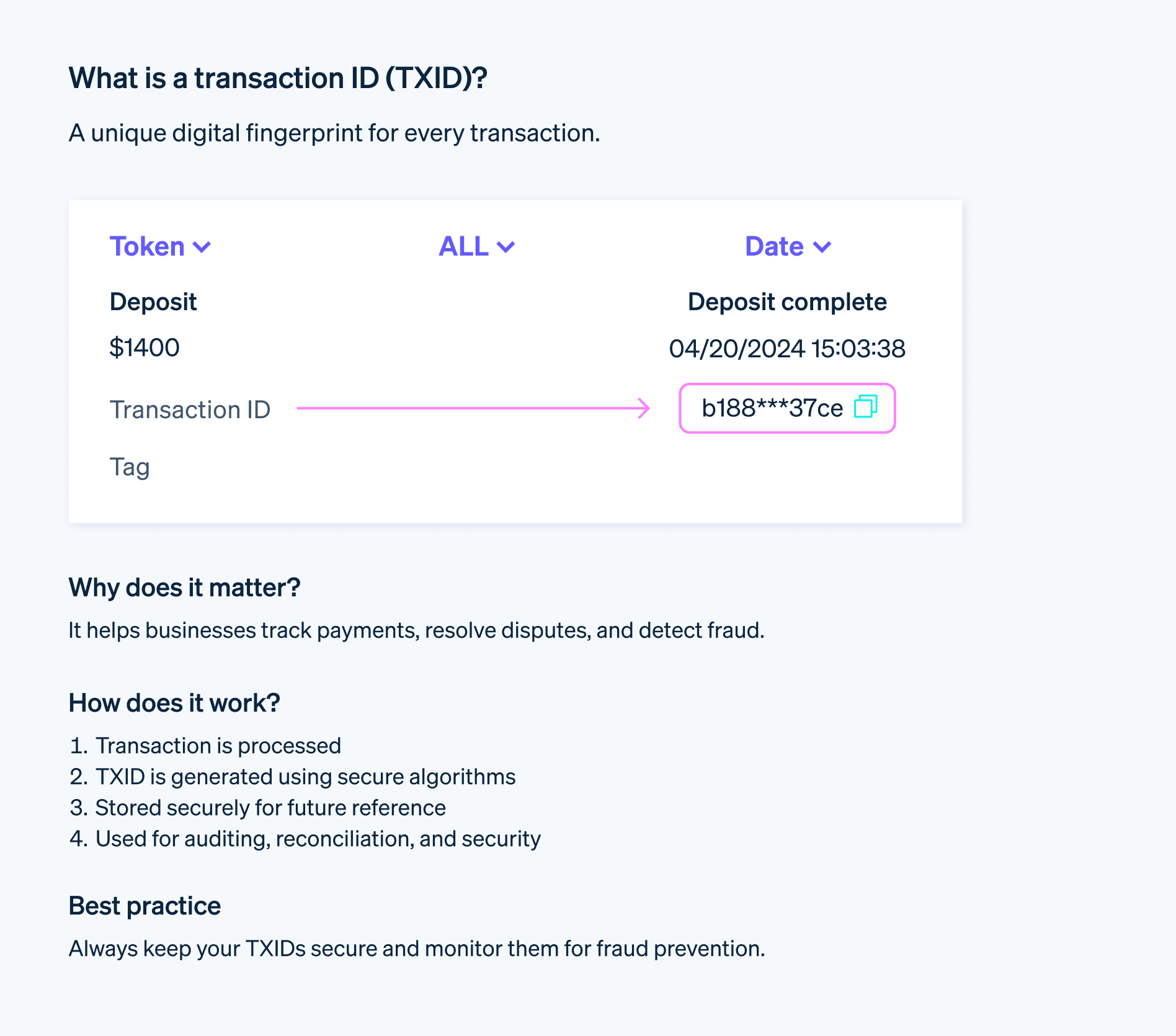

ID ธุรกรรม (TXID) คือรหัสที่เป็นตัวอักษรและตัวเลขที่ไม่ซ้ํากันซึ่งสร้างขึ้นและกําหนดให้ธุรกรรมทางการเงินแต่ละรายการโดยอัตโนมัติ รหัสนี้เป็นลายนิ้วมือดิจิทัลของธุรกรรม ซึ่งช่วยให้กระบวนการระบุและติดตามธุรกรรมเป็นเรื่องง่าย ธุรกิจใช้ TXID เพื่อติดตามและอ้างอิงธุรกรรมแต่ละรายการเพื่อวัตถุประสงค์ต่างๆ เช่น การตรวจสอบ การแก้ไขปัญหา และการยืนยันรายละเอียดธุรกรรม ID ธุรกรรมแต่ละรายการจะไม่ซ้ำกัน และสามารถนําไปใช้เพื่อดึงข้อมูลเกี่ยวกับเวลาและสถานะของธุรกรรม และบุคคลที่เกี่ยวข้อง รหัสระบุนี้มีประโยชน์เป็นพิเศษในบริการทางการเงินและอีคอมเมิร์ซ

การตรวจสอบ TXID เพื่อหารูปแบบที่ผิดปกติสามารถช่วยตรวจจับและป้องกันการฉ้อโกงซึ่งเป็นส่วนสําคัญในการดําเนินธุรกิจมากขึ้นเรื่อยๆ โดยในปี 2023 ผู้บริโภคในสหรัฐฯ รายงานว่าสูญเสียเงินไปกว่า 10 พันล้านดอลลาร์สหรัฐต่อการฉ้อโกง ด้านล่างนี้เราจะอธิบายการทํางานของ ID ธุรกรรม วิธีแก้ไขปัญหาที่พบบ่อย และแนวทางปฏิบัติที่ดีที่สุดในการจัดการ ID เหล่านั้น

บทความนี้ให้ข้อมูลอะไรบ้าง

- ID ธุรกรรมทํางานอย่างไร

- วิธีดู ID ธุรกรรมของคุณใน Stripe

- วิธีใช้ ID ธุรกรรมเพื่อติดตาม กระทบยอด และให้การสนับสนุน

- ผลกระทบด้านความปลอดภัยของ ID ธุรกรรมในการประมวลผลการชําระเงิน

- การแก้ไขปัญหาที่พบบ่อยเกี่ยวกับ ID ธุรกรรม

- แนวทางปฏิบัติที่ดีที่สุดสําหรับการจัดการ ID ธุรกรรม

ID ธุรกรรมทํางานอย่างไร

ธุรกรรมทางการเงินทุกรายการจะมี ID ธุรกรรมที่ไม่ซ้ํากัน วิธีสร้างและจัดโครงสร้าง ID เหล่านี้จะขึ้นอยู่กับระบบที่สร้าง ID แต่กระบวนการสร้าง ID ธุรกรรมมักจะเกี่ยวข้องกับปัจจัยและขั้นตอนต่อไปนี้

การประทับเวลา: ใช้การประทับเวลาเพื่อสร้าง TXID ธุรกรรมแต่ละรายการจะมีการบันทึกวันที่และเวลาเริ่มต้นที่แม่นยําจนถึงมิลลิวินาทีหรือแม้แต่ไมโครวินาที

ข้อมูลแบบสุ่ม: โดยทั่วไปแล้ว TXID มักจะมีตัวเลขหรืออักขระแบบสุ่มที่ป้องกันการซ้ำกัน แม้ว่าธุรกรรมจะเกิดขึ้นพร้อมกันก็ตาม

ฟังก์ชันแฮช: ฟังก์ชันแฮชคืออัลกอริทึมทางคณิตศาสตร์ที่สร้าง TXID สุดท้ายที่เป็นตัวอักษรและตัวเลขความยาวคงที่ ฟังก์ชันแฮชจะใช้ข้อมูลที่แตกต่างกันของธุรกรรม เช่น การประทับเวลา ข้อมูลแบบสุ่ม ข้อมูลผู้ส่ง/ผู้รับ และยอดธุรกรรมเป็นอินพุตเพื่อนำไปสร้าง TXID ความยาวของ TXID อาจแตกต่างกันไปขึ้นอยู่กับระบบและฟังก์ชันแฮชที่ใช้ บางระบบอาจใช้ ID ที่สั้นลงเพื่อประสิทธิภาพ ในขณะที่บางระบบอาจใช้ ID ที่ยาวขึ้นเพื่อรักษาความปลอดภัยจากการชนกัน (เมื่อธุรกรรมสองรายการมี ID เดียวกัน)

การป้องกันการชน: แม้ความน่าจะเป็นที่จะเกิดการชนกันอาจต่ํามากเนื่องจากมีการใช้การประทับเวลาและข้อมูลแบบสุ่ม แต่บางระบบอาจใช้มาตรการเพิ่มเติมในการป้องกัน การดําเนินการนี้อาจมีการตรวจสอบ TXD ที่มีอยู่ก่อนที่จะกําหนด ID ใหม่

เมื่อสร้าง TXID แล้ว ข้อมูลดังกล่าวจะถูกเก็บไว้ในฐานข้อมูลหรือบัญชีแยกประเภทพร้อมด้วยรายละเอียดอื่นๆ ของธุรกรรม แต่ละระบบก็ใช้กลไกการจัดเก็บข้อมูลที่ต่างกัน แต่หลักการพื้นฐานยังคงเหมือนเดิม โดยธุรกรรมแต่ละรายการจะผูกกับรหัสระบุที่ไม่ซ้ํากัน เมื่อจําเป็น ระบบจะใช้ TXID เพื่อดึงรายละเอียดธุรกรรมที่เกี่ยวข้องได้ ซึ่งช่วยในการเก็บบันทึก การแก้ไขการโต้แย้งการชําระเงิน และการตรวจจับการฉ้อโกง

ในระบบแบบกระจายศูนย์ เช่น บล็อกเชน TXID เป็นฟีเจอร์สําคัญที่รักษาความสมบูรณ์ของบัญชีแยกประเภท ธุรกรรมแต่ละรายการจะเชื่อมโยงกับธุรกรรมก่อนหน้าและธุรกรรมถัดไปผ่าน TXID ซึ่งก่อให้เกิดเป็นบล็อกเชนที่เปลี่ยนรูปไม่ได้

วิธีหา ID ธุรกรรมของคุณใน Stripe

สําหรับธุรกิจที่ใช้ Stripe คุณจะดู TXD ได้ในหลายตําแหน่งภายในแดชบอร์ด Stripe

หน้าการชําระเงิน

ไปที่แดชบอร์ด Stripe แล้วคลิก "การชําระเงิน"

การชําระเงินแต่ละรายการจะมี TXID ที่ไม่ซ้ํากันซึ่งระบุไว้ถัดจากรายการนั้นๆ ซึ่งโดยปกติจะระบุเป็น "ID" หรือ "ID การชําระเงิน" คลิกการชําระเงินที่ต้องการเพื่อดูรายละเอียดที่ครบถ้วน รวมถึง TXID แบบเต็ม

หน้าลูกค้า

ไปที่แดชบอร์ด Stripe แล้วคลิกที่ "ลูกค้า"

เลือกลูกค้าที่เฉพาะเจาะจงเพื่อดูประวัติการชําระเงินของลูกค้า การชําระเงินแต่ละรายการจะมี TXID ที่เชื่อมโยงกัน

API

ID ธุรกรรมไม่มีให้ใช้งานสําหรับธุรกรรมส่วนใหญ่ใน API แต่ Stripe แสดง ID การเรียกเก็บเงิน, ID ธุรกรรมยอดดุล และ ID การคืนเงิน ทั้งหมดนี้เป็นตัวระบุที่ไม่ซ้ําซึ่งแสดงการโต้ตอบแบบต่างๆ

ID การเรียกเก็บเงิน: ID การเรียกเก็บเงินจะแทนการดําเนินการเรียกเก็บเงินลูกค้าหนึ่งครั้ง ในขณะที่ ID ธุรกรรมจะแทนแนวคิดที่กว้างกว่าซึ่งอาจประกอบด้วยการเรียกเก็บเงินหรือการคืนเงินหลายรายการ

ID ธุรกรรมยอดดุล: เมื่อชําระเงินสําเร็จ Stripe จะสร้างธุรกรรมยอดดุลที่เกี่ยวข้องขึ้นมา ธุรกรรมนี้มี ID ที่ไม่ซ้ํากัน ซึ่งดูได้ในประวัติยอดคงเหลือ

ID การคืนเงิน: หากคุณทํารายการคืนเงิน รายการดังกล่าวจะมี ID ของตัวเองที่เชื่อมโยงกัน คุณสามารถดู ID นี้ในรายละเอียดของการชําระเงินแรกเริ่มหรือในประวัติยอดคงเหลือ

วิธีใช้ ID ธุรกรรมเพื่อติดตาม กระทบยอด และให้การสนับสนุน

ID ธุรกรรมเป็นเครื่องมือที่มีประโยชน์สําหรับการติดตาม การกระทบยอด และการให้การสนับสนุนลูกค้าสําหรับการชําระเงินผ่าน Stripe นี่คือวิธีที่คุณสามารถใช้ ID เหล่านี้ได้อย่างเต็มศักยภาพ

การติดตาม

ติดตามตรวจสอบการชําระเงิน: ใช้ TXID เพื่อตรวจสอบสถานะของการชําระเงินแต่ละรายการ คุณจะตรวจสอบได้ว่าการชําระเงินสําเร็จ รอดําเนินการ ไม่สําเร็จ หรือคืนเงินแล้ว

วิเคราะห์ยอดขาย: รวม TXID เข้าด้วยกันเพื่อวิเคราะห์แนวโน้มยอดขายในช่วงเวลาต่างๆ คุณสามารถระบุช่วงเวลาที่มียอดขายสูง ผลิตภัณฑ์ยอดนิยม และลูกค้าที่กลับมาซื้อ/ใช้บริการซ้ำได้

ตรวจจับการฉ้อโกง ตรวจสอบ TXID เพื่อดูรูปแบบหรือรายการซ้ําที่ผิดปกติ ซึ่งอาจบ่งบอกถึงกิจกรรมที่เป็นการฉ้อโกง

การกระทบยอด

จับคู่ TXID กับบันทึกภายใน: กระทบยอดการชําระเงินกับระเบียนภายในของคุณด้วยการจับคู่ TXID ทั้งนี้เพื่อให้แน่ใจว่าการชําระเงินทั้งหมดได้รับการลงบัญชีและไม่มีข้อมูลคลาดเคลื่อนระหว่างระเบียนของคุณกับ Stripe

กระทบยอดอัตโนมัติ: ผสานการทํางาน Stripe กับซอฟต์แวร์การทําบัญชีของคุณโดยใช้ TXID เป็นจุดอ้างอิง ซึ่งจะทำให้กระบวนการกระทบยอดทำงานอัตโนมัติและลดข้อผิดพลาดจากการดําเนินการโดยเจ้าหน้าที่

การสนับสนุนลูกค้า

ระบุตัวตนการชําระเงิน: เมื่อลูกค้าติดต่อคุณโดยมีข้อสงสัยหรือปัญหาเกี่ยวกับการชําระเงิน โปรดขอ TXID การทําเช่นนี้ช่วยให้คุณสามารถค้นหาธุรกรรมที่ต้องการได้อย่างรวดเร็วและให้ข้อมูลที่ถูกต้อง

แก้ไขปัญหา: ใช้ TXID เพื่อตรวจสอบปัญหาการชําระเงิน เช่น การชําระเงินที่ไม่สําเร็จหรือจํานวนเงินที่ไม่ถูกต้อง และดําเนินการอย่างเหมาะสมเพื่อแก้ไขปัญหา

ส่งเงินคืน: เมื่อออกรายการคืนเงิน โปรดดูข้อมูล TXID ของการชําระเงินดั้งเดิมเพื่อให้แน่ใจว่าระบบใช้การคืนเงินอย่างถูกต้องและบัญชีของลูกค้าได้รับการอัปเดต

ผลกระทบด้านความปลอดภัยของ ID ธุรกรรมในการประมวลผลการชําระเงิน

ID ธุรกรรมมาพร้อมกับความเสี่ยงด้านความปลอดภัย ต่อไปนี้คือข้อกังวลหลักๆ ด้านความปลอดภัยและแนวทางปฏิบัติที่ดีที่สุดในการแก้ไขปัญหา

ความเสี่ยงด้านความปลอดภัย

การติดตามธุรกรรม: ผู้ประสงค์ร้ายสามารถใช้ประโยชน์จาก TXID เพื่อติดตามประวัติการชําระเงินของผู้ใช้ในแพลตฟอร์มต่างๆ และอาจเผยให้เห็นรูปแบบการใช้จ่าย ซึ่งนําไปสู่ข้อกังวลด้านความเป็นส่วนตัว

การโจมตีแบบฟิชชิ่ง: มิจฉาชีพอาจพยายามขอรับ TXID ผ่านอีเมลฟิชชิ่งหรือเว็บไซต์ปลอมที่มีเนื้อหาเป็นธุรกิจที่ชอบด้วยกฎหมาย เมื่อได้ TXID ไปแล้ว คนเหล่านี้อาจหลอกให้ผู้ใช้เปิดเผยข้อมูลที่ละเอียดอ่อนอื่นๆ หรือแม้แต่พยายามเริ่มต้นธุรกรรมที่ไม่ได้รับอนุญาต

การละเมิดข้อมูล: หากฐานข้อมูลของบริษัทที่จัดเก็บ TXID ถูกใช้โดยไม่ได้รับอนุญาต อาจนําไปสู่การละเมิดข้อมูลธุรกรรมในวงกว้างได้ โดยเหตุการณ์นี้อาจส่งผลเสียต่อธุรกิจและลูกค้าอย่างรุนแรง

กลยุทธ์บรรเทาความเสี่ยง

การแชร์แบบจํากัด: แชร์ TXID กับบุคคลที่ได้รับอนุญาตและผ่านช่องทางที่ปลอดภัยเท่านั้น หลีกเลี่ยงการเปิดเผยข้อมูลในฟอรัมสาธารณะหรืออีเมลที่ไม่ได้เข้ารหัส

การเข้ารหัส: เข้ารหัส TXID ระหว่างการรับส่งข้อมูลและพื้นที่จัดเก็บเพื่อปกป้องจากการเข้าถึงที่ไม่ได้รับอนุญาต

การแปลงเป็นโทเค็น: เปลี่ยนข้อมูลเจ้าของบัตรที่ละเอียดอ่อนเป็นโทเค็นที่ไม่ซ้ําซึ่งไม่มีค่าในตัว การทําเช่นนี้จะช่วยลดความเสี่ยงที่เกิดจากการเก็บรายละเอียดของบัตรจริงได้

การตรวจสอบสิทธิ์แบบรัดกุม: ใช้การตรวจสอบสิทธิ์แบบหลายปัจจัย (MFA) เพื่อเพิ่มการรักษาความปลอดภัยอีกชั้นหนึ่งให้กับระบบการชําระเงินของคุณ

การติดตามตรวจสอบการฉ้อโกง: ใช้เครื่องมือตรวจจับการฉ้อโกงที่ตรวจสอบธุรกรรมเพื่อหารูปแบบและกิจกรรมที่น่าสงสัย

การจัดเก็บข้อมูลที่ปลอดภัย: จัดเก็บ TXID ไว้ในฐานข้อมูลที่ปลอดภัยที่มีการเข้าถึงแบบจํากัดเพื่อป้องกันการดึงข้อมูลหรือการแก้ไขที่ไม่ได้รับอนุญาต

การให้ความรู้แก่ลูกค้า: ให้ความรู้ลูกค้าเกี่ยวกับความสําคัญของการปกป้อง TXID และวิธีระบุความพยายามฟิชชิ่ง

การตรวจสอบเป็นประจํา: ทําการตรวจสอบความปลอดภัยเป็นประจําเพื่อระบุและแก้ไขช่องโหว่ในระบบประมวลผลการชําระเงินของคุณ

การแก้ไขปัญหาที่พบบ่อยเกี่ยวกับ ID ธุรกรรม

แม้ว่าโดยทั่วไปแล้ว ID ธุรกรรมจะเชื่อถือได้ แต่คุณอาจพบปัญหาบางประการ ต่อไปนี้เป็นปัญหาที่พบบ่อยเกี่ยวกับ ID ธุรกรรม และขั้นตอนในการแก้ไขปัญหาในกรณีที่เกิดขึ้น

ไม่มี TXID หรือ TXID ไม่ถูกต้อง

ตรวจสอบอีเมลยืนยันและใบเสร็จ: ค้นหาอีเมลหรือใบเสร็จที่เกี่ยวข้องกับธุรกรรม TXID มักจะแสดงอยู่ภายใต้ป้ายกํากับอย่าง "ID คําสั่งซื้อ" "ID ธุรกรรม" หรือ "หมายเลขอ้างอิง"

ค้นหาประวัติธุรกรรม: เข้าสู่ระบบบัญชีบนแพลตฟอร์มที่เกี่ยวข้อง (เช่น Stripe, PayPal, บัญชีธนาคาร) แล้วค้นหาประวัติธุรกรรมของคุณ TXID ควรเชื่อมโยงกับรายละเอียดธุรกรรม

ติดต่อฝ่ายสนับสนุนลูกค้า: หากคุณไม่พบ TXID โปรดติดต่อฝ่ายสนับสนุนลูกค้าของแพลตฟอร์มหรือบริการที่คุณใช้ โปรดระบุรายละเอียดที่เกี่ยวข้อง เช่น วันที่ จํานวนเงิน และคําอธิบายธุรกรรม

TXID ที่ซ้ํากัน

TXID ที่ซ้ํากันนั้นไม่ค่อยเกิดขึ้น เนื่องจากการใช้การประทับเวลาและข้อมูลแบบสุ่มในการสร้าง หากคุณพบปัญหานี้ อาจเป็นข้อผิดพลาดของระบบ

- ติดต่อฝ่ายสนับสนุน: ติดต่อฝ่ายสนับสนุนลูกค้าของแพลตฟอร์มหรือบริการที่เกี่ยวข้องเพื่อให้สามารถตรวจสอบและแก้ไขปัญหา

ไม่รู้จัก TXID

ตรวจหาการพิมพ์ผิดหรือข้อผิดพลาด: ตรวจสอบ TXID อีกครั้งเพื่อหาการพิมพ์ผิดหรือข้อผิดพลาดใดๆ แม้แต่อักขระที่ไม่ถูกต้องเพียงตัวเดียวก็อาจทําให้ระบบไม่รู้จัก TXID ได้

ตรวจสอบแพลตฟอร์ม: ตรวจสอบว่าคุณกําลังใช้ TXID บนแพลตฟอร์มที่ถูกต้อง TXID ที่สร้างขึ้นบนแพลตฟอร์มหนึ่ง (เช่น Stripe) อาจไม่ได้รับการยอมรับในอีกแพลตฟอร์มหนึ่ง

ติดต่อฝ่ายสนับสนุน: หาก TXID ถูกต้องและคุณอยู่ในแพลตฟอร์มที่ถูกต้อง โปรดติดต่อฝ่ายสนับสนุนลูกค้า อาจมีปัญหาทางเทคนิคหรือความล่าช้าในการประมวลผลธุรกรรม

ID ธุรกรรมที่ไม่สามารถติดตามได้

บางครั้งอาจไม่สามารถติดตาม ID ธุรกรรมในระบบได้เนื่องจากการบันทึกที่ไม่ถูกต้องหรือข้อมูลสูญหาย

ใช้ระบบการกู้คืนข้อมูล: ใช้กระบวนการสํารองข้อมูลและการกู้คืนข้อมูลเป็นประจำ

จัดเก็บ ID ในฐานข้อมูล: บันทึก ID ธุรกรรมในระบบส่วนกลางเพื่อให้คุณเข้าถึงและติดตามได้อย่างง่ายดาย

ข้อกังวลด้านความปลอดภัยเกี่ยวกับ ID ธุรกรรม

หาก ID ธุรกรรมคาดเดาได้หรือมีความปลอดภัยไม่เพียงพอ ID เหล่านั้นจะเป็นเป้าของการฉ้อโกงได้

ใช้วิธีการสร้างที่ปลอดภัย: ใช้วิธีการที่ปลอดภัยในการสร้าง ID ธุรกรรม เช่น ฟังก์ชันแฮชแบบเข้ารหัสลับ ซึ่งจะคาดเดาได้น้อยลง

รายงานกิจกรรมที่น่าสงสัย หากคุณพบธุรกรรมที่ไม่ได้รับอนุญาตที่เชื่อมโยงกับ TXID โปรดติดต่อสถาบันการเงินของคุณทันทีเพื่อรายงานปัญหา

ปัญหาด้านประสิทธิภาพ

การสร้าง ID ธุรกรรมที่ไม่ซ้ําในปริมาณมากอาจทําให้เกิดปัญหาคอขวดในประสิทธิภาพการทํางาน โดยเฉพาะในระบบที่มีการรับส่งข้อมูลสูง

- สร้างกระบวนการสร้าง ID ที่ปรับขนาดได้: เพิ่มประสิทธิภาพให้กระบวนการสร้าง ID เพื่อรับมือโหลดจํานวนมากอย่างมีประสิทธิภาพ คุณอาจใช้ระบบหรือบริการแบบกระจายที่ออกแบบมาสําหรับการสร้างรหัสระบุที่ไม่ซ้ํากันในขอบเขตที่กว้างโดยเฉพาะ เช่น Universal Identifiers (UUIDs) หรือบริการสร้าง ID โดยเฉพาะ

คําขอของลูกค้าเกี่ยวกับ ID ธุรกรรม

ระบุคําแนะนํา: ระบุคําแนะนําอย่างชัดเจนว่าลูกค้าจะดู ID ธุรกรรมของตัวเองบนใบเสร็จหรือระหว่างการยืนยันธุรกรรมที่ไหน

ฝึกอบรมทีมบริการลูกค้า: ฝึกอบรมทีมบริการลูกค้าเพื่อให้ค้นหารายละเอียดธุรกรรมได้อย่างรวดเร็วโดยใช้ ID ธุรกรรม เพื่อให้ช่วยเหลือลูกค้าได้อย่างรวดเร็ว

แนวทางปฏิบัติที่ดีที่สุดสําหรับการจัดการ ID ธุรกรรม

ต่อไปนี้คือแนวทางปฏิบัติที่ดีที่สุดสําหรับการจัดการ ID ธุรกรรม ซึ่งจะช่วยให้คุณรักษาความถูกต้องสมบูรณ์และความน่าเชื่อถือของระบบประมวลผลการชําระเงิน

การสร้างการรักษาความปลอดภัย

สร้าง ID ธุรกรรมโดยใช้อัลกอริทึมที่ปลอดภัย วิธีการสร้างที่มีความปลอดภัยด้านการเข้ารหัส (เช่น การใช้ฟังก์ชันแฮชเข้ารหัสลับ) เพื่อป้องกันความสามารถในการคาดการณ์และลดความเสี่ยงของการชนกันของ ID และการฉ้อโกง

การติดตามแบบรวมศูนย์

นําระบบติดตามแบบรวมศูนย์มาใช้กับการจัดเก็บและเข้าถึง ID ธุรกรรม ระบบนี้ควรบันทึก ID ธุรกรรมแต่ละรายการโดยมีข้อมูลการประทับเวลา รายละเอียดผู้ใช้ และข้อมูลเมตาอื่นๆ ของธุรกรรม และสามารถดําเนินการผ่านสเปรดชีต ฐานข้อมูล หรือซอฟต์แวร์เฉพาะทางได้ การติดตามแบบรวมศูนย์อํานวยความสะดวกในการติดตามดู การตรวจสอบ และการวิเคราะห์ที่ง่ายขึ้น

ความสอดคล้อง

รักษาความสอดคล้องกันในรูปแบบและตรรกะการสร้าง ID ธุรกรรมในทุกระบบและแพลตฟอร์ม ความสอดคล้องนี้ช่วยให้หลีกเลี่ยงความไม่ตรงกันในระหว่างที่ผสานข้อมูลและกระทบยอด โดยเฉพาะในสภาพแวดล้อมที่ซับซ้อนซึ่งมีเกตเวย์การชําระเงินและฐานข้อมูลหลายระบบเข้ามาเกี่ยวข้อง

พื้นที่เก็บข้อมูลที่ไม่สามารถดัดแปลงได้

จัดเก็บ ID ธุรกรรมในลักษณะที่ไม่แก้ค่าไม่ได้ ใช้ฐานข้อมูลที่รองรับการไม่แก้ค่าหรือโหมดผนวกเท่านั้นเพื่อป้องกันการแทรกแซงและรักษาความถูกต้องสมบูรณ์ของข้อมูล เทคโนโลยีอย่างบล็อกเชนอาจมีประสิทธิภาพเป็นพิเศษสำหรับวัตถุประสงค์นี้ โดยจะให้ความปลอดภัยและความสามารถในการตรวจสอบติดตามในระดับสูง

การตรวจสอบและการปฏิบัติตามข้อกําหนดเป็นประจํา

ตรวจสอบการใช้งานและการสร้าง ID ธุรกรรมเป็นประจําเพื่อปฏิบัติตามนโยบายภายในและข้อบังคับภายนอก หากธุรกิจของคุณจัดการธุรกรรมบัตรเครดิต คุณต้องปฏิบัติตามมาตรฐานการรักษาความปลอดภัยข้อมูลสําหรับอุตสาหกรรมบัตรชําระเงิน (PCI DSS) การตรวจสอบจะช่วยระบุและแก้ไขความผิดปกติหรือช่องโหว่ในวิธีที่ธุรกิจของคุณจัดการ ID ธุรกรรม

ความสามารถในการขยายขอบเขตและการเพิ่มประสิทธิภาพการทำงาน

ออกแบบระบบจัดการ ID ธุรกรรมให้รองรับ ID ในปริมาณมากโดยไม่ลดประสิทธิภาพของระบบ ซึ่งอาจเกี่ยวข้องกับการเพิ่มประสิทธิภาพอัลกอริทึม การทําดัชนีฐานข้อมูลที่มีประสิทธิภาพ หรือการใช้ระบบแบบกระจายที่สามารถปรับขยายได้ในแนวราบ

การควบคุมการเข้าถึงและการเข้ารหัส

ใช้มาตรการควบคุมการเข้าถึงที่เคร่งครัดเพื่อให้แน่ใจว่ามีเพียงบุคลากรที่ได้รับอนุญาตเท่านั้นที่สามารถดูหรือจัดการ ID ธุรกรรมได้ ใช้การเข้ารหัสทั้งขณะอยู่นิ่งและระหว่างส่งเพื่อปกป้อง ID ธุรกรรมจากการเข้าถึงที่ไม่ได้รับอนุญาตและการละเมิดข้อมูล

การตรวจสอบและการแจ้งเตือนแบบเรียลไทม์

ตั้งค่าการตรวจสอบและการแจ้งเตือนแบบเรียลไทม์สําหรับการสร้างและการใช้ ID ธุรกรรม การติดตามตรวจสอบอาจช่วยตรวจจับความผิดปกติหรือรูปแบบที่น่าสงสัย (เช่น การสร้าง TXID ที่เพิ่มขึ้นอย่างกะทันหัน) ที่อาจบ่งบอกถึงปัญหาด้านความปลอดภัยหรือความผิดปกติของระบบ

การจัดการและการกู้คืนข้อผิดพลาดอย่างรัดกุม

พัฒนากลไกการจัดการและการกู้คืนข้อผิดพลาดที่รัดกุมเพื่อแก้ไขปัญหาต่างๆ เช่น ID ซ้ําหรือความล้มเหลวของระบบ ตรวจสอบให้แน่ใจว่าการสร้าง ID ธุรกรรมสามารถกู้คืนได้อย่างราบรื่นหลังจากการหยุดชะงัก

ความโปร่งใส

ให้ลูกค้าเข้าถึง ID ธุรกรรมของตัวเองได้อย่างง่ายดาย และให้ความรู้เกี่ยวกับความสําคัญของ ID ในการติดตามธุรกรรม ความโปร่งใสนี้สร้างความเชื่อมั่นและช่วยให้ลูกค้ามีส่วนร่วมในการรักษาความปลอดภัยด้านธุรกรรม

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ