du régime simplifié, le montant de taxe sur la consommation à payer est calculé à l’aide du ratio d’achat présumé tel que décrit ci-dessus. Toutefois, le taux varie en fonction de la catégorie d’entreprise.

Le ratio d’achat présumé pour chaque catégorie d’entreprise est le suivant :

|

Segments d'activité

|

Proportion d'achats estimée

|

Entreprises cibles

|

|---|---|---|

| Entreprise de type 1 | 90 % | Vente en gros (une entreprise qui vend à d'autres entreprises des biens achetés à des tiers sans en changer la nature ou la forme). |

| Entreprise de type 2 | 80 % | Vente au détail (une entreprise qui vend des biens achetés à des tiers sans en changer la nature ou la forme, et qui n'est pas une entreprise de Type 1) ; agriculture, foresterie et pêche (une entreprise qui inclut le transfert de nourriture et de boissons). |

| Entreprise de type 3 | 70 % | Agriculture, foresterie et pêche (à l'exception des entreprises impliquées dans le transfert de nourriture et de boissons) ; exploitation minière, construction et production industrielle (y compris le commerce manufacturier et de détail). Le terme « entreprises d'électricité » doit englober toutes les entreprises de services publics (électricité, gaz, chauffage, eau), à l'exception des entreprises qui entrent dans les catégories Type 1 et Type 2, ainsi que celles qui fournissent des services pour lesquels elles facturent des frais de traitement ou d'autres frais similaires. |

| Entreprise de type 4 | 60 % | Une entreprise qui n'appartient pas aux types 1, 2, 3, 5 ou 6, comme un restaurant. Les entreprises qui fournissent des services en échange de frais de traitement ou d'autres frais similaires et qui n'entrent pas dans la catégorie Type 3, sont également considérées comme des entreprises de Type 4. |

| Entreprise de type 5 | 50 % | Transport et communications, finance et assurance, et services (à l'exception des entreprises qui entrent dans la catégorie « Restauration »). Les entreprises qui relèvent de les catégories d'entreprises de Type 1 à 3, à l'exception des entreprises qui entrent dans les catégories de Type 1 à 3. |

| Entreprise de type 6 | 40 % | Immobilier |

Documents de référence : NTA, « Classification des entreprises pour le régime de taxe simplifié »

Formule du régime simplifié

- Taxe sur la consommation à payer = Taxe perçue sur les ventes taxables - (Taxe perçue sur les ventes taxables × ratio d’achat présumé)

Exemple : Si le chiffre d'affaires taxable d'un commerçant est de 30 millions de yens, la taxe sur les ventes taxables est de 10 %, et aucun taux de taxe réduit n'est appliqué

Comme l’indique le tableau ci-dessus, le ratio d’achat présumé pour les commerçants est de 80 %. En utilisant la formule du régime simplifié, le montant de la taxe sur la consommation due serait de :

- 30 millions ¥ × 10 % - (30 millions ¥ × 10 % × 80 %) = 600 000 ¥

Le régime de taxe simplifié n’exige pas la séparation des transactions non taxables, et le calcul de la taxe sur la consommation y est plus simple que pour le régime normal, ce qui réduit la charge de travail associée aux opérations comptables. Contrairement au régime normal, le système de facturation n’est pas affecté et, comme les factures et autres documents ne sont pas requis, les transactions avec les entreprises exonérées de taxes peuvent se poursuivre comme auparavant.

Toutefois, s’il y a un montant élevé de taxe sur la consommation payable sur les achats et qu’il a été calculé à l’aide du ratio d’achat présumé, la taxe réelle à payer pourrait être plus élevée que sous le régime normal avec crédit d’achat. De plus, si la le régime de taxe simplifié simplifiée est retenu, il doit être utilisé de manière continue pendant au moins deux ans.

Lorsque vous choisissez un mode de calcul de la taxe sur les ventes, choisissez celui qui convient à votre situation en fonction des perspectives de votre entreprise et du plan d’affaires envisagé.

Calcul de la taxe sur la consommation à l’aide de l’exception spéciale de 20 %

L’exception spéciale de 20 %, introduite à titre de mesure transitoire pour le système de facturation, s’applique aux entreprises qui sont assujetties à la taxe après avoir été exonérées d'impôt. Lorsqu'il remplit une déclaration de taxe sur les ventes, le contribuable est tenu d'y joindre une attestation indiquant que l'exonération spéciale de 20 % a été appliquée.

Documents de référence : NTA « Guide de finalisation de l’exception spéciale de 20 % au titre de la taxe sur la consommation et de la taxe locale sur la consommation »

Formule de calcul de l’exception spéciale de 20 %

- Taxe sur la consommation à payer = Taxe sur les ventes taxables × 20 %

Exemple : Si le montant des ventes taxables est de 8 millions de yens et que la taxe sur les ventes taxables est de 800 000 yens (10 %) alors que la taxe payée sur les achats hors taxes est de 200 000 yens (10 %) pour un prix d’achat de 2 millions de yens, alors

- 800 000 ¥ × 20 % = 160 000 ¥

Dans les mêmes conditions, si nous calculons la taxe sur la consommation en utilisant le régime normal, nous constatons que le montant de la taxe à payer est de 600 000 yens, ce qui est beaucoup plus élevé que l’exception spéciale de 20 %, comme indiqué ci-dessous.

- 800 000 ¥ - 200 000 ¥ = 600 000 ¥

Lorsqu'une entreprise exonérée change de statut et devient assujettie à la taxe, elle doit introduire une demande d'enregistrement en tant qu'entreprise de facturation qualifiée en cochant la case appropriée sur le formulaire ou bien soumettre (uniquement pendant la période fiscale allant du 1er octobre 2023 au 30 septembre 2029) une Notification de sélection en tant qu’entité commerciale émettrice de factures admissible soumise à la taxe sur la consommation.

Les entrepreneurs individuels et les autres entreprises exonérées doivent examiner attentivement la pertinence de s'inscrire ou non au système de facturation en fonction de la taille de leur entreprise et de leurs bénéfices/pertes, car chaque option présente des avantages et des inconvénients.

Article connexe : « Comment les petites entreprises individuelles peuvent utiliser le système de facturation au Japon »

Comprendre comment calculer la taxe sur la consommation et remplir une déclaration

Nous venons de voir plus haut comment est calculée la taxe sur la consommation.

Il existe deux principaux modes de calcul de la taxe sur la consommation : le régime normal et le régime simplifié ; l’exonération spéciale de 20 % pour certaines périodes est une autre option. Il est conseillé aux entreprises assujetties à la taxe sur la consommation de comprendre ces modes de calcul de la taxe et de préparer leur déclaration de manière à verser le bon montant de taxe.

Si une entreprise auparavant exonérée devient assujettie à la taxe pour se conformer au système de facturation, il est recommandé d'utiliser l'exception spéciale de 20 % pendant la période d'application.

Face à l'évolution des circonstances et à la nécessité croissante de la transformation numérique, l'un des moyens de gérer la taxe sur les ventes consiste à utiliser un logiciel de calcul prenant en charge plusieurs taux de taxe et à envisager d'introduire des fonctions d'automatisation de la comptabilité afin d'effectuer les tâches administratives liées à la taxe sur les ventes de manière fluide et efficace.

Stripe propose Stripe Tax, une solution avec calcul automatique de la taxe sur les ventes, qui peut être personnalisée. Toutes les transactions électroniques automatisent le traitement des taxes, ce qui vous permet d’accroître votre efficacité opérationnelle.

Questions fréquemment posées

Q : Comment calculer la taxe sur la consommation à partir de la taxe interne (prix TTC) ?

R : Le mode de calcul requis pour une déclaration de taxe sur la consommation s’appuie sur le montant de l'assiette fiscale (ventes taxables avant la taxe). Il est également utile de connaître le mode de calcul pour vérifier la taxe sur la consommation à partir du prix du produit « taxe interne », c’est-à-dire le prix d’origine plus la taxe de vente.

Pour la taxe interne, divisez le prix de l’article par (1 + taux de taxe). Vous pouvez ainsi calculer le prix hors taxe, puis le multiplier par le taux de taxe applicable pour obtenir la taxe sur les ventes.

Par exemple, la formule pour un produit avec un taux de taxe normal de 10 % et une taxe interne de 11 000 ¥ est la suivante :

- Prix TTC 11 000 ¥ ÷ (1 + 0,1 [Calcul du prix HT]) × taux de taxe de 10 % (0,1) = 1 000 ¥

Si la taxe sur la consommation est de 8 % avec le taux de taxe réduit, la formule consiste à diviser le prix du produit par 1,08 :

- Prix TTC 10 800 ¥ ÷ (1 + 0,08 [Calcul du prix HT]) × taux de taxe de 8% (0,08) = 800 ¥

Q : Quelles sont les transactions soumises à la taxe sur la consommation ?

R : Plusieurs conditions s’appliquent aux transactions taxables pour lesquelles la taxe sur la consommation doit être payée au Japon, notamment les transactions effectuées au Japon et les transactions effectuées par une entreprise. Pour en savoir plus, consultez l’article connexe « Qu’est-ce qu’une transaction taxable assujettie à la taxe sur la consommation ? »

Q : Quelle est la date limite pour déclarer et verser la taxe sur la consommation ?

R : La date d’échéance est la même pour la déclaration et le paiement de la taxe sur les ventes, et pour les sociétés, elle est dans les deux mois suivant la fin de l’exercice financier (le dernier jour du mois fiscal). Par exemple, si chaque année l’exercice commence le 1er avril et se termine le 31 mars, la date d’échéance du paiement est le 31 mai de l’année en question.

En revanche, pour les entreprises individuelles, la date d’échéance est le 31 mars de l’année suivante (ou le lundi suivant si elle tombe un samedi ou un dimanche). Veuillez également noter que la date d’échéance est différente de la date d’échéance de la déclaration de revenus (le 15 mars).

Le contenu de cet article est fourni à des fins informatives et pédagogiques uniquement. Il ne saurait constituer un conseil juridique ou fiscal. Stripe ne garantit pas l'exactitude, l'exhaustivité, la pertinence, ni l'actualité des informations contenues dans cet article. Nous vous conseillons de solliciter l'avis d'un avocat compétent ou d'un comptable agréé dans le ou les territoires concernés pour obtenir des conseils adaptés à votre situation.