An invoice is a document a provider of goods or services issues to make or request payment. It is very important because it can confirm the details of transactions and act as evidence in the event of disputes with a business partner.

Depending on the circumstances of the transaction, you can issue invoices in installments. When can you do this, and when is it illegal?

This article also provides simple explanations and a template for creating a split invoice when you need to do so.

What’s in this article?

- Can invoices be split?

- Is it illegal to split invoices?

- What if I want to issue it separately to multiple addressees?

- How to create an instalment payment invoice

- Notes on splitting invoices

- How to correctly issue split invoices

Can invoices be split?

Splitting an invoice is usually fine if there is a valid reason and an agreement with the client. The greatest benefit of splitting the invoice is the reduced amount owed to the customer. This approach is helpful to the business owner, especially if the payment total is large, as they can finalise the contract and ask for installments rather than a lump sum.

Businesses can do so in the following cases:

Split delivery

When a business delivers goods or services multiple times, it can issue an invoice for each instance.

Long-term projects

If the transaction covers an extended period, such as in construction, businesses typically issue invoices for milestones in the work, and the client makes payments in instalments.

When you set up an instalment payment

If the amount is large or difficult for the customer to pay at once, the customer and business could agree upon instalments in advance in the contract. Again, the business can do so based on the payment schedule.

Additional orders after invoice issuance

If a customer places additional orders after an invoice has been issued, you can create a separate invoice to cover the additional amount.

Subscription services or recurring monthly payments

Bills are also split for recurring charges such as streaming services and insurance premiums.

Is it illegal to split invoices?

Splitting invoices is not illegal in most cases if there is an agreement with the supplier. However, it is prohibited under certain conditions, especially if there was malicious intent, such as violating tax laws or improperly splitting a bill.

For tax avoidance purposes

Intentionally splitting a bill into multiple invoices to avoid consumption tax is subject to regulation.

If the contents differ from those agreed upon in the contract

A business cannot split the bill without mutual agreement if the customer has already agreed to a “lump sum” payment in the contract.

To avoid regulatory violations

To take the “construction industry’s 2024 problem” as an example, fraudulently splitting invoices to spread out employees’ working hours and pretending that they have not reached the legal limit when, in fact, they have, is illegal.

What if I want to issue it separately to multiple addressees?

Issuing separate invoices to multiple clients when you provide services or goods to different clients is usually legal. Regardless, if this violates the tax law’s intent or is a malicious and unauthorised attempt to split one, it could be illegal.

For example, if multiple companies jointly invest in a single project, issuing separate invoices to multiple recipients is fine if the contract clearly states in advance that the business will send them to different recipients. Conversely, splitting an invoice “in bad faith”, as in the case of avoiding taxes, could be subject to regulatory action.

How to create an instalment payment invoice

Let’s examine how to prepare an instalment payment invoice and what it needs to contain. These invoices must contain the usual basic billing information and information regarding instalment payments.

Basic invoice information

- Invoice number

- Date of issue

- Information about business partners

- Information about the issuing company

- Date of delivery or services rendered

- Details of goods and services

If your company is enrolled in the Qualified Invoice System, check to see if it meets the requirements.

Information about instalment payments

- Statement of the total amount for the transaction

- Number of instalments

- Amount of this payment

- Total number of payments to be made

- Payment due

- Payment method

- Terms and conditions for instalment payment

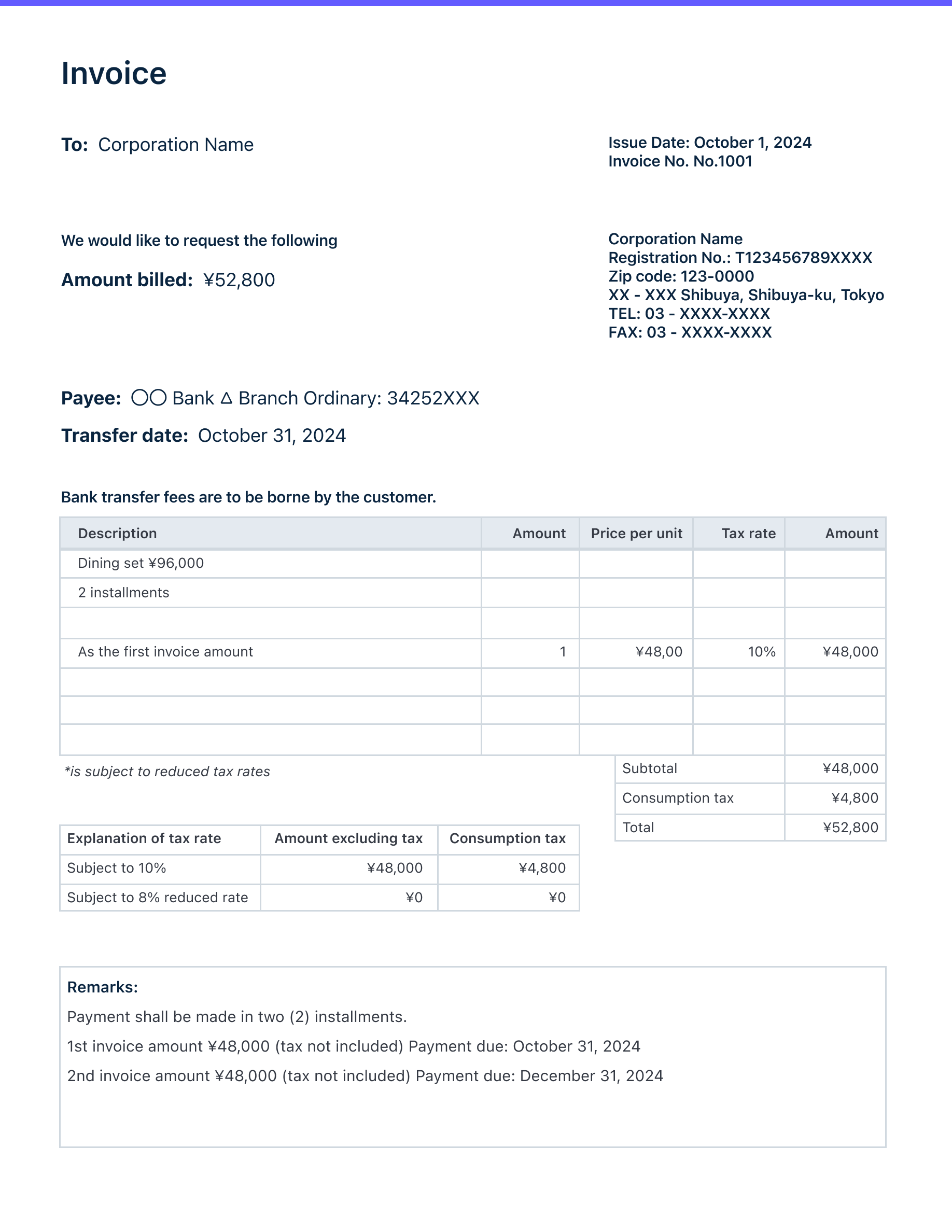

Template for splitting an invoice into two parts

Now that you know what to include in the instalment invoice, let’s review the template for splitting it into two parts.

Notes on splitting invoices

Billing for instalment payments varies between industries and service types. Although there is no single right answer, there are some common details to consider.

Specify the number of instalments

Issue an instalment invoice for each payment period. This will remind the customer of the amount owed and due date; failing to do so risks them forgetting to pay. You need to write the total billed and the number of payments due on each bill. If there are many instalments, include the balance to make it clear to the customer so they can make plans to pay.

Issue split invoices and bills correctly

Understanding the advantages and disadvantages of splitting invoices and using it correctly can make transactions with customers easier. You can also create and manage them from scratch. However, there are some instances where you might want to streamline your accounting operations as much as possible and spend more time on marketing and branding.

Consider implementing Stripe Invoicing if you need help with billing or other accounting-related tasks. Invoicing allows you to create one-time or recurring invoices and add product names, discounts, and tax rates directly to the document. You can easily create customised online and PDF invoices in minutes, reducing your accounting burden and allowing you more time to grow your business.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.