Transaction IDs (TXIDs) are unique alphanumeric codes that are generated and assigned automatically to each financial transaction. They are a transaction’s digital fingerprint, and they simplify the process of identifying and tracking transactions. Businesses use TXIDs to track and reference individual transactions for purposes such as auditing, troubleshooting, and confirming transaction details. Each transaction ID is distinct and can be used to retrieve information about the timing and status of a transaction, and the parties involved. This identifier is particularly useful in financial services and ecommerce.

Monitoring TXIDs for unusual patterns can help detect and prevent fraud, an increasingly important part of business operations: in 2023, US consumers reported losing over $10 billion to fraud. Below, we’ll explain how transaction IDs work, how to troubleshoot common issues, and best practices for managing them.

What’s in this article?

- How do transaction IDs work?

- How to find your transaction ID on Stripe

- How to use transaction IDs for tracking, reconciliation, and support

- Security implications of transaction IDs in payment processing

- Troubleshooting common issues with transaction IDs

- Best practices for managing transaction IDs

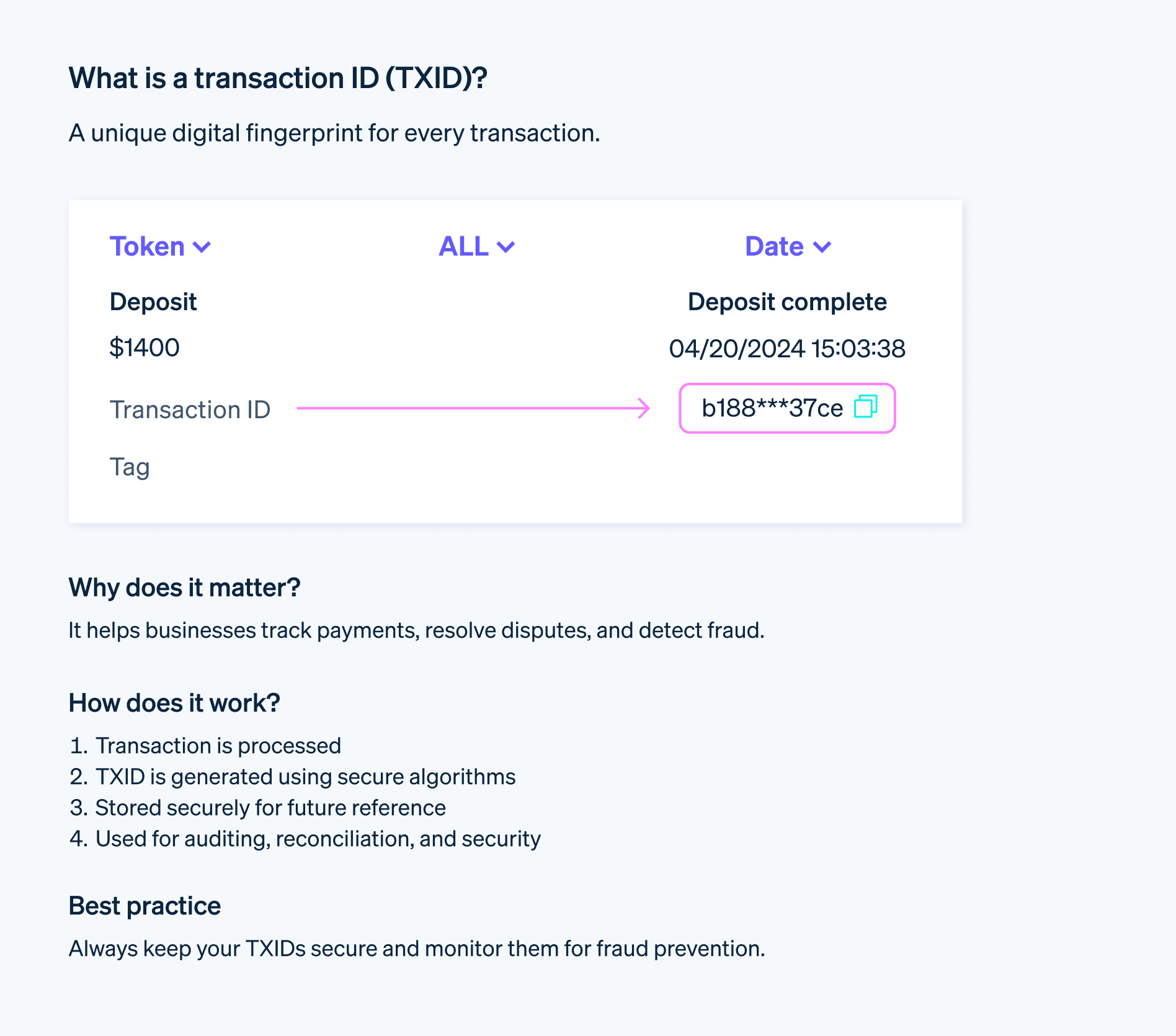

How do transaction IDs work?

Every financial transaction has a unique transaction ID. How these IDs are created and structured depends on the system that generates them, but the process of creating transaction IDs typically involves the following factors and steps.

Timestamp: Timestamps are used to generate the TXID. For each transaction, the precise date and time of initiation is recorded, down to the millisecond or even microsecond.

Random data: TXIDs also typically involve random numbers or characters that prevent duplication even if transactions occur simultaneously.

Hash functions: Hash functions are mathematical algorithms that produce the final fixed-length alphanumeric TXID. Hash functions take different transaction data such as the timestamp, random data, sender/receiver information, and transaction amount as input, then produce the TXID. The length of a TXID can vary depending on the system and hash function used. Some systems might use shorter IDs for efficiency, while others might use longer IDs for increased security against collisions (when two transactions have the same ID).

Collision prevention: While the probability of collision is extremely low due to the use of timestamps and random data, some systems employ additional measures to prevent it. This might involve checking for existing TXIDs before assigning a new one.

Once the TXID has been generated, it is stored in a database or ledger, with other transaction details. Different systems use different storage mechanisms, but the fundamental principle remains the same—each transaction is associated with its unique identifier. When needed, the TXID can be used to retrieve the associated transaction details, which helps with record-keeping, dispute resolution, and fraud detection.

In decentralized systems such as blockchain, TXIDs are an important feature that maintains the integrity of the ledger. Each transaction is linked to its previous and subsequent transactions through their TXIDs, creating an immutable chain of blocks.

How to find your transaction ID on Stripe

For businesses that use Stripe, TXIDs can be found in several locations within your Stripe Dashboard.

Payments page

Go to your Stripe Dashboard and click on “Payments.”

Each payment will have a unique TXID listed next to it, usually labeled “ID” or “Payment ID.” Click on a specific payment to view complete details, including the full TXID.

Customers page

Go to your Stripe Dashboard and click on “Customers.”

Select a specific customer to view their payment history. Each payment listed will have its corresponding TXID.

API

Transaction IDs aren’t available for most transactions in the API, but Stripe does show charge IDs, balance transaction IDs, and refund IDs. All are unique identifiers that represent different interactions.

Charge ID: A charge ID represents a single attempt to charge a customer, while a transaction ID represents a broader concept that can include multiple charges or refunds.

Balance transaction ID: When a payment is successful, Stripe creates a corresponding balance transaction. This transaction also has a unique ID, which you can find in your balance history.

Refund ID: If you issue a refund, it will have its own ID associated with it. You can find this ID in the details of the original payment or in your balance history.

How to use transaction IDs for tracking, reconciliation, and support

Transaction IDs are a useful tool for tracking, reconciling, and providing customer support for payments made through Stripe. Here’s how you can use these IDs to their maximum potential.

Tracking

Monitor payments: Use TXIDs to monitor the status of individual payments. You can track whether a payment is successful, pending, failed, or refunded.

Analyze sales: Aggregate TXIDs to analyze sales trends over time. You can identify peak sales periods, popular products, and recurring customers.

Detect fraud: Monitor TXIDs for unusual patterns or duplicates, which could indicate fraudulent activity.

Reconciliation

Match TXIDs to internal records: Reconcile payments with your internal records by matching TXIDs. This ensures that all payments are accounted for and that there are no discrepancies between your records and Stripe’s.

Automate reconciliation: Integrate Stripe with your accounting software using TXIDs as a reference point. This automates the reconciliation process and reduces manual errors.

Customer support

Identify payments: When a customer contacts you with a question or issue about a payment, request the TXID. This allows you to locate the specific transaction quickly and provide accurate information.

Resolve issues: Use the TXID to investigate any payment issues, such as failed payments or incorrect amounts, and take appropriate action to resolve the issue.

Provide refunds: When issuing a refund, reference the original payment’s TXID to ensure the refund is applied correctly and the customer’s account is updated.

Security implications of transaction IDs in payment processing

Transaction IDs come with security risks. Here are key security concerns and best practices to address them.

Security risks

Transaction tracking: Malicious actors can exploit TXIDs to track a user’s payment history across different platforms and potentially expose spending patterns. This can lead to privacy concerns.

Phishing attacks: Fraudulent actors might try to obtain TXIDs through phishing emails or fake websites posing as legitimate businesses. Once they have the TXID, they might trick users into revealing other sensitive information or even attempt to initiate unauthorized transactions.

Data breaches: If a company’s database that stores TXIDs is compromised, it could lead to a large-scale breach of transaction data. This could have severe consequences for the business and its customers.

Mitigation strategies

Limited sharing: Share TXIDs only with authorized parties and through secure channels. Avoid disclosing them in public forums or unencrypted emails.

Encryption: Encrypt TXIDs during transmission and storage to protect them from unauthorized access.

Tokenization: Replace sensitive cardholder data with unique tokens that have no intrinsic value. This reduces the risk associated with storing actual card details.

Strong authentication: Implement multi-factor authentication (MFA) to add an extra layer of security to your payment system.

Fraud monitoring: Use fraud detection tools that monitor transactions for suspicious activity and patterns.

Secure storage: Store TXIDs in a secure database with restricted access to prevent unauthorized retrieval or modification.

Customer education: Educate customers about the importance of safeguarding their TXIDs and how to identify phishing attempts.

Regular audits: Conduct regular security audits to identify and address any vulnerabilities in your payment processing system.

Troubleshooting common issues with transaction IDs

While transaction IDs are generally reliable, you might encounter some issues. Here are some common problems with transaction IDs—and troubleshooting steps to take if they occur.

Missing or incorrect TXID

Check confirmation emails and receipts: Look for emails or receipts related to the transaction. Often, the TXID is listed under labels such as “Order ID,” “Transaction ID,” or “Reference Number.”

Search transaction history: Log in to your account on the relevant platform (e.g., Stripe, PayPal, bank account) and search your transaction history. The TXID should be associated with the transaction details.

Contact customer support: If you cannot find the TXID, contact customer support for the platform or service you used. Provide them with relevant details such as the date, amount, and description of the transaction.

Duplicate TXID

Duplicate TXIDs are rare due to the use of timestamps and random data in their generation. If you encounter one, it’s probably a system error.

- Contact support: Contact customer support for the platform or service involved so they can investigate the issue and resolve any conflicts.

TXID not recognized

Check for typos or errors: Double-check the TXID for any typos or errors. Even a single incorrect character can prevent the TXID from being recognized.

Check platform: Check that you are using the TXID on the correct platform. A TXID generated on one platform, such as Stripe, might not be recognized on another.

Contact support: If the TXID is correct and you’re on the right platform, contact customer support. There might be a technical issue or delay in processing the transaction.

Untraceable transaction IDs

Sometimes, it might not be possible to trace transaction IDs in the system, due to incorrect recording or data loss.

Use a data recovery system: Implement regular backups and data recovery processes.

Store IDs in a database: Log transaction IDs in a centralized system that you can easily access for tracking purposes.

Security concerns with transaction IDs

If transaction IDs are predictable or not sufficiently secure, they can be the target of fraud.

Use secure generation methods: Use a secure method of generating transaction IDs such as cryptographic hash functions, which are less predictable.

Report any suspicious activity: If you notice any unauthorized transactions associated with a TXID, contact your financial institution immediately to report the issue.

Performance issues

Generating unique transaction IDs at high volumes can cause performance bottlenecks, especially in high-traffic systems.

- Create a scalable ID generation process: Optimize the ID generation process to handle high loads efficiently. Consider using distributed systems or services specifically designed for generating unique identifiers at scale, such as Universal Unique Identifiers (UUIDs) or dedicated ID generation services.

Customer queries regarding transaction IDs

Provide instructions: Provide clear instructions on where customers can find their transaction IDs on receipts or during transaction confirmations.

Train customer service teams: Train customer service teams to quickly locate transaction details using the transaction ID so they can assist customers quickly.

Best practices for managing transaction IDs

Here are some best practices for handling transaction IDs, which will help you maintain the integrity and reliability of your payment processing systems.

Secure generation

Generate transaction IDs using secure algorithms. Cryptographically secure methods of generation (such as by using cryptographic hash functions) to prevent predictability and reduce the risk of ID collision and fraud.

Centralized tracking

Implement a centralized tracking system for storing and accessing transaction IDs. This system should be capable of logging each transaction ID along with timestamps, user details, and other transaction metadata and can be done through spreadsheets, databases, or specialized software. Centralized tracking facilitates easier monitoring, auditing, and analysis.

Consistency

Maintain consistency in the format and generation logic of transaction IDs across all systems and platforms. This uniformity helps avoid mismatches during data integration and reconciliation, especially in complex environments that involve multiple payment gateways and databases.

Immutable storage

Store transaction IDs in an immutable manner. Use databases that support immutability or append-only modes to prevent tampering and preserve data integrity. Technologies such as blockchain can be particularly effective for this purpose, providing a high level of security and traceability.

Regular audits and compliance

Regularly audit the usage and generation of transaction IDs for compliance with internal policies and external regulations. If your business handles credit card transactions, your operations must comply with standards such as the Payment Card Industry Data Security Standard (PCI DSS). Audits help identify and rectify irregularities or vulnerabilities in the way your business handles transaction IDs.

Scalability and performance optimization

Design your transaction ID management system to handle high volumes of IDs without performance degradation. This might involve optimizing algorithms, using efficient database indexing, or implementing distributed systems that can scale horizontally.

Access controls and encryption

Implement strict access controls to ensure that only authorized personnel can view or manipulate transaction IDs. Use encryption both at rest and in transit to protect transaction IDs from unauthorized access and data breaches.

Real-time monitoring and alerts

Set up real-time monitoring and alerts for the generation and use of transaction IDs. Monitoring can help detect anomalies or suspicious patterns (such as a sudden spike in TXID generation) that could indicate a security issue or system malfunction.

Strong error handling and recovery

Develop strong error handling and recovery mechanisms to address issues such as duplicate IDs or system failures. Ensure that transaction ID generation can recover smoothly after disruptions.

Transparency

Provide customers with easy access to their transaction IDs and educate them on the importance of IDs in tracking transactions. This transparency builds trust and empowers customers to participate in their transaction security.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.