账单是商品或服务提供商签发的用于付款或请求付款的文件。这非常重要,因为它可以确认交易的细节,并在与业务合作伙伴发生纠纷时充当证据。

根据交易情况,您可以分期开具账单。那么什么时候可以拆分,什么时候拆分是非法的呢?

本文还提供了简单的说明和模板,用于在需要时创建拆分账单。

目录

- 账单可以拆分吗?

- 拆分账单是否违法?

- 如果想向多个收件人分别开具账单怎么办?

- 如何创建分期付款账单

- 拆分账单的注意事项

- 如何正确开具拆分账单

账单可以拆分吗?

如果有正当理由并与客户达成协议,拆分账单通常是可以的。拆分账单的最大好处是降低了客户的付款负担,尤其是当支付金额较大时,企业可以通过合同安排分期付款,而不是一次性收取全部费用。

在以下情况下,企业可以拆分账单:

分批交货

当企业多次交付商品或服务时,可以为每次交付开具账单。

长期项目

如果交易涵盖较长的时间段,例如在建筑业中,企业通常会为项目的各个里程碑开具账单,客户则按分期付款。

设定分期付款

如果金额较大或客户难以一次性支付,客户与企业可在合同中事先同意分期付款,企业可以根据付款计划开具分期账单。

开具账单后追加订单

如果客户在开票后增加了订单,您可以另行开具账单,以涵盖新增金额。

订阅服务或每月经常性付款

对于流媒体服务或保险费等定期收款,也可分开开具账单。

拆分账单是否违法?

在大多数情况下,如果与供应商达成协议,拆分账单并不违法。但在某些条件下,尤其是存在恶意行为时,如违反税法或不当拆分账单,则是禁止的。

为了避税

故意将账单拆分为多个账单以避免消费税的行为将受到管制。

内容与合同约定不符

如果客户已同意合同中一次性付款的条款,企业不得在未经双方同意的情况下拆分账单。

为避免违反法规

以“建筑行业 2024 问题”为例,若故意拆分账单以分散员工工作时间并伪装未达到法定时限,实际上已超出时限的做法,则属违法行为。

想向多个收件人分别开具账单怎么办?

当您向不同客户提供服务或商品时,向多个客户分别开具账单通常是合法的。但如果这样做违反税法意图或是一种恶意且未经授权的拆分账单行为,则可能会违法。

例如,如果多家公司共同投资一个项目,且合同中事先明确规定了将账单分别发送给不同收件人,则向多位收件人开具单独账单是可以的。相反,若出于避税等“不正当目的”拆分账单,可能会受到监管措施。

如何创建分期付款账单

以下是创建分期付款账单的步骤及其应包含的内容。这类账单需包含基本账单信息及有关分期付款的信息。

基本账单信息

- 账单编号

- 开具日期

- 业务伙伴信息

- 开具方信息

- 交付或服务日期

- 商品和服务的详细信息

分期付款信息

- 交易总金额

- 分期期数

- 当前付款金额

- 应付总次数

- 付款到期日

- 支付方式

- 分期付款的条款和条件

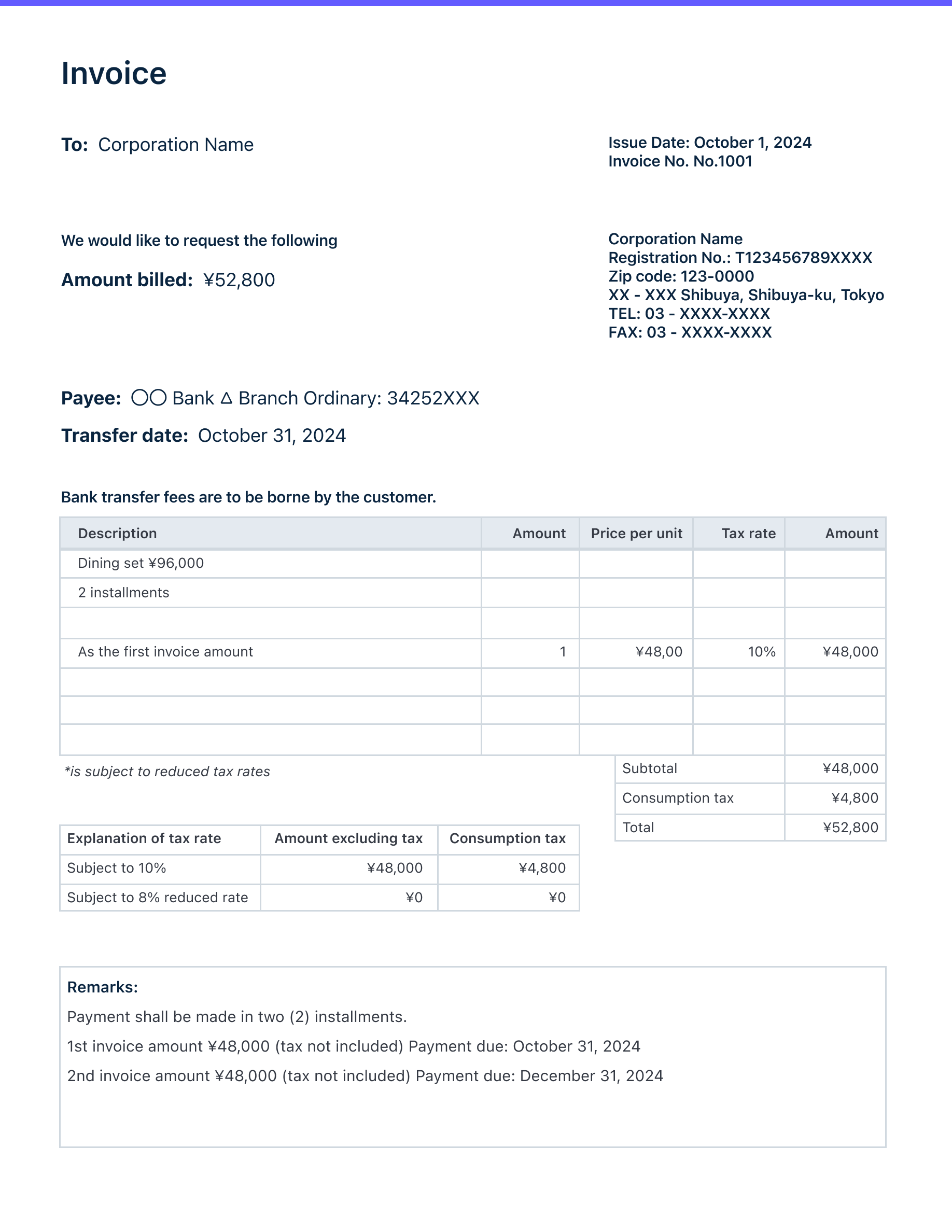

将账单拆分为两部分的模板

现在,您已了解分期付款账单应包含的内容,接下来是分期账单拆分成两部分的模板。

拆分账单的注意事项

分期付款的账单根据行业和服务类型有所不同,尽管没有统一的答案,但可以参考以下几个要点。

指定分期期数

在每个付款周期开具相应的分期账单,这样可以提醒客户付款金额和到期日期,避免他们忘记支付。每张账单上应标明总金额和剩余的付款次数。如果有较多期付款,请包含剩余金额,让客户清楚剩余款项,以便合理安排付款。

正确开具拆分账单和账单

了解拆分账单的优缺点并正确使用它可以使与客户的交易更容易。您可以从零开始创建和管理它们。不过,在某些情况下,可能希望尽可能简化会计操作,将更多时间用于市场推广和品牌建设。

如果您需要账单或其他会计相关帮助,可以考虑使用 Stripe Invoicing。Invoicing 可以让您快速创建一次性或定期账单,直接在文档中添加产品名称、折扣和税率。您可以在几分钟内轻松创建定制的在线和 PDF 账单,减轻会计负担,腾出更多时间发展业务。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。