接受客户的信用卡和电子支付是许多企业的基本需求。即使是线下的零售交易,2022 年客户使用现金支付的比例仅为 12%。但设置接受这些支付的必要系统对尤其是初创公司的业主而言可能是一项艰巨任务。

开设商家账户通常既复杂又耗时,要求企业提供各种文件并接受严格的审核流程。尽管有这些挑战,拥有商家账户的功能带来了显著的优势。商家账户不仅有助于增加销售和改善现金流,还可以通过提供更便捷的支付选项来增强客户体验。

许多企业都需要访问商家账户——但如果您提前规划并谨慎选择选项,获取该功能并不必然成为难题。以下是开设商家账户的快速指南,帮助您更自信、顺利地完成这一过程。

目录

- 什么是商家账户?

- 谁需要商家账户?

- 如何设置商家账户

- 注册企业

- 获取雇主识别码 (EIN)

- 开立企业银行账户

- 调研商家账户提供商

- 完成申请

- 提供支持文件

- 等待批准

- 设置支付处理

- 测试系统

- 开始接受付款

- 注册企业

什么是商家账户?

商家账户是一种专用银行账户,用于存储客户交易的资金,直至这些资金被转入企业的主业务账户。。它充当客户与企业之间的中介,交易处理完成后资金会立即进入商家账户。

提供商家服务的银行和金融机构通常会提供商家账户。虽然其中一些机构可能提供支付网关的硬件或软件,但许多只提供商家账户,企业需从第三方供应商处获取其他必要组件。

谁需要商家账户?

大多数接受电子支付(包括信用卡和借记卡支付)的企业都需要商家账户。这包括从小型家庭企业到大型公司的各种规模的企业。

以下是通常需要商家账户或通过支付处理提供商访问商家服务的企业示例:

- 电商企业: 在线零售商需要商家账户来处理客户在其网站上购买商品的支付。

- 餐馆: 餐馆厅和其他食品服务类企业需要商家账户,以便接受客户通过信用卡或借记卡的支付,不论是堂食、外卖订单,还是线上或移动应用程序上的下单。

- 医疗服务提供商: 医生和牙医等医疗服务提供商需要商家账户来处理患者使用保险卡或信用卡支付的费用。

- 零售店: 零售店需要商家账户来接受在实体店内用信用卡或借记卡购买商品的客户的支付。

- 服务型企业: 例如咨询公司等服务型企业需要商家账户,以接受客户通过信用卡或借记卡支付的服务费用。

- 非营利组织: 非营利组织需要商家账户来接受支持者通过线上或线下信用卡或借记卡进行的捐款。

开设商家账户的具体要求可能会因提供商和业务类型的不同而有所差异,因此必须仔细研究所有可选方案,为您的企业找到最合适的商家账户解决方案。

如何设置商家账户

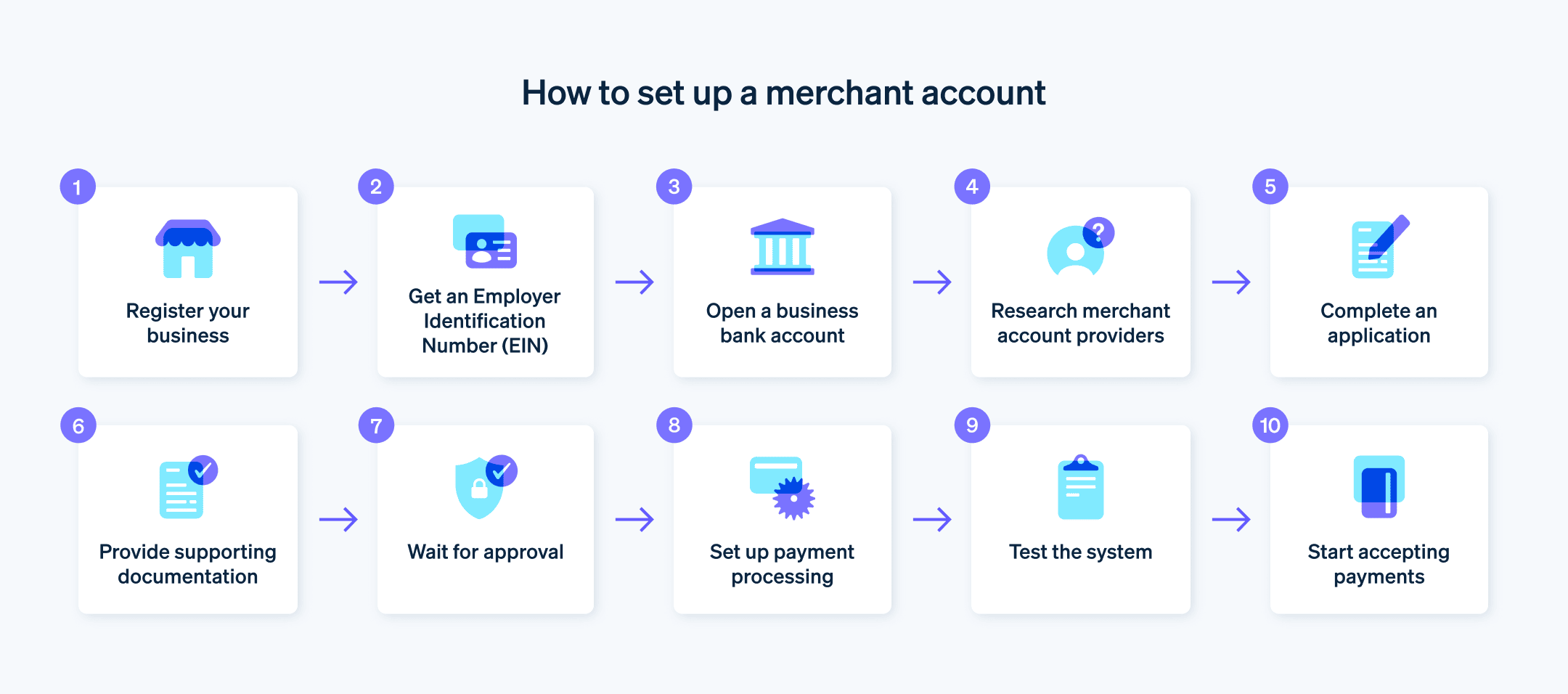

在开设商家账户之前,您需要先为企业建立一些基础设施。以下是准备您的业务、找到合适的商家账户,并开设商家账户的步骤概述:

1. 注册企业

计划在美国开展业务的企业,在开设商家账户之前,需要向相关政府部门注册。这包括获取必要的许可证、执照和税号。注册企业的具体要求会因位置和业务类型的不同而有所不同。

2. 获取雇主识别码 (EIN)

您还需要从美国国税局获取一个雇主识别码 (EIN)。EIN 是分配给您的企业的唯一标识,类似于企业的社会安全号码,用于各种银行和税务用途。

3. 开设企业银行账户

商家账户与常规企业银行账户不同。商家账户专用于接收客户交易的资金,而常规企业银行账户可用于更广泛的财务和银行活动。仅开设商家账户是不够的,您还需要一个企业银行账户来接收来自商家账户的款项。选择一个提供低费用、便捷的在线银行服务和良好客户支持的银行。

4. 调研商家账户提供商

并非所有的商户账户提供商都一样,因此仔细挑选最合适的提供商至关重要。以下是调研和选择商家账户提供商时需考虑的几个因素:

费用

商家账户提供商会对每笔交易收取费用,包括交易金额的百分比和每笔交易费用。一些提供商可能还会收取其他费用,例如设置费、月度维护费和其他服务费。务必仔细查看每个提供商的费用结构,以便了解使用服务的总成本。处理时间

一些商家账户提供商提供比其他提供商更快的处理时间。如果您的业务依赖快速周转时间(例如一家需要快速发货的电商店铺),那么选择一家能够快速处理支付的提供商就非常重要。客户支持

强大的客户支持对于解决有关商家账户的问题非常重要。寻找提供多种联系方式(如电话、电子邮件和在线聊天)来联系客户支持的提供商。安全功能

随着欺诈和网络攻击威胁的增加,安全功能成为了关键考量因素。寻找提供强大安全措施(如加密和欺诈检测)的商家账户提供商。与您的业务集成

考虑支付处理软件与现有系统(如网站或销售终端系统)的集成难易度。集成越容易,设置过程就越快、越顺畅。声誉

在签约之前,研究商家账户提供商的声誉很重要。查阅其他企业的评论,了解他们对该提供商的评价是否积极。

通过考虑这些因素,您可以缩小选择范围,选择适合您业务独特需求的商家账户提供商。

越来越多的企业选择不再开设商家账户,而是通过像 Stripe 这样的商家服务或支付处理提供商获取商家账户的功能。使用 Stripe 处理客户支付的企业无需单独寻找、审查、申请和集成商家账户即可享受传统商家账户的全部功能。如需了解 Stripe 如何让企业跳过开设独立商家账户的步骤,请阅读此处。

5. 完成申请

商家账户申请表通常会要求填写以下关于企业的信息:

- 公司名称

- 公司税号 (EIN)

- 联系信息

一些商家账户提供商可能还要求提供其他信息,如所属行业、企业结构、估计的月处理量以及处理历史。申请表还可能要求您提供有关所售产品或服务类型及计划接受的支付方式的详细信息。您可能需要表明是线下交易、线上交易,还是两者兼有。

除企业的基本信息外,您还可能需要提供作为企业主的个人信息,例如:

- 您的姓名

- 您的家庭住址

- 您的社会保障号码

这是因为商家账户提供商可能会在审核过程中对您进行信用检查。

在完成申请时,准确和全面地填写信息非常重要。提供错误或不完整的信息会延迟审批过程,甚至可能导致申请被拒。也请仔细阅读条款和条件,了解与账户相关的费用,包括设置费、交易费和月度维护费。

6. 提供支持文件

提交文件和审核过程是开设商家账户的重要步骤,因为它们验证了您企业的合法性和可信度。以下是您可以预期的步骤:

提交文件

完成商家账户申请后,您需要向提供商提交支持文件。所需的具体文件可能因提供商和业务类型而异,但通常包括企业注册文件、银行对账单和税务申报表。确保提交完整、准确且最新的文件。审核过程

一旦提供商收到您的申请和支持文件,他们将开始审核,这是一项评估您业务相关风险的过程。其目的是确保您是一个合法、值得信赖的企业。根据提供商的不同以及您业务的复杂性或高风险程度,审核过程可能需要几天到几周的时间。

在审核期间,提供商可能会对您(作为企业主)进行信用检查,还可能会查看您的处理历史、销售量以及其他因素,以评估欺诈或退款的风险。根据提供商的不同,他们可能还会联系您,要求提供其他信息或进一步说明。

审核过程有助于保护您和提供商免受欺诈和其他风险。尽管这可能会花费一些时间,但耐心配合并提供任何额外的信息或文件是非常重要的。

7. 等待批准

提交申请和相关文件后,您需要等待提供商审查您的申请并批准您的商家账户。这个过程可能需要几天到几周,具体取决于多个因素,包括提供商、业务类型以及提交的申请和文件的完整性。一些提供商对信用良好、风险低的企业提供加急审批服务。

可能导致审批延迟的因素包括:

- 申请表上的信息不完整或不准确

- 支持文件中的差异

- 企业的高风险状况

- 提供商要求的额外信息或文件

此外,提供商还可能审查您的处理历史、销售量等因素,以评估欺诈或退款的风险。如果您的企业属于高风险行业,如在线赌博或成人娱乐,审批过程可能会因严格审查而更长。

为了确保顺利通过审批,务必在申请表上提供准确、完整的信息,并及时回应任何额外信息或文件的请求。通过主动和及时的回应,您可以加快审批过程,使商家账户尽快开始运行。

8. 设置支付处理

一旦您的商家账户获得批准,您需要与提供商设置支付处理。具体所需的工具和服务将取决于您使用的支付渠道,以及您是为自己设置支付处理,还是为平台上的用户启用支付功能。这一步通常至少需要将支付处理软件与您的网站或销售终端系统集成。

9. 测试系统

测试支付处理系统,确保其正常运行并在开始接受客户付款前发现任何问题。若想了解如何测试 Stripe 集成,请从这里开始.。

10. 开始接受付款

一旦系统通过测试并正常运行,您就可以开始接受客户的付款。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。